Excessive rates of interest might be the perfect factor for traders, private finance fanatics, retirees, savers, and people in search of monetary independence. , most of us.

Regardless that it was uncomfortable to lose cash when the Fed first began climbing charges in 2022, the Fed could have finally did us a favor by climbing 11 instances thus far.

As long as the economic system would not crash and burn because of overly restrictive rates of interest, most of us will likely be web beneficiaries of upper rates of interest.

Why Excessive Curiosity Charges May Be The Finest Factor Ever

Basically talking, for these with a variety of money and robust money movement, larger rates of interest are a blessing. For individuals who are money poor and have weak money movement, the next rate of interest surroundings is suboptimal.

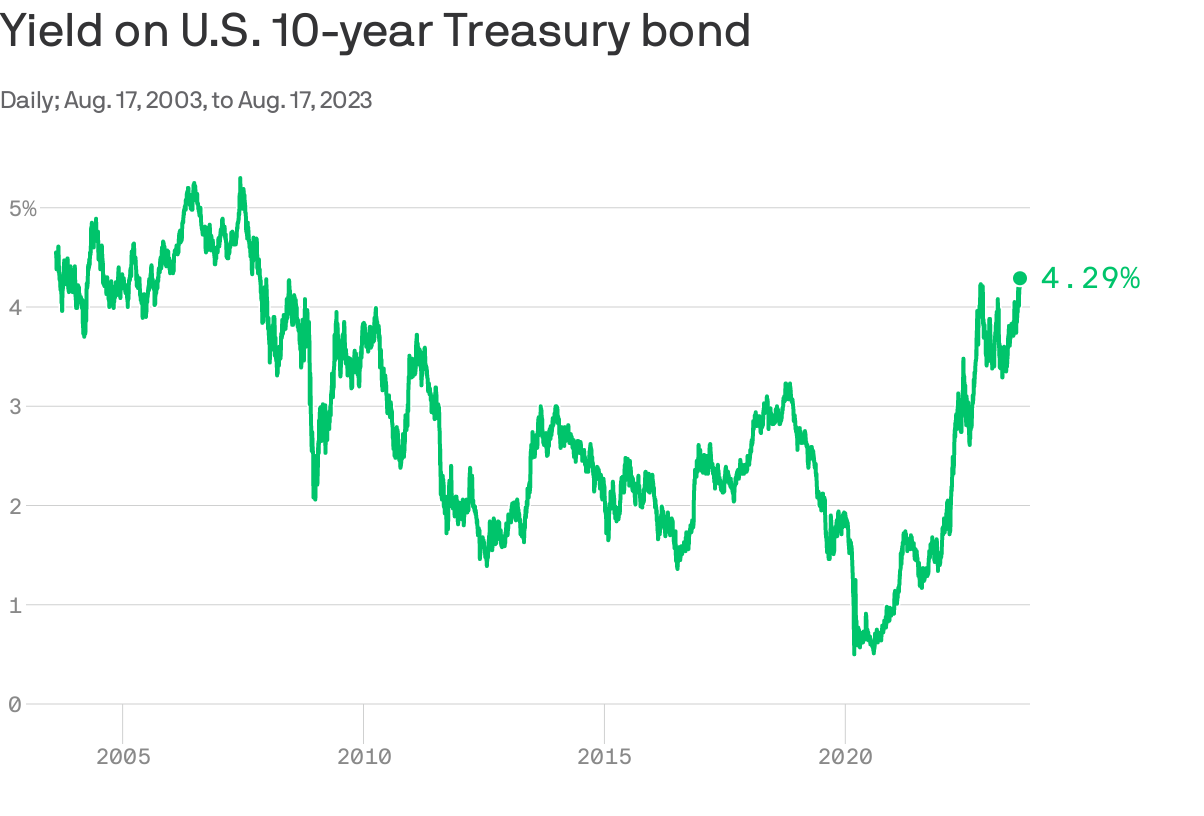

Let’s talk about all of the individuals who profit with the 10-year Treasury bond yield at a 15-year excessive.

1) Greater rates of interest are nice for retirees on a set earnings

For retirees who lack aspect earnings, larger rates of interest result in larger bond yields, CD rates of interest, and financial savings charges. Because of this, retirees get to earn larger risk-free and low-risk earnings to pay for his or her rising bills.

In fact, rates of interest do not simply rise in a vacuum. Greater rates of interest are usually correlated with larger inflation charges. Subsequently, even when a retiree earns the next low-risk earnings, they could nonetheless earn a unfavourable rate of interest.

Nevertheless, psychologically, retirees ought to really feel higher as a result of they’re incomes the next absolute greenback quantity from their fixed-income investments. Ultimately, inflation will roll over and there will likely be a second in time when retirees are benefitting much more.

For instance, as of 2H 2023, inflation is round 3.2% however Treasury bonds of each length are yielding above 3.2%. Subsequently, the retiree can be incomes a actual rate of interest.

See the newest fastened earnings chart under.

2) Greater rates of interest assist of us attain monetary independence sooner

Because of larger rates of interest, to remain aggressive, a lot of your present investments which have an earnings element have tended to extend as effectively. Because of this, larger rates of interest are serving to get you to FIRE sooner.

The earlier you get to your goal passive earnings quantity, the earlier you’ll be able to retire and stay a lifetime of freedom. There isn’t a higher reward than having the ability to do what you need if you need!

Personally, my passive earnings received a couple of 10% increase as a result of the common rate of interest earned by my varied income-producing investments went from about 3% to 4.85% in only one yr. The speed will go larger as my bonds mature and get reinvested.

It is simpler to generate extra passive earnings in a excessive rate of interest surroundings. Because of this, it is simpler to get to monetary independence sooner.

3) Greater rates of interest profit homebuyers with masses of cash

Because of larger mortgage charges, the demand for actual property has declined. Because of this, homebuyers with masses of cash not must compete in opposition to a variety of different homebuyers.

The bidding wars which result in 10%, 20%, and generally 50% over asking costs weren’t wholesome. They brought about many patrons to overpay and lots of potential patrons to be disillusioned.

Homebuyers with a hefty downpayment can now take their time and extra simply purchase what they need. As well as, sellers who checklist in a excessive mortgage price surroundings usually tend to lower costs to drive demand. Because of this, the cashed-up homebuyers can get higher offers in a high-interest price surroundings.

Because of larger rates of interest, the house I needed to purchase in 2022 grew to become out there at a 14.4% lower cost a yr later. Final yr, I virtually risked a friendship by eager to borrow cash from him.

The house by no means publicly got here available on the market once more. However by retaining in contact and writing a actual property love letter, I used to be capable of lock down the house with contingencies. I am grateful larger rates of interest have stored the competitors at bay.

4) Greater rates of interest allow extra present owners and renters to stay cheaper

The overwhelming majority of present owners refinanced throughout the pandemic or have mortgage charges far under present risk-free rates of interest. In the meantime, roughly 40% of householders haven’t any mortgage.

A surge in rates of interest means extra owners are incomes the next risk-free return than the price of their mortgage, e.g. 2.5% mortgage price, 5.4% risk-free Treasury bond. Because of this extra present owners reside without cost or are reducing their housing prices.

The identical factor goes for renters. Renters can now earn the next risk-free earnings to offset their hire. As long as the rise in risk-free earnings is larger than their hire enhance, renters are additionally profitable.

5) Greater rates of interest are nice for restricted companions in funds with masses of cash

In the event you spend money on well-capitalized non-public funds then you definitely’re feeling optimistic about this excessive rate of interest surroundings.

Your non-public actual property funds are shopping for business properties at a reduction. Or they’re lending cash to high quality builders and sponsors at extraordinary charges (12% – 13%). That is what Ben Miller, CEO of Fundrise mentioned his agency is doing in my one-hour lengthy interview with him.

Your enterprise capital funds that raised a ton of cash can extra simply win offers and spend money on non-public corporations at steeper reductions. As weaker enterprise capital funds start to carry out poorly, the perfect funds take market share.

Your enterprise debt funds are additionally stepping in to lend cash to high quality non-public corporations at higher-than-normal charges as effectively. Enterprise debt funds profit vastly from larger charges.

As soon as rates of interest normalize (head decrease), the worth of the investments made by non-public funds tends to go larger. In the meantime, some non-public funds may have locked-in long-term loans at larger charges.

6) Greater rates of interest earn arduous cash lenders more cash

In the event you’re a tough cash lender, then you definitely additionally get to cost higher-than-normal charges. In the event you’re savvy, you will attempt to lend cash at longer phrases to lock in larger charges for longer close to the top of the cycle.

I am not a fan of arduous cash lending as a result of I hate it when folks default. Not solely is there no recourse after a default, relationships can simply get ruined as effectively. Lending cash to family and friends is a harmful exercise.

I would a lot relatively spend money on a enterprise debt fund or a actual property earnings fund the place I am faraway from the method. It is also higher to have collateral to promote when lending cash.

7) Greater rates of interest present a chance to take market share from debt-laden rivals

There will likely be a purging of corporations that took on an excessive amount of debt earlier than and through a high-interest price surroundings.

For instance, a trucking firm known as Yellow filed for chapter as a result of it could not work out a take care of its lenders of $1.2 billion. A compromise additionally could not be made with its truckers union. Because of this, rivals will swoop in and purchase its vehicles and stations for pennies on the greenback.

Each firm in each trade that took on an excessive amount of debt is in danger. For these corporations with massive stability sheets, it is buying time.

8) Greater rates of interest supplies an opportunity to deal with a number of generations if there may be an financial disaster

Lastly, as an instance one other deep recession comes because of too-high rates of interest. Costs of danger property will decline, 1000’s of corporations will shut down, and hundreds of thousands will lose their jobs.

Those that are cashed up and capable of maintain their jobs in an financial disaster can go on the best shopping for spree. Again throughout the international monetary disaster in 2008, many cash-rich traders backed up the truck on shares and actual property. By 2012, the economic system recovered and began surging upward once more.

A few of those that purchased profited sufficient to create generational wealth so their kids by no means must work once more. They had been rewarded for being disciplined with their funds and taking dangers throughout sketchy instances.

Those that overextended themselves and needed to promote throughout the downturn missed out. Those that declared chapter needed to wait seven years to be eligible for credit score once more. By then, asset costs had been a lot larger.

Cynically talking, the wealthy Fed Governors are OK with financial destruction as a result of they and their wealthy buddies are capable of climate downturns the perfect. As soon as the lots are squeezed out of the system, they’ll then swoop in and buy worthwhile property at discounted costs for his or her heirs.

And when you get actually wealthy, you and your kids get much more privileges as evidenced by the a lot larger elite faculty acceptance charges for the highest 0.1%.

Excessive Curiosity Charges Are A Web Constructive For Private Finance Fans

For these of you who’ve been studying and listening to Monetary Samurai for some time, it is best to recognize this high-interest-rate surroundings. It will not final endlessly as I believe we’ll finally revert to our 40+-year development of downward-trending rates of interest. However we must always take pleasure in it whereas it lasts!

I am taking benefit by constructing a bond portfolio. I had lower than 5% of my web price in bonds earlier than charges shot up. However principally, I am benefiting from larger rates of interest by shopping for a dream residence. I by no means thought I would be capable to afford such a house at this stage in my life.

As long as the economic system would not replicate a 2008-style crash, excessive rates of interest must be good for many of us. Save on and luxuriate in your cash!

Reader Questions and Options

How are you benefiting from this larger rate of interest surroundings? What are a few of the issues you’re having fun with at present that you just weren’t having fun with with rates of interest had been low?

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and talk about a few of the most fascinating matters on this web site. Please share, price, and evaluate!

For extra nuanced private finance content material, be part of 60,000+ others and join the free Monetary Samurai e-newsletter and posts by way of e-mail. Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009.