This yr’s robust rally has stuttered over the previous few weeks. August has typically seen elevated volatility and declines in the principle market indexes. However that hasn’t affected a primary reality of the monetary markets: shares are people, they usually rise and fall for idiosyncratic causes. Buyers ought to at all times test underneath the hood, to search out out if a discount worth represents a very good purchase.

That test might be tough, nonetheless, as there are reams of knowledge to type. Happily, traders can at all times flip to the Sensible Rating, an AI-powered knowledge assortment and collation instrument, based mostly on the TipRanks database, that charges each inventory based on a set of things confirmed by historical past to match up with future outperformance. Search for shares that mix the best Sensible Rating, a ‘Excellent 10,’ with a pullback in share worth – that’s the place the true bargains could also be hiding.

We will get began with a take a look at two Robust Purchase shares that function each decreased share costs and a ‘Excellent 10’ from the Sensible Rating. These are shares which have attracted analyst consideration; are they best for you?

Shift4 Funds (FOUR)

The primary ‘Excellent 10’ inventory on our checklist is Shift4 Funds, a tech agency working within the fee processing enterprise. The Allentown, Pennsylvania-based agency supplies companies throughout a variety of industries, and counts some huge names amongst its buyer base: Greatest Western Motels, Applebee’s, the Utah Jazz, Gold’s Gymnasium. Total, the corporate boasts greater than 200,000 clients and over 7,000 gross sales companions, and processes greater than 3.5 billion transactions value greater than $200 billion yearly.

In an necessary announcement, earlier this month Shift4 indicated that it’s nearing the closure of its Finaro acquisition. The $525 million transfer will give Shift4 entry to Finaro’s European processing community. The deal was anticipated to have closed in March of this yr, however was held up as a consequence of ‘regulatory necessities;’ it’s now anticipated to shut in Q3/early This fall.

The corporate reported its 2Q23 outcomes early this month, and confirmed a collection of positive aspects, together with year-over-year income and earnings development, that beat expectations. On the high line, the corporate reported revenues of $637 million, up 26% year-over-year and virtually $4 million higher than had been anticipated. The underside line determine, a non-GAAP adjusted EPS of 74 cents per share, was 22 cents forward of the estimates, and greater than triple the year-ago consequence. The corporate noticed a 59% y/y improve in end-to-end fee quantity, and a 61% y/y improve in gross revenue.

Regardless of the robust outcomes, the inventory has been by way of a little bit of a selloff lately, having retreated by 19% throughout August. For Raymond James analyst John Davis, the inventory’s worth decline makes it a horny discount purchase. He writes in his protection, “We see upside to FY24 Avenue estimates, assuming Finaro does in actual fact shut, given the Avenue is implying simply ~22% natural income development (~800 bp decel) and ~80 bp of EBITDA margin enlargement… The inventory is now buying and selling close to trough valuation ranges at simply 10x FY24E EBITDA and a ~20% low cost to the S&P 500 on EV/EBITDA. As such, we view the current weak spot as a compelling entry level and advocate traders provoke or add to positions.”

As such, Davis lately upgraded his stance on FOUR, bumping it from Impartial to Outperform (a Purchase). The analyst enhances his new score with a $74 worth goal, implying a one-year upside potential of 33% from present ranges. (To observe Davis’s monitor file, click on right here.)

Shift4 has picked up 17 current analyst evaluations, together with 16 to Purchase in opposition to simply 1 to Maintain, to again up its Robust Purchase consensus score. The shares are buying and selling for $55.76, and the $83.75 common worth goal suggests it is going to acquire 50% within the yr forward. (See Shift4 Funds’ inventory forecast.)

Crocs (CROX)

Subsequent up is Crocs, a recognizable model identify in footwear. The corporate constructed its identify on its eponymous foam clogs that grew to become such successful within the early 2000s. Right now, the corporate provides a variety of footwear strains, from the froth clogs to flip flops to sandals, boots, and comfy work footwear. The corporate even markets a line of footwear designed for healthcare professionals who spend lengthy days on their ft.

By the numbers, Crocs has constructed itself an empire. The corporate has offered greater than 850 million pairs of footwear because it hit the markets in 2002. Crocs employs over 5,900 folks and has a presence in 85 international locations around the globe, and makes over 2 billion gross sales yearly. Collectively, all of this places Crocs among the many world’s high ten athletic footwear manufacturers.

Earlier this summer season, Crocs reported its 2Q23 monetary numbers – and confirmed a file income determine of $1.072 billion. This was up 11% y/y, and was $29.2 million forward of the forecast. On the backside line, Crocs reported earnings of $3.59 per share by non-GAAP measures. This marked an 87-cent per share improve over the prior yr’s Q2 earnings, and was 61 cents per share higher than anticipated.

Nonetheless, traders didn’t just like the outlook. For Q3, the corporate sees adj. earnings hitting the vary between $3.07 to $3.15 per share, on the midpoint, beneath consensus at $3.12. Furthermore, with Q3 revenues anticipated to develop round 3% to five% y/y, there are considerations about slowing development. The result’s a inventory that has been on the backfoot for the reason that Q2 print, down by 21%.

However, Jim Duffy, 5-star analyst from Stifel, takes an upbeat view of CROX, basing his stance on web positives from the earnings outcomes and on the corporate’s model energy, writing, “FY2Q outcomes had been a blended bag however positives outweigh the unfavourable and the [pullback] in shares presents a chance. Market disappointment displays the shortfall from HEYDUDE wholesale (~15% of world income) however appears previous optimistic developments for the Crocs model (~75% of world income). Particular components showcasing improved steadiness and growing our confidence into FY24 embrace 1) Crocs N. America model energy and product diversification, 2) Crocs worldwide energy led by +40% DTC comp and Asia/China, and three) debt discount bringing web leverage <1.7X.”

Duffy goes on to level out that Crocs has a strong basis for future positive aspects: “Revenue pool diversification, improved steadiness sheet optionality, and a really forgiving valuation improve our confidence in danger adjusted return prospects for CROX shares.”

At backside, all of this helps Duffy’s Purchase score, whereas his goal worth of $130 factors towards a 36% acquire on the one-year time horizon. (To observe Duffy’s monitor file, click on right here.)

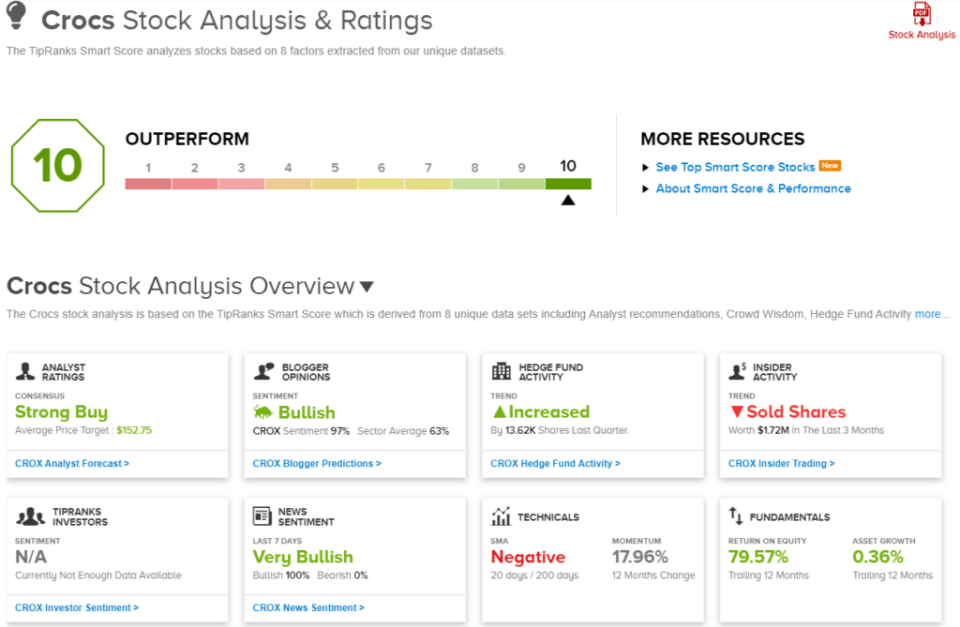

Of the 9 current analyst evaluations on CROX, 7 are to Purchase and a pair of to Maintain, sufficient to herald a Robust Purchase consensus score. The inventory’s $95.56 share worth and $152.75 common worth goal recommend a sturdy 60% upside over the subsequent 12 months. (See Crocs’ inventory forecast.)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.