Scott Barbour/Getty Pictures Information

Introduction

It is time to speak about Common Dynamics (NYSE:GD), a inventory I’ve had on my radar for a few years and one of many few protection contractors that is not part of my portfolio.

As most readers know, I’ve greater than 20% protection publicity, which is predicated on the significance of this business and its potential to generate constant dividend development and capital positive factors. It is an innovation play, not a play to learn from future wars.

Having stated that, in Could, I made the case that Common Dynamics is Too Good To Be This Low-cost. Since then, the inventory has began to kind what appears like a backside.

Not solely that, as we’ll talk about on this article, a whole lot of tailwinds are beginning to strengthen. This contains demand for its protection {hardware} like navy automobiles and personal jets and anticipated development acceleration in munition and provide chain enhancements.

From a dividend (development) investor’s standpoint, I’ve to say that I stay extraordinarily happy with this firm.

Not solely do I consider that GD shares stay undervalued and in a great spot to speed up shareholder returns, however I additionally consider that the subsequent rotation from development to worth shall be extremely useful for GD stockholders.

So, let’s dive into the small print!

Properly-Positioned For Development

Common Dynamics is a well-diversified protection contractor with publicity in quite a lot of extremely enticing segments. That is additionally the rationale why I don’t personal GD shares as a result of my different 4 protection contractors additionally cowl these areas. Not shopping for GD was solely primarily based on diversification.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Applied sciences |

12,457 | 32.4 % | 12,492 | 31.7 % |

|

Marine Techniques |

10,526 | 27.4 % | 11,040 | 28.0 % |

|

Aerospace |

8,135 | 21.1 % | 8,567 | 21.7 % |

|

Fight Techniques |

7,351 | 19.1 % | 7,308 | 18.5 % |

In its Marine Techniques phase, the corporate builds giant fight ships, submarines, and different ships that kind the spine of the mighty US Navy.

Common Dynamics

In Aerospace, the corporate primarily builds personal jets below its Gulfstream model. This phase can also be the rationale why 70% of the corporate’s gross sales are authorities gross sales. Most main rivals have a lot larger authorities gross sales.

Common Dynamics

In Fight Techniques, the corporate builds main protection automobiles just like the Abrams Primary Battle Tank, the Stryker, and numerous different armored automobiles which can be utilized by NATO protection forces.

Common Dynamics

This brings me to the core of this text.

Whereas the corporate’s hardware-focused enterprise was considerably lagging behind its friends with extra next-gen protection capabilities (like Northrop Grumman (NOC)), Common Dynamics is now in a implausible spot to develop all of its segments.

Throughout this yr’s annual Bernstein Strategic Choices Convention, the corporate highlighted quite a lot of tailwinds and the way it expects to develop its enterprise over time.

Gulfstream & Robust Cyclical Demand

Beginning with its Gulfstream (Aerospace) phase, the corporate is principally centered on profitability as an alternative of market share. Within the second half of this yr, the corporate expects certification of its G700 jet, which ought to enable the corporate to realize its objective of pushing aerospace margins to twenty%.

With regard to demand, Common Dynamics anticipates a book-to-bill ratio of 1, reflecting sturdy demand from North American private and non-private corporations, average demand from Europe, and powerful demand from the Mideast and components of Asia (excluding China).

GD believes that its broad portfolio of airplanes caters properly to company prospects with various missions, and excessive net-worth people additionally contribute to demand.

The corporate doesn’t consider {that a} delicate recession will harm demand. I agree with that, as we’re witnessing that the recession (to this point) is principally within the lower-income teams. Evidently, as this phase is vulnerable to cyclical demand, steeper recessions will probably result in an adjustment in anticipated demand.

Protection Tailwinds & Focused Spending

Because the overwhelming majority of GD’s income comes from anti-cyclical authorities orders, the funds is essential.

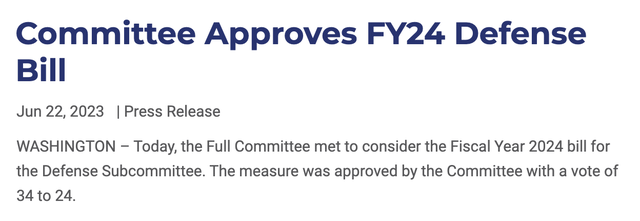

Committee on Appropriations

The FY2024 Protection Invoice seeks to spice up protection spending by nearly 4%.

The Protection invoice funds businesses and packages below the jurisdiction of the Division of Protection (“DOD”) and Intelligence Neighborhood, together with the Navy Companies, Central Intelligence Company, and the Nationwide Safety Company. For Fiscal Yr 2024, the invoice offers $826.45 billion in new discretionary spending, which is $285.87 million over the President’s Funds Request and $28.71 billion – or 3.6% – over the FY23 enacted degree.

Whereas that is beneath what some market members could have hoped for, Common Dynamics is kind of optimistic, because it expects continued assist, given the relevance of its main protection packages and the continued threats on the earth.

Whereas there may be some uncertainty associated to spending discussions, Common Dynamics believes it’s well-positioned to fare properly primarily based on the power of its packages.

For instance (emphasis added):

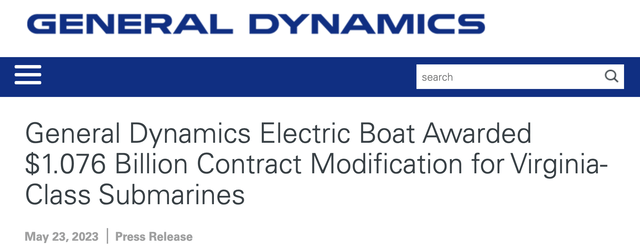

- Development within the Marine group is pushed by the nationwide crucial for Navy floor ships and the growing significance of submarines, significantly the Columbia class. Common Dynamics goals to stabilize the commercial base and enhance materials supply, throughput, and productiveness for the Virginia program. In line with the corporate, as challenges are overcome, appreciable development is predicted, particularly with the progress of the Columbia program. Moreover, margin enlargement is a key focus for the Marine group, and as they work by way of challenges, they anticipate reaching the 9% to 10% margin vary, which is taken into account a objective for the enterprise.

Moreover, GD is making large progress relating to hiring and utilizing effectivity positive factors to offset sure inflation-related pricing headwinds.

Common Dynamics

- The battle in Ukraine is popping into a large tailwind for Common Electrical’s Fight Techniques phase. Previous to the invasion, the corporate had anticipated flat to occasional unfavourable development in fight. Nevertheless, as a result of elevated risk setting, there may be now an anticipated low single-digit development in fight methods. There may be improved demand in Europe for fight automobiles, each tracked and wheeled, in addition to munitions and bridges. Common Dynamics sees potential for additional development relying on the pace of contract acquisition and elevated funding.

Whereas I’m no geopolitical battle skilled, I consider that Ukraine’s efforts to retake misplaced floor will flip into an excellent greater development engine for armored automobiles. In any case, earlier than the battle, armies did not lose fight automobiles. The horrors of the battle in Ukraine have unveiled how essential this phase is.

Moreover, Common Dynamics is the first provider of tactical bridges and expects growing development on this space. Moreover, there may be demand for fight automobiles like Cell Protected Firepower (“MPF”), Abrams, and Stryker. The Military’s MPF program is predicted to obtain full funding, and Abrams tanks have change into a strategic asset for a lot of allies.

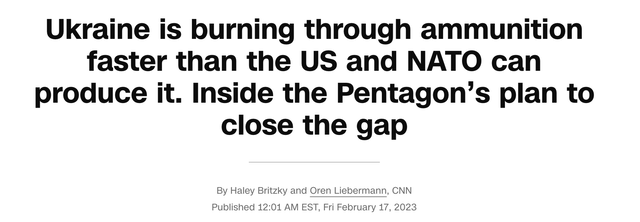

- Associated to that, the munitions enterprise is an space of focus for Common Dynamics, significantly within the context of the battle in Ukraine. The corporate has been working intently with the military and the administration to safe funding and contracts for munitions manufacturing. Whereas the Biden funds confirmed a lower within the munition funds, GD is assured that the administration is supportive and can present extra funding as wanted.

Given what I am listening to from folks conversant in protection procurement, I consider that munition development can also be turning into an even bigger tailwind than initially anticipated.

CNN

- Common Dynamics’ Applied sciences enterprise, together with GDIT (Common Dynamics Info Know-how) and Mission Techniques, has confronted provide chain challenges which have impacted its development. Whereas GDIT has continued to expertise worthwhile low single-digit development, Mission Techniques has seen a decline in income because of these challenges. Nevertheless, the corporate believes that the affect on the Applied sciences group is essentially behind them and expects each segments to develop sooner or later.

With all of this in thoughts, there’s extra excellent news for shareholders.

Shareholder Returns & Valuation

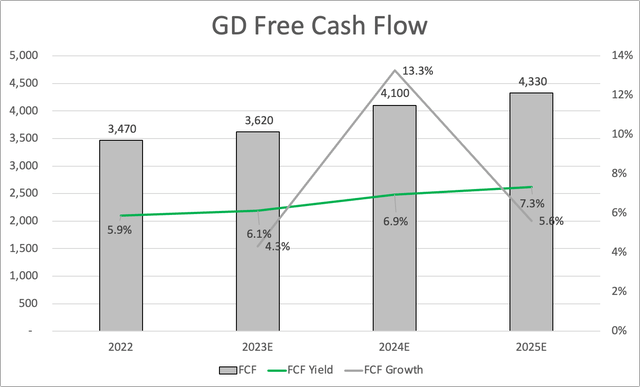

On high of recent rising tailwinds, Common Dynamics anticipates money conversion charges round or above 100% past 2023. Which means that the corporate will generate more money than web revenue, which is an indication of high-quality earnings.

In mild of that, the corporate’s capital deployment will give attention to sustaining the enterprise, R&D, and decreasing debt, with free money movement allotted to dividends and share repurchases.

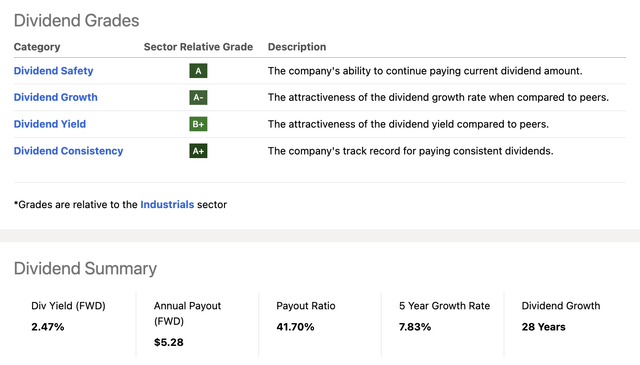

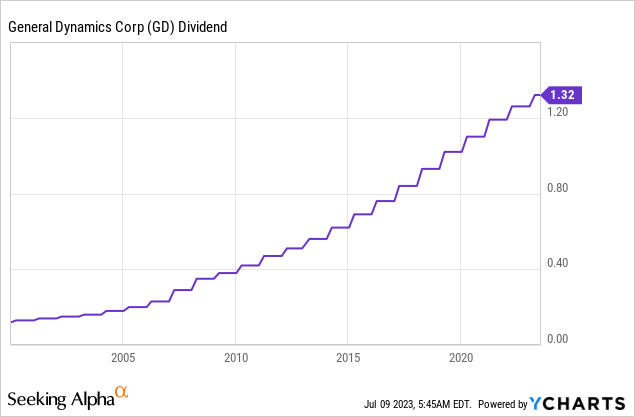

This dividend aristocrat with greater than 25 consecutive annual dividend hikes has a dividend scorecard to write down house about. The corporate has a 2.5% yield, a sub-45% payout ratio, and a 7.8% common annual dividend development price over the previous 5 years.

Searching for Alpha

The latest hike was 4.8%, which was introduced on March 9. Going ahead, I anticipate dividend development to choose up, boosted by larger development.

Trying on the chart beneath, we see that after 2023, free money movement is predicted to speed up, which might lead to a 7% free money movement yield. This is likely one of the highest numbers I’ve seen on this business.

Leo Nelissen

Not solely does a 7% free money movement yield defend a 2.5% dividend yield, but it surely additionally paves the street for larger development sooner or later.

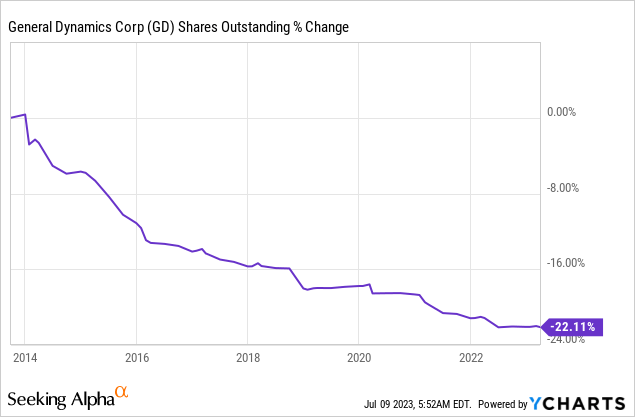

Moreover, as a result of the corporate has a 1.5x 2023E web leverage ratio and an A- credit standing, it doesn’t have to prioritize monetary well being. This enables for aggressive buybacks.

Over the previous ten years, the corporate has purchased again greater than a fifth of its shares. I anticipate this pattern to proceed, as the corporate is producing an excessive amount of money to not purchase again its personal shares.

I additionally have to say that the present valuation warrants quite aggressive buybacks.

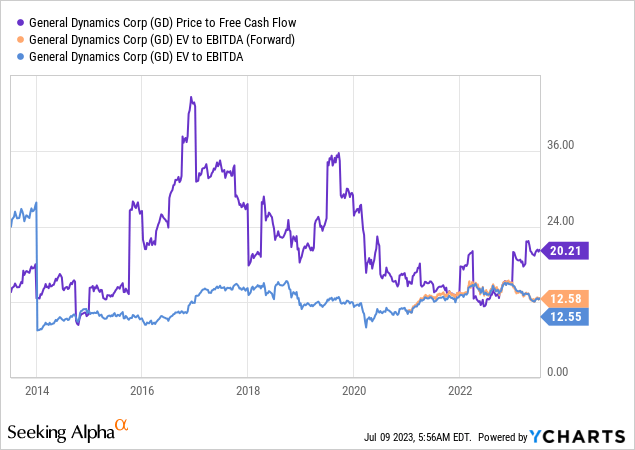

Utilizing the aforementioned free money movement estimates, GD is buying and selling at 14x 2024E free money movement. That is an ideal deal, as I consider that GD ought to commerce near 20x free money movement. The identical goes for EV/EBITDA, which is now again at its long-term median. Nevertheless, notice that free money movement conversion is stronger.

Analysts appear to agree with me. The consensus value goal is $261, which is 22% above the present value.

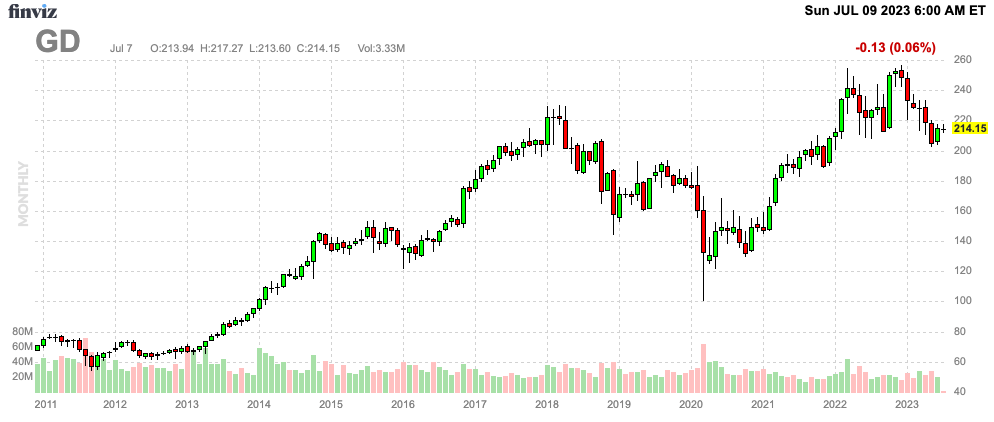

FINVIZ

I agree that GD should not commerce beneath that focus on.

Nevertheless, the market hasn’t acknowledged GD’s potential but.

We should not blame this on GD however available on the market typically.

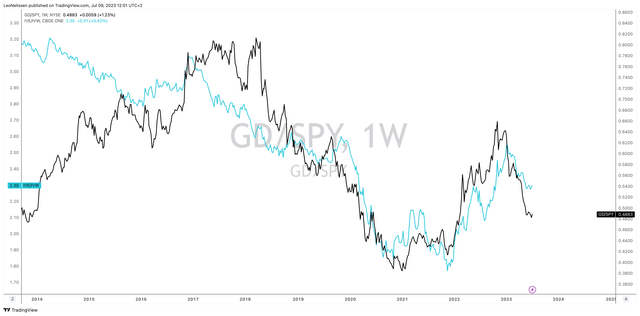

The chart beneath compares the ratio between GD and the S&P 500 (SPY) to the ratio between worth (IVE) and development (IVW) shares. Over the previous few years, GD has traded like a worth inventory. Given the sturdy efficiency of tech since final yr, the market wasn’t keen to guess on undervalued industrials.

TradingView (GD/SPY, IVE/IVW)

Whereas which may be annoying in the interim, I consider that these developments include a whole lot of alternatives – particularly if inflation seems to be sticky, which might give the Fed extra causes to maintain charges elevated on a chronic foundation.

If I did not have any protection publicity, I’d be a purchaser at present ranges, as I not solely think about GD to be too low cost, however I additionally consider that the inventory has the flexibility to outperform the market on a chronic foundation.

Takeaway

Common Dynamics presents a compelling funding alternative with its well-positioned development potential and enticing valuation.

The corporate’s diversified protection segments, together with Applied sciences, Marine Techniques, Aerospace, and Fight Techniques, provide a powerful basis for enlargement.

With anticipated demand for protection {hardware} like navy automobiles and personal jets, in addition to development in munitions and provide chain enhancements, GD is poised for achievement.

Moreover, GD’s give attention to profitability and powerful cyclical demand in its Gulfstream phase, together with elevated protection spending, present extra tailwinds.

The corporate’s dedication to shareholder returns by way of dividends and share buybacks, backed by its high-quality earnings and money era, provides to its attraction.

Present undervaluation and a possible shift from development to worth shares make GD a beautiful dividend play.