As journey spending improves and other people proceed to journey for leisure, there’s been a rise in demand for short-term leases like Airbnb.

Regardless of an inflationary atmosphere and worries of potential weakening within the U.S. economic system, vacationers don’t appear to be deterred. July broke the report for essentially the most short-term rental stays in a single month within the U.S., with 35.4 million nights, in accordance with knowledge from knowledge analytics firm AirDNA.

In different phrases, these internet hosting Airbnb and different short-term leases had a stellar summer time. And if the information is to be believed, demand possible gained’t let up anytime quickly.

Quick-Time period Leases Are in Demand Regardless of July Cooling

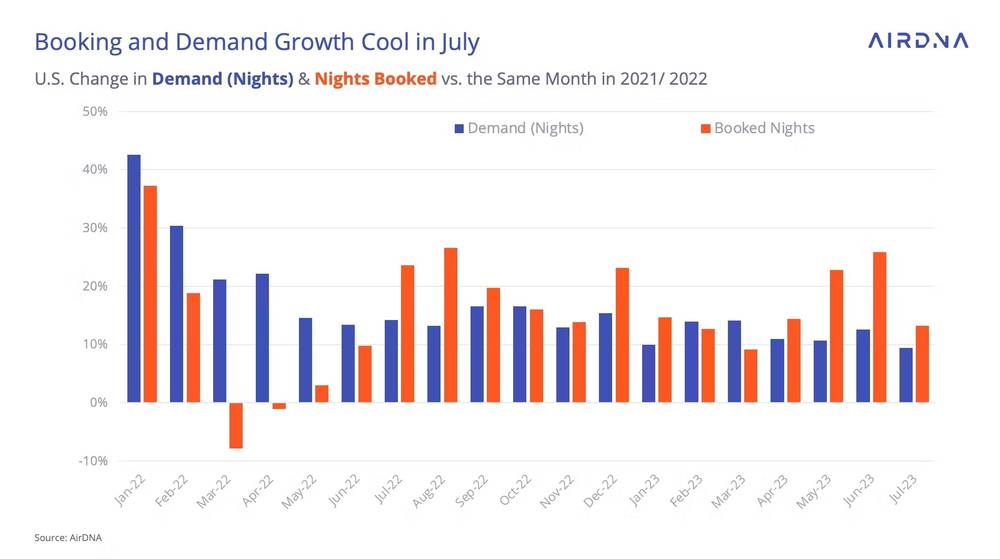

Whole demand (nights stayed) and nights booked for a future date rose in July. Demand was up 9.4% in comparison with the prior yr, whereas nights booked jumped 13.2%.

Whereas demand for short-term leases was on the rise in comparison with final yr, it was nonetheless barely down in comparison with June. Nonetheless, as July is normally the best month of demand for bookings, it doesn’t essentially imply that there’s a downward development. Actually, bookings for the months of September via November are already up 10% of what they have been on the similar interval in 2022, in accordance with AirDNA.

Actually, since March, there was a rise every month of two million nights stayed than the identical month in 2022. July alone noticed a rise of two.1 million nights in comparison with the yr prior.

The place Individuals Are Touring and Staying

The demand for short-term leases different barely relying on location in July. Small metropolis and rural areas have seen a big uptick in demand development over the previous few months, whereas bigger cities and concrete areas have confronted steeper competitors from worldwide markets as extra People are touring overseas after a steep decline throughout the pandemic.

So what have been the most popular markets in July? Surprisingly, it was additionally within the areas with the most popular months on report.

Demand for stays within the Phoenix/Scottsdale, Arizona, space was up 36% yr over yr, adopted by Coachella Valley, California, which rose 29.8% regardless of a median day by day excessive temperature of greater than 113 levels. What’s much more fascinating is that the summer time months are the low season for these areas. Phoenix, for instance, solely hosted about 60% of its March whole in July.

In the meantime, some Florida markets that usually see numerous summer time household holidays noticed smaller will increase or perhaps a loss in demand, as was the case in Orlando, the place demand fell 12.2% in comparison with the prior yr. Nonetheless, common day by day charges have been down 1% general from final yr, with the most important enhance in coastal cities like New York, Los Angeles, and Lengthy Island.

What This Means for Actual Property Traders

Whereas demand has elevated for bookings, the provision of short-term leases has slowed. In July, the tempo of provide rose solely 12.1% yr over yr, a far slower tempo than July 2022’s development of 24.4% yr over yr.

A part of that’s possible resulting from elements impacting the general actual property market proper now: an general lower in housing provide, elevated rates of interest resulting in excessive mortgage funds, and decrease occupancy charges.

Nonetheless, this is perhaps excellent news for present short-term operators. With much less month-to-month listings however a robust demand for in a single day stays, it means there is a little more stability within the short-term market.

For actual property traders seeking to broaden into short-term housing, the information is promising. Whereas there are nonetheless different market elements to contemplate, corresponding to skyrocketing mortgage charges, the Airbnb market is prone to develop as home journey continues into the vacation months.

In different phrases, there could also be alternatives for traders seeking to broaden into the short-term rental area.

The Backside Line

The short-term rental market continues to develop. A dip in provide has been welcome information to present holders, who’ve seen a rise in bookings in comparison with the yr earlier than. Nonetheless, there could also be room for actual property traders seeking to broaden into the short-term rental area. With journey at pre-pandemic ranges and the vacation season developing within the subsequent few months, the remainder of the yr is prone to be a busy one for short-term leases.

Prepared to achieve actual property investing? Create a free BiggerPockets account to study funding methods; ask questions and get solutions from our group of +2 million members; join with investor-friendly brokers; and a lot extra.

Be aware By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.