Which means of Inflation in Financial system and Definition of Inflation Price

Sorts of Inflation

Investing Throughout Inflation

Curiosity Price vs Inflation

Price of Inflation by Nation

Inflation Yr over Yr

Calculate Inflation

Discover the Inflation Price

How does deflation occur

Why Deflation is a Drawback

Investing in Deflation

Deflation within the US

Definition of Stagflation in Economics

What’s Stagflation Brought on by

Investments in Stagflation

Stagflation of the Seventies

Historical past presents no clear path for the longer term, together with the course of the financial system as soon as central banks finish their extraordinary financial insurance policies. Outcomes from an increase in rates of interest vary from an Inflationary increase, Deflationary stoop, or Stagflationary swamp; every has implications for the methods your portfolio is managed.

Traders can flip to historical past to know the implications of every situation and for steerage for the best-performing asset class in every case.

Which means of Inflation in Financial system and Definition of Inflation Price

In easy phrases, Inflation is the phenomenon that characterizes the rise of products and providers. Excessive Inflation is characterised by rising costs and a decline in buying energy. As an example, if Inflation Price is at 10%, shoppers would wish to spend $110 to buy items that may have beforehand value them $100.

Sorts of Inflation

Broadly talking, there are two varieties of Inflation that affect costs. This consists of:

A. Demand-Pull Inflation – Demand-Pull Inflation happens when the demand for items or providers exceeds that of the provision that at the moment exists within the markets. When demand-driven Inflation happens, an excessive amount of cash is chasing too few items.

B. Value-Push Inflation – Value-Push inflation is signified because of rising enter prices to ship items and providers. There are three elements that may contribute to cost-based Inflation, together with an Enhance in Commodity Costs, a Rise in Wages, and a rise in company taxes.

Whereas Inflation within the U.S. has traditionally been low (averaging 3.6% over the past 60 years), it has quickly been on the rise just lately. During the last 18-months, the U.S. has skilled a mixture of each demand-pull and cost-push inflation.

This consists of Covid-related favorable financial insurance policies equivalent to low-interest charges and monetary stimulus, which has elevated the broader cash provide, mixed with report ranges of employment and provide chain shortages.

Investing Throughout Inflation

In situations when Inflation is on the rise (equivalent to the present panorama), firms are inclined to publish greater revenues and income. Regardless of this, greater enter prices and margin pressures can result in shares underperforming.

Excessive-growth and tech shares have carried out properly in periods of excessive Inflation, however rising rates of interest which might be carried out to thwart Inflation can result in under-performance over the brief time period.

When Inflation has ravaged markets previously, actual property equivalent to Oil, Gold, and Actual Property have typically outperformed equities and debt, providing wealth preservation even when the worth of cash is quickly deteriorating.

Moreover, inflation-indexed bonds or financial savings merchandise may also assist buyers cope with the unfavorable affect of Inflation.

Curiosity Price vs Inflation

When inflation is persistent within the financial system, the central banks have to preserve elevating charges to convey it below management.

An increase in rates of interest slows down credit score circulation within the financial system, which in flip ought to ease inflation. However, rising charges lead to lead to a better danger of default for each residence and auto loans, together with a recession and ramping up unemployment.

For context, it took 9 years for the US to succeed in the identical unemployment fee after the 2008 crash, signaling the fragile nature of the financial system.

Curiosity Charges and Bond Costs have an inverse relationship and have a tendency to maneuver in the other way.

Say you personal a bond with a face worth of $1,000 and a coupon fee of two%. If rates of interest are elevated, the federal government or companies will situation new bonds with greater coupon charges. Let’s say the brand new bonds have a 3% coupon fee. Traders will need to purchase them as an alternative of your 2% bond.

Price of Inflation by Nation

Let us take a look at 3 of the foremost economies.

Present Inflation Price in america

Present UK Price of Inflation

Inflation Price of Germany

Inflation Yr over Yr

If you’re struggling to know if that is excessive or low, let’s take a look at the Yr-over-Yr figures for United States:

As you may see, the present inflation charges are at information heights for the final 25 years.

Calculate Inflation

The Inflation is calculated based mostly on the Client Worth Index (CPI). CPI is a measure of the common change over time within the costs that folks pay for a hard and fast provide of products and providers.

The CPI relies on knowledge collected from 1000’s of companies. These companies report what they pay for services and products each month. The Bureau of Labor Statistics then calculates how a lot these firms would have needed to pay in the event that they purchased the identical objects and providers at the start of the yr. They do that utilizing a system known as the “worth index.”

Under is how the CPI of United States for the newest 12 months seems to be like. It’s not arduous to see its good correlation to the inflation fee.

Discover the Inflation Price

I exploit TradingEconomics lots of the date I would like. In case you want to verify what’s the inflation fee on your nation, you’ll find it right here:

https://tradingeconomics.com/country-list/inflation-rate

What’s Deflation in Financial system

What’s the Distinction Between Deflation and Inflation

Deflation is an financial phenomenon that impacts costs, wages, and the financial system as an entire. In distinction to Inflation, in deflationary occasions, the buying energy of a forex unit will increase as a result of much less cash must be exchanged for items or providers.

In different phrases, it takes much less cash to purchase the identical quantity of products or providers as earlier than. As such, deflation creates a disincentive for firms and people to speculate, resulting in decreased financial exercise in the long term.

How does deflation occur

Deflation occurs when costs drop. It is brought on by a smaller cash provide or much less demand, or it will probably occur by itself. When costs drop too low, individuals and companies maintain onto their cash as an alternative of spending it.

Both means, the cash provide decreases, which suggests the worth of every particular person greenback will increase and costs go down.

Why Deflation is a Drawback

Deflation looks like a very good factor at first as a result of it helps to decrease costs for items and providers, however in the long run, it will probably trigger bother for the financial system. Primarily, since deflation happens, demand is decrease, resulting in firms reducing prices by reducing staff, thereby rising the extent of unemployment.

A traditional instance of deflation hurting buyers is the phenomenon that has occurred in Japan over the past twenty years. Low-population progress, mixed with a decline in wages, has led to a protracted interval of deflation.

Whereas wages within the U.S. and Europe have grown between 50 and 80% over the past 20 years, they’ve declined by 5%. Companies with stagnant gross sales because of low spending have lower costs, feeding a cycle of gradual progress and deflation.

Investing in Deflation

If deflation persists for a short while, buyers may look in direction of progress and tech shares, fueled by low charges. Nonetheless, Equities have traditionally underperformed in sustained intervals of deflation because of low demand, notably within the case of Japan since 1990.

In such circumstances, Bonds and different fixed-income devices are inclined to outperform, regardless of unfavorable rates of interest from central banks because of excessive demand from price-insensitive patrons. One other asset that performs properly, albeit with low returns, is money.

Deflation within the US

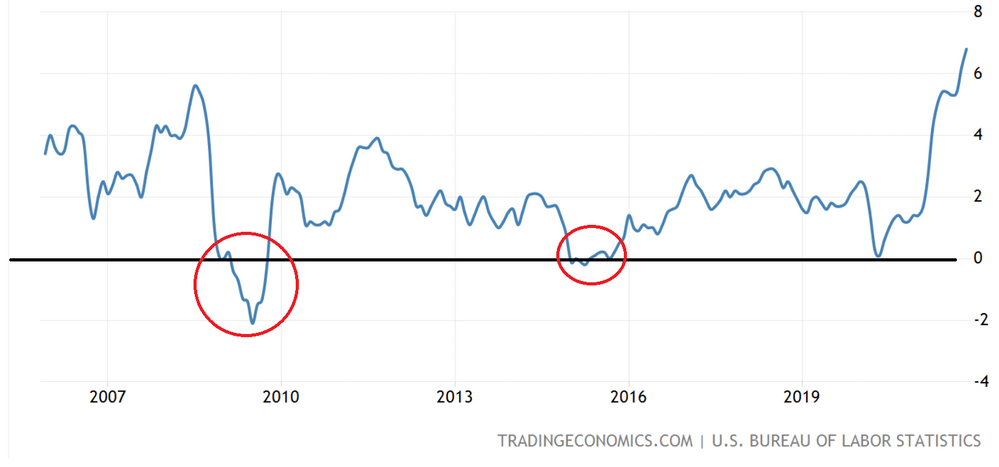

The final technical deflation occurred in US in 2015, when the inflation fee hit -0.1%. Nonetheless the final true deflation occurred in 2009 with the indicator hitting -2%. Everyone knows that story.

You’ll be able to determine the intervals of deflation by merely wanting on the inflation chart and looking for unfavorable values.

Definition of Stagflation in Economics

Stagflation is a mixture of financial stagnation, excessive unemployment, and extreme Inflation—may cause severe problem for a rustic’s financial system.

Though stagflation has hardly ever been documented, it occurred as just lately because the Seventies, when it adversely affected the monetary fortunes of central banks in america and Nice Britain.

Whereas stagflation is a uncommon situation, there are clear parallels between the present macroeconomic state and the Seventies. This consists of central banks easing markets by means of low charges and monetary stimulus, governments allocating massive sums of Monet to welfare packages, and commodities hovering because of heightened geopolitical tensions.

What’s Stagflation Brought on by

The next elements may result in the worst of each Inflation and deflation: limiting company progress and rising enter prices. The uncomfortable side effects of stagflation embody a pointy rise in unemployment and a continued rise in costs.

Investments in Stagflation

The perfect performing asset within the Seventies was gold, which surged from $35 an oz. to almost $700. Different property which have traditionally carried out properly in such circumstances embody valuable metals equivalent to silver and commodity and energy-focused equities equivalent to Vale, Exxon, and BHP.

Stagflation of the Seventies

Till the Seventies, many economists believed in a steady inverse relationship between inflation and unemployment. Then got here the stagflation of the Seventies, a mixture of gradual progress and quickly rising costs.

Then, in 1973, OPEC banned america from exporting oil because of its participation within the Arab-Israeli conflict. Oil costs skyrocketed consequently. That is the kind of worth shock that central banks cannot management. Nonetheless, as a result of it occurred at a time when inflationary psychology was already heightened, it contributed to the entrenchment of expectations of ever-rising costs.

Backside Line

Whereas the longer term stays unsure, markets are at the moment pricing in an financial increase and elevated asset costs. Markets have been trending upward since 2008, so it is sensible that buyers anticipate them to proceed doing so.

If nothing else, buyers know that any deviation from this pattern, equivalent to Inflation or stagflation — may trigger volatility and trigger totally different property, equivalent to commodities and actual property, to return to fray.

A portfolio balanced with all three property may be a good suggestion; it could embody some money for draw back safety and scope to purchase amid any wider selloff, even when it comes on the expense of underperforming markets within the brief time period.

Hope this was helpful for you! Please be aware that the above content material just isn’t an funding advise and shall be thought-about just for informative goal.

I like to recommend my eBook to be taught extra about the right way to construct passive revenue with funding and create your first funding technique. Plus get for FREE our information to Dividend Investing.

That was it for now. I hope it will likely be helpful for you! Be at liberty to ask any questions within the feedback part.

Joyful Investing

Really useful Articles on Inventory Market:

learn Earnings Report? Are they nonetheless essential?

Which brokerage is the very best for dividend investing?

Your information by means of Financial Cycles

References:

https://knowledge.oecd.org/earnwage/average-wages.htm

https://www.kiplinger.com/investing/shares/604318/5-superb-stocks-to-shield-against-stagflation