Obtain free Microsoft Corp updates

We’ll ship you a myFT Every day Digest e mail rounding up the newest Microsoft Corp information each morning.

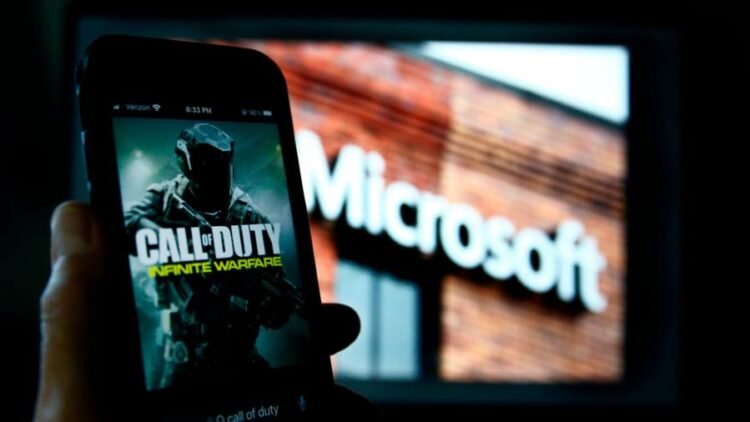

UK regulators have opened the door for Microsoft and Activision Blizzard to shut their $75bn video video games deal inside as little as six weeks, as the businesses scramble to restructure their settlement to fulfill competitors issues.

In the meantime, the US Federal Commerce Fee failed late on Friday in its last-ditch makes an attempt to stop the deal from closing within the US. Its request for a preliminary injunction to dam the deal pending a separate motion was denied by the Ninth Circuit Courtroom of appeals, the day after an analogous injunction request was denied by a federal courtroom in San Francisco. The actions left approval within the UK as the one hurdle left for the businesses of their efforts to seal the deal.

The UK’s Competitors and Markets Authority on Friday mentioned it might push again a July 18 deadline for it to dam the deal till August 29, after receiving a “detailed and complicated submission from Microsoft”. The corporate argued that the company ought to re-examine its conclusions because of “materials adjustments in circumstance and particular causes”.

That timetable may enable Microsoft to finish the merger extra rapidly than the CMA had urged earlier this week, when the company mentioned a restructured deal would set off a brand new investigation, seemingly taking a number of months.

The CMA’s transfer to reopen deliberations about its ultimate determination, which is uncommon so late within the regulatory course of, revives the potential for Microsoft to resolve the watchdog’s issues about competitors within the cloud gaming market. The CMA didn’t present particulars of Microsoft’s submission, which was made greater than a month in the past.

The extension comes as Microsoft explores methods of restructuring its cloud gaming enterprise within the UK to appease the CMA, which dominated in April that combining the maker of Xbox consoles with the creator of hit video games together with Name of Responsibility and Diablo would give it “the flexibility to undermine new and revolutionary rivals”.

The UK competitors regulator’s objections are seen because the final large authorized hurdle going through the world’s largest video video games deal, after US courts earlier this week sided with Microsoft to reject an preliminary try by the Federal Commerce Fee to dam the merger.

The merger settlement between Microsoft and Activision Blizzard is because of expire on July 18, which might enable both firm to stroll away from the deal and triggering a $3bn break payment. Nevertheless, after this week’s authorized victory within the US courts and a possible lifeline within the UK, individuals near the businesses say they’re prone to agree an extension to the deal early subsequent week.

“Issues are shifting fairly rapidly,” mentioned one particular person near the negotiations.

One potential concession to the CMA into consideration by Microsoft is a transfer to promote cloud streaming rights to its catalogue of video games to a different supplier within the UK, in keeping with individuals aware of the discussions. The association may see Microsoft in impact exit the cloud gaming market within the UK or hand over operations of a video games streaming platform for its Xbox console to a 3rd occasion.

Microsoft has sounded out potential traders and operators about such a deal, which could assuage the CMA’s issues that the Xbox maker would have an excessive amount of management over the nascent marketplace for cloud gaming.

Bloomberg earlier reported particulars of the cloud discussions. Microsoft and Activision Blizzard declined to remark.

Gareth Sutcliffe, analyst at Enders Evaluation, mentioned that such a deal can be “actually clunky” for customers however “is perhaps a manner across the CMA”. “Microsoft can be operating the numbers for a UK carve-out that may please the CMA,” he mentioned. “They might be taking a look at least-worst choices.”

Extra reporting by Kate Beioley in London and Richard Waters in San Francisco