Irrespective of how you are feeling about President Biden, there’s just one logical option to really feel about his Inflation Discount Act: Bullish on the way forward for power.

Regardless of the title, this laws represents one of many largest spending packages in U.S. historical past. Of the $500 billion in deliberate spending, $369 billion goes straight into the transition to renewable power — the White Home’s prime focus.

However tucked away within the invoice, beneath the reams of {dollars} headed straight for renewable sources like wind and photo voltaic, was a considerable tax credit score for a extremely environment friendly, secure, but outright despised renewable power supply…

I’m speaking about nuclear energy.

For many years, nuclear energy has suffered a stigma from buyers and world leaders alike because of the influence of simply three sore spots in its complete historical past.

That’s left it hated, feared and uncared for as an asset — particularly for the reason that final main incident, the Fukushima nuclear meltdown again in 2011.

In the present day, although, nuclear power shares have caught a tailwind. They’re carving out a brand new uptrend. And buyers who place a small stake in it now can comfortably nonetheless name themselves early on what I imagine may turn out to be an outlier within the bigger renewable power mega development.

That’s why this Banyan Edge is about serving to you perceive the chance that stands earlier than us in nuclear power … and displaying you the only means to participate.

A Darkish Cloud Is Clearing

A darkish cloud of sentiment has hung over the broader nuclear business for nicely over a decade. Now, it’s on the verge of clearing.

A latest Gallup survey indicated that 55% of People favor using nuclear power, the very best studying since proper after the 2011 Fukushima incident. The survey additionally confirmed the bottom opposition to the business since 2015.

This must be no shock when you think about the monitor file. Nuclear energy vegetation have existed for the reason that Nineteen Fifties … and we are able to depend the variety of vital accidents on one hand: Three Mile Island in 1979, Chernobyl in 1986 and Fukushima in 2011.

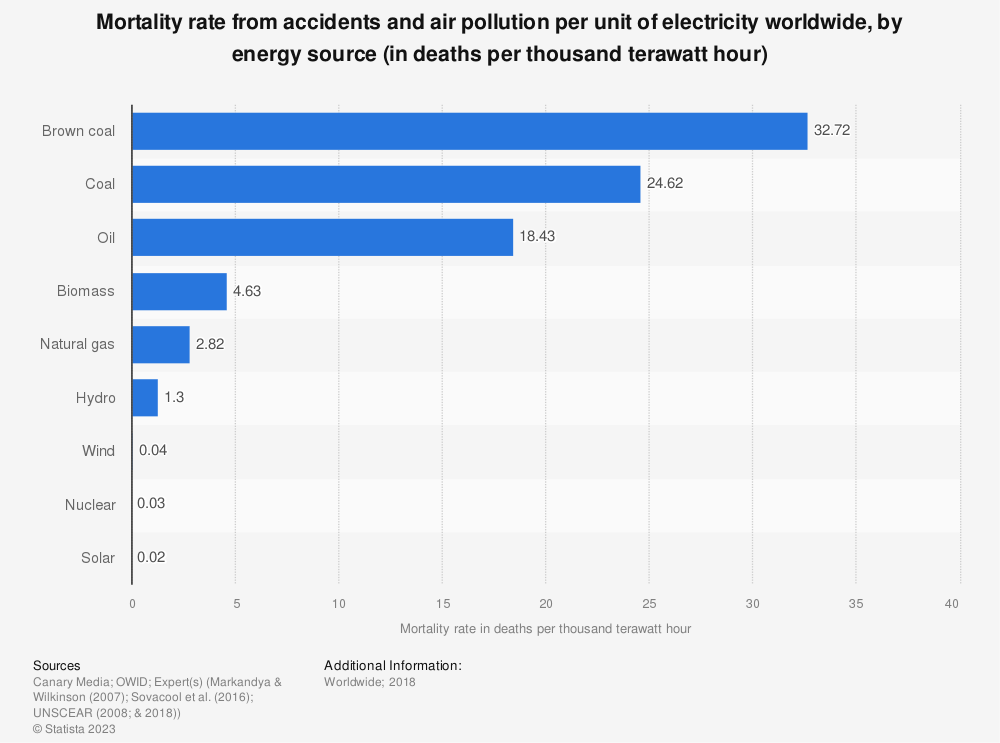

Put up in opposition to fossil fuels, and even different inexperienced power sources, the extent of security is miles aside. The chart under reveals that nuclear isn’t simply safer than coal, oil and pure gasoline … but additionally hydroelectric energy.

How harmful is it? About as harmful as wind energy.

(Click on right here to view bigger picture.)

On the similar time, nuclear is without doubt one of the most effective strategies of power manufacturing we’ve.

A typical nuclear reactor produces about one gigawatt of electrical energy per 12 months with near-zero carbon emissions, whereas requiring drastically much less land than wind farms (0.05% on common) or photo voltaic fields (0.25%).

And whereas nuclear energy vegetation are dearer to construct out, they final for much longer than photo voltaic or wind farms — typically a decade or extra. Additionally they require far much less refueling and upkeep, solely as soon as each one to 2 years.

However past capital and land assets, nuclear most significantly requires far fewer uncooked supplies to supply. Measured because the variety of metric tons of supplies per terawatt-hour of power produced, wind generators require 10 instances the uncooked supplies of nuclear … and photo voltaic panel arrays require 16 instances extra.

Regardless of all this, nuclear has lengthy had a repute for being soiled and even violent. The incidents I discussed above, together with the tip of World Struggle II and depictions of nuclear energy vegetation in well-liked media (bear in mind the three-eyed fish from The Simpsons?), are a minimum of partly accountable.

Nearly half of People nonetheless maintain this bias. However the ones that don’t, and might see the writing on the wall, are getting busy turning the tide.

For instance, Georgia Energy Co. not too long ago opened the 1,100-megawatt Vogtle facility. This facility, the primary new nuclear reactor since 2016, has the capability to energy half one million properties and companies.

Additional, there are plans for an additional new reactor in the identical location to start operation between November 2023 and March 2024. These two reactors mixed will make Vogtle the biggest nuclear plant within the nation.

This opening comes on the good time, contemplating the Inflation Discount Act gives a tax break to nuclear services working from 2024 to 2032. Each megawatt hour of power these services produce will earn them a $15 tax credit score.

If the typical nuclear energy plant generates one gigawatt of electrical energy per 12 months (1,000 megawatts), that totals out to a $15 million tax credit score per plant.

You’ll be able to see the inducement for nuclear energy starting to take form proper earlier than our eyes. The narrative tide is shifting, and the capital is shifting together with it.

So how one can observe that capital right into a pro-nuclear future for the U.S.?

A Turnkey Nuclear Commerce

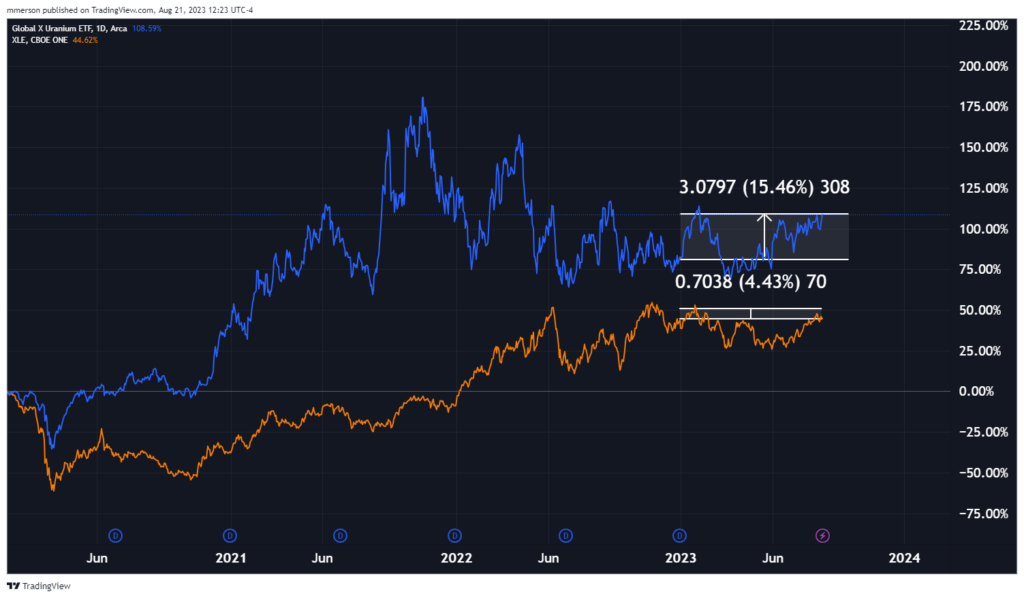

The best option to place your chips on the nuclear power mega development is to put money into the World X Uranium ETF (NYSE: URA). This exchange-traded fund (ETF) holds a basket of nuclear power firms from world wide. And regardless of the broader hunch in power shares in 2023, URA has outperformed.

URA is up over 15% 12 months to this point (blue line), whereas the Vitality Choose Sector SPDR Fund (NYSE: XLE) is up simply over 4% (orange line). And for the reason that begin of 2020, URA is outperforming XLE by 2-to-1.

URA’s Vitality Outperformance

(Click on right here to view bigger picture.)

(Click on right here to view bigger picture.)

URA is a good, pretty low-risk option to capitalize on the development. Nevertheless it’s definitely not the one with the best upside.

Nuclear firms based mostly within the U.S. stand to do significantly better because the IRA’s tax credit take maintain.

I not too long ago shared the title of 1 such firm with my Inexperienced Zone Fortunes subscribers. And it’s not simply any previous U.S. nuclear power firm.

This inventory has an efficient monopoly with the U.S. authorities in terms of a selected, important a part of nuclear energy.

Just lately, it obtained approval to start business manufacturing of its high-efficiency uranium enrichment course of — which is a staple of contemporary nuclear reactors. And it introduced a partnership with one other main nuclear firm based by one of many world’s richest males.

I delivered an replace on this inventory not too long ago to my Inexperienced Zone Fortunes subscribers, reiterating my purchase steering for anybody who hasn’t but gotten in. (Subscribers can learn that replace right here.)

However when you aren’t but a Inexperienced Zone Fortunes member and need to study the title of this outlier nuclear power firm, together with my different prime renewable power inventory suggestions, go right here and study how one can safe your membership.

To good income,

Adam O’Dell

Chief Funding Strategist, Cash & Markets

Takeaway From Peloton’s Downfall

It was a catastrophe everybody noticed coming…

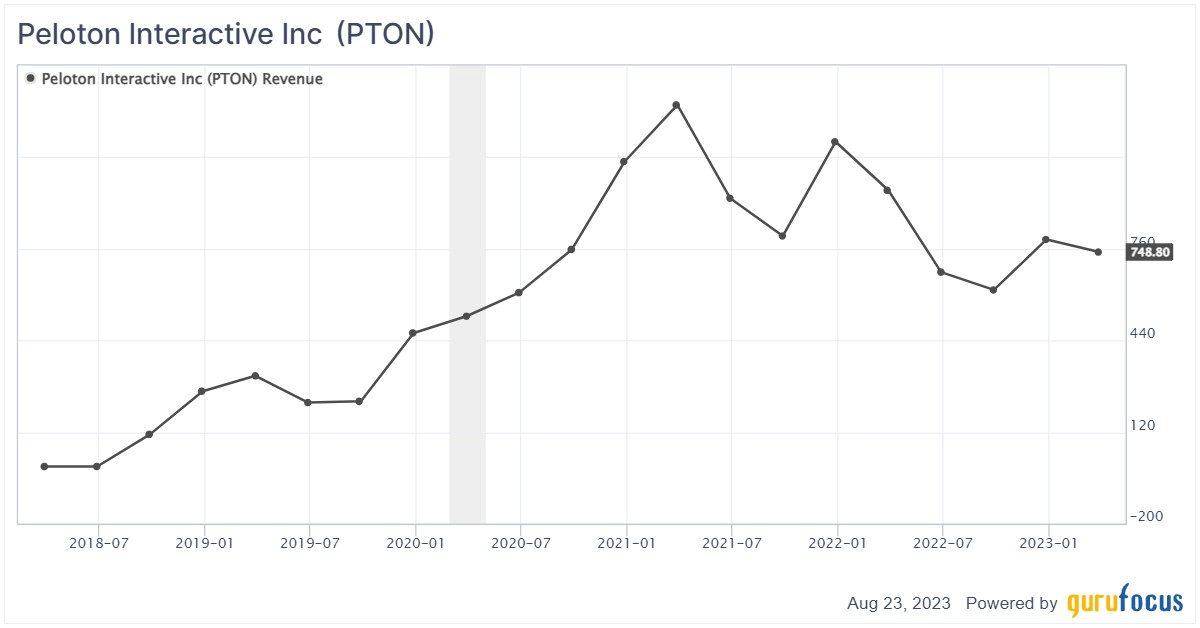

In case you missed it, Peloton Interactive (Nasdaq: PTON), the maker of high-end house train bikes, launched its fiscal fourth quarter earnings numbers.

Nobody actually believed their 2020 banner 12 months was sustainable.

The shares ended the day down over 20%. And it’s not simply because its revenues have been trending decrease for 2 and half years. The drop-off in gross sales was anticipated, because the pandemic had massively inflated them.

However this was simply the tip of the iceberg.

(Click on right here to view bigger picture.)

Now, the difficulty that spooked Wall Avenue was the drop-off in subscriptions.

Peloton misplaced 29,000 subscribers within the quarter.

Peloton had a sensible enterprise mannequin. They didn’t simply promote you an costly bike. Additionally they offered you a month-to-month Netflix-style subscription stuffed with train applications to go along with it!

It’s simple sufficient to know why this enterprise mannequin is unbelievable.

You’ll be able to solely realistically promote one bike to a buyer. They received’t purchase a alternative for years … in the event that they ever purchase one.

However by together with a month-to-month subscription, you have got turned that one-time sale right into a recurring revenue stream.

An Costly Dry Rack

Now, when you’ve ever purchased house train gear, you understand its final destiny … it will get used for about six months (six weeks may really be extra correct)…

And then you definitely get bored, lose curiosity and it turns into a very costly rack to dry your laundry on…

Earlier than finally getting dumped in a storage sale to another poor shmuck who will use it for six months earlier than it turns into a drying rack in his home too.

You understand I’m proper.

In the event you’ve really owned a stationary bike, a treadmill or some other piece of house train gear for longer than six months and never finally used it as a drying rack for seashore towels, inform me.

I in all probability received’t imagine you, however I’d love to listen to your story.

People will maintain fitness center memberships they by no means use for months and even years as a result of quitting the membership is an admission of failure. I count on Peloton memberships are not any completely different.

There’s disgrace concerned in chopping a Peloton membership as a result of it means you have got lastly accepted that you simply’re not going to make use of it and, sure, it’s an costly laundry rack.

Shopper Slowdown?

So, what’s the takeaway right here?

I’ve been writing for months that the American client is in bother.

The pandemic windfall has been spent, bank card debt is at new highs and we’re about to see pupil mortgage funds restart.

Each main retailer has warned of its clients chopping again on discretionary spending and focusing extra on requirements.

As for luxurious spending, individuals are targeted on experiences … not “stuff.”

Name it the canary within the coal mine, however Peloton’s earnings are simply the most recent indication that we’re seemingly a serious client slowdown earlier than 12 months finish.

Regards,

Charles Sizemore

Chief Editor, The Banyan Edge