Zimbabwe is dealing with a number of urgent challenges that voters dearly need the subsequent president to deal with. Persistently excessive inflation, elevated rates of interest, and a slumping and unstable Zimbabwe greenback have mixed to gasoline a value of residing disaster for households and battered enterprise exercise.

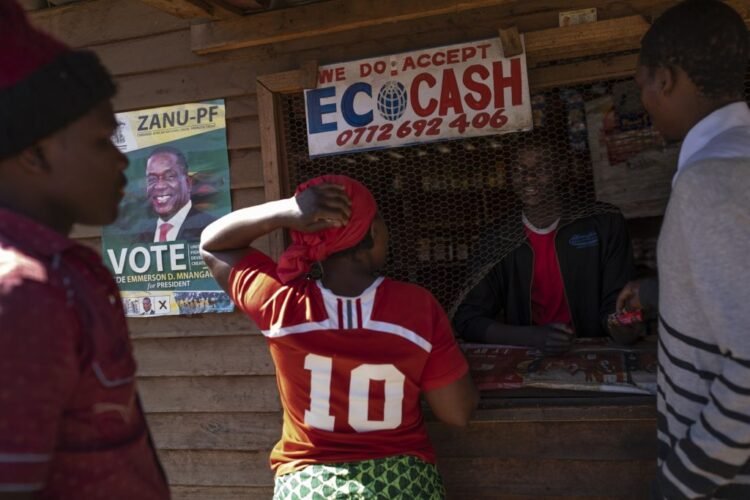

These can be among the many key financial considerations weighing on Zimbabweans as they put together to solid their votes at elections scheduled for late August. President Emmerson Mnangagwa is campaigning to safe a second mandate that can prolong his five-year time period in energy. He’ll sq. off in opposition to 10 presidential candidates, together with the opposition’s major candidate Nelson Chamisa.

Inflation stays sticky and jumped 175.8% in June from 86.5% a month in the past. A part of the current re-acceleration in inflation was triggered by the Zimbabwe greenback’s slide, which plunged 85% within the two months via Might and pushed up import prices. Though inflation edged decrease in July, it nonetheless stays considerably elevated.

The central financial institution responded by climbing rates of interest to 150% from a beforehand elevated stage of 140%. This transfer intensifies the pullback on enterprise and client spending brought on by foreign money weakening. Moreover, the excessive tempo of value progress has outpaced nominal wage progress, leaving many individuals struggling to afford on a regular basis necessities. Fewer jobs add to those considerations.

Stubbornly excessive inflation and its unfavourable affect on the worth of the Zimbabwe greenback are signs of a lot deeper issues rooted in a long time of fiscal and central financial institution governance weaknesses. That’s why inflation has defied central financial institution efforts to rein it in with a sequence of aggressive charge hikes.

The following president will due to this fact have to push for reforms in governance to sort out deep underlying issues. In any other case the nation will stay locked in a seemingly limitless battle to beat back the financial disaster that’s being acutely felt by voters.

Governance vulnerabilities

Governance broadly refers to establishments used to train authority by the federal government. Lengthy-running weaknesses in fiscal and central financial institution governance establishments have undermined the capability of the federal government to successfully formulate and implement sound fiscal and financial insurance policies for a few years.

Between 2005 and 2008 for instance, the federal government pursued an expansionary fiscal coverage. Public spending averaged 8% of GDP.

Nevertheless, due to weak budgetary processes, spending was much less environment friendly particularly in areas important for supporting stronger progress resembling schooling, well being, and public infrastructure. This meant that the economic system couldn’t generate extra authorities income. Common authorities income collected was solely about 5% of GDP over this era. The funds shortfalls had been financed by printing cash, which undermined the independence and credibility of the central financial institution. This impaired the central financial institution’s potential to satisfy its mandate, together with supporting value stability.

The inflow of printed money within the economic system fanned home demand however did nothing to spur the manufacturing of products and providers to fulfill it. Inflation spiked and drove the worth of the foreign money decrease, elevating the price of imported items and thus amplifying inflation pressures.

This dynamic created a suggestions loop through which rising inflation and a weakening foreign money bolstered one another. The outcome was hyperinflation. In 2008 inflation reached 231 million %, prompting the federal government to withdraw the weakening Zimbabwe greenback from circulation the next 12 months and to switch it with the US greenback to fight hyperinflation.

Within the years following the change to the US greenback, inflation receded till 2019 when the Zimbabwe greenback was re-introduced. This was achieved with out fixing vulnerabilities in fiscal and financial governance that had ultimately led to the demise of the Zimbabwe greenback in 2009.

Due to these vulnerabilities, inflation skyrocketed to 255% in 2019 – a 23-fold enhance from a 12 months earlier as cash provide progress quickened from 28% to 250% amid a widening authorities funds deficit which topped 10% of GDP in 2017. Since then, the central financial institution has not been in a position to get a sustained deceleration in inflation regardless of aggressive charge hikes.

And the unfavourable suggestions loop between excessive inflation and a collapsing native foreign money was on full show once more following the plunge within the foreign money in current months. This has made the US greenback extra enticing, and it’s used extra extensively to pay for all the pieces from meals, gasoline, faculty charges, lease and different providers. In February the central financial institution adopted a brand new inflation gauge that tracks costs in each Zimbabwean and US {dollars} to seize this actuality.

The US greenback can be seen as a haven which has taken on larger significance as inflation stays stubbornly excessive. In some ways, the return of the Zimbabwe greenback evokes unhealthy reminiscences of the inflation disaster of 2008 which nonetheless loom massive for many individuals.

Weaknesses in governance breed corruption

Weaknesses in governance additionally create alternatives for increased ranges of presidency corruption, which may result in public spending waste, inefficiencies and decrease income assortment. All worsen funds deficits and add to financial financing pressures on a central financial institution missing independence.

In 2022, Transparency Worldwide ranked Zimbabwe 157 out of 180 international locations based mostly on perceived ranges of public sector corruption, the place the decrease the rank the upper the perceived corruption. The proof additionally confirmed no vital progress in tackling corruption for greater than a decade. One other 2022 survey by Afrobarometer revealed {that a} staggering 87% of Zimbabweans imagine corruption has elevated or stayed the identical.

A path ahead

Zimbabwe’s economic system is dealing with a confluence of challenges: inflation that gained’t go away, increased rates of interest and a sliding foreign money. The fallout has included a value of residing disaster, slowing enterprise exercise and fewer jobs. These issues are signs of deeply embedded structural weaknesses within the economic system.

The next reforms are essential for addressing these structural weaknesses:

- Fiscal governance reforms to strengthen the budgetary course of. This may improve income assortment and enhance the effectivity of presidency spending. These reforms also needs to intention to spice up income assortment by decreasing pervasive informality within the economic system.

- Central financial institution governance reforms to advertise autonomy of the financial institution’s operations, together with financial coverage independence which is vital for preserving value stability.

As well as, good fiscal governance positively impacts central financial institution governance by decreasing the necessity for central financial institution financing, which permits a discount in inflation.

Jonathan Munemo is professor of Economics on the Salisbury College.

This text is republished from The Dialog underneath a Inventive Commons licence. Learn the unique article.