Guido Mieth/DigitalVision through Getty Photographs

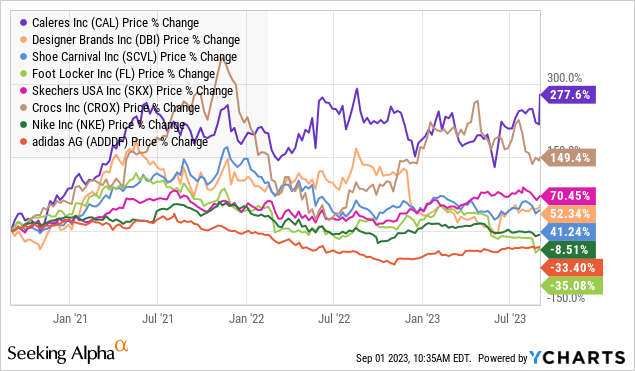

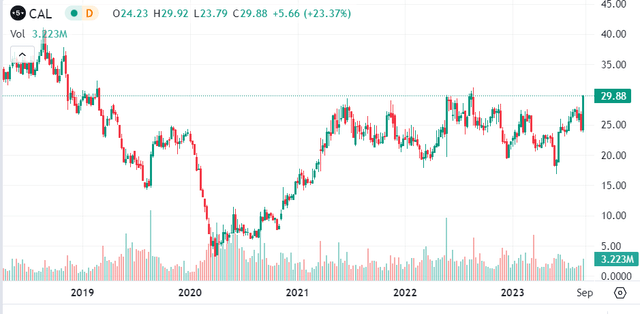

Caleres, Inc. (NYSE:CAL) has quietly emerged as an outperformer within the footwear section of the market, with shares up greater than 30% this 12 months to a 52-week-high. The “Well-known Footwear” retailer with a diversified portfolio of in-house manufacturers has been an exception within the trade in comparison with bigger gamers struggling with the difficult client spending surroundings.

Certainly, since 2020 CAL has climbed almost 300% whereas names like Foot Locker, Inc. (FL), and even Nike, Inc. (NKE) are down over the interval. The story right here is spectacular working and monetary developments, with information suggesting Caleres has captured market share in key classes.

The corporate’s newest earnings beat expectations whereas administration provided optimistic steering for the remainder of the 12 months. In our view, CAL is a high quality small-cap that deserves to be on extra buyers’ radars. We anticipate continued earnings momentum as a catalyst for the inventory into 2024.

CAL Q2 Earnings Recap

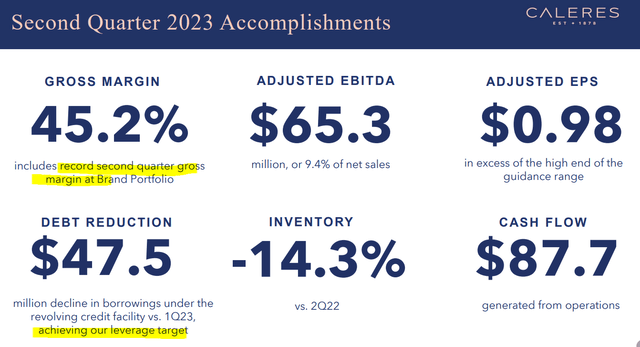

CAL reported a Q2 non-GAAP EPS of $0.98, coming in $0.10 forward of the consensus. Whereas income of $696 million, declined by -6% y/y, the outcomes are seen as general higher than anticipated given what administration is asking a “uneven macro surroundings.” Comparable gross sales at Well-known Footwear have been down by -4.3%, however that compares to a -9.4% drop from Foot Locker this previous quarter as an trade benchmark.

Caleres is benefiting from the energy of its model portfolio, with trend names like “Allen Edmonds,” and “Vionic” sneakers seeing sequential features in quarterly gross sales. That aspect of the enterprise achieved a document gross margin and represents a progress runway amid a optimistic response by clients to current fashion launches.

Firm IR

The opposite vital theme is an ongoing deleveraging. Caleres ended the quarter with $244 million in whole debt, a degree that declined by $47.5 million in Q2 and even $105 million over the previous 12 months. Contemplating the present stability sheet place of $47.1 million in money and $240 million in adjusted EBITDA over the previous 12 months, a web leverage ratio underneath 1x is a optimistic within the firm’s funding profile.

Remember that Caleres distributes a quarterly dividend of $0.07 per share, which yields a modest 1.1%. The corporate has additionally been energetic with buybacks, repurchasing roughly $14 million in shares within the first half of the 12 months, with 5.6 million remaining underneath the present authorization.

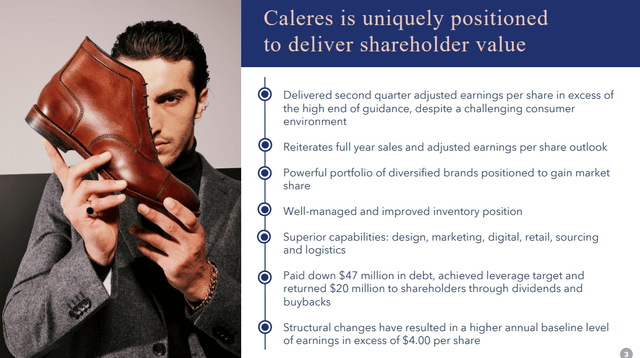

By way of steering, administration is focusing on full-year comparable gross sales to be modestly decrease, down within the -3% to -5% vary from 2022. The adjusted EPS forecast between $4.10 and $4.30, on the midpoint, represents a -7% decline in comparison with $4.52 final 12 months. Once more, dealing with a few of the macro pressures, however in any other case resilient.

Wanting forward, the expectation is for progress to rebound and earnings to speed up into 2024 as the continuing energy within the model portfolio and direct-to-consumer operation helps even increased margins.

Firm IR

CAL Inventory Value Forecast

The attraction of Caleres is its distinctive place on this aspect of “low cost footwear” and worth manufacturers. The corporate’s community of 955 retail areas together with 861 Well-known Footwear shops provide inexpensive costs which are more and more seen as a great possibility for a big section of the market.

In an surroundings of excessive rates of interest and broader client spending pressures, it is smart to us that Caleres is capturing the affect of customers substituting away from extra premium labels.

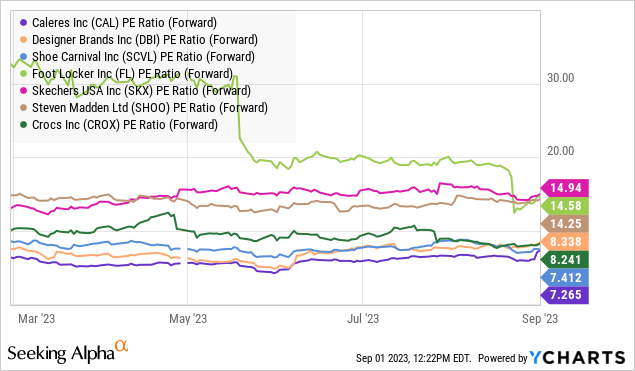

On the finish of the day, the important thing level right here is that the technique and monetary execution are working. What we like about CAL is that shares proceed to be priced at a reduction to friends. Based mostly on the 2023 consensus EPS which is according to administration steering for the 12 months, CAL is buying and selling at a ahead PE of round 7.25x, which is beneath names like Designer Manufacturers Inc. (DBI) at 8.3x, and even Shoe Carnival (SCVL) at 7.4x.

We deliver each of those names up as DBI and SCVL seemingly signify the closest comps to CAL’s enterprise mannequin, but have been delivering weaker outcomes. DBI reported comparable gross sales falling by -10% in its final report. SCVL guided earnings decrease. The case we make is that CAL deserves a premium given its extra optimistic outlook and firming monetary place.

Ultimate Ideas

We charge Caleres, Inc. as a purchase with a value goal of $36.00 representing a 9x a number of on the present consensus EPS for 2023. In our view, a mixture of an ongoing stability sheet deleveraging, energy within the model portfolio, and room for margins to climb can help a structurally increased valuation a number of for the corporate. With shares approaching their highest degree since early 2019, the setup right here is for the run to proceed.

Protecting a few of the dangers, weaker-than-expected outcomes would seemingly open the door for renewed volatility within the inventory. Whereas we imagine there’s a defensive facet to this section of low cost footwear, the corporate stays uncovered to unstable macro circumstances.

A pointy deterioration in client spending may stress demand and drive a reassessment of the outlook. Monitoring factors over the subsequent few quarters embody the evolution of the gross margin and underlying money circulate developments.

In search of Alpha