Immediately shares of Uber are hitting a brand new 52-week excessive. They report earnings tomorrow (Tuesday) earlier than the opening bell. The inventory has doubled this yr and has now turn into my single largest holding personally. And if it ought to fall tomorrow, due to fund supervisor short-sightedness or daytrader idiocy, I’ll purchase much more, seemingly elevating my common price (at the moment mid-30’s after three years value of including to my place) within the course of.

My private opinion (not prediction, opinion) is that it is a inventory that would commerce to $100 per share over the following two to a few years. And the rationale why I believe that is attainable isn’t a stretch to think about at this time. Whereas Elon Musk fantasizes about the potential of Twitter customers turning over their monetary info to his demented preventing pit circus, Uber has already laid the groundwork to truly turn into the “Every little thing App” that “X” won’t ever be. Uber has a ten yr head begin technologically, a large person base (that’s really paying cash) and a income base throughout which to unfold the price of this imaginative and prescient.

Uber is a verb. It’s how folks get locations. Not simply on quick discover like the unique black city car-hailing service it began out as. You may e-book a automotive days or hours upfront now. You may be picked up by knowledgeable driver in a Cadillac Escalade or an beginner driver in a Kia Sorento, relying on how a lot you wish to spend. This enterprise was crippled in the course of the pandemic, which is why the inventory fell into the 20’s. It’s come again with a vengeance. Each type of person – enterprise vacationers, work commuters, vacationers, drinkers, partiers, urbanites with out automobiles, teenagers, the aged, you identify it, they’re driving once more.

Moreover, Uber has turn into a verb describing not simply how folks get locations but additionally how they get issues. The Uber Eats enterprise now has extra common customers than the Uber Rides enterprise. Earlier than the pandemic, Eats seemed like a loser and plenty of within the funding neighborhood have been exhorting the corporate to wind it down or promote it off. When the plague got here, Eats actually saved this firm’s life. It’s now in a hyper-scaling part with new customers and drivers flocking to the platform as different, much less dependable providers fade away. This enterprise has not slowed down in the course of the reopening, like so many lockdown companies have (Zoom, Docusign, Peloton, Zillow). If something, it has accelerated.

Lastly, Uber has been including much more providers now that its logistics and funds have been constructed out and confirmed. They’re delivering groceries. They’re bringing folks objects from the comfort retailer. Their Drizzly app delivers wine, beer and liquor all day and evening. They’re bringing prospects prescriptions from the pharmacy. They launched a freight enterprise to assist firms ship objects by truck.

If any firm at this time has the prospect of changing into the “every part app”, it’s this one. In contrast to legacy Twitter (I refuse to name it X), which barely is aware of something about its customers (therefore the failure to construct a worthwhile promoting enterprise), Uber is aware of fairly a bit concerning the individuals who use its app. For starters, they use it to pay for issues. They’re utilizing it in their very own identify with a bank card on file, not anonymously or pseudonymously. Most significantly, folks don’t open the Uber app to argue over abortion rights or Ukraine or to casually be a part of outrage mobs and accuse random strangers of racism. They open it as a result of they’ve higher issues to do. They wish to go someplace or get one thing. Twitter is for individuals who don’t have anything to do, so that they scroll it in search of amusing or a combat.

I ought to level out that nearly nobody makes use of Twitter. It’s obtained an outsized voice in our tradition as a result of journalists and folks within the media are obsessive about it and always speaking about it. Twitter is the inventory marketplace for reporters – it’s how they’ll see what takes are rising and falling in reputation and what (or whom) they need to be masking. In the true world, solely the weirdest folks (perhaps your self included) are on it. Solely 23% of US adults use Twitter (Fb is 69%, YouTube is 81%). In a survey this previous spring, 60% of people that had used Twitter instructed Pew they have been taking a break from it. Some 25% of present customers mentioned they have been unlikely to nonetheless be utilizing it in a yr. With the identify change and unintentional (intentional?) destruction of the product, 25% may be low. The chances of this platform evolving to supply monetary providers, rides, deliveries, video chat, gaming, and so forth just like the super-apps in China do could be very low.

Uber had a formidable competitor in Lyft in the USA however they’ve mainly crushed it into submission. They want Lyft to remain alive in order that they’ll’t be seen as a monopolist however, in follow, that’s what they’re changing into on the Rides aspect. Lyft wants an activist to step in. It’s not sufficiently big to compete with Uber and would possibly make extra sense as part of another person’s bigger enterprise. If anybody desires it. The CEO of Uber, Dara Khosrowshahi, who had taken over when the founder, Travis Kalanick, was pushed out a decade in the past, rightfully noticed {that a} sturdy driver ecosystem was the important thing to profitable the class. Providing a extra beneficiant take-rate for the drivers meant a fully-stocked provide aspect in order that customers would all the time have automobiles able to get them. This turned habit-forming as folks started to test Uber first. It was costly but it surely paid off. Dara gained the person expertise recreation by concurrently profitable the drivers recreation. They’ll be writing about this in enterprise faculty textbooks sometime.

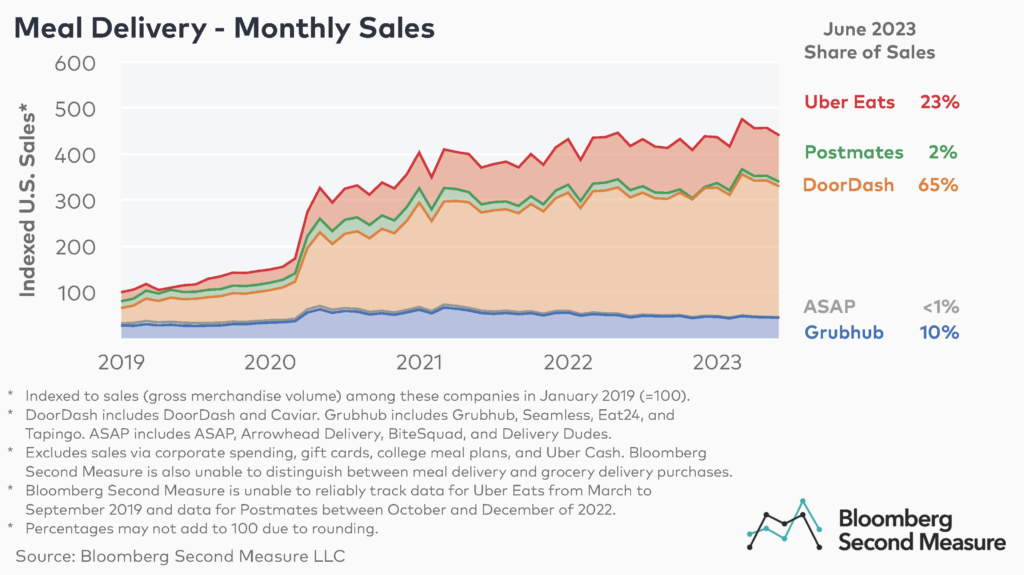

Uber has fiercer opponents in Eats however as you may see under it’s a horserace and so they’re very a lot in it to win:

Uber owns Postmates (acquired in 2020) so their share is about 25%. Uber Eats has 81 million US customers. This market is rising and can most likely not turn into winner-take-all on a nationwide foundation. New entrants should not going to be a menace going ahead, nevertheless, given how costly it’s been to construct out these networks and entice the thousands and thousands of individuals (eating places, drivers, customers) essential to show it right into a enterprise. Uber Eats and DoorDash mainly personal this market and possibly will without end. What else can they ship down the identical pipes? Something? Every little thing?

Now, I would like you to remember that it is a world enterprise and it’s a giant one, although Uber isn’t but talked about in the identical breath because the Googles, the Apples and the Amazons. It’s not but as worthwhile because the Magnificent Seven firms and it’s a a lot youthful firm (based in 2008, public because the spring of 2019). However it’s enormous and rising quick.

On the Eats and deliveries aspect, we’re speaking a few platform enabling 1000’s of companies to serve thousands and thousands of consumers they might not ordinarily be capable to. These numbers come immediately from the corporate…

Globally:

- 780,000+ complete energetic retailers on the platform in additional than 9,000 cities throughout 6 continents

- Over 60% are small or medium sized companies

- 3M+ customers are getting their grocery and comfort objects delivered every month by way of Uber Eats

- 1.7+ billion orders have been facilitated by the Uber Eats platform within the final yr immediately pumping:

- $28+ billion into native economies within the final yr (in gross sales facilitated by Uber Eats prior to now yr)

Within the US:

- 400K+ complete energetic retailers on the platform, throughout all 50 states

- Greater than half a billion orders within the final yr have been facilitated by the Uber Eats platform, immediately pumping:

- $11+ billion into native economies within the final yr (in gross sales facilitated by Uber Eats prior to now yr)

In accordance with a US service provider survey, single, native, independently-owned companies report:

- Uber Eats is a vital a part of SMB success in driving larger income.

-

- 95% report that working with Uber Eats has had a optimistic influence on their enterprise within the final yr, in the course of the pandemic.

- 86% say that Uber Eats has been useful to their backside line.

- 84% report that providing supply or pickup with Uber Eats has elevated their income, and by a mean of 15%.

- Uber Eats helps SMBs to realize their two greatest priorities: progress and new buyer acquisition.

-

- 94% imagine that Uber Eats helps to reveal their enterprise to new prospects.

- 90% really feel that Uber Eats helps them serve a bigger neighborhood than they may serve on their very own.

- 88% really feel that Uber Eats has pushed extra gross sales than they might have in any other case had.

- Uber Eats is a vital a part of SMB success for minority-owned SMBs specifically.

-

- 94% say that working with Uber Eats had a optimistic influence on their enterprise in the course of the pandemic.

- 86% say that Uber Eats has been useful to their backside line.

- 84% say that Uber Eats has helped them improve income.

On the Rides aspect of the enterprise, the corporate is now extremely dominant with no actual challenger to talk of anymore, only a shell of a former competitor (Lyft) and a ragtag group of Taxi lobbyists in a handful of municipalities desperately clinging to the 1970’s.

Throughout calendar 2022, Uber had 72% of the worldwide market share for rides with over 7.6 billion journeys. Uber has 131 million customers in 72 nations being served by 5.4 million drivers in over 10,000 cities. This most likely can’t be replicated, by anybody, for any amount of cash. That community and person base is a certainly one of a form asset.

Within the newest quarter they reported (again in Might), Uber noticed the platform’s gross bookings rise 19% to $31.4 billion whereas its revenues jumped 29% to $8.8 billion. The corporate claimed that in the course of the first quarter, the 5.7 million drivers and couriers who use its app had been paid $13.7 billion collectively, an all-time file excessive. The corporate’s ecosystem has turn into the lifeblood for a lot of companies, full-time entrepreneurs and part-time staff. Offering these alternatives to so many helps the corporate cement its market share and main place. This has been under-appreciated till lately.

As I write this, Uber has not but damaged above a $100 billion market cap, however I believe that’s coming very quickly. If they’ll report their first full yr of working revenue (which is their steerage for 2023), I believe this can lead to Uber being added to the S&P 500 index, which traditionally has meant a wave of shopping for by managers who each monitor and / or compete with the benchmark. As a fast-growing, worthwhile expertise large with a defensible moat round its companies and a charismatic, achieved CEO, Uber has the power to shake off the stigma of its underwhelming 2019 IPO and be a part of essentially the most profitable firms in at this time’s progress inventory pantheon. That’s what I believe will occur, which ought to imply a considerably larger inventory worth if I’m proper. Uber is a platform upon which 1,000,000 companies may be constructed. This places it on a par, from an enterprise standpoint, with firms like Microsoft, Amazon, Alphabet and Meta. And, much like these firms, the bigger it grows, the tougher it turns into to work round. Uber isn’t there but, but it surely’s certainly one of a only a few firms that has the power to get there. It’s also one of many few public firms that has really seen the advantages of its AI investments and might translate them to elevated buyer satisfaction and profitability. Each time you name for a automotive or a cheeseburger, Uber’s AI is deciding how finest to serve that as much as you.

If I’m incorrect, it’s going to most likely be due to one of many following dangers, so as of how seemingly I believe they’re to materialize:

- Execution danger: Profitability continues to elude Dara & Co as driver prices rise or customers pull again due to larger charges.

- Pandemic 2.0: This can be a large danger to Uber but additionally to everybody else. Can’t do something about it.

- Federal laws in opposition to enterprise mannequin: In my private opinion, that ship has sailed. Uber’s legal professionals and lobbyists are profitable all over the place it counts. They’re profitable as a result of that is what the buyer desires. No mayor or governor is getting themself elected by being the man or gal who chased the journey sharing apps out of city. And, opposite to the far left aspect of the Democratic celebration, it seems that the drivers don’t wish to be labeled as full-time staff of Uber. The flexibleness of the platform is why they’re interested in it within the first place. When Proposition 22 in California handed this March, voters had made it clear that working for Uber or Lyft as an unbiased contractor is a superbly legitimate standing and the way in which most individuals appear to love it. If California doesn’t wish to eradicate Uber’s enterprise mannequin, it’s unlikely one other state would even strive.

I believe a type of three “large dangers” would be the cause I find yourself incorrect on the inventory, if I find yourself incorrect. After which, after all, there may be all the time the potential for a broader bear market that takes down all shares – particularly excessive a number of shares like this one – when and if it ought to come up.

Now, a little bit bit about me, for context. I don’t not put money into issues as a result of there may be a bear market. That may be like by no means leaving the home as a result of it’d rain. I make investments regardless of these dangers as a result of I do know bear markets are by no means everlasting. And if I actually imagine in an funding, the bear market merely provides me an opportunity to personal extra of the corporate at even decrease costs. Any angle opposite to this could characterize a dealer’s mindset and never an investor’s. I’m not a dealer. I don’t have interaction in non-meaningful monetary transactions in my spare time as a result of I’ve no spare time. I’m solely taken with conditions the place I could make so much over an extended time period and I don’t must be glued to a display screen all day or apprehensive concerning the newest analyst scores or opinions.

I’ve held shares like Apple and Nvidia for actually a whole lot and 1000’s of share factors over years and years, by way of bull markets, bear markets, flat markets, financial crises, charge cuts, charge hikes, and so forth. At any given time I’ve been in deep drawdowns with these shares, however I’m not afraid of drawdowns. I don’t react simply because different individuals are. I’ve been doing this for 25 years and have realized higher. Lengthy-term winners like Alphabet, Apple, Nvidia, Berkshire Hathaway, JPMorgan and different shares I’ve held onto greater than offset the losers as a result of they develop in proportion to an general portfolio whereas the losers fade in each measurement and influence. I’ve my share of inventory investments which have failed miserably, identical to anybody else. Matterport, ChargePoint, Roblox, Carlisle Group, and so forth. Some I’ve offered and a few I’ve held however they get smaller and smaller as the remainder of my holdings rise and, finally, they don’t matter in any respect. Holding shares like Uber is the entire level of what I do, however most shares don’t turn into what Uber has turn into, and that is a part of the danger of investing in progress firms.

Danger is important, not one thing to be hedged away solely. We’re right here to win, to not present.

Typically you win, typically you study. Typically there may be nothing to study, as a result of random shit occurs that makes an funding not work out. It’s okay, we maintain going. Solely the unemployed, maladjusted mind donors on web message boards assume batting common is necessary and that being incorrect on a inventory is a few type of an insurmountable error that may’t be overcome. You’re speculated to have dropping investments. It means you’re really making an attempt.

Everybody has dropping investments besides the bullshit artists on social media. In the true world, skilled cash managers don’t make enjoyable of one another for being incorrect as a result of professionals all reside in glass homes. For each dangerous commerce another person has performed publicly, I’ve obtained one equally dangerous I wouldn’t need introduced up both. We don’t behave that manner as a result of dropping is a part of the sport if you happen to’re really within the recreation. The simplest option to determine a piker who doesn’t handle actual cash is to look at somebody who spends their days criticizing the investments of others. The common individual solely has 6,000 hours per yr throughout which they’re awake (look it up). Think about spending any fraction of them apprehensive about another person’s inventory picks.

I’ve no edge in any respect on what Uber will report tomorrow. My recreation plan for earnings is all the time to commerce the response and never commerce forward of the occasion.

If the corporate impresses The Road with their second quarter numbers and full-year steerage, I believe it could possibly be sufficient to ascertain a brand new buying and selling vary within the excessive 40’s and low-50’s for the second half of the yr.

If, for some cause, they disappoint, I’d anticipate a big drawdown merely due to how a lot scorching cash has come into the inventory as a result of its latest momentum (Relative Power or RSI is now 67, something over 70 could be thought-about “overbought” by the technicians). Sizzling cash will flee on the slightest trace of weak spot, thus exacerbating that weak spot and producing a gap-down open. It may occur, and if it does, I’ll use the chance to purchase extra. If the inventory ought to fall into the 30’s (solely attainable), I’ll add to my holdings considerably, relying on the circumstances. I’ve to make use of the potential short-term volatility to my benefit as a result of as a long-term holder I’m compelled to endure it.

Over the past a number of quarters, Dara has appeared on CNBC’s Squawk Field program instantly following the earnings name, which is often held at 8am EST. Someday earlier than the opening bell, Wall Road can have already learn the corporate’s launch, heard the convention name, learn the transcript and watched the TV look. If the inventory is down greater than 10% following this, I’ll most likely be on the market including to my place. My timeframe is more likely to be longer than the timeframe of those that would promote the inventory after a single earnings report.

I’ve written this piece with a view to flesh out my very own ideas on the chance and to relay a little bit bit about how I take into consideration my very own investments. I hope this has been fascinating for you. Please keep in mind, it’s not recommendation or a solicitation so that you can place any trades. Nothing I write on this website must be thought-about monetary recommendation for any cause. I get completely nothing from you buying and selling on something I say. I don’t need it, I don’t want it. At all times do your personal analysis and solely take the dangers which are acceptable in your personal state of affairs. This submit is for informational / instructional functions solely.

Thanks for studying.