ANDY_BOWLIN/iStock by way of Getty Pictures

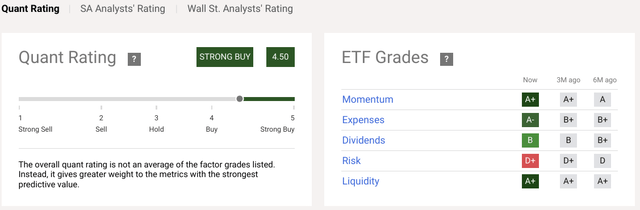

Each August, the Fed’s Jackson Gap summit is hosted by the Kansas Metropolis Fed. The occasion’s historical past is deeply intertwined with the Fed’s previous and present efforts to conquer inflation. As long-term charges have risen over the previous few weeks, expertise shares within the Nasdaq (QQQ) have suffered. Nevertheless, I think Powell’s tone at Jackson Gap will assist the index. Moreover, I think US long-term charges are at or close to their peak, which can relieve the QQQs.

Looking for Alpha

The primary time the Jackson Gap Summit was held in 1982 was instantly after Chairman Volcker had taken probably the most aggressive and (on the time) controversial actions within the Fed’s trendy historical past to interrupt the again of inflation. There is a theme yearly, and this 12 months’s theme is “Structural Shifts within the World Financial system.” This theme is a touch that the Fed will argue that a lot of the inflation was brought on by extraordinary occasions moderately than financial or fiscal coverage.

The preliminary 1982 summit had been deliberate shrewdly by Kansas Metropolis Fed President Roger Guffey to be a vacation spot identified for fly fishing, a favourite interest of then Chairman Volcker. One of many distinguishing options of fly fishing is knowing the psychology of the fish or doing what’s referred to as studying the water.

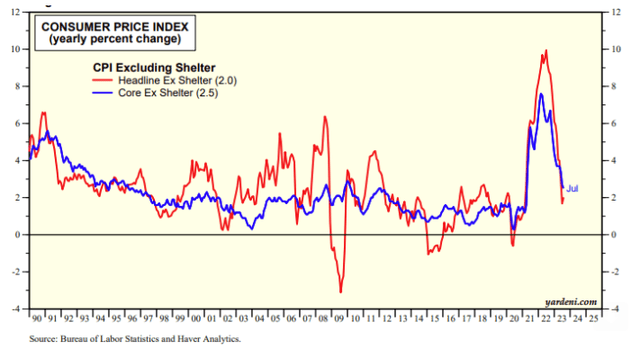

Whereas inflation was close to a multi-decade peak final 12 months as Powell introduced out the belt, whenever you exclude Shelter, we’re a lot nearer to the Fed’s goal than grumbling from bears hanging their hat on Milton Friedman-inspired syllogisms would recommend. Current indications recommend the Shelter element will fall sooner than consensus expects.

Yardeni.com

Thus, final 12 months’s symbolic water was very completely different than this 12 months’s, and I feel there is a setup right here for the market to renew its rise after a wholesome sell-off and consolidation. I feel there are a number of the explanation why Chairman Powell will give some bullish aid in his feedback.

- Broad progress on inflation during the last 12 months and two successive optimistic CPI studies have given the Fed much less have to hike additional, at the least within the brief time period.

- Labor markets have been behaving persistently with the soft-landing thesis, and there is growing consensus a recession shouldn’t be imminent.

- Financial weak spot in China means downward stress on inflation is extra more likely to be sustainable.

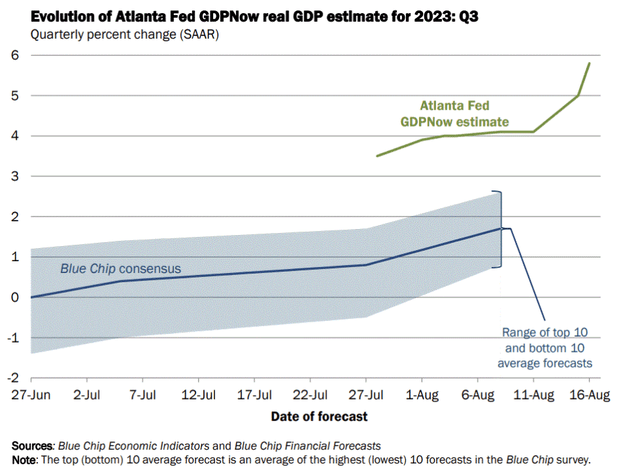

- Financial energy in the USA is growing, with the latest Atlanta Fed GDP Tracker suggesting GDP progress of 5.8%.

- Current rises in charges coupled with mounting hedge fund bearishness on long-term charges have raised US borrowing prices to file ranges.

- This, coupled with mounting pressures on US banks, implies that the Fed would love “larger for longer” to final lengthy sufficient to conquer inflation, however actually now not than obligatory.

This successfully places an upward restrict on charges, regardless of a necessity for powerful discuss, and makes me much more assured that the speed climbing cycle is over. Whereas Powell and buddies will certainly give some lip service to inflation, the latest CPI studies prompt that CPI can proceed its downward pattern.

I used to be enormously inspired by Philadelphia Fed President Harker’s latest feedback that prompt the Fed climbing cycle was over and that cuts additionally might come earlier than the consensus at present expects.

Powell Doubtless Treads Evenly and Touts Progress on Inflation

The Fed’s Jackson Gap summit is the Fed watcher’s summer season block social gathering, and it is much more consequential on the finish of probably the most aggressive climbing cycle since Paul Volcker, the person whose love of flyfishing is accountable for the genesis of the summit, walked the halls of the Eckles constructing.

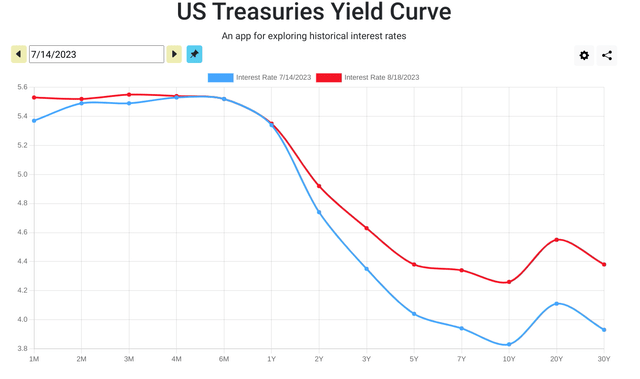

And the bears seem prepared for a celebration on condition that there was what appeared to be a “bear steepening” within the US curve. However this provides Powell an ideal opening to give attention to progress within the inflation combat and to set the market’s sights on cuts in 24 moderately than including to present fears, which might evolve into monetary stability issues.

But when Powell brings honey as an alternative of vinegar, the consequence would seemingly be some normalization of the busted-up curve. That is necessary for sustaining monetary stability and relieving embattled regional banks. Whereas some traders could also be apprehensive about financial weak spot in China, moderately than monetary contagion being exported to our aspect of the Pacific, I would guess low costs shall be what’s on the way in which. This provides the Fed cowl to challenge optimism.

USTreasuryYieldCurve.com

Final 12 months, the market loved a summer season rally that undid monetary situations to a level unacceptable to a Fed within the early phases of its climbing cycle. And up to date financial energy would possibly usually tempt Powell to place the main focus again on how massive a menace inflation stays, however monetary situations have tightened significantly into Jackson Gap this 12 months, regardless of projections for white-hot financial progress from the Atlanta Fed.

Atlanta Fed GDP Now Tracker

In fact, that led to Powell admonishing the markets and speaking down the rally in furtherance of his mandate final 12 months. This 12 months, I feel will probably be the approximate reverse. Many market bears, pissed off by the 12 months’s prolific rally in shares, have been enormously inspired by the final three weeks of consecutive market losses. Nonetheless, I strongly suspect this 12 months’s Jackson Gap assembly shall be roughly the inverse of final 12 months, giving markets extra cause to proceed their postponed rally.

I’ve lined this extraordinary Fed climbing cycle extensively:

- Earlier than Silicon Valley Financial institution’s collapse, I postulated that the Fed was calling the bond market’s bluff that it might “break one thing” and that that they had a greater grip on monetary stability than consensus afforded.

- After the final Fed assembly, I acknowledged that I believed the Fed would hike zero occasions or just one extra time (one and achieved). That is now the consensus view, nevertheless it was not then.

- I predicted there was potential for diminished volatility following the final jobs report after the sell-off brought on by the ADP report. I received folks into the Dow earlier than its latest 13-day streak.

- Now, I am confirming that notion. I consider this subsequent hike would be the final in a gauntlet of a climbing cycle. A majority of economists now agree with this take.

- Constructive financial knowledge are more and more validating the potential for a comfortable touchdown. Inflation is coming down convincingly, because the July CPI report validated.

There might actually be some weak spot between now and the Fed’s press convention on Friday. Nevertheless, I feel this newest interval of market weak spot will finish briefly order. And I feel Powell’s feedback at Jackson Gap could also be a main catalyst in turning markets round.

Dangers and The place I May Be Unsuitable

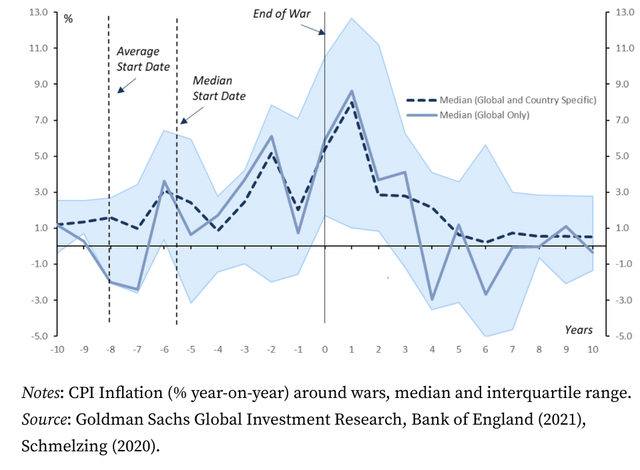

There have been loads of causes for mounting negativity in August, and naturally, all of those are seemingly exacerbated by low quantity and far of Wall Avenue seemingly absorbing the rays as an alternative of glued to their Bloombergs. And certainly, August is mostly a dangerous month from a seasonal perspective. Whereas the present inflationary drivers appear to be below management, we’re additionally in an agitated geopolitical setting that would shortly result in that reversing.

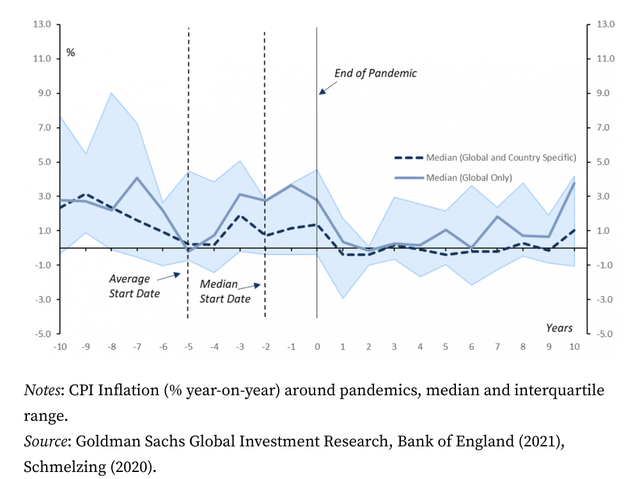

Heart for Financial Coverage Analysis

Struggle, specifically, has been a historic driver of inflation, not simply when the struggle is being fought but additionally in its aftermath. Thus, one of many main dangers to the Fed in its climbing cycle is that if the Russia-Ukraine Struggle or different geopolitical scorching spots result in additional provide chain disruptions and commerce obstacles that reignite diminishing inflationary stress or end in a market panic that takes the main focus off inflation altogether.

- Escalation in Ukraine or Taiwan

- Fed Coverage Error

- Banking Points Worsen

- US fiscal points or political division

- CRE meltdown

- Chinese language Actual Property/Debt concern contagion

Apart from this, any shock to the worldwide vitality complicated that spikes costs might be the first danger that the Fed should proceed climbing or doubtlessly {that a} coverage error has occurred. In fact, a number of different important dangers might derail the market’s progress, even when the Fed comes out with a conciliatory tone.

Two days earlier than the Fed’s press convention is Nvidia’s (NVDA) earnings report. Final quarter, this propelled the entire market into a serious rally. Disappointment within the report might consequence within the reverse this time. If CRE’s weak spot blows up, it might be a double-whammy that would concurrently velocity up the slow-motion banking issues.

Conclusion: The Doves Are Again in City

The assembly minutes from the Fed’s final assembly have been handled primarily as a bearish growth since Fed members appeared keenly centered on potential upside dangers to inflation. Nevertheless, in the event you learn between the strains, it is also clear the dovish parts of the FOMC have gotten extra empowered by financial knowledge that more and more vindicates their philosophy on the expense of monetarists and inflation hawks.

Heart for Financial Coverage Analysis

Whereas struggle is traditionally a strong driver of inflation, the alternative is discovered within the aftermath of pandemics. For the reason that pandemic had a way more ubiquitous impact on the worldwide economic system than the Struggle in Ukraine has, I feel it is potential that normalization from COVID is the one most important pressure on inflationary stress and that inflation’s decline shall be sustainable. The latest near-record outflow in long-term US bonds additionally satisfied me we’re close to a shift towards extra optimistic sentiment.

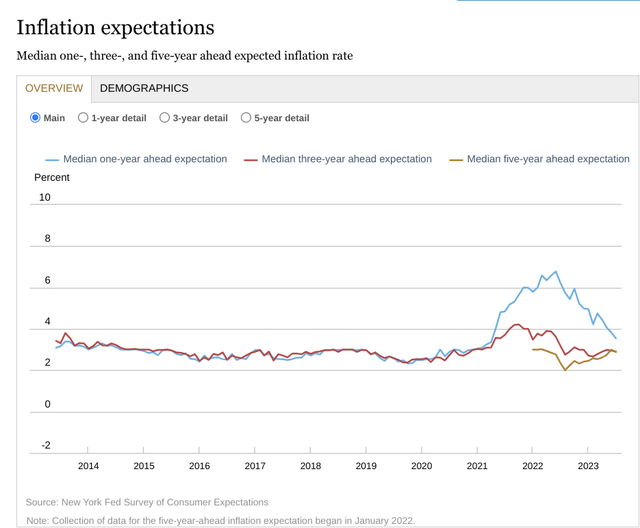

NY Fed

If long-term charges can retreat and halt their march larger, then I think the Nasdaq won’t solely reverse its latest losses however will march ahead to new native highs. I am more and more assured that the Fed’s climbing cycle is over. I consider they are going to present perception to recommend this at Jackson Gap whereas remaining guarded. Mounting US debt service additionally places a de-facto cap on how lengthy “larger for longer” can final.

Looking for Alpha

Whereas the minutes present lingering issues about inflation, in addition they present that the doves are more and more empowered and extra conscious of the pointless injury that overly restrictive coverage might inflict on the US economy-the minutes occurred earlier than the July CPI report when June’s optimistic studying might have been an anomaly. The info has favored the doves these previous three months, and I feel they’re going to make themselves extra obvious at Jackson Gap than they’ve because the starting of this fateful climbing cycle.