alanphillips

In my earlier 10x Genomics (NASDAQ:TXG) article, I mentioned that TXG had been on my radar to be added to the Compounding Healthcare “Bio Growth” speculative portfolio because of the firm’s merchandise, companies, and analysis and improvement capabilities. I concluded the article with a recreation plan centered on technical evaluation and particular situations. Properly, these situations by no means got here to fruition, so I’m nonetheless sitting on the sideline ready for a possibility to lastly set up a place in TXG. 10x’s Q2 earnings revealed spectacular development, which has solely strengthened my bullish conviction on TXG, whereas additionally offering me with some data to reformulate my entry parameters.

First, I’ll present an summary of 10x Genomics and its Q2 efficiency. Then, I’ll lay out my up to date bull thesis. Subsequently, I’ll spotlight some key potential downsides that buyers ought to contemplate when managing their TXG positions. Lastly, I’ll define my up to date technique for initiating a place in TXG.

Background on 10x Genomics

10x Genomics is a number one life sciences know-how firm specializing in cutting-edge instruments and merchandise with a world buyer base. Their method entails steady analysis and improvement efforts to ship top-notch merchandise. Moreover, the corporate has expanded its scope via a collection of strategic acquisitions.

10x Genomics affords a spread of services, together with consumables for his or her chromium devices and related software program. These choices present recurring income and enticing margins. The corporate’s flagship platform is the Chromium Single-Cell Platform, identified for its distinctive efficiency and flexibility. Additionally they have the Visium Spatial Platform for spatial evaluation, in addition to the Xenium In Situ Evaluation Platform, which is extremely delicate and adjustable. Moreover, the corporate supplies numerous software program purposes, which embody cloud evaluation and the Loupe Browser.

These devices allow single-cell evaluation, a beneficial technique for understanding mobile processes and complexity at a granular degree. Single-cell evaluation has purposes in personalised drugs, illness analysis, and drug discovery, enabling researchers to develop tailor-made therapies and assess drug efficacy.

Q2 Efficiency

In Q2 2023, 10x Genomics achieved spectacular outcomes, with income rising by 28% year-over-year to succeed in $147M. This development was pushed by the corporate’s efficiency in each single-cell and spatial biology portfolios, with robust execution within the Americas and EMEA areas. Nevertheless, it is essential to notice that there have been continued challenges within the Chinese language market.

Regardless of the stellar income development, there was a notable shift in gross margin, which settled at 68% for the quarter. This can be a vital drop from the 76% logged in Q2 of 2022. The corporate attributed this lower in gross margin to alterations in product combine, largely impacted by the launch of recent merchandise. Clearly, a giant drop in margins is regarding, nevertheless, this shift is primarily is results of the corporate’s innovation efforts to fulfill evolving market calls for.

The corporate’s Q2 OpEx got here in at $163M, which is a 9% enhance from the $150M in Q2 of 2022. Consequently, 10x recorded an working lack of $63.4M, marginally larger than the $63.1M reported in Q2 of final yr.

It is price declaring that this working loss contains $45.7M in stock-based compensation. This can be a notable enhance from the $36.3 million reported in Q2 of final yr. Fortunately, regardless of the rise in OpEx, the corporate’s Q2 web loss was $62.4M, down from $64.5M in Q2 of final yr. So it seems like 10x is taking strides in the direction of attaining a extra sustainable monetary situation.

By way of money, 10x revealed a strong $391.4M in money and money equivalents, together with marketable securities. So, it seems as if 10x has a wholesome monetary cushion that can be utilized for development, strategic investments, or to fund the corporate till they break even.

General, 10x’s Q2 earnings report presents a narrative of development and flexibility. Whereas some metrics like gross margin and OpEx have skilled transferals, the corporate stays ready to capitalize on market alternatives. With a powerful money place, 10x is in an advantageous place to trace strategic initiatives and stand up to potential trade headwinds. Nevertheless, buyers ought to monitor 10x’s monetary efficiency to see how the corporate’s margins fluctuate and their money reserves are being consumed on this dynamic market.

Q2 Highlights

Past the corporate’s financials, they’d some noteworthy achievements in Q2, together with excellent momentum behind the Xenium platform. 10x scaled up their Xenium shipments, however the demand was capable of exceed their provide. Xenium is gaining recognition because the principal platform for In Situ evaluation and is complemented by the continued demand for the Visium suite of spatial discovery instruments. The success of Xenium highlights 10x’s capability to innovate and match the wants of researchers in the hunt for first-rate spatial biology options.

The corporate’s Chromium platform, a frontrunner in single-cell evaluation, was capable of produce double-digit year-over-year development. Notably, Chromium Flex has grown momentum since its launch a yr in the past and is predicted to be a game-changer for the Chromium franchise. Furthermore, the upcoming Function Barcode software for Flex will develop its purposes, making it much more alluring to researchers. It seems as if 10x Genomics is concentrated on increasing Chromium’s capabilities, providing researchers the power to profile gene expression and cell floor proteins concurrently throughout multiplexed samples and hundreds of thousands of cells.

The Visium platform, identified for its sturdy spatial biology capabilities, noticed robust demand for the CytAssist instrument, which has simplified workflows and pushed elevated utilization of the Visium platform. With the launch of the Visium CytAssist Gene and Protein Expression Assay, researchers now have the power to investigate a number of analytes on the identical tissue part, enhancing the platform’s versatility. Moreover, the corporate is making progress on Visium HD, a powerful undertaking anticipated to supply unmatched spatial discovery at single-cell-scale decision.

Regardless of challenges within the APAC area, primarily attributed to the Chinese language market, 10x Genomics was inspired sufficient by the robust Xenium momentum to lift their full-year income steering to a spread of $600M to $620M.

Amplifying The Bull Thesis

In my earlier 10x Genomics article, I laid out my bull thesis, which was centered on the corporate’s development trajectory, strategic deal with innovation, and product improvement. These options had been driving 10x’s success within the ever-evolving panorama of biotech and life sciences. Properly, the corporate amplified that standpoint with its outstanding Q2 efficiency, showcasing a development trajectory that’s each outstanding and promising. With a year-over-year income enhance of 28%, reaching $147M, 10x’s strategic focus is driving its success.

10x’s development is coming from each single-cell and spatial biology platforms. These platforms have made vital advances. Notably, the Xenium platform has gained fast adoption, underscoring their capability to develop elite cutting-edge tech for what researchers require. Furthermore, the Chromium single-cell evaluation merchandise are in demand, highlighting 10x’s significance on this planet of life science analysis.

The corporate’s relentless efforts to innovate are evident of their capability to develop their product portfolio. The introduction of the Chromium Flex platform and plans to launch the Function Barcode software are indicative of the corporate’s willpower to remain on the forefront of the trade. These strategic strikes are usually not solely increasing their market attain however will probably be acknowledged as being a part of vital analysis in quite a lot of illnesses, together with most cancers analysis.

In spatial biology, the corporate’s Visium and Xenium platforms are shaping the way forward for spatial biology analysis. The corporate reported that demand for the CytAssist instrument is powerful, and the upcoming launch of Visium HD holds vital promise. Xenium, particularly, is harvesting admiration for its excellent efficiency, sensitivity, throughput, and flexibility in quite a lot of tissues and pattern sorts.

Happily, the corporate’s IP portfolio seems to be robust sufficient to assist shield their merchandise and place. With over 2K patents issued or pending, 10x seems to have safeguarded its technological developments and preserved a aggressive benefit of their contentious market stuffed with IP authorized battles.

By way of financials and business efficiency, the corporate’s Q2 outcomes had been robust with an enchancment in complete income that helped encourage the corporate to lift their full-year steering to the vary of $600M to $620M, signaling a powerful inner perception that they’ll have sustained development within the second half of the yr.

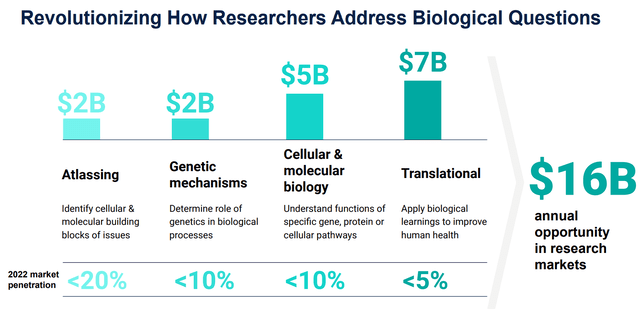

Though there will probably be some hurdles and headwinds, the corporate’s long-term development prospects are distinctive. 10x Genomics aspires to determine itself as a major contender in a $16B market, overlaying areas corresponding to atlas creation, genetic mechanisms, cell bio, molecular bio, in addition to translational biology. Business specialists predict sturdy double-digit growth within the forthcoming years, doubtlessly resulting in a income surpassing the $1B mark.

10x Genomics Estimated Market Alternative (10x Genomics)

To me, 10x Genomics is changing into a necessary participant within the life sciences trade, with its know-how poised to play a vital position in future medical developments. This presents a considerable market alternative in each the brief and long run. Moreover, the corporate maintains favorable margins and a powerful monetary place. For my part, TXG’s bull thesis is stronger than ever and is worthy of a spot within the Compounding Healthcare Bio Growth Portfolio.

Key Dangers

Speculative healthcare shares carry a substantial quantity of threat, and TXG isn’t any exception. The corporate remains to be reporting losses, and profitability is unclear. So, virtually each little concern is magnified till the corporate is ready to tackle it. For instance, 10x acknowledged challenges within the Chinese language market, with comfortable demand and stock dynamics affecting their Q2 efficiency in that nation. Make notice, that they anticipate continued headwinds in China for the subsequent couple of quarters. One other situation to control is the short-term influence of Xenium’s adoption on gross margins and money circulate. Sure, each of those issues shouldn’t hurt the corporate’s long-term development and prospects as a market chief, however they could be a supply of apprehension amongst buyers.

A special ingredient to think about is that 10x is in a really aggressive trade, with established gamers and rising innovators that might pose a problem each commercially and when it comes to IP.

One other concern is that TXG’s inventory worth has exhibited appreciable volatility, which is widespread for tickers of corporations in genomics, healthcare tech, and life sciences instruments. Due to this fact, buyers in TXG ought to stay attentive and have an outlined technique for managing this volatility.

Contemplating these dangers, I’m giving TXG a conviction degree of two out of 5.

Nonetheless Wanting For An Entry Level

I’ve to confess, I used to be prepared to tug the set off on TXG a number of instances over the previous few months, but it surely nonetheless stays on my watchlist as a result of some issues raised throughout subsequent technical evaluation.

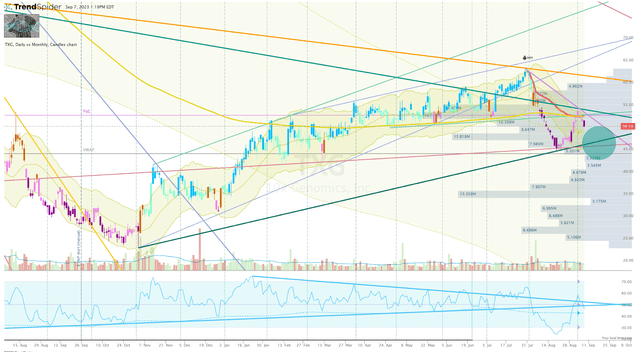

The share worth was capable of break the wedge sequences that we noticed over the primary half of 2023, but it surely acquired rejected after operating into one other downtrend ray fashioned from the April 2022 excessive.

TXG Every day Chart (Trendspider)

Subsequently, the share worth fell right into a step sell-off however bounced off the earlier uptrend, however was rejected by the anchored VWAP spawned from the August-high. Furthermore, the Go-No-Go indicator is bearish in the meanwhile. Due to this fact, we actually don’t have a stable setup to work with in the meanwhile.

I will be monitoring the share worth because it approaches the uptrend ray from the lows (inexperienced dot). If it efficiently rebounds off the uptrend ray and surpasses the downtrend ray from the current excessive, I will contemplate initiating a modest place in TXG. Nevertheless, ought to the share worth dip under the uptrend ray earlier than breaking the downtrend, I will be inclined to determine a place on a excessive conviction setup across the $35 assist degree.

After securing a place, my technique entails step by step rising my holdings in TXG over the subsequent few years. TXG will probably be a key element of my Bio Growth portfolio, with the intention of reworking the place right into a “Home Cash” standing via a collection of trades. This method will assist mitigate threat and pave the way in which for long-term holding potential in my “Bioreactor” development portfolio.