Igor Kutyaev

The primary half of 2023 noticed the start of a banking disaster that can have repercussions for years to return, which is able to result in a interval of consolidation inside the banking trade in addition to a rethink of the function of banks within the US economic system. Throughout this era of great stress, it is very important be aware that there are huge variations within the high quality of banks in addition to various working fashions which is able to lead to broadly diversified outcomes. These nuanced variations are usually not appreciated by most traders and are usually not mirrored in inventory costs, thereby making the sector opportunity-rich for lengthy/quick fairness managers.

The principle situation at present plaguing the trade was dropped at the forefront of the market’s consideration in March. Financial institution belongings and liabilities are at an excessive length mismatch, the place stability sheets are crammed with long-duration, low-yielding fixed-income securities and loans, whereas liabilities are shorter-term than beforehand anticipated. As rates of interest rose, the worth of their belongings declined considerably. The difficulty was even worse than most traders first realized as a result of a big portion of financial institution belongings had been labeled as “held-to-maturity” and weren’t marked to market. This artificially made the belongings on financial institution stability sheets look financially higher than they really had been.

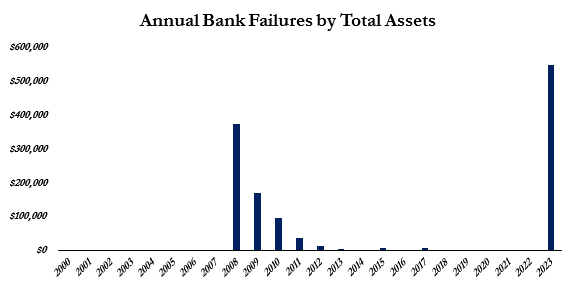

The issue was compounded as some banks had an outsized share of their deposits uninsured by the FDIC. These banks, with suspect liquidity, skilled vital deposit outflows, culminating with the headline failures of Silicon Valley Financial institution (OTCPK:SIVBQ), Signature Financial institution (OTCPK:SBNY) and First Republic Financial institution (OTCPK:FRCB). The chart under illustrates the historic nature of those occasions. Even throughout the Nice Monetary Disaster of 2008, we didn’t see anyplace close to this degree of belongings at failed establishments.

S&P World, Bloomberg

It was at this level that the Federal Reserve and the Treasury Division did three issues to alleviate the short-term liquidity squeeze on the trade. These included offering an implied FDIC assure on all financial institution deposits to cease runs on the banks, creating the the Fed Financial institution Time period Funding Program (BTFP) to help banks having liquidity points (however at a excessive rate of interest), and serving to prepare weak financial institution acquisitions by bigger banks (probably costing the FDIC tens of billions). These measures successfully stabilized the short-term liquidity points inside the trade, however solely briefly.

Important points persist inside the banking sector in regards to the high quality of their stability sheets, which, in lots of circumstances, have deteriorated additional as a consequence of rising rates of interest and banks’ decreased potential to generate revenue.

There are 3 ways to judge financial institution threat, although every needs to be thought-about over markedly totally different time intervals.

- Liquidity, which we now have addressed above.

- Solvency, belongings versus liabilities – increased charges will proceed to be a headwind on capital ranges and the trade is sick ready for any opposed credit score occasions.

- Profitability.

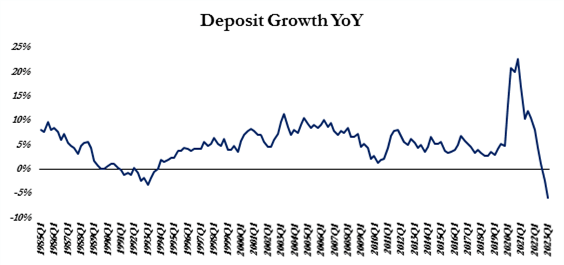

In inspecting the solvency of a lot of the banking trade, the length mismatch of belongings and liabilities has not gone away. Some banks have offered a few of their long-duration securities at losses to scale back their rate of interest threat, nonetheless, most financial institution belongings are loans. With only a few individuals paying off their mortgages or refinancing their maturing CRE debt, the typical length has been lengthening significantly because of the low charges prevalent at origination. Concurrently, the trade is experiencing the biggest contraction in deposits in over 50 years.

S&P World, Bloomberg

As issues about financial institution runs unfold throughout the trade this previous spring, many banks repositioned their stability sheets to enhance their liquidity profile. Notably, many of those actions have lowered capital ranges and resulted in bigger money balances. Most significantly, competitors for liquidity from different banks, cash market funds or broader mounted earnings options has compelled banks to proceed to pay up for liquidity. To place the aggressive charge surroundings in perspective, current accessible market charges embody:

- Federal House Mortgage Financial institution (OTCPK:FHLB): 5.50%

- Cash Market Funds (MMF): 5.00%

- Fed Financial institution Time period Funding Program (BTFP): 5.47%

- Fed Low cost Window (DW): 5.25%

- Common US Certificates of Deposit (CD): 4.75%

- Common US Financial institution Deposit Charges: 0.54%

Nevertheless, the common securities yield of banks’ portfolios is roughly 2.75%.

Sadly for the banking trade, depositors have awoken to the brand new actuality that extra money balances can generate returns – leading to a drastic remix out of non-interest bearing accounts into higher-yielding options, which can completely change the trade.

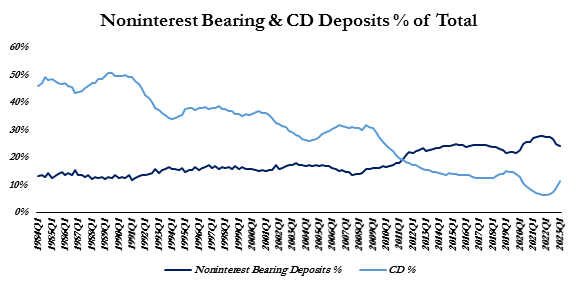

Over the previous 50 years, banks had turn out to be a lot much less reliant on Certificates of Deposits (“CD”) to fund their stability sheets, but this pattern is starting to reverse. A reversal which might have a drastic long-term influence on run-rate earnings.

S&P World, Bloomberg

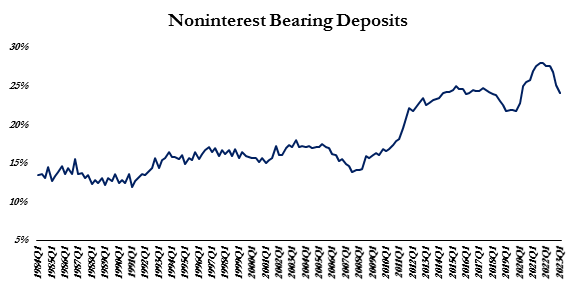

Non-interest bearing (NIB) deposits at present symbolize 24% of complete deposits, down from a cycle peak of 28%. The common share of deposits that had been non-interest bearing since 2011 is ~24%, signaling a return to pre-pandemic ranges. Nevertheless, a have a look at the pre-ZIRP (Zero Curiosity Fee Coverage) surroundings sheds some gentle on what the long run may maintain and brings with it questions in regards to the length expectations of financial institution liabilities. The common share of NIB deposits to complete deposits between 1984 and 2007 was 15%.

S&P World, Bloomberg

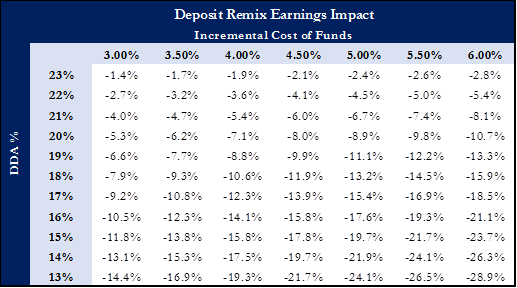

The sensitivity desk under depicts what would occur to trade earnings if non-interest bearing deposits proceed to contract and are changed with higher-cost funding sources. For dramatic impact, if the trade had been to revert to the pre-GFC common non-interest bearing deposit mixture of 15% and people NIBs are changed with present market charges, trade earnings would decline by ~20%. This re-mix of liabilities will proceed to strain the trade’s earnings, whereas present sell-side estimates misrepresent this actuality.

S&P World, Bloomberg

Greater charges aren’t simply impacting the legal responsibility/deposit facet of financial institution stability sheets however the asset facet as properly. When rates of interest rise, the market worth of mounted earnings securities and loans decline. As well as, there are vital credit score points dealing with the trade at a time when the trade lacks enough loss absorption buffers (reserves, capital and earnings) ought to credit score materially deteriorate.

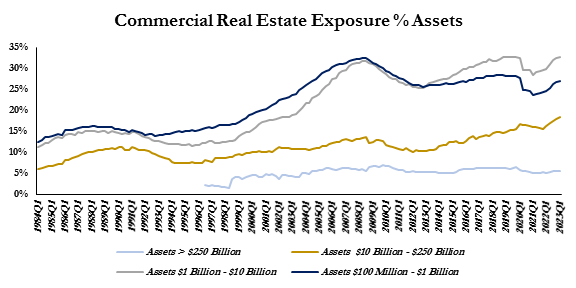

The largest space of concern for many traders facilities round Business Actual Property, particularly workplace and retail properties in central enterprise districts.

S&P World, Bloomberg

Business workplace actual property is being devastated by the shift to distant work, the place leasing exercise within the 1st quarter dropped for the third straight quarter, sinking 42% under pre-pandemic ranges. Massive emptiness charges are lowering money flows at a time when many loans should be renewed at considerably increased charges. Some trade specialists are forecasting a 30-40% loss in worth of business workplace actual property in lots of the central enterprise districts. This could lead to many debtors selecting handy the keys to the financial institution reasonably than doing a “cash-in” refinancing.

As stress within the industrial actual property pipeline continues to construct, it would take time earlier than losses present up on financial institution stability sheets. The uncertainty across the frequency and severity of CRE losses is chopping off entry to credit score to all however the highest-quality debtors. This can doubtless influence combination financial exercise over the following 12 months.

When contemplating investments in corporations whose headline CRE exposures seem unfavorable, it is very important differentiate between banks whose CRE exposures are genuinely susceptible to incurring losses and people whose precise threat profile is far decrease than headlines counsel. Curiously, regardless of outsized industrial actual property publicity, many small banks’ workplace publicity can have low charge-off charges, as they’re sometimes situated outdoors of the foremost metropolitan areas. Moreover, small banks are sometimes extra conservative of their underwriting, demanding extra upfront fairness and private ensures.

One space of the financial institution mortgage market that has but to garner a lot consideration is the standard industrial and industrial (C&I) area. Business loans sometimes carry a variable rate of interest and are underwritten primarily based on the underlying money flows of the group or collateralized by tools worth. With every passing month, industrial debtors face incremental strain as their curiosity expense will increase whereas the present disinflationary actual property surroundings pressures margins and collateral values. Most industrial loans had been underwritten in an surroundings the place corporations’ earnings statements had been extremely wholesome as a consequence of decrease expense bases and better fiscal assist within the type of COVID aid. Most notably, we merely haven’t skilled a correct enterprise cycle for the reason that Nice Monetary Disaster, and most enterprise homeowners and traders lack the data and expertise to adapt to the realities of a slowing economic system.

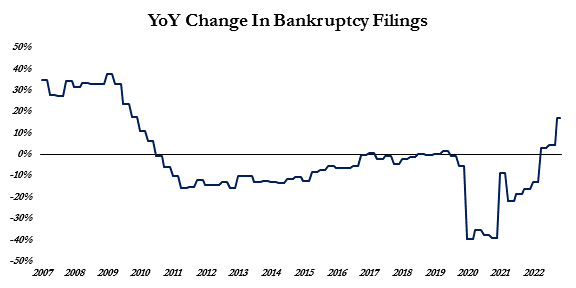

In line with Epiq Chapter, U.S. Chapter 11 chapter filings have elevated 68% within the first half of 2023 in comparison with a yr earlier. The Bloomberg information under depicts the year-over-year change in chapter filings for big and center market enterprises, which exhibits a drastic improve within the first half of 2023. Current information exhibits an extremely liquid and, for now, resilient US client which has supported financial exercise within the first half of the yr. With rates of interest set to be increased for some time, small enterprise default charges ought to proceed to maneuver increased.

S&P World, Bloomberg

Whereas there are numerous banks which have outsized CRE exposures, regulatory controls have restricted the proportion of a financial institution’s capital that may be uncovered to CRE. Nevertheless, there aren’t any limits to a financial institution’s publicity to industrial credit score. Many regional banks which have been within the information for CRE dangers have solely 20% of their mortgage guide in CRE with greater than 50% of their mortgage guide in industrial lending. For instance, KeyCorp (KEY), a $197bn asset financial institution primarily based within the Midwest, has been within the information lately concerning liquidity and different issues – not industrial lending associated. The corporate has 14% of its loans in Business Actual Property, whereas 54% of its loans are in industrial lending. Equally, Areas Monetary (RF), a $150bn financial institution primarily based in Alabama, has not been within the information actually because its liquidity and capital place has been perceived as steady and thus has considerably outperformed the benchmark. Its CRE and Multi-Household mortgage guide makes up 12% of complete loans – industrial loans comprise 53% of complete loans.

Abstract

Except rates of interest drop dramatically, the banking disaster will, in time, result in a excessive degree of financial institution failures and subsequent consolidation inside the banking trade. Nevertheless, there are substantial worth disparities amongst particular person banks that aren’t well-understood by most traders and haven’t been mirrored in inventory costs. Some banks will certainly be negatively impacted by their asset legal responsibility mismatch and credit score portfolios. Others will excel, benefitting from superior credit score profiles and/or diversified enterprise fashions that allow them to make the most of market dislocation to realize market share.

Unique Supply: Writer

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.