gorodenkoff/iStock through Getty Pictures

Introduction

Biohaven (NYSE:BHVN) is a biopharmaceutical firm pioneering therapies for each uncommon and customary illnesses. Their experience spans illnesses like migraine, melancholy, and schizophrenia, with a dynamic pipeline focusing on situations with restricted therapies. The corporate makes use of modern platforms, such as Kv7 ion channel and glutamate modulation, and possesses a various portfolio, together with analysis on neuropathic ache and novel applied sciences like MoDE.

Current Developments: The FDA declined Biohaven’s new drug utility for troriluzole, citing inadequate Part 3 trial outcomes. Biohaven plans to pursue additional FDA discussions.

The next article particulars Biohaven’s current developments, together with FDA’s rejection of a drug utility, their monetary place, and funding concerns.

Q2 Earnings Report

Biohaven’s most up-to-date earnings report, as of June 30, 2023, the corporate held $349M in money and equivalents, down from $467.9M on the finish of 2022, with $13.9M restricted and excluding $40.4M payable to the Former Father or mother. R&D bills in Q2 2023 dropped to $79.5M from $177.1M in Q2 2022, largely on account of decreased non-cash share-based compensation prices. G&A bills additionally decreased to $14.5M from $20M over the identical interval. Different earnings confirmed a internet achieve of $5.8M in Q2 2023, in comparison with a slight expense in 2022. The corporate reported a internet lack of $90.3M in Q2 2023, a major enchancment from the $203.3M loss in the identical interval of 2022.

Money Runway & Liquidity

Turning to Biohaven’s stability sheet, as of June 30, 2023, the mixture of ‘Money and money equivalents’, ‘Marketable securities’, and ‘Investments’ quantities to $335.1M. Inside a span of six months ending June 30, 2023, the corporate skilled a internet money outflow from working actions of $122.0M, translating to a median month-to-month money burn of about $20.3M. Based mostly on these numbers, the corporate’s money runway, which signifies how lengthy it might maintain its present burn charge, stands at roughly 16.5 months. It is important to notice that these values and estimates are primarily based on historic information and may not immediately point out future efficiency.

Concerning liquidity, Biohaven displays affordable liquid belongings to cowl its short-term obligations. Nevertheless, with no listed money owed, the corporate’s monetary leverage seems minimal. Given the corporate’s wholesome liquidity place and minimal liabilities, securing further financing, ought to the necessity come up, appears believable. These observations and/or estimates are my very own and may range from different analyses.

Valuation, Development, & Momentum

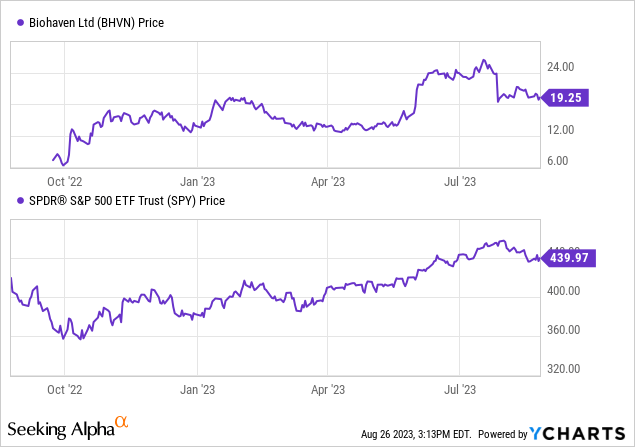

In line with Searching for Alpha information: Biohaven’s capital construction reveals a comparatively small quantity of debt compared to its market capitalization, mixed with a considerable money place. With an enterprise worth of $1.01B, the agency’s valuation metrics, akin to P/E, aren’t relevant, as Biohaven is in a pre-revenue section. As indicated by minimal gross sales projections for 2024 and 2025, its progress is being assessed in gentle of its developmental stage, specializing in the earnings potential and the inherent uncertainties tied to drug improvement. The inventory’s momentum during the last 9 months has been notably optimistic, outpacing the S&P 500.

Scientific Updates

Biohaven is actively advancing its analysis and improvement initiatives:

-

Kv7 Platform: Biohaven emphasizes the promising potential of its Kv7 platform. Particularly, BHV-7000, a Kv7.2/3 activator, is progressing with a Part 1 EEG research set for the primary half of 2023 and pivotal research for focal epilepsy and bipolar dysfunction starting within the latter half of the yr.

-

Bispecific Platform: Updates had been shared about their focused extracellular protein degradation franchise, which incorporates numerous applications. Notably, the IND utility for BHV-1300, an modern IgG degrader, is scheduled for submission in 2023.

-

TYK2/JAK1 Inhibition: With BHV-8000, a twin TYK2/JAK1 inhibitor designed to penetrate the mind, dosing has commenced in a Part 1 research involving wholesome volunteers.

-

Taldefgrobep Alfa:

- For Spinal Muscular Atrophy, they anticipate finishing the enrollment of round 225 sufferers in a worldwide Part 3 trial by 2023.

- For Metabolic Problems, the initiation of a Part 2 trial is deliberate for the second half of 2023.

Regulatory Updates

On the regulatory entrance, Biohaven’s investigational drug, troriluzole, underwent a vital Part 3 scientific trial focusing on spinocerebellar ataxia (SCA). Nevertheless, its outcomes introduced a dichotomy. Whereas the first endpoint, measured by the change within the f-SARA rating from the begin to the top of 48 weeks, didn’t meet statistical significance for the final SCA inhabitants, deeper analyses hinted at a possible silver lining, particularly amongst a sure SCA subtype.

The FDA’s resolution to not settle for the NDA for troriluzole is rooted within the lack of clear statistical significance within the drug’s main efficacy measure. This suggests that for the broad SCA affected person inhabitants, troriluzole didn’t present a pronounced benefit over the placebo. In drug approval processes, assembly the first endpoint is paramount because it demonstrates the drug’s efficacy, setting the stage for its market potential and therapeutic impression.

Whereas the general outcomes weren’t promising, put up hoc evaluation introduced forth intriguing insights. Particularly, sufferers with SCA Kind 3—a subgroup accounting for 41% of the research individuals—appeared to learn from troriluzole. This subgroup confirmed minimal illness development and a major discount in fall threat. Moreover, the f-SARA Gait Merchandise rating findings instructed that troriluzole may be significantly helpful for sufferers who may ambulate independently on the outset.

The corporate is positioned at a crossroads. Assuming a Kind A gathering with the FDA doesn’t yield favorable outcomes, a brand new trial may be on the horizon. This time, the corporate may doubtlessly give attention to the SCA Kind 3 subgroup, the place the drug confirmed promise. Such a pivot may optimize the probabilities of approval, focusing on a particular affected person inhabitants.

A Kind A gathering with the FDA is actually a high-priority dialogue that facilities on important drug improvement issues. It presents the corporate a chance to handle the FDA’s considerations, current further information, or strategize on the trail ahead. Given the blended outcomes of the Part 3 trial, this assembly will likely be pivotal in shaping troriluzole’s future.

My Evaluation & Suggestion

In summing up Biohaven’s current state and future prospects, it’s evident that the trail ahead for troriluzole appears difficult. The FDA’s current rejection primarily based on unclear statistical significance in its main efficacy casts a shadow over its general potential, even when a subgroup of SCA Kind 3 sufferers displayed promising outcomes. Whereas these findings point out that there may nonetheless be a ray of hope for troriluzole, significantly if the corporate refocuses its efforts on this particular subgroup, buyers have to be cautious and conscious of the potential dangers and setbacks that might come up from one other spherical of scientific trials and subsequent FDA evaluations.

Outdoors of troriluzole, it is value noting that a lot of Biohaven’s portfolio is, in essence, nonetheless within the early phases. Though Taldefgrobep Alfa is enrolling for a Part 3 in Spinal Muscular Atrophy, this figures to be a tricky name, significantly within the context of accessible disease-modifying therapies (DMT). Subsequently, Biohaven’s drug should show helpful along with DMTs. Part 1/2 information demonstrated enhancements in lean physique mass, however it stays to be seen if this may translate into important purposeful enhancements. To play satan’s advocate: while the chances seem low to me, Part 3 success may, undoubtedly, rework Biohaven. For now, Biohaven’s valuation seems considerably stretched when contemplating the present stage of lots of its tasks, even with its admirable money place and comparatively low debt.

Wanting forward, buyers ought to regulate Biohaven’s forthcoming interactions with the FDA, significantly any developments concerning the much-anticipated Kind A gathering. This interplay is essential, as it is going to doubtless dictate the corporate’s instant technique surrounding troriluzole. Moreover, given the significance of the Kv7 and Bispecific platforms, in addition to the TYK2/JAK1 inhibitor, staying abreast of updates in these areas will likely be pivotal for understanding the corporate’s long-term potential.

Contemplating the corporate’s current state of affairs, its stretched valuation, and the uncertainties related to its pipeline (significantly troriluzole), I like to recommend a “Promote” on Biohaven. The myriad of challenges related to the biopharmaceutical trade, mixed with the current FDA setback, makes its present valuation troublesome to justify.

Dangers to Thesis

When the information change, I modify my thoughts.

In recommending a “Promote” for Biohaven, there are dangers and counterpoints which may problem my advice:

-

Underestimation of Pipeline: I could have undervalued the potential of Biohaven’s various pipeline. Whereas troriluzole confronted a setback, different medication within the pipeline may turn into important income streams.

-

Bias In direction of FDA Rejection: The emphasis on the FDA rejection may very well be seen as overly bearish. The drug confirmed promise in a subset of sufferers, and a profitable pivot in direction of this subgroup may result in eventual approval.

-

Money Reserves: With a considerable money place, Biohaven has a buffer in opposition to short-term operational dangers and has the potential to put money into promising R&D initiatives and even acquisitions.

-

Trade Comparisons: Different biotech corporations in comparable levels may need comparable or much more elevated valuations. Thus, judging Biohaven’s valuation in isolation may be myopic.

-

Momentum: The corporate’s inventory outpaced the S&P 500 in current months. Dismissing this momentum may very well be a mistake.

-

Market Notion: There is a threat that I am emphasizing the corporate’s uncertainties an excessive amount of, whereas the market could have a extra optimistic view primarily based on future potential.