Overview

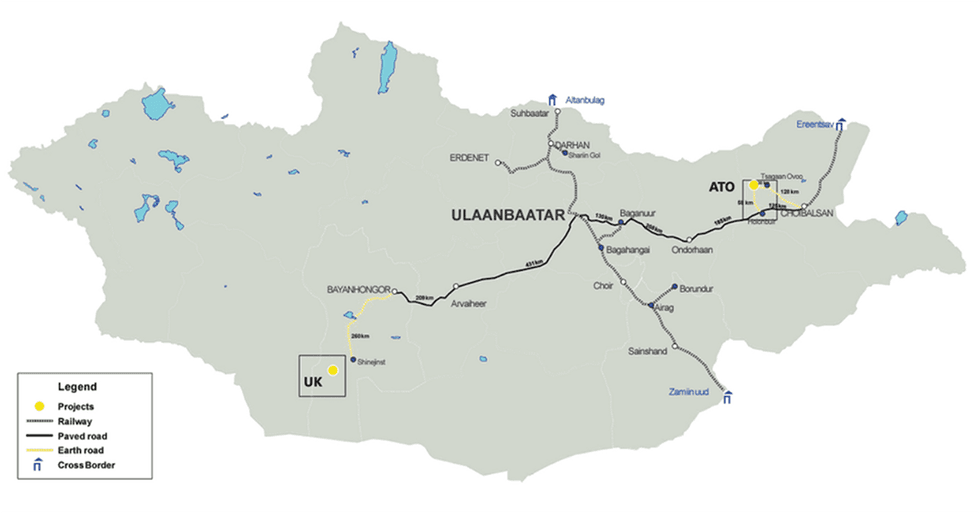

Steppe Gold (TSX:STGO) is a treasured metals growth firm and gold and silver producer in Mongolia. The corporate owns the Altan Tsaagan Ovoo (ATO) and the Uudam Khundii (UK) gold initiatives in Mongolia and the Tres Cruces gold venture in Peru.

Steppe Gold commenced gold manufacturing in April 2020, at its flagship ATO Gold Mine. As of December 31, 2022, the corporate had mined 3.4 million tonnes, crushed and stacked 2.8 million tonnes @ 1.92 grams per ton (g/t) for roughly 173,958 ounces (oz) of gold on the leach pad and 498,000 tonnes of ore at a mean grade of 0.79 g/t on the ROM pad. At an estimated 70 % restoration, the whole stock from oxide ores is roughly 80,000 oz of recoverable gold inclusive of 16,000 oz in situ based mostly on inner reserve estimates.

Operational progress at ATO Gold Mine

The 100-percent-owned flagship ATO Gold Mine’s Section 2 enlargement venture has been up to date to roughly 103,000 oz of gold every year, with a 12-year mine life, for a complete of 14 years to 2036 at AISC of ~US$850. Steppe signed a binding time period sheet settlement with the Commerce and Growth Financial institution (TDB) of Mongolia to supply as much as US$150 million in financing for the development and completion of the Section 2 Enlargement on the ATO Gold Mine. Steppe anticipates the primary focus manufacturing and gross sales from Section 2 in 2025.

Current outlined contemporary rock sources are anticipated to be supplemented by the brand new discovery of high-grade gold and silver mineralization on the Mungu pattern. Steppe Gold’s exploration is exhibiting that the high-grade Mungu discovery is semi-continuous to the structurally-controlled mineralization drilled on the ATO 4 deposit and that important useful resource enlargement is feasible.

The UK gold venture is the first-of-its-kind three way partnership (80/20) between Steppe Gold and the Bayankhongor Provincial Authorities. The corporate has accomplished an preliminary exploration program on this venture consisting of IP and magnetic surveys, in addition to rock chip and soil geochemical packages. This system resulted in 4 discoveries that the corporate plans to additional discover with an in depth program of trenching and drilling within the close to time period.

Steppe Gold is continuous to evaluate various further alternatives to amass exploration licenses and mining initiatives throughout Mongolia, led by a administration staff with a monitor document of success within the nation. In March 2023, the Steppe staff entered right into a binding settlement with Anacortes Mining, to additional the corporate’s progress technique past Mongolia.

Steppe has since accomplished the acquisition of all the issued and excellent widespread shares of Anacortes anticipating extra progress for the corporate with the event of the high-grade Tres Cruces oxide venture in Peru, positioned roughly 10 kilometers from the Lagunas Norte mine. Tres Cruces boasts 424,000 contained ounces of gold in oxide materials grading 1.37 g/t, one of many highest-grade gold oxide growth deposits on this planet.

The 5,493-hectare ATO gold-silver venture is positioned within the Dornod province of japanese Mongolia. Steppe Gold’s mining license for the venture is absolutely permitted for 30 years.

Steppe Gold commenced gold manufacturing on the ATO venture in April 2020. As of December 31, 2022, the corporate has mined 3.4 Mt, crushed and stacked 2.8 Mt @ 1.92 g/t for roughly 173,958 oz of gold on the leach pad and 498,000 tonnes of ore at a mean grade of 0.79 g/t on the ROM pad. At an estimated 70 % restoration, the whole stock from oxide ores is roughly 80,000 oz of recoverable gold inclusive of 16,000 oz in situ, based mostly on inner reserve estimates.

ATO Mine Mineral Reserves and Useful resource

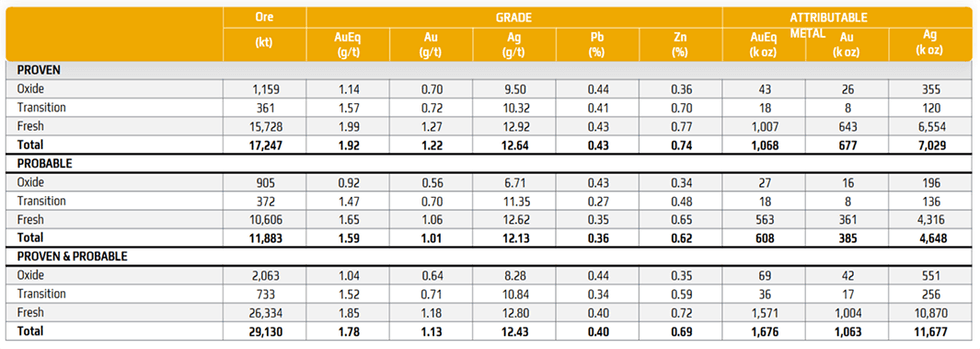

As of August 27, 2022, the ATO gold deposit accommodates mixed confirmed and possible mineral reserves totaling 29.1 million tonnes (Mt) at 1.13 g/t gold and 12.43 g/t silver, containing 1.1 million ounces of gold and 11.7 million ounces of silver. The reserves have been labeled as roughly 59 % confirmed and 41 % possible on a tonnage foundation. The mineral reserve throughout the 2022 reserve pit shell was based mostly on a gold equal cut-off grade of 0.43 g/t gold equal for Contemporary materials and 0.40 g/t gold equal for oxide materials and income of $1,700 per ounce gold, $20 per ounce of silver, zinc value of $2,500/t and lead value of $1,970/t. as the worth assumptions.

Mineral Reserve Estimate, Efficient August 27, 2022

Exploration

Centerra Gold (TSX:CG), the prior operator and proprietor of the ATO venture, spent over US$25 million on exploration, together with the completion of 67,000 meters of drilling and 28,421 meters of trenching. Since buying the property, Steppe Gold has accomplished a further 20,000 meters of drilling.

ATO 4 & Mungu Discovery

The Mungu discovery is positioned northeast of the present useful resource from the ATO 4 deposit. The invention is positioned on a 20-kilometer-long structurally managed, north-trending, mid-sulfidation epithermal gold-silver system. Steppe Gold believes that the ATO 4 deposit could also be semi-continuous to the mineralization on the Mungu discovery. The ATO 4 Deposit presently stays open alongside strike to the north and at depth.

Shifting Ahead

Now that the corporate has been in manufacturing for greater than three years, Steppe Gold plans to show its focus in the direction of exploration on the ATO deposits and Mungu discovery. The corporate can be working in the direction of releasing an up to date feasibility examine for the contemporary rock venture that’s anticipated to incorporate the Mungu discovery. Steppe Gold can be seeking to full the next actions at ATO:

- Obtain cyanide allow, start leaching and pour first gold.

- Full maiden mineral useful resource on Mungu deposit.

- Restart the exploration program at ATO and Mungu deposit.

UK Gold Undertaking

The 14,397-hectare Uudam Khundii property consists of 1 exploration license and is positioned 800 kilometers southwest of Ulaanbaatar, Mongolia. The property is an 80/20 three way partnership with the Provincial Authorities of Bayankhongor.

The property is positioned between Erdene Useful resource Growth Company’s (TSX:ERD) Bayan Khundii gold discovery and Altan Nar epithermal gold deposits.

Steppe Gold has accomplished an preliminary exploration program on the property that included geological mapping, geochemical sampling and geophysical surveys. The corporate expects to begin its trenching and drill packages within the close to time period. Steppe Gold can be trying into enlargement alternatives to additional consolidate its footprint within the space.

Up to now, the corporate has accomplished:

- 1,940 line kilometer floor magnetic survey

- A 12-line kilometer IP survey

- 346 rock chip samples

- 8,427 soil geochemical samples

A maiden program commenced in July 2022 with the drilling of three,000 meters with assay outcomes pending.

Administration Staff

Bataa Tumur-Ochir – Chairman and CEO

Bataa Tumur-Ochir is accountable for new enterprise acquisitions, growth, authorities and group relations and every day operations in Mongolia. He has robust relationships with all ranges of presidency in Mongolia and was not too long ago appointed impartial advisor to the Ministry of Mining and Heavy Trade accountable for overseas funding and promotion.

He’s presently a director at GCD Mongolia and CEO and government director of ASX-listed Wolf Petroleum. Below his steering, Wolf Petroleum was awarded the “Operator of the 12 months Award” from the Petroleum Authority of Mongolia, and in the present day, Wolf Petroleum is acknowledged because the fastest-growing petroleum exploration firm with the most important petroleum exploration acreage in Mongolia. He holds a bachelor’s diploma in enterprise administration and graduate certificates in worldwide enterprise and advertising and marketing from Australia and Singapore.

Tumur-Ochir is a founding director of Steppe Gold and he has led the corporate as CEO since December 2019. He’s additionally now the most important shareholder of the Firm, on {a partially} diluted foundation.

Byambatseren Tsogbadrakh – President

Byambatseren Tsogbadrakh is a founding member of Steppe Gold. A Mongolian nationwide, she has held progressively senior positions within the firm over the previous few years.

Aneel Waraich – Director and Government VP

Aneel Waraich is the founding father of ATMA Capital Markets and ATMACORP LTD. He’s a monetary service skilled with progressive expertise in asset administration and company finance companies. Waraich focuses totally on advising private and non-private corporations within the pure useful resource sector.

In earlier roles at Goodman and Firm Funding Counsel and Dundee Capital Markets, he labored as an analyst valuing personal corporations. Most not too long ago he labored as an funding banker specializing in deal origination, going-public transactions and financings for each private and non-private corporations within the useful resource and expertise sectors. He accomplished his MBA from the Goodman Institute of Funding Administration on the John Molson College of Enterprise.

Jeremy South – Senior VP and CFO

Jeremy South has been a director of Steppe Gold since March 2017. He has over 33 years of expertise in M&A, capital markets and personal fairness in Europe, North America and Australia, together with senior positions in funding banking at Deutsche Financial institution, NatWest Markets and Deloitte. For 10 years, he was a World Chief and Mining M&A Advisor at Deloitte.

Based mostly in Beijing for 4 years, he suggested main Asian buying and selling homes and monetary buyers on mining M&A, financing and technique, and he has labored with a few of Asia’s largest corporations. He acted as chairman of Aldridge Minerals Inc. up till its current sale to Trafigura Ventures. South is a chartered accountant and holds a Bachelor of Economics from Monash College (Australia). He holds the ICD.D designation as a graduate of the Institute of Company Administrators.

Greg Wooden – VP Operations

Gregory Wooden is an Australian citizen and was appointed as Vice President of Operations of Steppe Gold LLC in 2016. He’s accountable for all mining-related operations in Mongolia. Earlier than becoming a member of Steppe, he held positions as director and non-executive chairman of Carajas Copper Firm, operations supervisor of Harvest Minerals and as CEO of Black Star Petroleum. He has intensive expertise within the oil and gasoline trade via his previous household oil enterprise and has accomplished the Petroleum Engineering for non-engineers programmer in Houston, Texas.

Wooden was a programs accountant with over 12 years of intensive expertise in monetary reporting, monetary evaluation, creating key efficiency indicators and modeling of monetary stories over a number of industries together with transport, media and infrastructure. He held administration positions at Asciano and Patrick Stevedores.

Enkhtuvshin Khishigsuren – VP Exploration

Enkhtuvshin Khishigsuren has over 30 years of Mongolian mineral exploration expertise. He spent the primary 10 to 12 years of his profession at Central Geological Expedition doing regional geological mapping in varied areas of Mongolia, adopted by seven years as senior exploration supervisor on the exploration of treasured steel in Mongolia for Harrods Minerals.

Since 2005, he has been working his personal firm, Erdenyn Erel, which offers exploration and consulting providers to western exploration and mining corporations. He’s accountable for figuring out targets and properties based mostly on his information and expertise. His expertise has resulted within the discovery of a number of potential gold and copper deposits in Mongolia; such because the multimillion-ounce gold deposit Olon Ovoot, the Zuun mod molybdenum porphyry deposit and the Shand copper porphyry deposit. He holds a bachelor’s diploma in geological exploration from Azerbaijan State College and a Grasp’s in geological science from Shimane College, Japan.

Matthew Wooden – Non-executive Director

Matthew Wooden is a mineral useful resource explorer and developer with over 25 years of worldwide trade expertise in mining and commodities investments. He has managed funding offers in diamonds, coal, power, ferrous metals, base and treasured metals, amongst different commodities.

His distinctive expertise in technical and financial analysis of useful resource alternatives have resulted in a document of nurturing useful resource offers from early-stage, to market listings and exit methods for his buyers.

He was previously the founder and government chairman of the Mongolian coal firm, Hunnu Coal Restricted. Hunnu Coal was IPO of the 12 months for all sectors on the ASX in 2010, and its sale for roughly AU$500 million in 2011 to Banpu PCL was acknowledged because the Mines and Cash 2012 Deal of the 12 months. Wooden has based and been concerned in lots of different useful resource corporations and investments over time. He has intensive expertise and plenty of key relationships in Mongolia and was not too long ago awarded the Order of the Polar Star, the best state honor that may be awarded to a non-citizen of Mongolia. He has an Honors Diploma in Geology from the College of New South Wales and a Graduate Certificates in Mineral Economics from the Western Australian College of Mines.

Patrick Michaels – Director

Patrick Michaels is the Chairman of Zuri-Make investments AG and the Chairman of Asty Capital AG in Zurich, Switzerland. He has been concerned in quite a few financings of gold mines in North America, amongst others. He’s a well-respected monetary adviser and fund supervisor all through Europe.

Michaels has intensive expertise within the fields of mining finance, fund administration and asset allocation. He has a background in regulation and economics and did his coaching within the areas of personal banking and funding analysis at UBS in Zurich. Moreover, he attended post-graduate programs on the Colorado College of Mines in Golden, Colorado.

Dr. Zamba Batjargal – Director

Dr. Zamba Batjargal has over 35 years of expertise working for the federal government in Mongolia, coping with problems with environmental safety and local weather change. He was the Minister of the Surroundings of Mongolia from 1990 to 1996 and Director Normal of the Nationwide Company for Meteorology, Hydrology and Environmental Monitoring from 1996 to 2001. Dr. Batjargal has expertise in working outdoors of Mongolia as a result of his engagement in worldwide bi-and multilateral cooperation actions.

He was the Ambassador of Mongolia to Japan from 2001 to 2005. Between 2005 and 2011, he labored in New York as a Consultant of the World Meteorological Group (WMO) to the UN. Since 2014, he has served as an impartial guide on local weather change and the event of inexperienced coverage for public establishments and non-profit organizations. He was additionally an advisor on the Workplace of the President of the United Nations Environmental Meeting (UNEA) in Ulaanbaatar (2014 to 2016). He obtained his Ph.D. in physics and arithmetic in 1978 from the Hydrometeorological State College, St.Petersburg, Russia.

Batukhuu Budnyam – Director

Batukhuu Budnyam is a profitable entrepreneur and monetary professional who has intensive expertise within the banking and finance sectors in Mongolia. Till not too long ago, Budnyam served as Advisor to Chinggis Khaan Financial institution. Previous to becoming a member of Chinggis Khaan Financial institution, he was Managing Director of Natural Options Mongolia LLC and former to that, he was Managing Director of MFS Capital LLC. Budnyam is a Mongolian native and speaks fluent English, Russian and German. He has a Bachelor’s Diploma in Economics from the Nationwide College of Mongolia.

Sereenen Jargalan – Director

Sereenen Jargalan has been a professor on the Mongolian College of Science and Know-how since September 2003 and head of the Division of Mineral Exploration since 2011 the place she teaches ore geology and metallogeny to bachelors, masters and doctorate college students and supervises Ph.D. pupil analysis initiatives. She has a Ph.D. and Grasp’s in Earth Science from the Institute of Mineralogy, Petrology and Financial Geology at Tohoku College in Japan, targeted on petrology of igneous rocks and a Bachelor of Mineral Exploration from the Mongolian Polytechnical College.

She accomplished postdoctoral work targeted on the REE potential in Mongolia on the Mineral Assets Analysis Group, Institute for Geo-Assets and Surroundings and the Nationwide Institute of Superior Industrial Science and Know-how, Japan. She has co-authored or contributed to over 50 educational books, articles and different publications. She has been the recipient of quite a few educational awards and honors in each Magnolia and Japan.

Steve Haggarty – Director

Steve Haggarty is the Managing Director of Haggarty Technical Providers Company and a registered member of the Skilled Engineers Ontario. He has over 35 years of commercial expertise each on-site and at a company degree, involving a number of treasured steel and copper producers, with a background in venture design, commissioning, start-up, metallurgy, course of optimization, venture administration, reclamation and closure.

With a mining profession spanning almost 4 a long time, Haggarty’s trade expertise contains 24 years in operations and 14 years in company and EPCM-related roles. Most not too long ago, he was Senior Director for the Metallurgy at Barrick Gold Corp. On this function, he was accountable for operational efficiency enhancements, defining GeoMet fashions, processing technique and danger mitigation. Haggarty has labored at a number of mine websites world wide, together with as Normal Supervisor of Barrick Gold’s Veladero heap leach venture in Argentina. He’s thought-about a technical chief in heap leach processing, implementation and optimization.