-

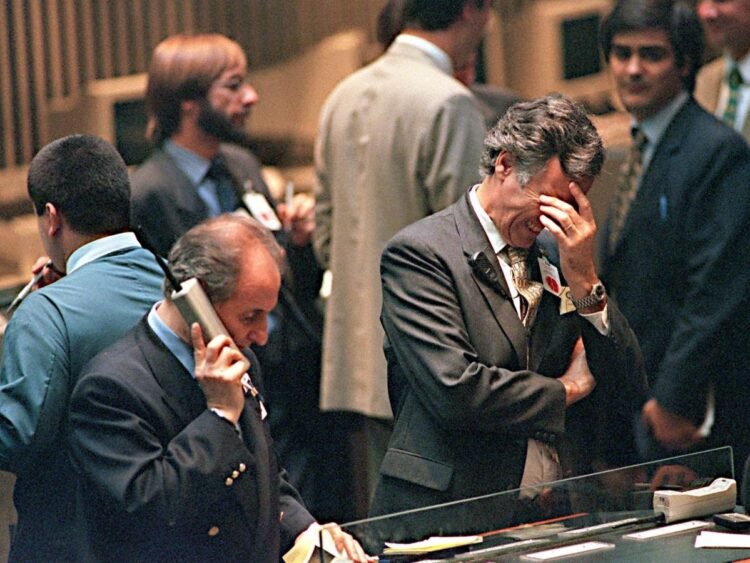

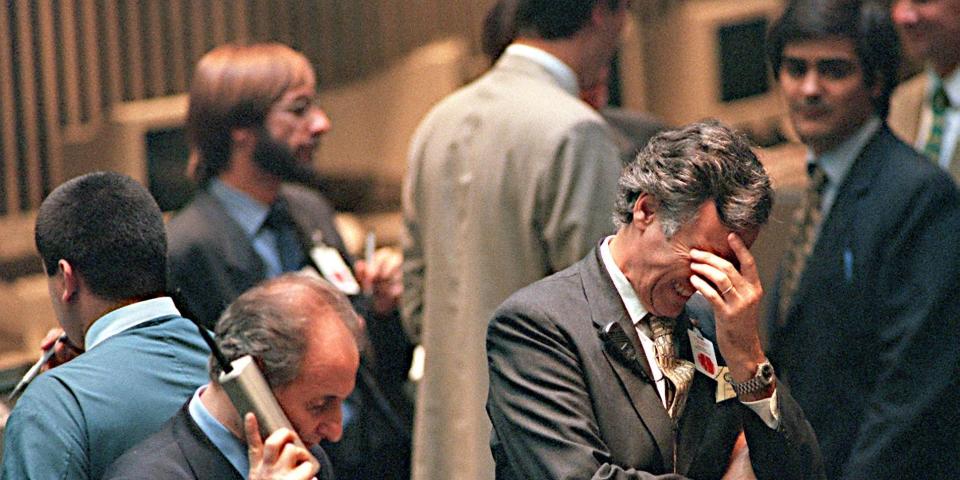

John Hussman, an asset-bubble knowledgeable, forecasts the continued rally in US shares will “finish in tears.”

-

The S&P 500 dangers a 64% collapse given excessive valuations and “unfavourable market internals,” he mentioned.

-

Listed below are the long-time market bear’s six most hanging quotes from a latest be aware.

The US shares have loved a powerful rally in 2023, due to a mix of cooling inflation, fading recession fears and hype over synthetic intelligence.

However do not guess on the cheer lasting lengthy, in line with John Hussman.

The long-time fairness bear who known as the 2000 and 20008 crashes just lately doubled down on his grim outlook for US shares, warning of an astonishing 64% plunge within the S&P 500 index that’ll burst what he known as an “excessive yield-seeking speculative bubble”

The president of Hussman Funding Belief has primarily based his views on stretched fairness valuations and unfavourable “internals” – deeming a steep plunge in shares essential to revive market circumstances again to regular.

The S&P 500 has rallied 19% thus far this 12 months, taking its features for the reason that finish of 2008 – the 12 months of the worldwide monetary disaster – to greater than 400%. The value-earnings ratio of the index, one of many valuation metrics tracked by buyers, has climbed to about 26 from final 12 months’s lows close to 19, in line with knowledge from macrotrends.web.

Listed below are Hussman’s six most hanging quotes from a latest be aware.

1. “There’s a explicit ‘setup” that we have traditionally discovered to be related to abrupt ‘air pockets’ and ‘free falls’ within the S&P 500. It combines hostile circumstances in all three options most central to our funding disciple: wealthy valuations, unfavourable market internals, and excessive overextension.”

2. “The current mixture of traditionally wealthy valuations, unfavorable internals, and excessive overextension locations our market return/threat estimates – close to time period, intermediate, full-cycle, and even 10-12 12 months, on the most adverse extremes we outline.”

3. The potential for a near-term ‘air pocket’ or ‘free fall’ is not a forecast a lot as a regularity that shouldn’t be dominated out. Likewise, with valuations once more larger than at any level in historical past previous to December 2020, apart from a number of weeks surrounding the 1929 peak, the potential for a a lot steeper follow-through needs to be taken critically.”

4.“At current, the valuation extremes we observe indicate {that a} -64% loss within the S&P 500 could be required to revive run-of-the-mill long run potential returns. I do know. That sounds preposterous. Then once more […] I’ve change into used to creating seemingly preposterous threat estimates at bubble peaks.”

5. “Regardless of enthusiasm in regards to the market rebound since October, I stay satisfied that this preliminary market loss will show to be a small opening act within the collapse of probably the most excessive yield-seeking speculative bubble in U.S. historical past.”

6. “Sure, it is a bubble in my opinion. Sure, I consider it’s going to finish in tears.”

Learn the unique article on Enterprise Insider