Obtain free Markets updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the newest Markets information each morning.

US shares edged greater on Friday, however had a weekly decline alongside international equities which have slipped in current classes as buyers assess the outlook for regional economies and rates of interest.

Wall Road’s benchmark S&P 500 completed 0.1 per cent greater on Friday, dropping 1.3 per cent within the holiday-shortened buying and selling week. The tech-focused Nasdaq Composite climbed 0.1 per cent, trimming decline throughout the previous 4 classes to 1.9 per cent.

The weekly losses are partly on account of inventory market heavyweight Apple enduring a two-day sell-off that wiped virtually $200bn from its market capitalisation following experiences the Chinese language authorities was planning to broaden a ban on iPhone use. Shares of the tech group edged 0.3 per cent greater on Friday.

However the indices’ slide additionally came about as knowledge earlier this week indicated that whereas the US financial system might be on target for a so-called smooth financial touchdown, it will imply rates of interest might stay elevated for an extended interval. The latter would weigh on the costs of shares and different dangerous belongings.

Senior Federal Reserve officers signalled in current days that the central financial institution would maintain charges regular at its September assembly, however shunned declaring an finish to their battle towards inflation.

European and Chinese language shares declined on a weekly foundation, as each markets have been hit by a string of weak knowledge that made buyers fret over the prospect of a world financial downturn.

The FTSE All World index completed flat after three straight days of declines that left it down 1.3 per cent for the week.

A streak of bleak financial knowledge releases signalled a continued decline in China’s exports and imports, in addition to a weakening companies sector in Europe.

The vast majority of buyers suppose the European Central Financial institution will maintain again from additional tightening at its upcoming coverage assembly subsequent week, however some wager there are nonetheless extra rate of interest rises to come back earlier than the tip of this 12 months.

“We don’t suppose the ECB will need to ‘shock’ the market, significantly towards a backdrop of weakening financial knowledge,” stated Paul Hollingsworth, chief European economist at BNP Paribas.

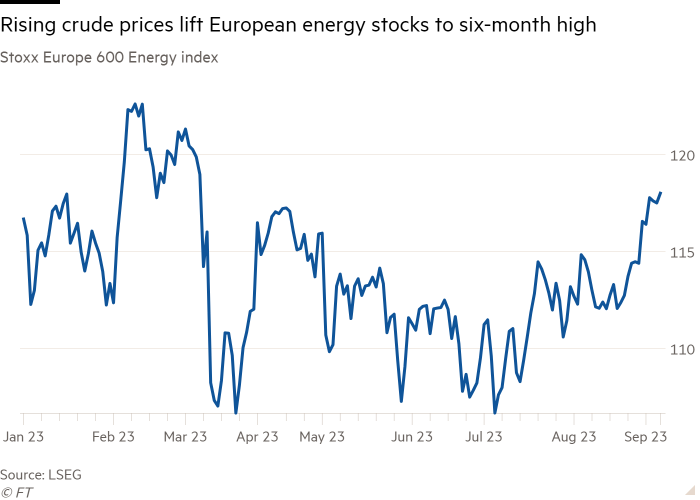

On Friday, although, Europe’s broad Stoxx 600 index closed 0.2 per cent greater to finish a seven-session dropping streak. The advance was helped alongside by vitality shares, which continued to trace the rising value of oil.

Brent crude rose 0.8 per cent to $90.65 a barrel, it’s highest settlement value since November. West Texas Intermediate, the US counterpart, rose 0.7 per cent to $87.51.

The Stoxx Europe 600 Vitality index rose 0.4 per cent, closing at its highest degree since March.

US oil and gasoline shares additionally superior. The S&P 500 Vitality index superior 1 per cent on Friday, making it the benchmark’s best-performing sector. Valero Vitality was a prime performer, rising greater than 4 per cent.

Oil costs have been climbing because the begin of the week when two of the world’s prime producers, Saudi Arabia and Russia, introduced they might prolong provide cuts till the tip of this 12 months.

Merchants are poised for the carefully watched US inflation report due subsequent week, the place greater commodity costs might push up the headline determine and trickle into different classes.

“We count on the August [CPI] report back to be stronger than in current months . . . due largely to a surge in vitality costs,” wrote Stephen Juneau and Michael Gapen, economists at Financial institution of America.

Nonetheless, analysts don’t “count on oil costs to float an excessive amount of upwards within the context of an total slowdown in financial development . . . and with the Chinese language financial system struggling to satisfy its development targets”, based on Nadège Dufossé, international head of multi-asset at Candriam.

Asian markets edged decrease on Friday, with China’s benchmark CSI 300 down 0.5 per cent, whereas Japan’s Topix fell 1 per cent. Hong Kong markets have been shut due to storms and flooding.