Earnings season occurs each three months. That is when firms share particulars on their latest monetary efficiency, which helps traders perceive how the corporate is working.

Firms file these stories as a result of they should. Below SEC rules, they’re required to take action inside 45 days of the top of the quarter.

Buyers can spot traits within the reported information. They’ll additionally use the numbers to find out whether or not a inventory is a purchase or promote.

Analysts additionally take note of the stories. They use that information to replace their fashions. Well timed information ought to assist analysts present correct forecasts. Nevertheless, that doesn’t precisely occur.

A Typical Earnings Season

The latest quarter was typical. Over three-quarters of firms within the S&P 500 Index beat analysts’ expectations. Usually, about 15% miss expectations. In a mean quarter, lower than 10% of firms ship earnings equaling the estimate.

These are probably the most extensively adopted firms on the planet. But analysts nearly all the time underestimate earnings. Over the previous 20 quarters, an common of 77% of firms beat expectations in 1 / 4. Over 10 years, the typical beat fee is 73%.

Regardless that they’re mistaken, earnings estimates are helpful.

All of these errors don’t actually quantity to a lot. For the businesses within the S&P 500 Index, all these earnings beats elevated earnings by about 4.8%.

Reported earnings for the second quarter are $54.80, up $2.50 from the estimate when earnings season began. That’s somewhat under common. Sometimes, earnings beat estimates by a mean of 6.4%.

Earnings for the S&P 500 aren’t the sum of the earnings for the businesses within the index. Outcomes are weighted by the scale of the inventory. Apple (Nasdaq: AAPL) carries probably the most weight within the S&P 500, about 7.6%. That quantity of its earnings are utilized to the index earnings determine.

We will use estimated earnings to search out worth targets for the index.

Discovering Value Targets for S&P 500

For the top of 2023, analysts anticipate S&P 500 earnings of $219.41. Earnings in 2024 are anticipated to be $244.06.

A price-to-earnings (P/E) ratio gives a worth goal. The present P/E ratio for the index is about 20.5. That’s close to the long-term common. The ten-year common is 20.3. The 25-year common is nineteen.95.

Based mostly on 2024 earnings and a mean P/E ratio, the worth goal is 5,003, about 2% increased than the present worth.

However the P/E ratio has been a lot increased than common. The 25-year excessive is 30.7. At that degree, the worth goal is 7,492, a achieve of greater than 53%.

The P/E ratio is also decrease than common. The 25-year low is 11.95. That yields a worth goal of two,916. That’s 40% decrease than the place we are actually.

Utilizing earnings estimates, we see that costs might transfer considerably increased or decrease. The path of the pattern will rely upon sentiment.

For now, sentiment is bullish. That factors to probably increased costs.

Regards,

Michael CarrEditor, Precision Income

Michael CarrEditor, Precision Income

Retail Gross sales Reviews Present How “Actual America” Is Doing

I’ve been masking the plight of the American shopper for weeks now, and we’ve an actual treasure trove of recent information to type by…

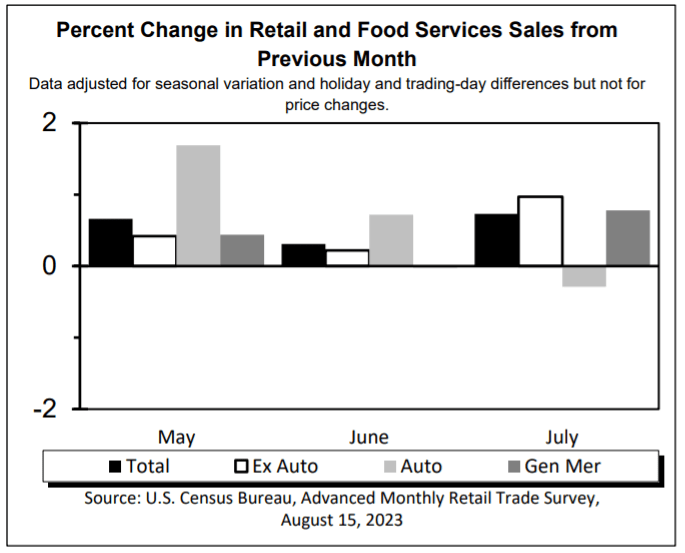

Let’s begin with the retail gross sales report for July. At first look, it didn’t look too shabby. Complete retail gross sales have been up 0.7% over June and up 3.2% over July of final yr.

In fact, these numbers aren’t adjusted for inflation.

And inflation has been working hotter than 3.2% over the previous yr.

However whereas this progress isn’t strong, the numbers don’t appear to color an image of the American shopper sheathing their bank cards both.

Digging deeper, the numbers get extra attention-grabbing…

Furnishings shops noticed gross sales down 6.3%, and electronics shops and residential enchancment shops noticed shrinkage of three.1% and three.3%, respectively.

And what do these have in frequent?

They’re all associated to the house.

With these excessive mortgage charges, Individuals are shifting much less, and are due to this fact shopping for much less.

Now, the true brilliant spot on the report was in eating places and bars, the place spending was up almost 12% over final yr.

Once more, a few of that is inflation, however definitely not all of it. Individuals, regardless of feeling the pinch, are nonetheless having fun with dinner and drinks away from house.

How “Actual America” Is Navigating the Economic system

Goal, the retail retailer, additionally launched its earnings this week.

That is one thing I learn each quarter. If you wish to see how Fundamental Avenue Individuals are doing on this economic system, learn the quarterly stories of Goal and Walmart.

After which hear to what administration is saying.

That is mainstream, mass-market America and you may usually see traits forming right here earlier than they present up in authorities statistics, months later…

Effectively, the information popping out of Goal isn’t nice. The retailer slashed its estimates for the rest of the yr. It indicated that customers are specializing in requirements and delaying their purchases of discretionary gadgets.

However there was one remark by Michael Fiddelke, Goal Chief Monetary Officer, that received my consideration:

“The resumption of scholar mortgage repayments is considered one of many elements that we’re watching actually intently.”

Sound acquainted?

I’ve been warning about this for months.

Economics is an train in what folks do with that subsequent marginal greenback. If the price of your primary requirements has risen by a greenback, then it’s one greenback much less you’ve accessible to spend elsewhere or save.

Therefore, Goal’s feedback that increased grocery costs imply much less cash to spend on garments and residential items.

The everyday scholar mortgage fee is wherever from $200 to $500 per 30 days. Effectively, wages aren’t mechanically rising by $200 to $500 per 30 days. So once more, that implies that each greenback spent on debt reimbursement is a greenback popping out of different spending.

Now, I discussed yesterday that Warren Buffett is implicitly betting on the American shopper, through his $700 billion funding in homebuilders (and likewise bank card issuers).

But in addition keep in mind this: Generally segments of the inhabitants do properly, even whereas different segments actually wrestle.

I’ll be maintaining a tally of this, as I anticipate this tug-o-war in conflicting financial information will proceed to create alternatives for us for the remainder of this yr — particularly in short-term buying and selling methods.

Mike Carr is an professional relating to this type of buying and selling: environment friendly, focused, with a give attention to high-quality investments. If you wish to be taught extra about what he’s engaged on in his Commerce Room, go right here for extra particulars.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge