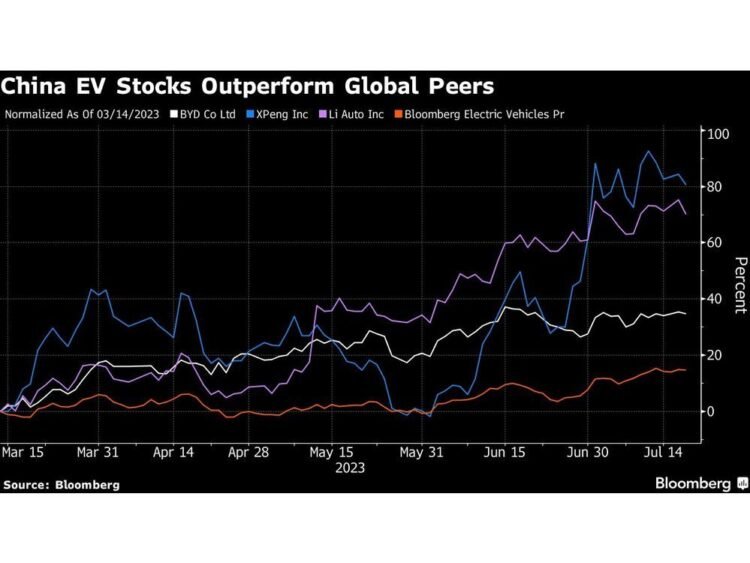

China’s electric-vehicle makers are defying an unprecedented value warfare with their share features trouncing overseas rivals, and analysts say the rally could run additional because of a stronger pipeline of recent merchandise.

![460vc7g]6(ntp7frjxox[aq}_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/07/china-ev-stocks-outperform-global-peers.jpg?quality=90&strip=all&w=288&h=216&sig=TqM-5-FLFwf_R3anm4WrJg)

Article content

(Bloomberg) — China’s electric-vehicle makers are defying an unprecedented price war with their share gains trouncing foreign rivals, and analysts say the rally may run further thanks to a stronger pipeline of new products.

Advertisement 2

Article content material

Li Auto Inc. delivered greater than 30,000 items for the primary time in June, a 150% improve from a 12 months earlier. The shares have risen 90% in Hong Kong this 12 months, with bears positioned close to the bottom stage since September, in accordance with IHS Markit knowledge. The agency has held off in slicing costs for its fashions.

Article content material

There’s additionally BYD Co., the EV chief that overtook Volkswagen because the best-selling automotive model in China within the first quarter, which has seen shares leap 38% this 12 months in Hong Kong. That’s greater than double the worldwide business gauge’s 17% rise. BYD has additionally seen rising market share, chipping away at Tesla Inc.’s portion in recent times, in accordance with knowledge from the Passenger Automotive Affiliation.

Learn: How China Beat Everybody to Be World Champ in Electrical Automobiles

Article content material

Commercial 3

Article content material

The sturdy gross sales underscore strong demand for native clear autos regardless of China’s lackluster client spending, because of favorable authorities insurance policies, sturdy product roll-outs and enticing pricing. There’s additional upside as analysts say the current demand restoration could enhance margins within the second half.

“Valuations usually are not too wealthy but so the rally has legs as long as the businesses can ship on their month-to-month numbers,” stated Kevin Internet, head of Asian equities at LA Banque Postale Asset Administration, including that he’s “much less involved now” in comparison with earlier this 12 months when Tesla kicked off its aggressive pricing technique.

BYD is buying and selling at 23.5 instances ahead earnings, about one-third of its common over the previous three years. In the meantime, Tesla is buying and selling at about 70.5 instances, its highest stage since Could 2022.

Commercial 4

Article content material

Numerous massive banks and brokers have turned extra favorable on the sector. HSBC Holdings Plc. forecasts that China new power automobile gross sales could attain 8.2 million items this 12 months, a ten% improve from its earlier forecasts. “As costs stabilize, we see a stronger demand restoration, as shoppers who’ve been ready for a greater value usually tend to purchase a brand new automotive,” analyst Yuqian Ding wrote in a report.

Sanford C Bernstein can also be turning extra constructive on China’s auto cycle after seeing bettering retail demand. The brokerage holds a cautiously optimistic view, anticipating client confidence and credit score impulse to assist auto demand within the coming months.

There are some dangers, nonetheless. The summer season months are usually the softest by way of demand, which might harm the current momentum for Chinese language shares. There are additionally indicators of overheating, with Li Auto and XPeng Inc. nearing technically overbought ranges. Bearish bets specifically for XPeng are hovering close to a report excessive in Hong Kong after practically doubling in its share value not too long ago.

Commercial 5

Article content material

International gamers have additionally had some sturdy share rallies, with Tesla gaining greater than 136% for the reason that begin of the 12 months, partially as a result of a man-made intelligence growth.

The subsequent focus shall be on the outlook for margin trajectory and supply momentum of recent fashions introduced throughout second-quarter earnings launched subsequent month, Morgan Stanley analysts together with Cindy Huang wrote in a observe.

Early indications present issues are holding sturdy. BYD reported a threefold improve in preliminary earnings for the primary six months and its revenue per automobile could have risen to eight,000 yuan ($1,108.5) within the second quarter, up from the earlier quarter’s 7,500 yuan, in accordance with Citigroup Inc.’s estimates.

Prime Tech Tales

- Netflix Inc. projected third-quarter income that fell wanting Wall Road estimates, suggesting a crackdown on password sharing and a brand new promoting tier aren’t but delivering the gross sales development analysts anticipated.

- Tesla Inc. is sparing no expense to change into a participant in supercomputing, with Elon Musk saying the electrical carmaker plans to speculate greater than $1 billion on its so-called Undertaking Dojo by the tip of 2024.

- Tencent Holdings Ltd. co-founder Pony Ma has penned a prolonged op-ed backing Chinese language pledges to resuscitate the personal sector, turning into essentially the most outstanding entrepreneur to endorse Beijing’s guarantees to unshackle an enormous swath of the financial system.

- Worldwide Enterprise Machines Corp. maintained its full-year forecast of three% to five% gross sales development, overcoming investor anxiousness about weakening demand for web know-how.

—With help from Jeanny Yu.

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We now have enabled e mail notifications—you’ll now obtain an e mail in case you obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Neighborhood Pointers for extra data and particulars on the way to regulate your e mail settings.

Be a part of the Dialog