The 2023 Charles Schwab Trendy Wealth Survey highlights the numerous paradoxes of wealth in America. Over 1,000 people of all totally different backgrounds stuffed out the survey.

General, the survey, carried out between March 1 and March 23, 2023, says it takes a web price of $2.2 million to be thought of rich in 2023. The web price quantity is similar because it was in 2022 however up from $1.9 million in 2021.

If there’s one constructive factor a bear market does, it is that it lowers wealth expectations.

On this submit, I might wish to look extra carefully on the information and level out the wealth paradoxes. People do not appear to know what it means to be rich. We additionally do not appear to behave in accordance with our monetary objectives and private beliefs!

Wealth Paradox #1: Inflation Is Not As Unhealthy As It Appears

The primary paradox of wealth is People’ incapacity to just accept actuality. People imagine inflation is a giant damaging to way of life high quality.

Excessive inflation is why the Federal Reserve has aggressively raised rates of interest since 2022. Nonetheless, regardless of inflation reaching 40-year highs, the quantity of web price essential to really feel rich has not elevated.

With inflation up between 4% to six.4% YoY in 2023, it could be logical to imagine the web price required to be rich in 2023 would additionally rise by 4% to six.4%. If that’s the case, the web price vary in 2023 needs to be between $2.288 and $2.34 million. However paradoxically, the web price quantity stayed flat.

So possibly, the specter of inflation to American livelihoods is overstated. Simply as life goes on whether or not you’re taking motion or not, inflation goes on whether or not you are accumulating extra wealth or not.

Wealth Paradox #2: Feeling Rich Regardless of Not Having Sufficient

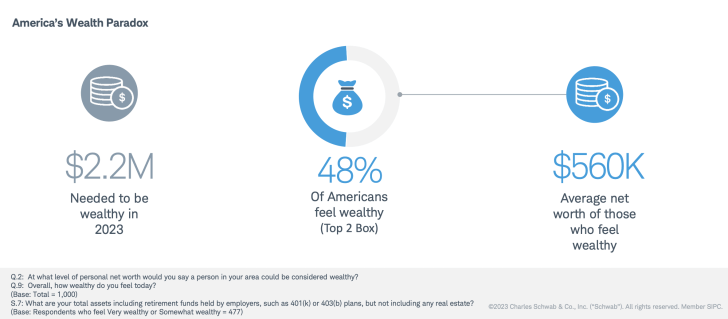

48% of Schwab’s Wealth Survey respondents really feel rich, but the common web price of those that really feel rich is just $560K. But, we simply discovered that $2.2 million is the web price thought of by survey respondents to be thought of rich! A $1.64 million shortfall is large, particularly by way of proportion.

Subsequently, both the respondents are mendacity in regards to the quantity wanted to really feel rich, mendacity about their web price, or are inexperienced about how a lot it actually takes to really feel rich. Or possibly People are merely delusional about cash.

As a private finance author since 2009, I imagine most individuals overestimate their wants on account of concern and uncertainty. On the similar time, most individuals underestimate how a lot wealth they will obtain over time via consistency and compounding.

It is exhausting to know the way a lot cash you really want till you might be put within the scenario. It is also exhausting to know the way you may really feel when you get to your goal web price determine.

The variations between the creativeness and the truth are why I attempt to write each article on Monetary Samurai from firsthand expertise.

Wealth Paradox #3: Feeling Of Wealthiness By Technology

One other paradox is that Millennials really feel the wealthiest among the many 4 main generations. But, the mass media constantly rags on Millennials for being the unhappiest, loneliest, and poorest technology.

Regardless of making up practically 1 / 4 of the inhabitants, Millennials — outlined as these born between 1981 and 1996 — personal a scant 3% of the nation’s wealth, in accordance with the Federal Reserve’s Survey of Shopper Funds.

Within the survey, 57% of Millennials really feel rich in comparison with solely 40% of Boomers. But, in one other wealth paradox, it’s the Boomers who’re really the wealthiest technology in historical past given they saved and invested over the longest bull market in historical past.

Beneath is one among many charts yow will discover that spotlight the proportion of U.S. family wealth by technology. Boomers are dominating the quantity of wealth in America, adopted by Gen Xers, Millennials, and Gen Zers.

Why Do Millennials Really feel The Wealthiest And Boomers The Least Rich?

So what explains why extra Millennials really feel wealthier than different generations? My hunch is that American Millennials have extra perspective than the mass media offers them credit score for. They grew up with the web and know the way fortunate they’re relative to billions of others who did not develop up with their similar privileges.

Millennials are additionally within the prime age vary for earnings and well being. As a result of they’re making career-high incomes, they’re most hopeful about accumulating extra wealth than after they have been of their 20s. And since they’re additionally nonetheless wholesome, they get to really feel bodily good whereas having fun with their wealth on the similar time.

As for why Boomers really feel the least rich, I feel the reply is time is extra helpful than cash. When you could have the least period of time left in your life in comparison with different generations, then you definitely really feel the least rich. Boomers even have extra well being points and regrets relating to what they might or ought to have accomplished after they have been youthful.

However but in one other wealth paradox, research have proven happiness tends to extend the older one will get. The truth is, I’ve argued that larger happiness is the greatest purpose to retire earlier!

Wealth Means Having Extra Cash Than Time: No Paradox Right here

I did not must even have a look at the Time vs. Cash query to know that almost all People really feel that having time is extra vital than having cash. I’ve felt this manner since I used to be 13 when my 15-year-old good friend handed away in a automotive accident.

As you possibly can see from the chart, Boomers have the best variety of members who imagine time is extra helpful than cash at 67%.

However curiously, Millennials have the bottom proportion of contributors who imagine time is extra helpful than cash at 56%, regardless of not being the youngest technology surveyed. I am undecided why.

The stronger you maintain the idea that point is extra helpful than cash, the extra motivated you’ll be to save and make investments for the long run. Additionally, you will be extra motivated to retire earlier or discover a job you additionally get pleasure from doing.

My robust perception within the worth of time is the rationale why I left my job at 34 and haven’t returned. Up to now, I’ve but to search out any full-time job that’s extra helpful than my freedom.

My robust perception within the worth of time can also be why I did not discover it tough to repeatedly save over 50% of my after-tax revenue for over a decade. For me, the reward of shopping for again time sooner or later was nicely price it.

These Who Consider Cash Is Extra Precious Than Time

Regardless of 61% of all generations believing time is extra helpful than cash, that also leaves 39% who imagine cash is extra helpful than time. To me, 39% is a surprisingly excessive proportion as a result of whereas we are able to all the time earn more money, we are able to by no means make extra time. I feel the proportion cut up needs to be nearer to 80% / 20%.

However I additionally acknowledge why a big proportion of individuals would say cash is extra helpful than time in a wealth survey. First, the survey is targeted on cash, so there could also be an invisible hand of persuasion. However extra importantly, when you really feel you do not need sufficient cash, then you’ll logically select cash over time.

Describing Wealth Reveals Extra Paradoxes

The ultimate paradoxes of wealth are what the survey contributors describe as what wealth means to them.

- 72% of contributors imagine having a satisfying private life and a wholesome work life stability are an important elements of wealth, but People are essentially the most overworked individuals on the planet. People work extra hours every week and take the fewest variety of holidays a yr.

- 70% of contributors imagine not having to emphasize over cash is extra vital than having extra money than most individuals they know. But, the long-term median saving fee in America is just 5%. If People actually believed wealth shouldn’t be having to emphasize over cash, People would save a larger proportion of their revenue.

- If 63% of survey contributors imagine being in good well being is extra vital than being profitable, why do not People eat higher and train extra? People have the very best weight problems fee on the planet.

- If 64% of survey contributors imagine in paying for experiences to spend time with household now over leaving an inheritance, then why is there greater than $50 trillion in wealth set to be transferred from the oldest technology?

Not Appearing In accordance To Our Beliefs: The Largest Paradox

It’s clear that many People don’t act in accordance with their monetary beliefs. In consequence, many People will endure from dissatisfaction, remorse, and unhappiness as they become old.

To all Monetary Samurai readers and listeners, I encourage you to act extra congruently along with your ideas. Do not be that one that places off beginning a enterprise, writing a e book, touring, becoming a member of a special trade, or discovering love sometime. As a result of when you by no means take motion, sometime tends to by no means come.

My Present Wealth Paradox

I am at present experiencing a wealth paradox as a result of I am discovering it tough to spend much more cash to decumulate, regardless of accumulating greater than I want. As an alternative, I proceed to avoid wasting and make investments a minimum of 20% of my after-tax disposable revenue yearly to supply for my household.

After 24 years post-college, I discover it exhausting to alter my monetary habits. I am always hedging in opposition to an unknown future that might embrace bear markets, sicknesses, thefts, and accidents.

Now that my household has stabilized at 4, I ought to be capable to mannequin out extra aggressive spending patterns. For the second half of my life, I plan to remove my wealth paradox by giving extra, spending extra, and investing much less.

Wanting to provide extra is partially why I proceed to put in writing a lot on Monetary Samurai, regardless of the time it requires. I wish to assist extra individuals to acquire the monetary braveness to do extra of what they need.

It Takes Two In A Married Family To Spend

The opposite drawback I’ve is that even when I wish to spend extra money, I nonetheless face the problem of getting my spouse on board.

For instance, I do know the best strategy to decumulate is to improve houses. With greater property taxes and upkeep prices, it is easy to spend down your wealth on an costly dwelling.

However upgrading houses has confirmed to be a problem, so we let that humorous cash keep invested in shares, bonds, and on-line actual property. Over 10 years, the likelihood is excessive our investments might be price much more, which additional compounds my wealth paradox!

Simply as saving cash requires intentional effort, spending cash requires an equal quantity of intentionality. Nonetheless, given the trail of least resistance is to do nothing, it is a lot simpler to only let our investments compound to larger wealth.

Reader Questions And Solutions

What are some wealth paradoxes you discover in America or your nation? What are some wealth paradoxes you acknowledge in your individual life? Why do not extra individuals take motion to get what they need?

If schooling is priceless, why not decide up a replica of my e book, Purchase This, Not That, at present obtainable on Amazon for lower than $20 after tax? The e book is essentially the most complete private finance e book with motion steps that will help you construct nice wealth.

If wealth is vital for offering extra happiness and freedom, why not join Empower’s free wealth administration software program? After linking $100K+ in investable belongings, why not join a free web price evaluation with one among their wealth advisors? Getting a second opinion from knowledgeable might be very useful.

If you wish to acquire extra monetary information, be part of 60,000+ others and join the weekly Monetary Samurai e-newsletter and subscribe to my podcast on Apple or Spotify. They’re all free.