Over the summer season months the bull market that has outlined 2023 thus far has been taking a break. The query is, can it regain momentum and push forward once more? Or as Oppenheimer’s Chief Funding Strategist John Stoltzfus places it, is it simply “the pause that refreshes?”

Whereas Stoltzfus notes the potential for “some uptick in volatility” within the weeks and months forward, his total view of what’s to return subsequent might be encouraging to buyers.

“We stay optimistic on the US economic system and the fairness markets,” he mentioned. “The Fed’s 11 charge hikes and a ‘skip’ (since March of 2022) in its efforts to stem untoward ranges of inflation present appreciable indicators of success, even when nonetheless at a ways from its aim of two% inflation.”

“Jobs, client spending, employment vs. unemployment, GDP (Q1 and Q2) and company leads to the S&P 500 Q2 earnings season persist in displaying resilience that gives help to the case that the central financial institution this hike cycle could very effectively not ‘break one thing’ that will push the US economic system right into a recession as its detractors posit,” Stoltzfus additional added.

In the meantime, the Oppenheimer analysts have been looking for out the names poised to make use of the bull market’s resumption to their benefit. They’ve been calling buyers’ consideration to 2 names which have retreated by vital quantities over the previous months, however which they see as prepared to leap once more – and by bounce, we imply get a correct bounce, within the order of triple-digit development over the approaching yr.

We ran these beaten-down names via the TipRanks database for a fuller image of their prospects. Listed below are the small print.

Aeva Applied sciences (AEVA)

Let’s first check out Aeva Applied sciences, a cutting-edge tech agency that makes a speciality of the event of superior notion techniques for autonomous autos and different industries.

Based by former Apple engineers, Soroush Salehian and Mina Rezk, Aeva has attracted consideration for its distinctive and revolutionary strategy to sensing and notion. On the coronary heart of Aeva’s expertise is its “4D LiDAR” system, which mixes conventional LiDAR (Gentle Detection and Ranging) with a novel frequency modulation method, or extra particularly, Frequency-Modulated Steady Wave (FMCW) lidar expertise. This units Aeva other than typical LiDAR techniques, because the strategy not solely permits for extremely correct distance measurements and object detection, but in addition offers velocity data, enabling objects to be tracked in each area and time.

That mentioned, whereas it’s nonetheless early days and there might be a big alternative within the autonomous car market, it hasn’t been straightforward working within the present setting, as was evident within the current Q2 print. Income fell by 50.3% year-over-year to $0.74 million, simply falling shy of consensus expectations. The corporate additionally commonly operates at a loss, though adj. EPS of -$0.13 beat the forecast by $0.01.

Shares fell as soon as the Road digested the report, and that has been occurring fairly commonly this yr. Since peaking in February, the shares have swooned by 49%.

Nonetheless, after assessing the Q2 print, Oppenheimer’s 5-star analyst, Colin Rusch, is holding the religion, and he highlights why Aeva is well-positioned for higher days forward.

“AEVA continues to make significant progress on commercializing its 4D lidar whereas managing its money place effectively. We’re inspired by commentary on its Tier 1 auto OEM buyer transferring ahead with strategic effort to develop software program across the AEVA’s 4D knowledge in addition to industrial gross sales anticipated in 2024 and the announcement of Railergy as a buyer (the primary rail win for Avea). We see the corporate persevering with to diversify its goal markets whereas leveraging the distinctive facets of its {hardware} providing,” Rusch opined.

“With quite a few innovators within the notion area struggling to fulfill business timelines, we consider AEVA is methodically derisking its platform. As we alter estimates to mirror a slower income ramp as AEVA seeds extra prospects, we stay constructive on AEVA shares given expertise progress and potential development,” the highest analyst went on so as to add.

Constructive, certainly. Together with an Outperform (i.e. Purchase) score, Rusch provides AEVA a $6 value goal. This projection permits for a considerable 488% upside from the present share value of solely $1.02. (To look at Rusch’s observe report, click on right here)

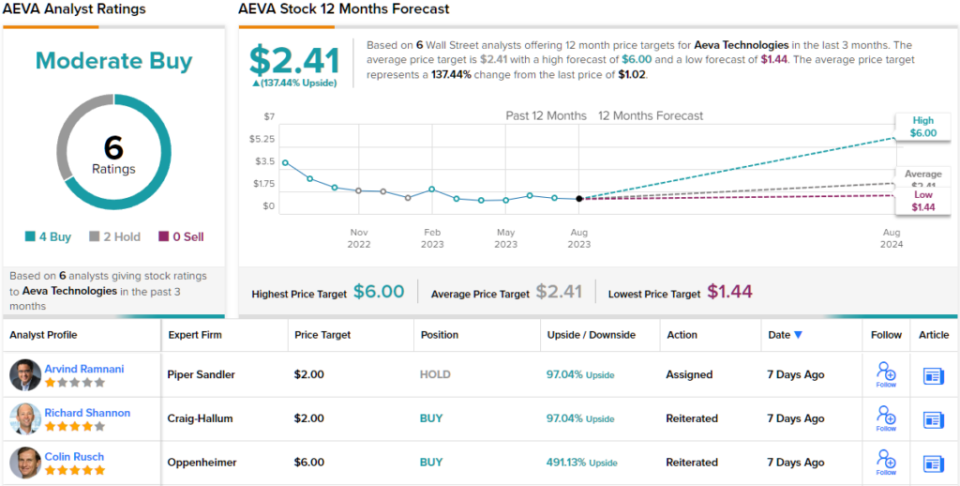

General, 3 different analysts be a part of Rusch within the bull camp, and with the addition of two Holds, the inventory claims a Reasonable Purchase consensus score. Shares are anticipated to climb 137% greater over the approaching months, contemplating the common goal stands at $2.41. (See AEVA inventory forecast)

Arvinas, Inc. (ARVN)

We’ll flip now to the biotech area the place Arvinas, an organization devoted to creating novel therapies for a various array of sicknesses by using ingenious protein degradation strategies, comes into play. The corporate employs its proprietary PROTAC (PROteolysis TArgeting Chimera) expertise, which leverages the physique’s inherent protein elimination mechanism to exactly take away dangerous proteins related to illnesses. This strategy seeks to supply superior and longer-lasting remedies in comparison with commonplace small molecule inhibitors or antibodies.

It’s nonetheless early days for Arvinas’ pipeline however quite a few medicine are already present process medical research.

Within the ongoing Part 1/2 dose escalation and growth trial, ARV-766, Arvinas’ therapy for prostate most cancers, demonstrated commendable tolerability and showcased encouraging effectiveness.

Moreover, in collaboration with Pfizer, the corporate has just lately commenced affected person enrollment for the examine lead-in of the first-line Part 3 trial of vepdegestrant (ARV-471) together with palbociclib as a therapeutic routine for metastatic breast most cancers. The corporate now has two ongoing Part 3 trials with vepdegestrant (one with it as a monotherapy) with Arvinas eyeing a primary Part 3 knowledge read-out in 2H24. Beforehand, the corporate intends on presenting extra knowledge from the Part 1b mixture trial with palbociclib at a medical congress in the course of the second half of the yr.

Oppenheimer analyst Matthew Biegler has been keeping track of this drug’s progress and whereas an replace from the ARV-471 program earlier within the yr didn’t impress, Biegler thinks the considerations could be overblown.

“There have actually been hiccups (current ARV-471 knowledge didn’t look as sturdy as they did a yr and a half in the past + potential considerations with the palbociclib mixture), however we expect the Road could be irrational in its averseness to this inventory,” Biegler opined. “Arvinas continues to be an trade chief in protein degradation, a discipline nonetheless admittedly discovering its footing—however one we might argue has delivered actual medical validation. What’s extra, the chance for ARV-471 is actual—simply have a look at ORSERDU’s current launch. We hope pipeline updates in 2H23 can flip this former darling round.”

A turnaround can be welcome because the inventory is down by 35% since this yr’s February highs. For Biegler, the present value is means too low cost. His goal stands at $95, implying shares will put up development of an enormous 278% within the months forward. (To look at Biegler’s observe report, click on right here)

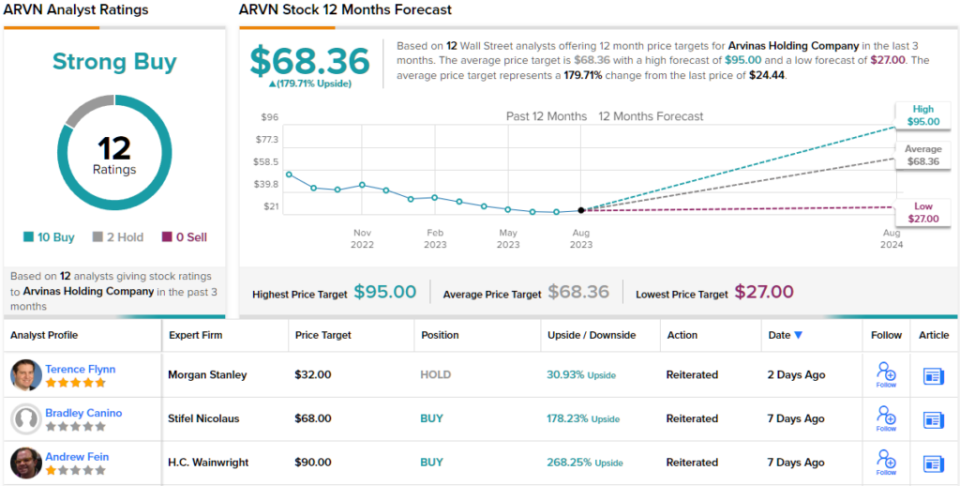

What does the remainder of the Road assume? Most agree with the Oppenheimer analyst. The inventory boasts a Sturdy Purchase consensus score, primarily based on 10 Buys vs. 2 Holds. Most assume the shares are considerably undervalued too. Going by the $68.36 common goal, they are going to put up beneficial properties of ~180% over the course of the yr. (See ARVN inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your individual evaluation earlier than making any funding.