It’s usually stated that (nearly) nobody goes into enterprise to do their very own accounting. So it’s no shock that many entrepreneurs lean closely on a trusted advisor for assist, significantly round busy instances like EOFY when tax, compliance, payroll and different enterprise obligations come into play.

For these on the Xero platform, collaborating along with your accountant or bookkeeper is straightforward through the cloud. However, there are additionally many instruments and methods you possibly can study to a) impress your advisor and b) make your life – and theirs – simpler within the lead-up to tax time. Under is a round-up of 4 options that may provide help to save time and increase effectivity over the approaching weeks (and all yr spherical). What Xero tip would you add to this listing? Tell us within the feedback part.

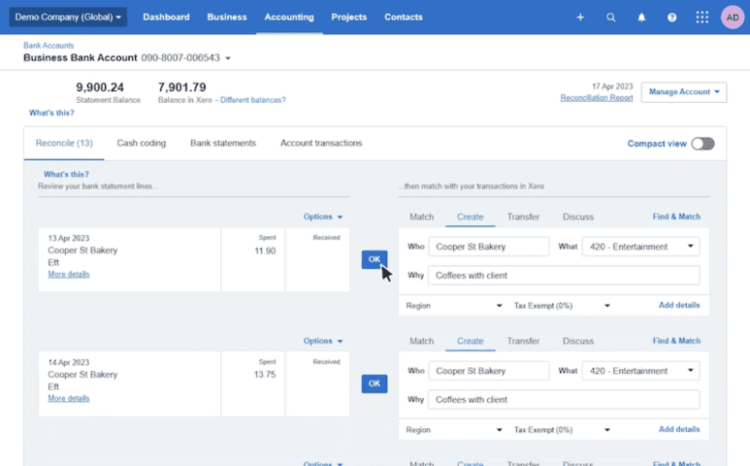

Finalise financial institution recs quicker with computerized refresh

As any small enterprise proprietor is aware of, financial institution reconciliation (the method of confirming all transactions in your financial institution accounts are recorded in your small business accounting information) is a kind of duties it’s good to keep on prime of. Why? As a result of come tax time, finding an unreconciled transaction from months in the past can typically really feel like trying to find a needle in a haystack.

To make issues less complicated, we’ve added computerized refresh to financial institution rec simply in time for EOFY. Now, once you full the transaction particulars beneath the ‘Create’ tab, Xero will populate related transactions with the identical info – with no need to refresh your display screen. This implies you possibly can reconcile a number of information quicker whereas minimising errors in handbook knowledge entry.

Retailer tax time information in a single central file library

The Xero file library is the place to retailer all the things you want readily available for EOFY, like receipts, financial institution statements, rental summaries and even vital emails. Beneath ‘Recordsdata,’ you’ll discover present folders titled ‘Inbox’ and ‘Contracts.’ You possibly can add recordsdata straight or electronic mail them straight to the inbox folder, and whilst you’re there, it’s a good suggestion to create a customized folder particular to tax time (e.g. EOFY 2023).

Ensure that your advisor is aware of that you simply’re utilizing the file library to allow them to additionally discover and share paperwork. Storing all the things in a single central place will prevent from going backwards and forwards through electronic mail and shedding vital information throughout the chain (we’ve all been there).

Notice to self: preserve observe of contacts with the free textual content subject

From working with prospects and suppliers to distributors and advisors, it’s simple to lose observe of motion gadgets, IOUs, follow-ups and all types of particulars – particularly when tying up unfastened ends in June. So why not exchange the psychological notes with actual ones – no, not the pen and paper sort; we’re speaking concerning the free textual content subject beneath contacts. The following time you’re in Xero, click on on a reputation beneath the ‘Contacts’ tab and add any related data – like that point you requested your provider for an announcement. It will provide help to observe what you’ve requested or what’s left to do main as much as EOFY.

Use the International Search operate to search out any lacking puzzle items

Xero’s ‘International Search’ now encompasses a new and improved search bar, dropdown menu and filter icon. What’s extra, we’ve upgraded its capabilities to select up extra hits. It consists of an ‘All’ choice within the filter menu and a brand new look to the search outcomes web page with columns for extra easy navigation. So should you’re on the lookout for the ultimate items of your yr finish puzzle, International Search will provide help to match phrases inside invoices and buy descriptions with out working reviews.

Whether or not you’re a seasoned tax time professional or simply studying the ropes, we now have every kind of assets and hacks that will help you alongside the way in which. Go to Xero’s EOFY Useful resource Hub to study extra, and whilst you’re there, remember to register for our upcoming webinar: Get your small business prepared for monetary yr finish.