(Bloomberg) — Two extra Chinese language builders have failed to fulfill dollar-bond funds, occurring amid renewed home-sales softness and a scarcity of aggressive stimulus.

Most Learn from Bloomberg

Central China Actual Property Ltd. stated it didn’t pay curiosity on a word earlier than the tip of a grace interval on Friday and that it will droop funds on all offshore debt. Smaller peer Main Holdings Group Ltd. disclosed in its personal alternate submitting Friday evening that it hadn’t paid all the $119.4 million of principal plus curiosity due on a greenback bond issued a 12 months in the past as a part of a debt swap.

Each companies additionally stated they are going to interact with exterior advisers and work on holistic options for his or her offshore debt. Central China is the nation’s Thirty third-largest builder by contracted gross sales, in line with China Actual Property Data Corp., whereas Main Holdings isn’t within the prime 100.

The delinquencies adopted a number of Chinese language builders final week remitting funds for curiosity funds on the finish of 30-day grace durations or shortly afterward. The property sector’s unprecedented money crunch resulted in document defaults on Chinese language issuers’ greenback bonds final 12 months and still-elevated missed funds thus far in 2023.

Expectations have been rising that Chinese language officers will unveil extra stimulus for struggling sectors together with actual property. However buyers had been left disenchanted final week after Chinese language banks minimize their mortgage reference price by lower than some anticipated. A sluggish stimulus rollout is including to issues concerning the nation’s economic system.

“China’s builders proceed to face skepticism from buyers amid a renewed slowdown in gross sales, and refinancing may very well be selectively prolonged by banks even submit the 16-point plan,” stated DBS Financial institution Ltd. strategist Chang Wei Liang.

Central China’s announcement doubtless isn’t a giant market shock given buying and selling ranges for the agency’s shorter-term greenback bonds, in line with Zerlina Zeng, senior credit score analyst at CreditSights. “Most smaller privately owned builders nonetheless face dire liquidity situations due to the muted restoration of contracted gross sales,” she stated.

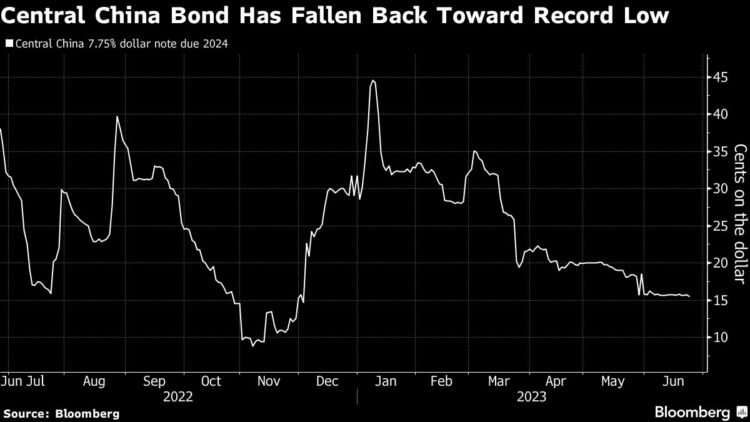

The corporate’s notes fell as a lot as 4 cents Monday, outpacing declines of as a lot as 0.5 cent in China’s builder-dominated high-yield greenback bond market, in line with credit score merchants. Chinese language belongings had been broadly decrease, with equities and the yuan weakening on recent indicators of slowing financial momentum.

The Central China and Main Holdings notes on which funds weren’t made have been indicated at under 30 cents on the greenback a lot of this 12 months, in line with knowledge compiled by Bloomberg. Such costs are typically thought of deeply distressed ranges and sign investor doubts about on-time fee.

Central China’s mum or dad offered a 29% fairness stake within the builder lower than a 12 months in the past to a government-owned entity in its dwelling province of Henan. Market optimism, stoked by hopes the transfer would offer state assist to the builder, didn’t final. Central China exchanged three greenback notes in April that had been because of mature in 2023.

–With help from Pearl Liu and Lorretta Chen.

(Provides market efficiency within the eighth paragraph.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.