REKINC1980/E+ through Getty Pictures

The Shopify Funding Thesis Seems Vibrant, Thanks To The Two Pronged Method

We beforehand lined Shopify (NYSE:SHOP) in Could 2023, discussing the administration’s choice to shed its logistics phase.

We believed that this was a prudent technique certainly, because it allowed the corporate to raised concentrate on its higher-margin SaaS choices, whereas accelerating its market share within the headless commerce resolution market globally.

Mixed with the steering of Free Money Move [FCF] profitability for each quarter of 2023, due to the improved monetization price, it was unsurprising that the SHOP inventory had additionally took off then.

For now, SHOP has met expectations with one other quarter of optimistic earnings in FQ2’23, with adj working earnings of $146M (+570.9% QoQ/ +447.6% YoY) and FCF era of $97M (+12.7% QoQ/ +211.4% YoY). That is regardless of the reasonable income progress to $1.69B (+12.6% QoQ/ +31% YoY).

We consider that this promising growth is attributed to 2 key methods.

One, SHOP has raised its subscription costs by +34% from April 2023 onwards, triggering the gross margin enlargement of the extremely worthwhile Subscription Resolution phase to 80.8% (+2.1 factors QoQ/ +4.1 YoY) within the newest quarter.

Two, the shedding of logistics phase has been the appropriate name in any case, for the reason that administration has already guided as much as 3 factors enchancment in its general gross margins from the following quarter onwards. That is in comparison with the 49.3% (+1.8 factors QoQ/ -1.4 YoY) reported in FQ2’23.

The improved profitability is unsurprising certainly, for the reason that Shopify Achievement Community and Deliverr have been beforehand dilutive to its Service provider Options gross margins.

For instance, SHOP reported Service provider Options gross margins of 38% (+0.8 factors QoQ/ -2.3 YoY) within the newest quarter, down from its FY2021 ranges of 42.9% (+2.1 factors YoY) previous to the acquisition of Deliverr.

With FQ3’23 anticipated to totally profit from each the hiked costs and the logistics divestiture, it’s unsurprising that market analysts have priced within the acceleration of SHOP’s profitability by FY2023, in comparison with the earlier projection of FY2025.

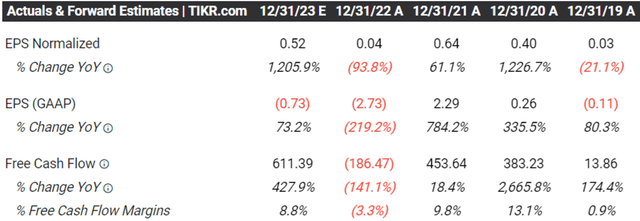

SHOP’s Projected Profitability

TIKR Terminal

The projected enchancment is drastic certainly, with market analysts anticipating adj FY2023 EPS of $0.52 (+1,205.9% YoY) and FCF era of $611.39M (+427.9% YoY). The expanded profitability will additional enhance its wholesome steadiness sheet, with web money of $3.87B (-2% QoQ/ -35.9% YoY) within the newest quarter.

As well as, regardless of the elevated rate of interest atmosphere, there are early indicators of market sentiment restoration, with Amazon (AMZN), the worldwide e-commerce big reporting smashing FQ2’23 efficiency with revenues of $134.38B (+5.5% QoQ/ +10.8% YoY).

The identical has been reported by PayPal (PYPL), with the fintech recording almost +6.5% MoM progress for branded checkout quantity in June 2023 and one other +8% MoM in July 2023, as “the highest month-to-month progress price for the reason that finish of the pandemic.”

These developments corroborates with SHOP’s increasing Gross Merchandise Quantity [GMV] of $55B (+10.8% QoQ/ +17.5% YoY) and Gross Cost Quantity of $31.7B (+15.2% QoQ/ +27.3% YoY) in FQ2’23.

Its Month-to-month Recurring Income has additionally expanded to $139M (+19.8% QoQ/ +29.6% YoY), with Plus retailers contributing $41M (+5.1% QoQ/ +21.6% YoY).

With the July 2023 CPI showing to be moderating at +3.2% YoY, in comparison with +8.5% a 12 months in the past, we consider shopper spending could return to its regular progress state because the inflation development strikes in the appropriate course.

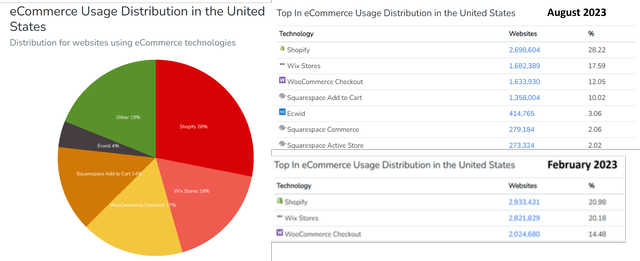

SHOP’s Market Share within the US eCommerce Utilization Distribution

Constructed With

With the Fed anticipated to pivot within the close to time period, SHOP’s prospects look like very vibrant certainly. That is considerably aided by its rising market share within the US eCommerce Utilization Distribution to twenty-eight.22% by August 07, 2023 (+7.24 factors from February 2023).

Within the long-term, SHOP’s entry into the promoting market isn’t overly speculative as nicely, with the current introduction of Audiences, as “a software that helps (sellers) to search out new clients by producing an viewers record for promoting platforms.”

With the platform solely producing improved conversion price and GMV for now, we consider its monetization of Audiences (amongst different promoting instruments) is just a matter of time, as equally witnessed with AMZN’s Amazon Adverts choices and Sponsored Show.

It is very important notice that AMZN has had nice success within the phase, with accelerating promoting revenues to an annualized sum of $42.72B (+12.4% QoQ/+22% YoY) by the newest quarter. That is on high of the rising world digital advert market share to 12.4% in 2023 (+0.7 factors YoY), due to its multi-channel choices.

Due to this fact, with the administration already laser targeted on progress and profitability, whereas tapping into a number of AI alternatives, we consider the SHOP nonetheless has an extended runway forward of it.

So, Is SHOP Inventory A Purchase, Promote, or Maintain?

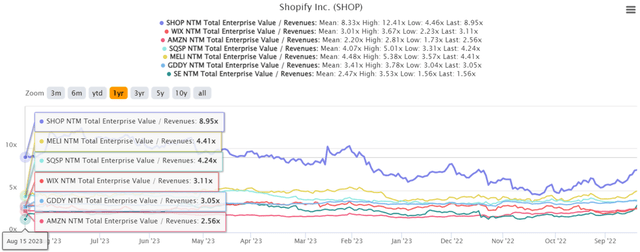

SHOP 1Y EV/Income Valuations

S&P Capital IQ

Then once more, these promising developments have additionally over inflated SHOP’s valuations to NTM EV/ Revenues of 8.95x, in comparison with its 1Y imply of 8.00x, its e-commerce friends’ median of 0.91x, and IT service friends’ median of three.07x.

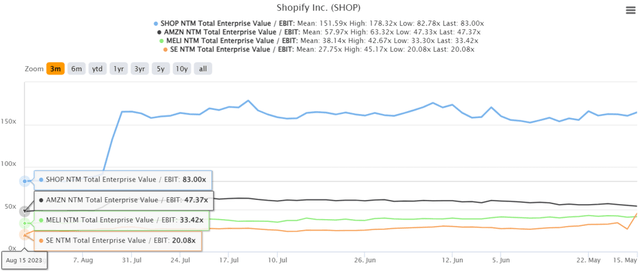

SHOP 3M EV/ EBIT Valuations

S&P Capital IQ

The identical can be noticed with SHOP’s NTM EV/ EBIT of 83.00x, in comparison with its e-commerce friends’ median of 8.87x and IT service friends’ median of 18.90x.

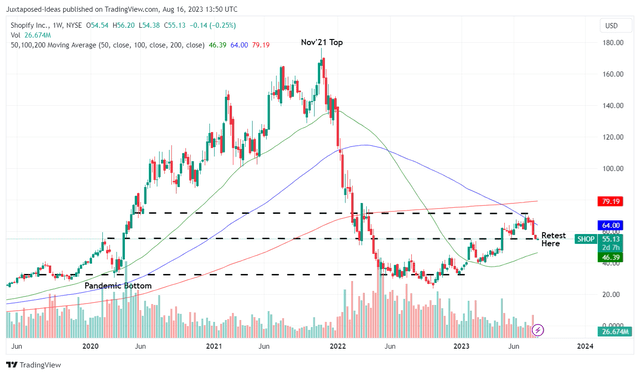

SHOP 5Y Inventory Worth

Buying and selling View

Due to this fact, whereas SHOP’s current pullback could appear enticing, due to its accelerated profitability and excessive progress cadence, we’re not satisfied by the lofty valuations but.

Whereas the inventory could also be an incredible addition to most portfolios, traders could need to look ahead to an additional retracement to our earlier purchase suggestion of low $40s in March 2023 for an improved margin of security.

We desire to price the SHOP inventory as a Maintain right here. There is no such thing as a must rush.