Yevhen Roshchyn/iStock through Getty Photos

The BABA Funding Thesis Is Not For The Faint Hearted

We beforehand lined Alibaba Group Holding Restricted (NYSE:BABA) in March 2023, discussing the administration’s resolution to break up up Jack Ma’s empire into six smaller bite-size autonomous elements. The restructuring announcement had been well timed then, pointing to China’s formidable GDP goal of 5% in 2023, on prime of the supposed leisure of regulatory crackdowns.

Nonetheless, buyers who determined to dip their toes want to pay attention to the creating restructuring story, on prime of the unsure macroeconomic outlook and the unstable geopolitical state of affairs.

For now, it seems that BABA remains to be caught within the cross fireplace, with its valuations remaining sluggish at NTM EV/ Revenues of 1.62x and NTM P/E of 11.05x, in comparison with its 5Y imply of 4.43x and 20.63x, or 3Y pre-pandemic imply of 8.25x and 28.43x, respectively.

Based mostly on its NTM P/E and the market analysts’ FY2025 adj EPS projection of $9.45, we’re additionally taking a look at a long-term value goal of $104.42, suggesting minimal upside potential from present ranges.

We suppose this cadence means two issues.

One, the BABA inventory’s prospects could all the time be affected by the unstable geopolitical threat, irrespective of the outcomes of the renewed audit in July 2023. Two, anybody hoping for a turnabout in its valuations could should be very affected person certainly.

That is as a result of ever widening scope of commerce ban between the US and China, with the most recent drastically impacting Micron (MU) and the export management on chip-making metals: gallium and germanium.

Whereas market analysts have hypothesized that the RMB 7.12B or the equal of $985M wonderful on Ant Group could sign the top of Beijing’s crackdown, we’re much less sure if the Chinese language inventory market and BABA could ultimately regain the worldwide buyers’ confidence transferring ahead.

The US authorities seems able to additional intensify its restriction on future Chinese language-based investments as effectively, concentrating on “non-public US fairness and enterprise capital funding in extremely strategic technological sectors.” That is on prime of the drastic decline in US funding from $35B in Q1’21 to ~$400M in Q1’23, suggesting an ideal shift in market sentiments away from China.

Beijing’s newest interim guidelines for generative AI doesn’t seem encouraging as effectively, with state scrutiny seemingly being a continuing transferring ahead:

Adhere to the core values of socialism, and should not generate incitement to subvert state energy, overthrow the socialist system, endanger nationwide safety and pursuits, injury nationwide picture, incite secession. (Our on-line world Administration of China)

With BABA additionally launching a number of generative AI companies, due to its in-house analysis institute DAMO Academy, it stays to be seen if there could also be any regulatory backlash transferring ahead, as seen with OpenAI within the US and the EU. As well as, the newly restructured firm will even must vie with SenseTime Group (OTCPK:SNTMF) and Baidu (BIDU) within the quickly altering AI panorama.

Whereas previous efficiency is probably not indicative of future outcomes, BABA could stay a battleground inventory in spite of everything.

Then once more, the inventory continues to commerce very attractively at these compressed ranges, with a powerful ebook worth of $56.24 per share (+2.8% QoQ/ inline YoY). That is due to its sturdy stability sheet at $76.36B (+1.4% QoQ/ +6.3% YoY) and sustained share repurchases to its present shares excellent of two.61B (-60M YoY) by the most recent quarter.

Mixed with the contemporary begin and improved fundraising functionality from the continuing restructuring, BABA seems to be extraordinarily effectively capitalized for its future endeavours certainly.

So, Is BABA Inventory A Purchase, Promote, or Maintain?

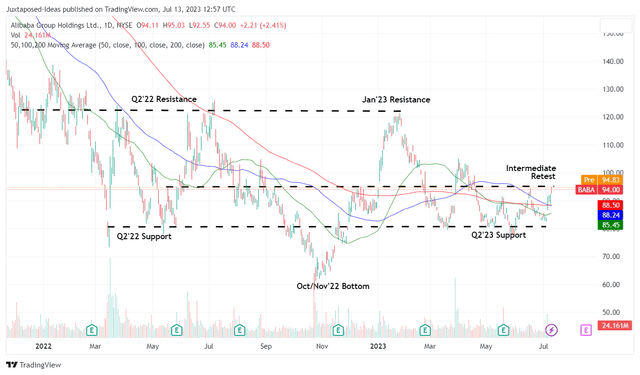

BABA 2Y Inventory Worth

TradingView

For now, anybody hoping for a fast return to BABA’s earlier inventory costs of almost $300 could also be sorely disenchanted, particularly with the unsure reopening cadence in China.

Subsequently, we reckon the inventory could also be extra appropriate for fast trades between $80s and $95s momentarily, in any other case generally known as the swing commerce sample, previous to the inventory’s speculative restoration if the geopolitical dangers are lifted, probably from 2025 onwards as soon as the US presidential election is concluded.

Naturally, it is usually unknown if these headwinds could also be totally resolved or additional intensified transferring ahead. This cadence suggests the BABA inventory’s extremely speculative nature, in comparison with its extra secure US counterparts, comparable to Amazon (AMZN) buying and selling at NTM EV/ Revenues of two.54x/ NTM P/E of 77.63x, Alphabet (GOOG) at 4.67x/ 22.27x, and Microsoft (MSFT) at 10.90x/ 32.54x, respectively.

On account of its blended prospects, we proceed to price the BABA inventory as a Maintain (Impartial) right here.

Then once more, anybody who continues to carry to BABA via the volatility so far, most likely have sturdy fingers, implying their willingness to attend out the storm. With many of the geopolitical headwind and ADR threat already baked in, it seems that the present Q2’23 ranges can also present a long-term flooring for anybody trying to commerce.

Assuming that BABA is ready to revert to a extra geopolitically impartial ahead P/E valuations of 20x, we may even see its long-term value goal rise to $189, implying an almost doubled upside potential from present ranges. It goes with out saying that this speculative investing technique isn’t for the faint hearted, with this nice upside coming with nice dangers.