Overview

As one of many core supplies in rechargeable batteries, lithium is important for the electrification of the automotive sector. Steadily rising electrical car gross sales contributed closely to the rising lithium market. With investments in battery gigafactories reaching practically $300 billion, demand for lithium will solely proceed to rise. Other than electrical automobiles, lithium can also be a necessary materials for renewable vitality applied sciences and the Web of Issues.

Present lithium manufacturing merely can not sustain with hovering demand, and until there may be an exponential enhance in accessible provide, we may hit a tough cap as early as 2027, in keeping with S&P World’s Commodity Insights.

Nicely-established junior gold growth firm GMV Minerals (TSXV:GMV, OTCQB:GMVMF) noticed the writing on the wall. Having invested appreciable time and capital into its promising, Arizona-based Mexican Hat gold mission, GMV sought to diversify its mineral belongings. Pushed as a lot by investor curiosity in lithium as by its personal recognition of the battery metallic’s potential worth, GMV shifted its focus.

This pivot culminated in a three-year choice settlement which is able to see the corporate acquire a 100-percent curiosity within the Daisy Creek lithium mission, situated in Lander County, Nevada.

Named by Fraser Institute because the 2022 prime jurisdiction on this planet for mining funding, Nevada hosts the solely producing lithium mine in North America at present, and is residence to Thacker Move, the biggest recognized lithium deposit within the US, with mineral reserves of three.7 million tonnes of lithium carbonate equal at 3,160 components per million lithium.

Daisy Creek was first recognized as a wealthy potential supply of lithium within the Nineteen Eighties. Its then-owner, Phillips Uranium, opted to not develop it additional as a consequence of their concentrate on uranium. Nevertheless, the corporate did observe that high-grade lithium is probably going contained in lithium-bearing clay present in altered volcanic tuffs. Geologists staked claims within the space after seeing similarities between the geology of Daisy Creek and Lithium America’s vital Thacker Move discovery.

Constructing on the historic drilling information from Phillips and dealing with a number of of the geologists who have been initially chargeable for gathering that information, GMV intends to discover the property to evaluate its potential for growth previous to growth.

Firm Highlights

- GMV Minerals is a junior gold growth firm with a lately added declare block specializing in lithium.

- Pushed by investor curiosity and market situations, the corporate entered into an settlement to acquire 100-percent possession of the extremely potential Daisy Creek lithium mission.

- GMV additionally maintains 100-percent possession of the Mexican Hat gold mission, notable for its estimated 10-year mine life, low capex and a pre-tax $153-million NPV utilizing a US$1,600 per oz base case.

- Mexican Hat hosts an inferred 688,000 ounces of gold, glorious metallurgical outcomes and a low strip ratio.

- Each Daisy Creek and Mexican Hat are located in secure, mining-friendly jurisdictions with available and skilled service suppliers. Every asset can also be located in shut proximity to current infrastructure, additional decreasing preliminary capex.

- GMV can also be noteworthy for its tightly-held share construction, with 24 p.c of shares held by administration and advisors.

Key Tasks

Daisy Creek Lithium

Situated in Lander County, Nevada, Daisy Creek consists of 82 lode claims. Initially focused for uranium by a number of oil and mining corporations within the late Nineteen Seventies and early Nineteen Eighties, the mission as an alternative proved wealthy in lithium, displaying values of as much as 2 p.c in clay-altered volcanic tuffs, which geologists famous was seemingly hectorite-based.

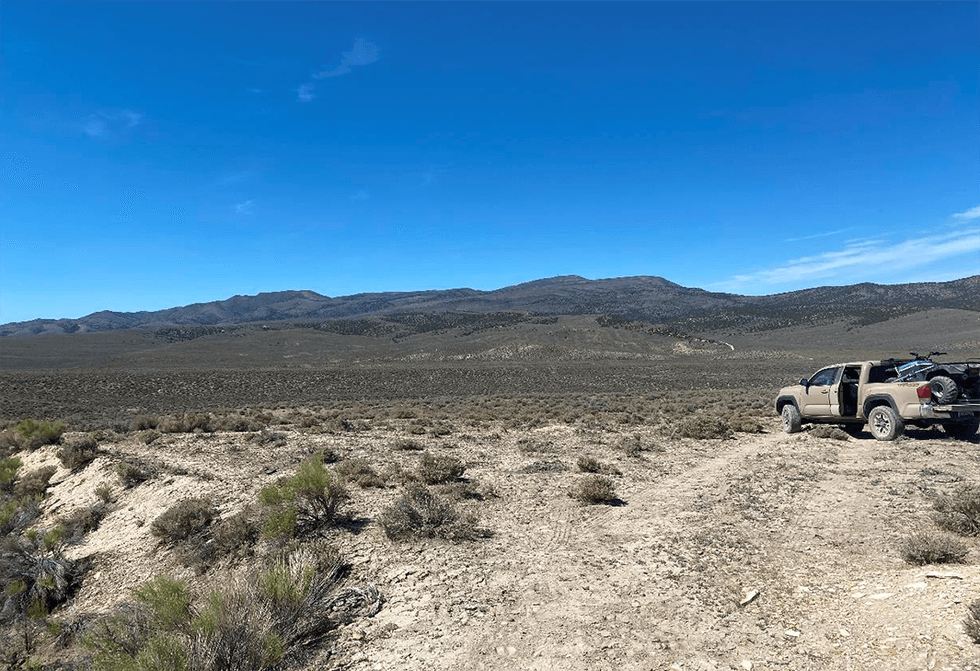

GMV’s Daisy Creek Lithium Venture in Nevada

As a result of there was little or no demand for lithium on the time, Daisy Creek largely sat ignored and forgotten. It was not till a number of many years later that two of the geologists concerned within the mission’s authentic drilling program famous a number of similarities between Daisy Creek and Lithium America’s burgeoning, extremely potential Thacker Move discovery. GMV plans to conduct a subject program to verify these observations.

Highlights:

- Full Possession: In Might 2023, GMV entered right into a three-year choice settlement with Daisy Creek’s authentic proprietor which is able to see it will definitely acquire a 100-percent curiosity within the mission.

- Space Geology: Daisy Creek is a part of a mountainous formation primarily composed of crystal-rich, early Miocene period ash-flow tuff. Mentioned formation covers roughly 200 sq. miles with a volcanic complicated that incorporates a collapse-type or graben construction crammed with finely-laminated tuffs that seemingly host anomalous lithium reserves. The basin that hosts the mission itself covers roughly 18 sq. miles and consists primarily of finely laminated fissile sediments.

- Pre-Current Infrastructure: Daisy Creek is located close to a number of working gold mines and has prepared entry to energy, water and paved highways, significantly decreasing the preliminary capital funding that can be required to develop the mission.

- Potential and Promising: Daisy Creek shows comparable geology to Lithium America’s Thacker Move deposit, with a mineral reserve of three.7 million tonnes of lithium carbonate equal at 3,160 components per million lithium.

Mexican Hat

A low-sulphidation epithermal gold deposit, Mexican Hat incorporates an estimated gold useful resource of roughly 700,000 ounces throughout 4,800 acres. As GMV’s flagship mission, the corporate nonetheless goals to additional increase this useful resource by way of drilling, finally shifting from an inferred useful resource estimate to a measured and indicated estimate. The mine growth itself will encompass two pits — a smaller southeast pit can be mined first, adopted by a bigger pit to the north.

As with Daisy Creek, GMV has a 100-percent curiosity in Mexican Hat.

Mexican Hat Venture in Arizona

Highlights:

- A Essential Asset: Mexican Hat represents one of the promising gold growth alternatives within the Western United States and GMV’s most superior anchor asset.

- Established Infrastructure: Mexican Hat is situated in shut proximity to appreciable transportation and energy infrastructure, and a talented workforce.

- Nicely-established Mining Course of: GMV plans to extract minerals from Mexican Hat by way of heap leaching, a mining course of recognized for its low capital funding and working prices, quick payback, lack of tailings, low vitality and water necessities, and easy setup and operation.

- Surveys and Allowing: GMV has, to date, carried out groundwater sampling, air high quality sampling, wildlife evaluation and an archaeological evaluation of the mission space. The world has additionally been the goal of intensive exploration by its earlier proprietor, Placer Dome USA.

- Space Geology: Major mineralization in Mexican Hat consists of gold and oxides in a metasomatic assemblage of chlorite, carbonate, epidote and minor silica organized alongside a collection of fractures and fault zones inside a tilted conformable bundle of tertiary rock.

- Mineral Useful resource Estimate Outcomes: The outcomes of Mexican Hat’s 2020 MRE indicated an inferred useful resource of 688,000 ounces at 0.58 g/t gold in 36.73 million tonnes with a cut-off of .20 g/t gold and a strip ratio of two.36.

- Preliminary Financial Evaluation Highlights: Mexican Hat’s PEA, carried out with the up to date 2020 MRE, signifies a 10-year mine life; $100 million NPV; $67.8 million preliminary capex; 29.3 p.c IRR after tax at $1,600/ounce of gold; and common annual gold manufacturing of 52,250 ounces.

Administration Group

Ian Klassen — President and CEO

Ian Klassen has 30 years of expertise in public firm administration, public relations, authorities affairs, entrepreneurship, media relationship methods and mission administration. Klassen is the president of a North American mineral exploration firm and sits on the board of administrators of a number of personal and public corporations. Earlier to his administration actions inside personal and public corporations, he held quite a lot of positions inside federal Canadian politics, together with as senior political advisor to the Minister of State (Transportation), and as chief of workers, Workplace of the Speaker of the Canadian Home of Commons.

Klassen graduated with an undergraduate honors diploma from Western College in 1989. In 1992, he obtained the Commemorative Medal for the a hundred and twenty fifth Anniversary of the Confederation of Canada in recognition of his vital contribution to his group and nation.

Dr. D.R. Webb — Lead Marketing consultant

Dr. D.R. Webb graduated with a geological engineering diploma from the College of Toronto, the place he obtained awards for the best marks in each third-year and fourth-year subject camps. He obtained his M.Sc. and Ph.D. in geological sciences at Queen’s College and Western College, respectively, the place his focus was on the structural and geochemical controls on gold mineralization within the Yellowknife Greenstone Belt.

Webb is credited for locating each the biggest granitic hosted gold deposit within the Northwest Territories and the biggest gold deposit within the Yellowknife Greenstone Belt discovered prior to now 30 years. He served as president and director of Tyhee Gold Corp, the place he and his workforce developed a high-grade gold deposit into manufacturing, changing into Mongolia’s first hard-rock gold mine. He later superior his discoveries in Yellowknife right into a multimillion-ounce useful resource, accomplished financial and engineering evaluation and initiated each feasibility research and allowing.

Webb additionally developed the Mon Gold Mine into probably the most lately permitted gold mine within the Yellowknife Gold Belt, working for seven years then shutting down in 1997, as a consequence of declining gold costs. He lately accomplished allowing to begin reopening of this mine. Webb is a advisor to the business, offering companies all through the world and sits on the board of Lake Victoria Mining Firm Inc. and Metallis Assets Inc., a number of personal firms, and is on the advisory council for the Centre of Coaching Excellence in Mining.

Webb co-authored the qualifying report on Fortune Minerals’ Nico Deposit, recommending acquisition of what’s now the biggest bismuth useful resource on this planet.

Michele Pillon — Chief Monetary Officer

Michelle Pillon is an accountant with a number of years expertise within the junior mining exploration sector. Since 1988, Pillon has been offering accounting and regulatory help to private and non-private corporations.

Ronald L. Handford — Vice-president, Communications

Ronald Handford is a mining and expertise entrepreneur and advisor with 18 years of CEO and senior govt expertise. He has raised or participated in elevating virtually $80 million in personal and public fairness, and has in depth investor, banking, business and authorities contacts in North America, Europe and Asia.