If you wish to protect your wealth … diversify.

Unfold your cash amongst 20 to 30 shares or higher but, purchase an index fund.

This fashion, nobody inventory will sink your portfolio.

However have in mind, you received’t make excellent returns.

And the reason being easy: You’ll be able to’t outperform the index, in case you are the index.

Holding that form of “Noah’s Ark” portfolio … a bit of of each inventory beneath the solar, is the way in which to go for many buyers.

However … in case your major purpose is to GROW your wealth (and never simply protect it) then you must keep away from diversification just like the plague!

As a result of that’s merely not the way you grow to be rich.

Nice fortunes weren’t constructed by holding 50 or extra shares in a portfolio.

They had been made by individuals who recognized an impressive enterprise, and held for the long run.

And that’s not simply my view, both.

A few of historical past’s most profitable fortunes had been constructed by concentrating (not diversifying) their cash…

A Century of Proof

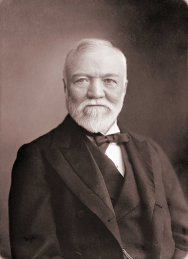

On the flip of the twentieth century, Andrew Carnegie was one of many richest individuals on this planet.

When he was 13 years previous, he immigrated to America along with his household, with out a penny to his title.

Carnegie labored as a “bobbin boy” altering spools of thread in a cotton mill 12 hours a day, 6 days every week in a Pittsburgh cotton manufacturing unit.

His beginning wage was $1.20 per week (value $41 per week in 2022’s {dollars}).

From these meager beginnings, Carnegie went on to make a fortune in metal.

And on the time of his loss of life, his web value was $310 billion (2022 equal).

Carnegie was no fan of diversification.

He stated that individuals who scattered their capital have “scattered their brains, additionally.”

Warren Buffett later echoed the identical sentiment, declaring that: “When you perceive the enterprise, you don’t must personal very lots of them.”

I personally don’t know too many individuals that bought wealthy off their 15th finest thought, however I do know many who made their fortunes on their perfect thought.

And the necessities of sustaining a extra concentrated portfolio are fairly minimal…

Concentrated Earnings

Proudly owning a concentrated portfolio means realizing one thing concerning the enterprise.

Which may sound like a fundamental requirement, however you’d be shocked. Most individuals do not know what service or product the corporate offers! All they know is the ticker.

It’s straightforward to purchase an ETF or an index fund with out a lot as a second thought.

However should you solely personal a handful of companies, you’d need to solely purchase the perfect.

And you must perceive the enterprise itself so as to know whether or not it has a bonus over the competitors.

The second requirement of a concentrated portfolio is that you simply concentrate on long-term prospects.

Really nice companies adapt and evolve to fulfill altering market circumstances. The most effective corporations constantly rise to fulfill alternative and take advantage of out of it.

The ultimate requirement is that you simply ONLY purchase at a lovely worth.

The worth you pay determines the return in your cash. Pay a excessive worth, and your returns will probably be low. Pay a low worth and your returns will probably be excessive.

Even an incredible enterprise purchased at a excessive worth will produce a horrible return.

Hearken to Charlie

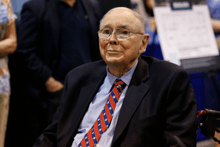

Warren Buffett’s Vice Chairman, Charlie Munger, constructed his personal huge wealth with a portfolio consisting nearly totally of simply three investments.

In line with Munger: “The concept very sensible individuals with funding abilities ought to have massively diversified portfolios is insanity.”

As a result of should you can determine a couple of nice companies, purchase them at a lovely worth after which sit in your butt … it’s fairly arduous to not generate profits.

Proper now Principal Avenue buyers have the chance to construct their very own fortune with only a handful of the very best companies.

As a result of the subsequent era of huge corporations is simply starting to surge.

This identical class of shares has delivered among the largest long-term good points of the last decade.

And now, historical past is ready to repeat itself.

You’ll solely want a couple of of those “Tremendous Shares” to remodel your portfolio and turbocharge your returns … and you will get began proper right here.

Regards,

Founder, Alpha Investor

Reject Retirement. AKA: Warren Buffet’s Most Precious Lesson

I simply bought again from my first actual trip in years. It was improbable … fully exhausting … and completely mandatory.

However as I used to be sitting in a Paris café having fun with a espresso, I assumed for a minute how good it could be to be retired. To have the ability to waste away in a Paris café each day.

After which I shortly dismissed the thought. After a few week, I do know I’d get bored and my mind would flip to mush.

The information backs this up. A latest paper within the American Geriatrics Society journal tracks the progress of a pattern of retirees over a 10-year interval. Maybe not surprisingly, there was a measurable decline in individuals’s cognitive perform instantly following retirement: in verbal fluency, reminiscence and international perform.

However the deeper you dig into the numbers, the extra it will get attention-grabbing. The consequences had been twice as extreme in males in comparison with girls. This decline was additionally worse for each women and men who attended school in contrast to those who didn’t.

It appears that evidently with out the stimulus and sense of objective of a job, our minds actually do go into decline … and it’s worse for males.

So for the gents on the market: You wish to reside a protracted and fulfilling life and preserve your psychological colleges sharp for so long as potential.

Don’t retire. Die together with your boots on.

Warren Buffett: 92 and Nonetheless Buffetting

Contemplate the GOAT himself, the Oracle of Omaha, Warren Buffett. He’s 92 years previous and nonetheless as sharp as a tack. Certain, he most likely doesn’t preserve the hours he did in his 40s, however he nonetheless fits up and goes to the workplace day by day.

Buffett has been reported to learn 600 to 1,000 pages of fabric each single workday. I’d be shocked if he nonetheless retains that tempo at 92, however he nonetheless claims to spend 80% of his day studying.

That goes a protracted technique to explaining why Buffett has managed to stave off cognitive decline. He works his mind like an excessive bodybuilder.

And by the way in which, Buffett is a veritable spring rooster in comparison with his longtime vice chairman Charlie Munger. Mr. Munger will probably be turning 100 in January.

Nevertheless, there’s a distinction between working arduous and being a workaholic. Working arduous helps to maintain your thoughts sharp.

Being a workaholic will put on you down and burn you out.

It’s essential to respect your weekends, and sure, take the occasional trip to refresh your self. And also you want hobbies to take your thoughts off work. Buffett is a hell of a bridge participant who additionally performs the ukulele.

However if you wish to reside lengthy and keep sharp, it actually does come again to work. Discover a job you’re keen on, keep it up and push off retirement so long as you presumably can.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge