agnormark

We’re almost by means of the Q2 Earnings Season for the Gold Miners Index (GDX) and it was a mediocre reporting interval total, with one-time headwinds (extreme climate, energy outages, ongoing strike) affecting manufacturing ranges at some mines and rising working prices, even when inflationary pressures have eased a bit of from the double-digit inflation skilled final 12 months. Sadly, this resulted in restricted profit from file gold costs from a margin standpoint, with names like Coeur Mining (CDE), First Majestic Silver (AG) and Iamgold (IAG) reporting razor-thin margins. Nonetheless, New Gold (NYSE:NGD) was one firm that reported stable working outcomes which I lined one month in the past, noting that whereas the inventory was fairly valued, it was tough to justify paying up for the inventory above US$1.20 per share.

Since that point, we have seen a 20% drawdown in NGD which is partially as a result of sector-wide correction. That mentioned, the inventory stays a turnaround story, with an excellent higher 2024 on deck with business manufacturing from the C Zone barely 12 months away, and a shift to being free money circulate constructive. Let’s take a more in-depth take a look at its Q2 2023 monetary outcomes beneath:

All figures in United States {Dollars} until in any other case famous.

Q2 Manufacturing & Gross sales

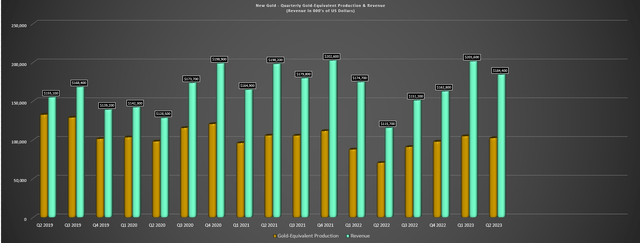

New Gold launched its Q2 outcomes final month, reporting quarterly manufacturing of ~102,400 gold-equivalent ounces [GEOs], a forty five% enchancment from the year-ago interval. The numerous improve in quarterly manufacturing will be attributed to straightforward year-over-year comparisons with heavy rainfall and flooding affecting Wet River’s manufacturing in Q2 2022 and the completion of Raise 1 mining at its New Afton Mine in British Columbia. The excellent news is that these outcomes are right here to remain and manufacturing ought to rise over 10% vs. its FY2023 steerage midpoint looking to 2025. It’s because New Gold will profit from a lot larger grades at its C-Zone (New Afton) in addition to larger grades any further at Wet River, with the asset anticipated to turn into a constant ~350,000 ounce gold producer (2024-2028) at a lot decrease prices. And this mixture of margin growth and better manufacturing helps a compelling turnaround story right here.

New Gold – Quarterly GEO Manufacturing & Income (Firm Filings, Writer’s Chart)

Digging into the manufacturing outcomes a bit of nearer, we will see that New Gold’s manufacturing improved materially on a year-over-year, and the upper gold worth within the interval contributed to significantly better gross sales efficiency as properly. In truth, income was up ~60% year-over-year to $184.4 million, with the rise within the gold worth ($1,970/oz) and better gross sales volumes greater than offsetting the softer copper worth within the interval ($3.61/lb vs. $3.97/lb). At Wet River, the upper manufacturing was pushed by improved grades and recoveries, with a mean feed grade of 0.97 grams per tonne of gold (Q2 2022: 0.69 grams per tonne of gold) and a 100 foundation level enchancment in recoveries. This contributed to decrease prices year-over-year when mixed with decreased sustaining capital, with all-in sustaining prices of $1,725/oz, down from $1,925/oz in Q2 2022.

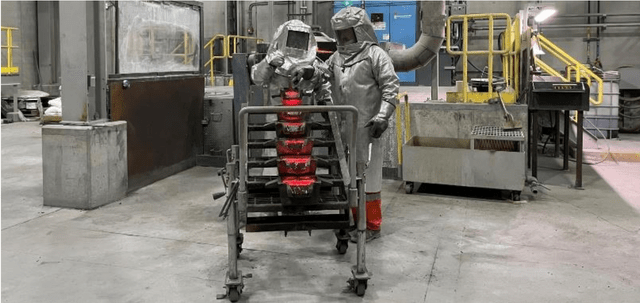

New Gold Operations (Firm Web site)

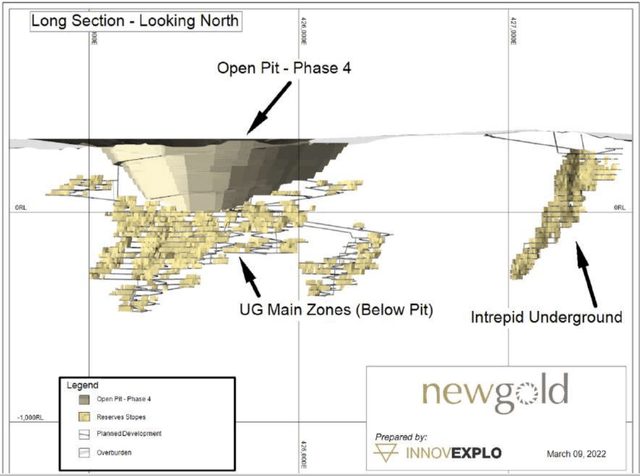

In addition to the higher working efficiency at Wet River with ~61,400 ounces produced within the interval, the mine was free money circulate constructive, with $16.6 million in mine-site free money circulate year-to-date. New Gold famous that its mining sequence was optimized to permit for a extra constant manufacturing profile and that it benefited from decrease diesel costs, which helped to contributed to decreased mining prices within the interval ($3.16/tonne vs. $4.01/tonne). Sadly, this was partially offset by larger processing prices of $11.00/tonne with larger prices associated to mill upkeep. Lastly, the corporate famous that after inside evaluations; it plans to defer the in-pit portal for the Predominant Zone and entry from the underground Intrepid Zone. That is anticipated to be extra environment friendly and scale back haulage distance, and it is also encouraging to know that underground grades and tonnes are reconciling properly at Wet River UG to this point.

Wet River 2022 TR – Firm Filings

Transferring over to New Afton, it was a stable quarter right here as properly, with ~41,000 GEOs produced, up 52% from the year-ago interval. This was pushed by larger copper and gold grades 0.72 grams per tonne and 0.78%, respectively, and significantly better recoveries for each metals. And whereas the decrease copper worth was a slight drag within the interval, this was greater than offset by the upper gross sales volumes and decrease sustaining capital with New Afton’s AISC enhancing to $1,299/oz vs. ~$3,222/oz in Q2 2022. Simply as necessary for the larger image, the C-Zone superior 1,415 meters in Q2, up from 1,172 meters in Q2, benefiting from the completion of the vent increase, which contributed to larger improvement charges. So, assuming New Gold stays on schedule, buyers can sit up for first ore from the C-Zone in This autumn with business manufacturing in H2-2024.

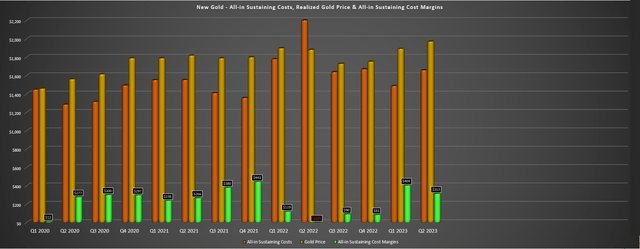

Prices & Margins

Transferring over to prices and margins, New Gold’s all-in sustaining prices [AISC] improved materially year-over-year, benefiting from larger gross sales volumes and extra normalized sustaining capital spend vs. the $56.9 million spent in the identical interval final 12 months. This resulted in AISC dropping from $2,373/oz to $1,657/oz, and AISC would have are available at even higher ranges at ~$1,556/oz if not for the ~6% distinction in ounces produced vs. bought within the interval (~96,200 vs. ~102,400). Given the upper common realized gold worth mixed with a extra respectable AISC determine, all-in sustaining price margins improved to $313/oz in Q2, up from [-] $494/oz within the year-ago interval. And simply as importantly, prices are monitoring properly towards steerage of $1,555/oz on the mid-point, sitting at ~$1,566/oz year-to-date.

New Gold – AISC & AISC Margins (Firm Filings, Writer’s Chart)

Sadly, regardless of the improved working outcomes, free money circulate was nonetheless adverse within the interval, with a money outflow of $26.1 million. Nonetheless, it is necessary to notice that this may be attributed to elevated progress capital at New Afton, with its company-wide progress capital up ~90% year-over-year in Q2 to ~$36.0 million, offsetting many of the profit from the decrease sustaining capital within the interval. Nonetheless, with extra relaxed capital spending in FY2024 (~$200 million vs. FY2023 steerage of $320 million), and assuming gold and copper costs can cooperate, we must always see New Gold generate a minimum of $60 million in free money circulate subsequent 12 months, with a major improve in free money circulate in 2025 with a full 12 months of business manufacturing from the high-grade C Zone. So, for affected person buyers, there may be actually room for a re-rating right here with New Gold set to generate upwards of $180 million in free money circulate in FY2025.

Based mostly on an enterprise worth of ~$920 million, New Gold trades at barely 5x FY2025 free money circulate estimates, a really cheap valuation for a Tier-1 jurisdiction producer.

Latest Developments

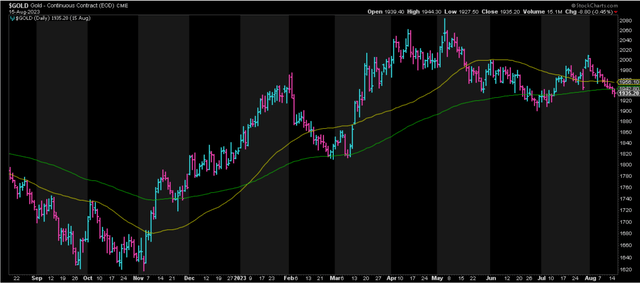

Whereas the progress on the C Zone and Wet River Underground is constructive and buyers can breathe a sigh of reduction that the TSF worries have been resolved instantly with lower than two days of misplaced time, the decrease gold and copper costs might have an effect on its Q3 outcomes, with copper sliding nearer to its Q2 lows and gold additionally drifting in direction of its Q2 lows. This might strain margins within the interval assuming much like barely larger all-in sustaining prices in H2 (implied by steerage), placing a dent in margins sequentially (Q3 2023 vs. Q2 2023). That mentioned, that is hardly related to the larger image outlined above, which is a ~450,000 ounce producer in 2025 with sub $1,250/oz AISC able to producing over $180 million in free money circulate. And whereas this won’t matter to the market as we speak, it ought to assist with a re-rating 18 months from now, suggesting that additional weak point within the inventory ought to current a shopping for alternative.

Gold Value – Day by day Chart – StockCharts.com

Abstract

New Gold had a significantly better quarter in Q2 with the good thing about being up towards straightforward year-over-year comps and is monitoring properly towards its FY2023 steerage midpoint of 395,000 ounces with ~207,200 GEOs produced year-to-date. In the meantime, the inventory is buying and selling again close to the engaging valuation ranges it sat at in March of this 12 months regardless of being only a 12 months away from business manufacturing on the C Zone and already chewing by means of higher-grade ore from Wet River Underground. That mentioned, whereas New Gold is affordable, a number of of its friends have additionally discovered themselves on the sale rack regardless of having larger margins and higher-grade belongings. So, whereas I see New Gold as a Speculative Purchase at US$0.94 for its up to date low-risk purchase zone, my Impartial ranking displays the truth that I proceed to see higher alternatives elsewhere within the sector.

Editor’s Word: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.