(Bloomberg) — MaxLinear Inc., a maker of chips for broadband communications, mentioned it terminated its try to amass Silicon Movement Expertise Corp., ending a cash-and-stock deal price $3.8 billion.

Most Learn from Bloomberg

The Carlsbad, California-based firm mentioned in a press release Wednesday that Taiwan-based Silicon Movement failed to finish a number of the situations of closing, suffered a “materials hostile impact,” and is in breach of agreements.

The transaction, which might have been MaxLinear’s largest, was initially deliberate to shut within the first half of this yr.

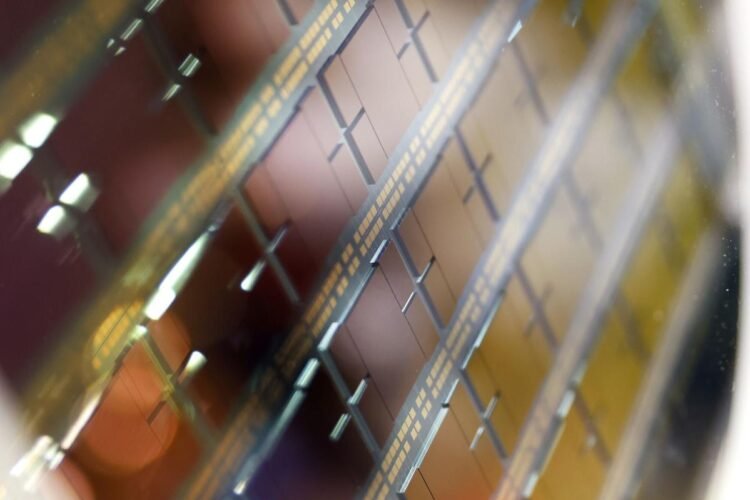

Silicon Movement makes NAND flash controllers for solid-state storage gadgets. It additionally provides knowledge middle and specialised industrial and automotive solid-state drives.

The announcement comes shortly after the transaction had obtained a sign-off from regulators in China, the most important marketplace for semiconductors. Silicon Movement’s US-listed shares had rose 25% Wednesday after that approval, with situations connected, in keeping with a press release on the State Administration for Market Regulation’s web site in China. MaxLinear shares closed down 13% in common buying and selling in New York.

Semiconductors have grow to be an important space of dispute between China and the US of their rising geopolitical rivalry.

The US authorities needs to restrict entry to the know-how by Beijing, concerning it as a menace to nationwide safety, and has launched measures to restrict exports to the world’s second-largest financial system. That growing pressure has made cross-border acquisitions harder to finish in an unsure regulatory setting.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.