nikitos77

This Evaluation Assigns a ‘Maintain’ Score to Mesabi Belief

This evaluation provides shares of Mesabi Belief (NYSE:MSB) — a New York-based royal belief concerned within the Minnesota iron ore mining enterprise — a “Maintain” advice ranking resulting from uncertainty surrounding the outlook for this enterprise.

About Mesabi Belief

Mesabi Belief earns income from royalties it claims for the mining of taconite from the Peter Mitchell Mine close to Babbitt and Silver Bay, on the japanese finish of the Mesabi Iron Vary, in Minnesota.

Northshore Mining Company, a subsidiary of Cleveland, Ohio-based flat metal producer within the US, Cleveland-Cliffs Inc. (CLF), is the operator of the Peter Mitchell Mine.

Northshore Mining Company on the Peter Mitchell Mine close to Babbitt mines taconite, which is then shipped by rail to Silver Bay, the place the magnetite-rich pure useful resource undergoes a pelletizing [process] to supply a 62 – 65% iron focus. The materials is used within the metal business to fabricate metal merchandise.

Mesabi Belief’s royalty earnings depends upon the taconite manufacturing of the Peter Mitchell mine and the value of the uncooked materials (or the value of iron ore as a benchmark). The extra taconite mined, the higher it’s for Mesabi’s revenue, and the upper the value of iron ore, the higher it’s for Mesabi’s revenue.

Whereas the manufacturing of taconite depends upon native elements, firm insurance policies, and demand and worth elements, the value at which the uncooked materials is bought depends upon provide and demand elements, that are in flip influenced by the financial outlook in addition to geopolitical elements.

How Mesabi Belief Performs

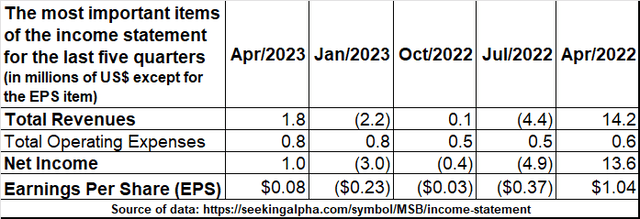

The latest interval of the final 5 quarters has not been one of many happiest for Mesabi Belief’s royalty earnings, as proven within the desk beneath, which relies on Searching for Alpha’s knowledge on the corporate’s financials.

Supply of information: Searching for Alpha

Royalty earnings has been confined to extraordinarily low ranges/destructive areas resulting from: Cleveland-Cliffs’ determination to shut its Northshore taconite ore operation in Could 2022 and a downward pattern within the worth of iron ore futures contracts over the past 5 quarterly reporting intervals.

Northshore’s suspended taconite ore operations impacted revenues from the July 2022 quarter by the January 2023 quarter as Northshore Mining was unable to reopen till early April 2023, albeit not at full capability. Whereas a considerably decrease iron ore worth mixed with nonetheless some headwinds from the partially working Northshore impacted operations within the April quarter of 2023.

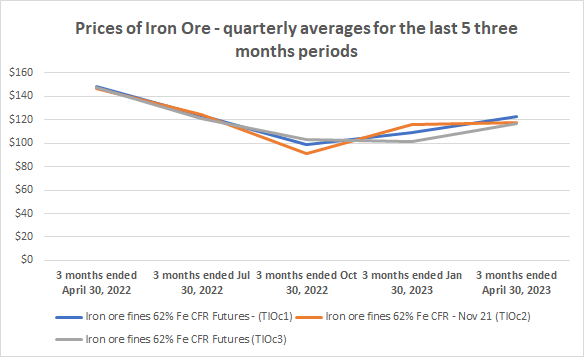

In comparison with the April 2022 quarter, when Northshore’s taconite ore operations have been nonetheless working at full capability (earlier than the Could 2022 suspension), the common worth of iron ore within the April 2023 quarter was 19.2% decrease.

Supply of information: Searching for Alpha

Or primarily based on the slopes of the curve strains exhibiting worth developments for Iron Ore Fines 62% Fe CFR Futures – (TIOc1), Iron Ore 62% CFR – Nov 21 (TIOc2), and Iron Ore Fines 62% Fe CFR Futures (TIOc3) from the April 2022 quarter to the April 2023 quarter, costs fell by roughly 6.7% to eight.2% on a quarterly foundation.

Operations on the taconite ore mine have been shut down as a result of Cleveland-Cliffs stockpiled greater than sufficient taconite ore at different places whereas demand for metal merchandise was weak, in line with Cleveland-Cliffs’ information and reported on this Star Tribune article. However that does not appear to be the one drawback at the moment dealing with the Peter Mitchell Mine, the Mesabi Belief’s supply of earnings. In actual fact, in line with the Star Tribune article, there’s a dispute between Cleveland-Cliffs and the Mesabi Belief over royalties to be paid to the Belief for a Babbitt manufacturing that Cleveland-Cliffs CEO Lourenco Goncalves referred to as “absurdly excessive”.

And it is a main concern for Mesabi Belief’s traders as a result of pending the decision of the dispute, Northshore’s operations may very well be scaled again sooner or later to fulfill Cleveland-Cliffs’ particular operational wants, impacting Mesabi’s internet earnings. In actual fact, Cleveland-Cliffs Inc. has additionally disclosed that it intends to proceed working the Babbitt mines at a decreased capability, which can range primarily based on the corporate’s operational wants.

The Dividend May Face Extra Headwinds

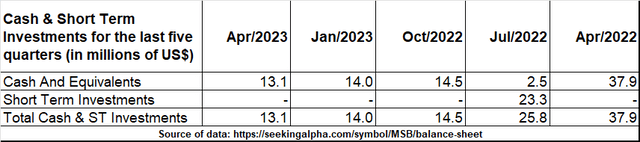

With rising uncertainty concerning the contribution of Babbitt’s mining royalties, the chance to renew the dividend may come underneath strain as accessible money has additionally weakened to make up for a couple of 12 months of mine closure.

Supply of information: Searching for Alpha

There is no questioning Mesabi Belief’s means to proceed to fund the fee of the dividend after Northshore reopens. By the point Belief resumes paying dividends, if it does, maybe shares may have gotten even buying and selling decrease. Nonetheless, the final circumstances underneath which the corporate is at the moment working are much less versatile than earlier than, additionally resulting from an unfavorable financial cycle for the metal business.

Mesabi Belief paid dividends totaling $22.960 million within the April 2022 quarter, $13.645 million within the July 2022 quarter, and paid a complete of $11.021 million within the October 2022 quarter. The belief didn’t pay dividends for both the January 2023 quarter or the April 2023 quarter. The inventory consists of about 13.12 million shares excellent.

Iron Ore Outlook: Lack of Drivers within the Metal Trade

The close to future is just not very promising for iron ore demand and iron ore worth. The first goal of the iron ore product is the steel-making business, and when that business falters, so do the iron ore producers, and with it the Mesabi Belief’s royalties. As with many manufacturing actions at the moment slowing down, metal making within the US and Europe is more likely to face sluggish demand proper now as greater borrowing prices to fight core inflation, which stays resilient regardless of aggressive financial coverage, are inflicting issues for consumption and company investments. The well being of producing actions within the US and the Eurozone is deteriorating considerably.

America of America now tops the listing of the world’s largest consumers of metal merchandise, however China can also be an essential client. The Asian nation ranks second, however the present financial state of affairs doesn’t bode effectively for the metal business, which may even have a destructive influence on iron ore demand and iron ore costs.

China is struggling to gas the financial restoration and there are additionally indicators of deflation, elevating doubts concerning the energy of the demand. The Asian nation would additionally lack assist from Western economies, whose methods aren’t in good condition and dealing with the danger of recession resulting from their central banks’ aggressive financial insurance policies. In actual fact, exports from China have fallen very sharply, marking a 12.4% year-on-year decline to $285.32 billion as of June 2023. This was the sharpest drop in additional than two years as world demand eased. Gross sales of a number of commodities fell, together with metal merchandise (-0.6%), and among the many Chinese language nation’s fundamental buying and selling companions, US exports fell 23.7% yoy, whereas EU and ASEAN exports to China decreased by 12.9% and 16.9% respectively.

These macroeconomic developments aren’t serving to to create constructive expectations for future demand for iron ore, which is more likely to have a destructive influence on the value of the commodity. Analysts at Buying and selling Economics anticipate iron ore costs to fall practically 1% by the top of this quarter and eight.6% by June 2024.

The Inventory Valuation

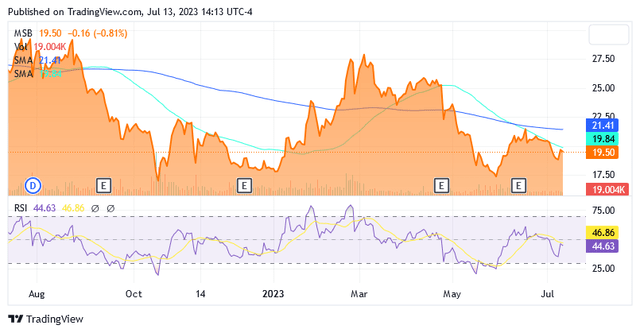

Shares of Mesabi Belief traded at $19.50 apiece as of this writing giving it a market cap of $257.94 million. Shares are buying and selling beneath the center level of $23.255 of the 52-week vary of $16.56 to $29.95.

Supply: Searching for Alpha

Shares are additionally buying and selling barely beneath the 50-day easy transferring common of $19.84 and effectively beneath the 200-day easy transferring common of $21.41.

That doesn’t imply, nonetheless, that you’re inspired to enhance your place as a result of in case you do this, you’ll then miss out on all the problems this firm is at the moment dealing with, which, as highlighted on this evaluation, aren’t any small matter.

Mesabi Belief’s future seems to be plagued with an excessive amount of uncertainty over the receipt of royalties which will now not be common because the asset from which they originate turns into a swing enterprise for Cleveland-Cliffs. As well as, the market may need much less taconite resulting from a slowdown in metal manufacturing over the following few months, which additionally looms over the specter of a recession. Situations are too unsure to foretell when the corporate would possibly resume dividend funds, and money readily available has dwindled throughout Babbitt Mine’s inactive quarters. For now, I’d accept a Maintain ranking and see what’s going to occur with the dispute between the Mesabi Belief and Cleveland-Cliffs over royalty funds and whether or not the financial system may go into recession.

Conclusion

Traders ought to take into account a “Maintain” ranking on Mesabi Belief shares as they nonetheless have vital room to commerce beneath present ranges because of the following headwinds: the royalty income-generating asset in Minnesota is unlikely for use as a daily ore mining operation, maybe till the dispute over Cleveland Cliff’s royalty fee to Mesabi has been resolved. The demand and worth outlook for taconite ore (a magnetite-rich pure useful resource used to supply a 62-65% iron focus) doesn’t bode effectively for the Mesabi Belief both, and a recession seems to be imminent.

In the meantime, shares may fall additional earlier than the Belief resumes dividend funds. The investor ought to be affected person and wait till the whole lot turns into clearer in entrance of him.