DoctorEgg

Funding Thesis

We are sometimes informed that the inventory market is sweet for long-term investments.

There may be each fact and falsehood in such a basic assertion. It jogs my memory of what a superb good friend informed me some years in the past. He stated that he had made a short-term hypothesis on a inventory that was a long-term funding. It was clear that the worth had tanked and my good friend had fallen into the anchoring biases ready for the worth to get well in order that he may eliminate the shares. As if the market cared what he had paid for it.

One traditional instance of that is for those who had purchased the Nikkei Index as a Christmas present in 1989 and held it till immediately – you’ll have misplaced 14.7%

Nikkei 225 misplaced 14% since 1989 (Yahoo Finance)

That isn’t good when you think about that $1 in 1989 is equal in buying energy to about $2.45 immediately, in accordance with the CPI inflation calculator.

There have been loads of warning lights that ought to have put individuals off from shopping for into the Japanese inventory market on the peak of what was an incredible bubble. A cyclically adjusted worth to earnings, or CAPE, does matter. It had elevated to 77 by the top of 1989. CAPE for the S&P500 was slightly below 20. The Japanese market even revisited these excessive CAPE numbers between 2000 and 2008.

CAPE of Nikkei 225 versus S&P 500 (Barclays)

After the GFC, the valuations of Japanese shares have change into extra enticing.

It’s straightforward to grasp why the Japanese inventory market, regardless of its giant measurement, was not in style with traders prior to now. Nonetheless, the previous is the previous and will solely function an awesome lesson to traders.

What concerning the future? Is Japan extra investable now?

Why purchase an ETF versus particular person shares in Japan?

We cowl a few of Blackrock’s iShares ETFs for numerous inventory markets in Asia. These are for the inventory market in China (CNYA), Hong Kong (EWH), and Singapore (EWS). As well as, we do cowl some Japanese firms corresponding to Mitsubishi UFJ Monetary Group (MUFG) and Mitsubishi Company. (OTCPK:MSBHF)

It’s not for everyone to spend money on particular person shares. We’re additionally humble sufficient to confess that it is rather tough to search out alpha from inventory selecting.

Blackrock does have an ETF for the massive and mid-cap Japanese shares referred to as iShares JPX-Nikkei 400 ETF (NYSEARCA:JPXN). This ETF goals to trace the broad-based Nikkei Index whereas nonetheless selectively selecting firms which are worthwhile and shareholder-friendly. In response to BlackRock (BLK), these firms also needs to ship an acceptable return on fairness.

The ETF holds 393 firms within the fund with a view to carefully monitor the Nikkei 400. Here’s a record of the biggest 10 positions within the fund:

JPXN – high 10 holdings (Blackrock)

The NAV of the fund is $89.3 million with the NAV per unit of $66.43 which is near the share worth of $66.16 as of the third of July 2023.

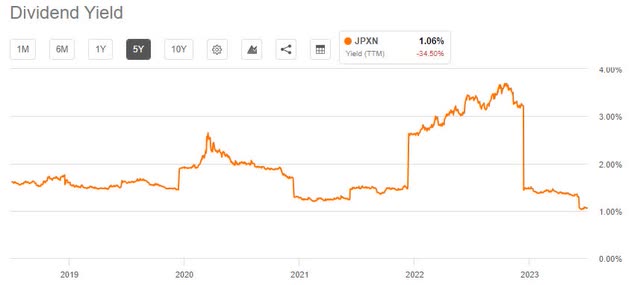

The expense ratio for the fund is 0.48%, and the dividend yield during the last 5 years has been between 1% and a couple of%, aside from final yr when it was above 3%.

JPXN’s 5-year dividend historical past (SA)

Japan’s Financial system

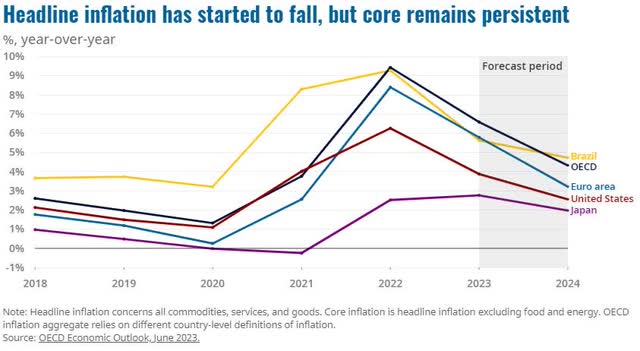

One constructive side of the Japanese economic system has been its decrease inflation than many different giant OECD economies.

Japan’s low headline inflation in comparison with different OECD international locations (OECD)

Because of the decrease inflation, the Japanese central financial institution has stored its ultra-low rate of interest just about unchanged. On the sixteenth of June, the coverage board of BOJ determined to maintain their coverage rate of interest at minus 0.1%.

They’ll proceed with Quantitative and Qualitative Financial Easing (QQE) and with a Yield Curve Management, aiming to realize worth stability.

When it comes to GDP progress, in accordance with OECD’s June report on their outlook, they’ve a projection of Japan’s GDP to develop 1.3% this yr and 1.1% in 2024.

Japan’s unemployment fee can also be pretty low at simply 2.6%, as of Might 2023.

The broader image is that we anticipate that the world goes to enter a interval of a super-cycle in new giant capital investments in gear that can change mobility, industries, mining and vitality, and know-how for 2 completely different causes. These investments will come from each governments and the personal sector.

We’ve got simply printed an evaluation of how the delivery trade is now in the midst of big modifications when it comes to decreasing its giant carbon footprint. A whole bunch of billions of {dollars} will likely be required to finish this transformation. The identical is going on in giant polluting industries like mining, metal manufacturing, chemical, and cement manufacturing.

The world had change into very depending on the availability of every thing from pumps to microchips produced in China and Taiwan. The strict restrictions they placed on the actions of individuals throughout the pandemic precipitated big interruptions to manufacturing during the last two years. The implication was felt globally. This has prompted international firms to diversify their provide chain. The Russian invasion of Ukraine was the following geopolitical occasion that put a better significance on firms and international locations’ must change into extra antifragile.

We’ve got simply began this journey, and the winners from these big investments will likely be giant firms that manufacture equipment, new energy gear, know-how together with microchips, navy gear, and so forth.

Japan does have a big high-technology manufacturing base with a number of firms that ought to profit from this. To call some, we might point out MSBHF, HTHIY, TOELF, and KYCCF.

Dangers and Conclusion

We’ve got typically reminded our readers that Japan has a demographic problem with a declining beginning fee. Opposite to another international locations with declining birthrates, Japan doesn’t have sufficient immigration to make up for the loss.

Nonetheless, though the inhabitants is shrinking and as such the variety of particular person taxpayers fall, Japan has at all times been good at exporting and organising companies oversea. Due to this fact, this shrinking inhabitants shouldn’t be a lot threat to their firms’ profitability.

Nonetheless, the share worth of JPXN has lagged SPY quite a bit during the last 5 years.

Comparability between JPXN and SPY (SA)

JPXN has been up simply 3.4% towards SPY including on a wholesome 62% over a five-year interval.

We may see the hole between the SPY and JPXN slender going ahead as institutional traders, corresponding to giant life insurance coverage firms and pension funds doubtlessly transfer extra of their portfolio away from mounted earnings to the fairness market.

One essential issue to remember when investing in markets that aren’t in your individual dwelling market is the impression of modifications to overseas trade. Though JPXN is in USD, the underlying belongings and its dividends are derived from the Japanese Yen.

The Japanese Yen has weakened during the last seven months. Ought to this pattern proceed, it is going to be damaging for JPXN.

Our stance is that of a Maintain for now.