hapabapa

Introduction

I personal AbbVie (ABBV) in my dividend progress portfolio. Regardless of its struggles with competitors from biosimilar merchandise, I am extraordinarily proud of my funding, as I imagine in a robust future for well-managed biotech firms.

Certainly one of these well-managed firms is Amgen (NASDAQ:AMGN). This biotech large with a market cap of just about $120 billion is struggling a bit. Its shares are 25% beneath their 52-week excessive and down 16% year-to-date. The corporate is combating regulatory headwinds and competitors from biosimilar merchandise, which isn’t one thing biotech traders wish to encounter.

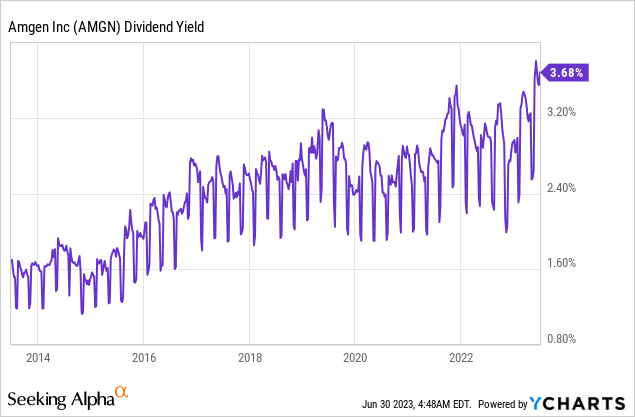

The excellent news is that this unlocks worth. AMGN is at the moment yielding 3.9%, which is its highest yield ever. Moreover, its enterprise continues to do properly, which comes with sturdy anticipated free money circulate and a sexy valuation.

On this article, we’ll talk about all of this and assess the danger/reward for (dividend) traders at present ranges.

So, let’s get to it!

AMGN & Its Struggles

When investing in biotech, traders aren’t simply depending on an organization’s capacity to innovate but additionally on its capacity to take care of interference from policymakers.

Final month, the Wall Avenue Journal ran a headline that completely captured the corporate’s ongoing struggles.

Wall Avenue Journal

Primarily, AMGN is hit quite a lot of headwinds which have precipitated traders to remain away.

In response to the WSJ, the IRS is pursuing Amgen for billions of {dollars} in again taxes, whereas the Federal Commerce Fee, led by Lina Khan, is looking for to dam its $27.8 billion acquisition of Horizon Therapeutics (HZNP).

Moreover, the Supreme Court docket just lately dominated in opposition to Amgen in a big patent case.

Nonetheless, essentially the most urgent concern for Amgen is the looming patent cliff, with a lot of its top-selling medication anticipated to face income declines because of patent expirations and elevated competitors within the coming years.

One of many firm’s blockbuster medication, Enbrel, which treats autoimmune illnesses like rheumatoid arthritis, is already dealing with challenges because of competitors from AbbVie’s Humira (which additionally misplaced its patent).

AbbVie’s aggressive rebates to pharmacy-benefit managers have put stress on Enbrel’s market share, resulting in a decline in gross sales.

One other drug, Otezla, has additionally missed estimates because of competitors from a competitor owned by Bristol-Myers Squibb (BMY). Prolia and Xgeva, two bone well being medication, have helped offset some progress stress. Nonetheless, they may face patent expirations sooner or later as properly.

However wait, there’s extra dangerous information!

Amgen’s acquisition of Horizon Therapeutics was primarily pushed by Horizon’s key product, Tepezza, a drug used to deal with thyroid eye illness. In 2022, Tepezza generated roughly $2 billion in gross sales. For the Horizon deal to achieve success, Amgen would wish to see Tepezza’s gross sales proceed to develop. Nonetheless, the drug’s first-quarter gross sales declined by 19%, main Wall Avenue to doubt its long-term prospects.

As dangerous as all of this sounds, the corporate is making progress, whereas the corporate’s inventory value decline has priced in a whole lot of dangerous information.

Regardless of Struggles, AMGN Is not Doing Half-Unhealthy

With regard to the Horizon deal, Amgen’s CEO, Bob Bradway, commented on points with the FTC through the Goldman Sachs Annual International Healthcare Convention.

Regardless of the aforementioned points, Mr. Bradway stays assured that the deal will finally shut. Amgen believes there aren’t any anti-competitive points stopping the 2 firms from becoming a member of forces. The corporate is ready for a listening to within the autumn the place it’s going to current its viewpoint and hearken to the FTC’s considerations.

Bradway additionally emphasised that worldwide regulators haven’t expressed any considerations in regards to the mixture.

Therefore, Amgen expects the deal to shut by the tip of the 12 months.

Moreover, with regard to TEPEZZA (Horizon’s key drug), the corporate emphasised potential post-merger synergies which can be anticipated to boost the worth of this necessary drug. In the course of the aforementioned convention, Amgen highlighted its worldwide presence, manufacturing capabilities, and experience in designing molecules for uncommon illnesses as components that may contribute to the success of the mixture. Relating to TEPEZZA, Amgen acknowledged that there aren’t any surprising developments, which is what analysts wanted to listen to.

With regard to its worldwide presence, AMGN is basically saying that TEPEZZA gross sales can speed up as soon as it advantages from the bigger dimension of AMGN and its gross sales capabilities. It is exhausting to disagree with that.

Including to that, AMGN is ramping up its biosimilar investments.

The corporate believes its capabilities in manufacturing proteins and medical growth place them properly for fulfillment within the biosimilar market. AMJEVITA, their most up-to-date biosimilar launch, has been acquired positively, and Amgen is assured about its long-term prospects.

On this case, AMJEVITA is a direct competitor to HUMIRA, the important thing drug of AbbVie, which just lately misplaced its patent safety.

Amgen Inc.

Amgen plans to launch further biosimilars, they usually anticipate this enterprise to contribute considerably to their progress by means of the tip of the last decade and past.

Current Occasions Assist Lengthy-Time period Development

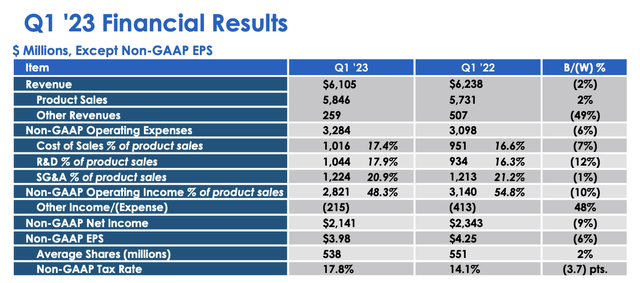

Whereas the corporate noticed 1Q23 adjusted internet earnings fall by 9% because of larger bills, quantity progress was sturdy.

Amgen Inc.

The corporate witnessed 14% quantity progress, which supplies it confidence for the rest of this 12 months. This was attributable to quite a lot of tailwinds, together with the impression of COVID on the healthcare system, which seems to be fading, mirrored in year-over-year prescription progress throughout numerous specialties within the US, together with cardiology and oncology.

On this case, AMGN is without doubt one of the few pharma giants that advantages from fewer COVID instances (the tip of COVID).

The restoration additionally reveals that sufferers are returning to their pre-pandemic routines and looking for acceptable diagnoses and coverings from healthcare suppliers.

Consequently, quite a lot of key medication, like Repatha, EVENITY, BLINCYTO, and KYPROLIS, achieved file gross sales through the first quarter.

Talking of Repatha, Amgen believes that there’s important upside potential for this drug, particularly for high-risk cardiovascular sufferers who wrestle to achieve their beneficial LDL ranges. Given the severity of coronary heart illnesses in developed nations, I imagine the corporate is onto one thing right here.

On a facet notice, the surge in coronary heart illnesses can also be why I like {hardware} suppliers like Abbott (ABT).

Including to that, the corporate is making nice progress in its worldwide enterprise.

Outdoors the US, Amgen noticed greater than 20% quantity progress, with the Asia-Pacific area main the best way with practically 50% progress.

The corporate is increasing its affected person attain in Japan and China, two quickly getting older nations, with medicines like Repatha and Prolia. The deal with international growth goals to serve a broader affected person inhabitants whereas contributing to long-term progress.

Furthermore, given the corporate’s earlier feedback on favorable regulatory environments, I imagine that AMGN will put a a lot greater deal with worldwide gross sales.

The corporate additionally noticed sturdy progress within the irritation space, which noticed growth with the US launch of AMGEVITA, alongside progress in TEZSPIRE and TAVNEOS.

Regardless of challenges like value erosion and competitors, Amgen stays optimistic about its potential for progress, pushed by its sturdy portfolio and ongoing medical growth of its pipeline.

Talking of its pipeline, R&D investments had been boosted by 12% in 1Q23.

Shareholder Returns

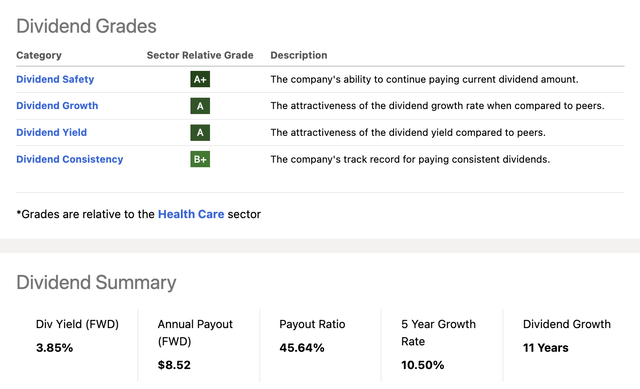

With all of this stated, AMGN is a dividend progress inventory. The corporate has probably the greatest dividend scorecards I’ve seen in a very long time.

Looking for Alpha

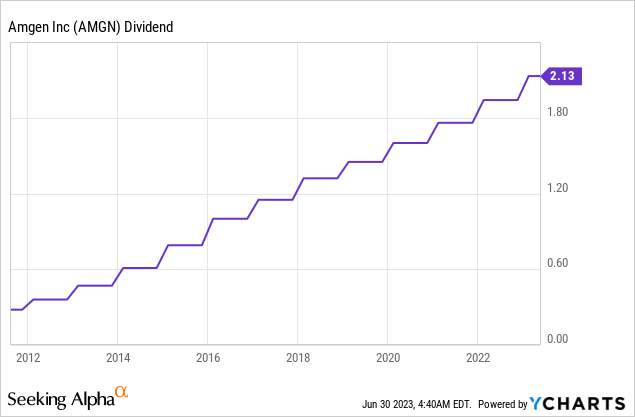

The corporate at the moment yields 3.9%. This yield is backed by a 46% payout ratio. Over the previous 5 years, the typical annual dividend progress fee was 10.5%. The corporate has hiked its dividend for 11 consecutive years.

In different phrases, the corporate has hiked its dividend yearly since initiating a dividend.

Because of the mixture of dividend progress and inventory value weak point, the inventory’s yield is now at an all-time excessive.

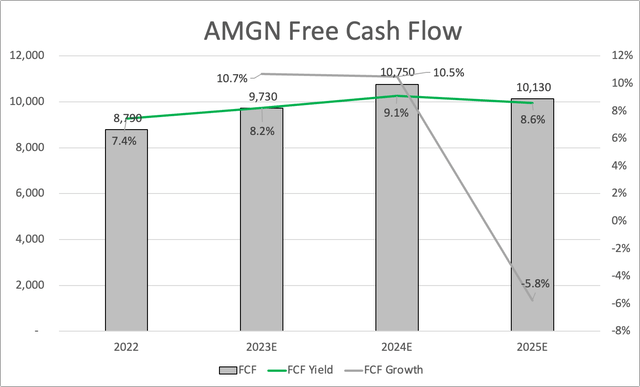

Moreover, the corporate is just not anticipated to come across free money circulate weak point within the subsequent two years. In 2024, AMGN is anticipated to generate sufficient free money circulate to finish up with a free money circulate yield that exceeds 10%.

This could point out a money payout ratio of lower than 40%, which opens up a whole lot of room to scale back debt (publish the potential acquisition of Horizon) and buybacks.

Leo Nelissen

AMGN has a 2023E internet leverage ratio of simply 1.5x EBITDA. It enjoys a BBB+ credit standing, which is one step beneath the A-range.

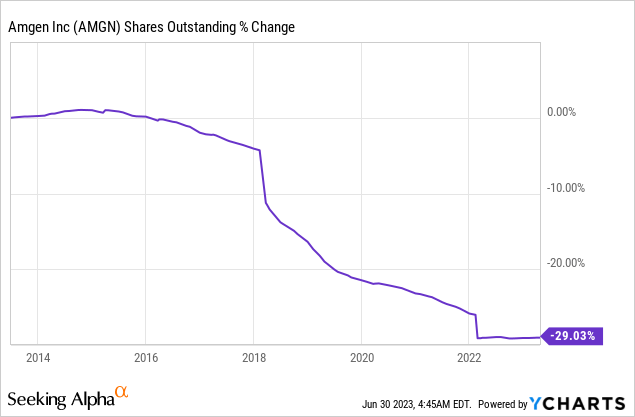

Consequently, extra free money circulate has been used to purchase again inventory prior to now, leading to a discount in shares excellent of 29% since 2013.

This 12 months, buybacks should not anticipated to exceed $500 million.

In response to the firm:

We plan to proceed to meaningfully enhance our dividend. We proceed to anticipate share repurchases to not exceed $500 million in 2023.

Full-12 months Steerage & Valuation

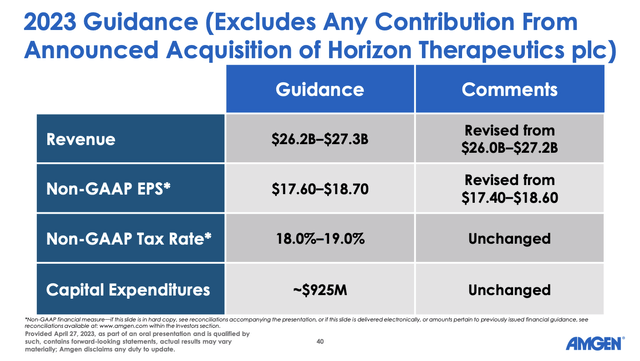

On a full-year foundation, the corporate has raised its income steering vary to $26.2 to $27.3 billion, from $26.0 to $27.2 billion. These numbers exclude Horizon.

This displays our confidence within the underlying enterprise and the bettering total market situations for our sufferers to entry our medicines that Bob and Murdo talked about. We’re additionally elevating our 2023 non-GAAP EPS steering to $17.60 to $18.70 versus earlier steering of $17.40 per share to $18.60 per share.

Amgen Inc.

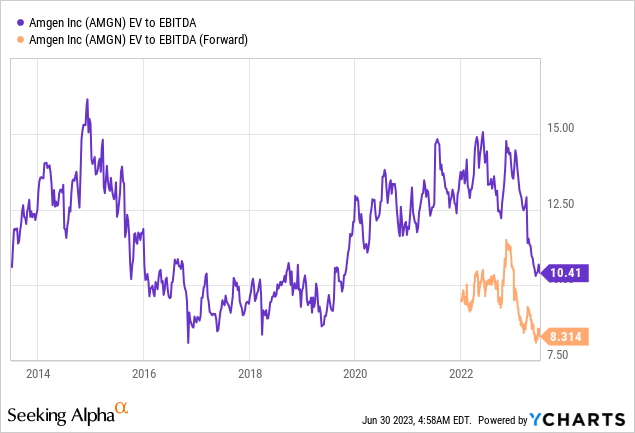

With that stated, the corporate is buying and selling at 8.3x NTM EBITDA, which is a large low cost versus its longer-term median. Whereas I agree that uncertainty must be priced in, I imagine AMGN has change into extremely enticing.

Regardless of its challenges, the corporate retains getting purchase and outperform rankings.

The present consensus value goal is $255 after Oppenheimer gave the inventory a $290 goal. The consensus value goal is 15% above the present value.

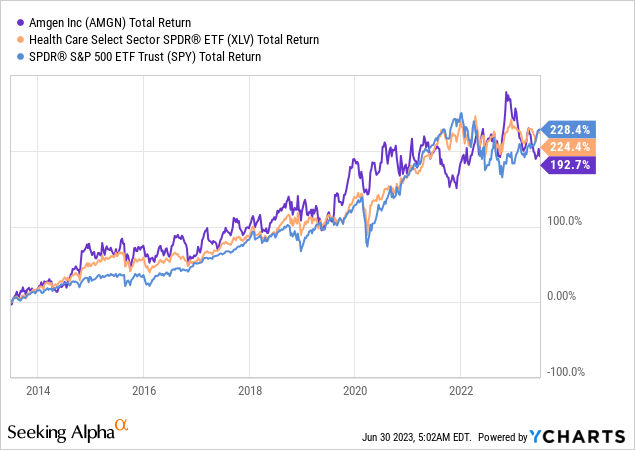

Whereas the corporate’s struggles should not insignificant, I anticipate the share value to work its technique to its consensus value goal over the following 12 months, adopted by a chronic upswing with above-market returns. Previous to 2022, AMGN used to outperform the market. I imagine it’s going to stay that manner sooner or later.

Nonetheless, regardless of its enticing valuation and enhancements, this is not a no brainer. Biotech is tough to foretell and depending on Washington-based policymakers. Traders want to pay attention to these dangers. It is also why I will not go chubby in biotech shares, as a lot as I like what they bring about to the desk as dividend-growth shares.

Takeaway

Regardless of dealing with important struggles, together with regulatory headwinds and competitors from biosimilar merchandise, Amgen presents a possibility for dividend traders.

The corporate’s inventory value decline has already priced in a lot of the dangerous information, making it a sexy funding.

AMGN’s excessive dividend yield of three.9% and robust enterprise efficiency, with anticipated free money circulate and an interesting valuation, contribute to its enchantment.

The corporate is making progress, as mirrored in its potential acquisition of Horizon Therapeutics and its efforts within the biosimilar market.

Moreover, latest occasions, equivalent to sturdy quantity progress and file gross sales of key medication, assist AMGN’s long-term progress prospects.

Whereas dangers exist, together with the unpredictable nature of the biotech business and dependence on policymakers, AMGN has the potential to outperform the market and ship above-average returns to shareholders.

Execs & Cons

Execs:

- Excessive dividend yield of three.9%.

- Sturdy enterprise efficiency and gross sales progress.

- Investments within the biosimilar marketplace for future progress.

- Engaging valuation with a reduction in comparison with its historic median.

Cons:

- Regulatory challenges and uncertainties.

- Patent expirations and elevated competitors.

- Dependence on policymakers and potential regulatory modifications.