Paying all money for a home is without doubt one of the finest methods to beat out your competitors and get a greater deal.

With all money, you do not have to submit a proposal with a financing contingency, which sellers dislike. Consequently, you improve your possibilities of profitable a bidding warfare at an inexpensive worth. Additional, with all money, you may be capable of get a bigger low cost.

I paid all money for a house in 2019 and was in a position to save about $100,000 – $150,000 off the market buy worth. Being a neighbor, going twin company, writing a strong love letter, and having a quick shut have been additionally essential variables.

Though paying all money makes the home-buying course of simpler, there are nonetheless some downsides to concentrate on. Let’s talk about!

The Downsides Of Paying All Money For A Home

The older I’ve gotten and the upper rates of interest go, the much less motivated I’m to tackle a mortgage to purchase a home.

Getting pre-approved for a mortgage is a cumbersome course of that requires plenty of paperwork and an incredible quantity of persistence. There’s additionally the mortgage software price, which may simply run between $2,000 – $10,000. Therefore, if I can pay all money for a home, it’s my desire.

Nonetheless, there are downsides to the whole lot. These are the principle ones if you happen to’re contemplating paying all money for a house.

1) Capital beneficial properties tax

One strategy to pay all money for a house is to boost funds by promoting different investments. The longer you personal your investments, often, the larger the beneficial properties. The bottom line is to try to promote your investments in a approach that matches sufficient losers with winners to attenuate your capital beneficial properties tax.

However after an extended bull market, paying capital beneficial properties taxes on asset gross sales is likely to be an inevitability. Chances are you’ll finally be overwhelmed with too many winners.

The one strategy to keep away from capital beneficial properties tax is if you happen to can make the most of uninvested money to purchase a house. You may even scale back your tax legal responsibility since you’ll now not need to pay federal and state revenue taxes on the revenue earned by your money.

However except you by no means plan to promote your investments, you’ll finally need to pay capital beneficial properties tax. It is good to promote shares once in a while whenever you’ve earned sufficient to purchase no matter you need. In any other case, what is the level of investing within the first place?

2) You may miss out on additional beneficial properties

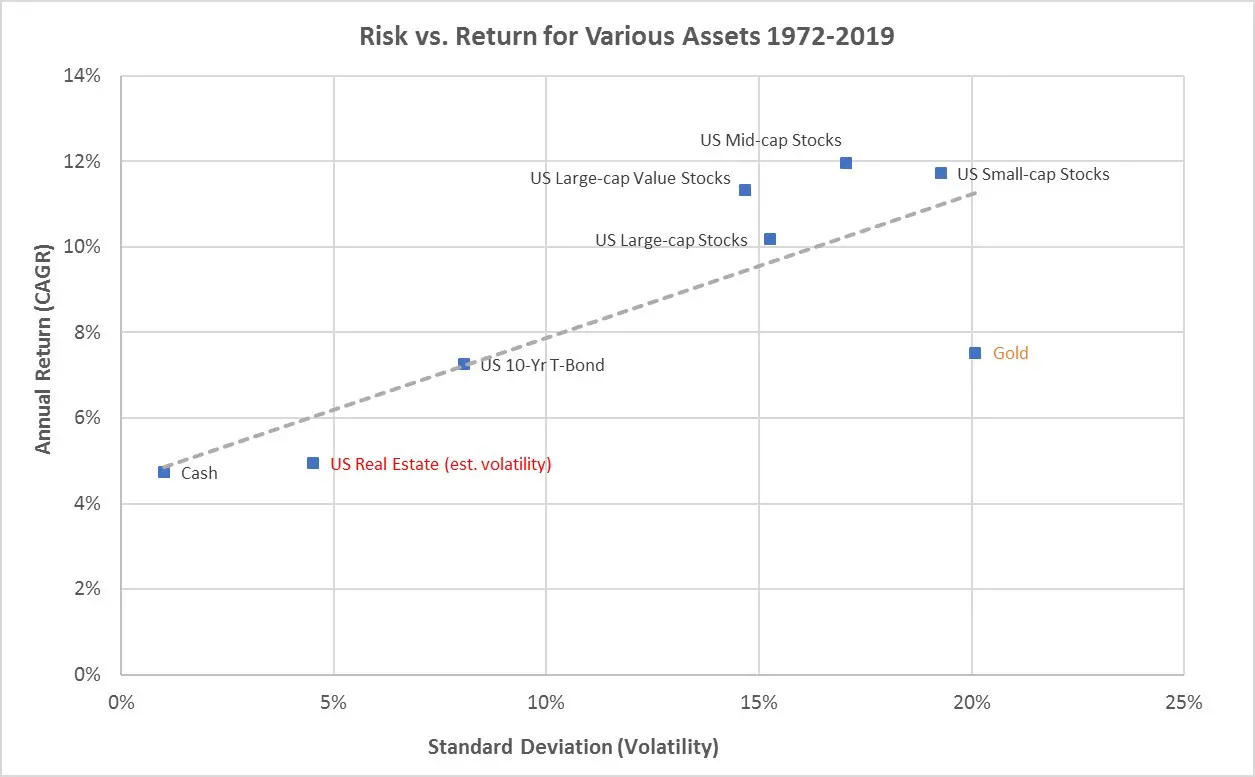

The S&P 500’s historic annual return is about 10% in comparison with solely a 4.6% historic annual return on actual property. Subsequently, chances are high excessive if you happen to promote the S&P 500 index to purchase a house with all money, your transferred capital will underperform over the long term.

The larger the proportion of your internet value is in a house in comparison with shares, the slower your internet value might develop. In fact, your internet value may additionally outperform if you happen to so occur to promote shares earlier than a crash and residential costs outperform shares, as they did from 2000 – 2006.

However total, paying all money for a house by promoting shares will probably trigger a slowdown within the tempo of your internet value progress. Alternatively, if you’re wealthy sufficient to pay for a house with idle money, then you’ve gotten a greater likelihood of accelerating your internet value by shopping for a house with all money.

For instance, in 2023, you are in a position to earn ~5% in a cash market fund. But when actual property costs rise by 6.5% by July 2024, as Zillow predicts, then the switch of your money to a house may make you richer. This may particularly be true if rates of interest begin to decline and actual property costs begin to speed up upward.

3) Paying all money reduces your potential return on your private home

Leverage is nice on the way in which up and damaging on the way in which down. In case you pay all money for a house and costs go up by 5% in a single 12 months, you earn a 5% gross return. Nonetheless, if you happen to solely put down 20%, then your gross return in your money will increase by 25%.

The primary strategy to develop your internet value sooner with actual property in contrast with shares is with a mortgage. Regardless that actual property is often thought of much less dangerous than shares, you’ll be able to satirically make much more. However that is an article about paying all money for a house.

Maybe one technique is to pay all money for a house, assess the actual property market over the subsequent 12 months or two, after which do a cash-out refinance if you’re bullish. This fashion, you purchase your self extra time to make a probably extra optimum money utilization determination.

Simply bear in mind that when it is time to entry your private home’s fairness, some banks might now not provide House Fairness Traces of Credit score (HELOC) or cash-out refinances. Finest to double examine along with your financial institution now.

4) You lose an incredible quantity of risk-free revenue and safety

You’d assume paying all money in your residence would offer you a larger quantity of safety. As soon as you’ve got bought your private home absolutely paid off, life is far simpler.

Nonetheless, this is the irony in a excessive rate of interest surroundings. In case you pays all money for a home, it means you even have the power to earn a hefty quantity of risk-free revenue. This additionally means you would be forgoing monetary safety.

To illustrate you’ll be able to pay $2 million money for a home. In case you have been to only make investments the $2 million in a 5%-yielding cash market fund, you’d earn $100,000 a 12 months risk-free. The overwhelming majority of us with no main well being points and no debt ought to be capable of fortunately reside off $100,000 a 12 months in gross revenue. Some may even contemplate this a Fats FIRE way of life in lower-cost areas of the nation.

However if you happen to resolve to make the most of your $2 million money to purchase a house, your $100,000 in risk-free revenue goes away. Not solely that, however with a brand new residence, you’ll now need to pay extra property taxes, insurance coverage, HOA (the place related), and ongoing upkeep bills endlessly.

Therefore, even if you happen to plan to purchase a house with all money, I like to recommend following my internet value information for residence shopping for. See the appropriate three columns of the chart beneath. I’ll tailor the rule sooner or later for money consumers in a brand new publish.

5) You’ll nonetheless really feel anxious regardless of paying all money for a house

You’d assume paying all money for a house would provide you with super peace of thoughts. In any case, with no mortgage, there is no such thing as a financial institution on the market than can take your private home away from you. Even the federal government could have a troublesome time kicking you out if you happen to do not pay your property taxes. In the meantime, a downturn in the actual property market will not wipe away 100% of your fairness.

Paying all money for a house is solely an asset switch. The switch will be out of your idle money or from different investments like municipal bonds, shares, and non-public actual property investments. That stated, you’ll nonetheless really feel unsettled in regards to the asset switch as a result of the money you inject into a brand new residence turns into unproductive.

You’ll always wonder if there have been higher makes use of in your money than tying it up in a house chances are you’ll not want. The one strategy to quiet these doubts is by creating fantastic experiences within the new residence for a number of years. However that takes time.

Your anxiousness might make you extra irritable or harassed. And a bitter temper just isn’t good for your loved ones and mates.

Therefore, if you’re going to pay all money for a house, you had higher have much more money and liquid securities behind. Over time, the nervousness ought to fade as you rebuild your money or liquid reserves.

6) You must determine what to do along with your previous residence

In case you’re at the moment renting and pay all money for a brand new residence, then you haven’t any worries. Give your landlord a 30-day discover or longer that you simply’re shifting out and also you’re good to go. Simply be certain your new residence is definitely prepared to maneuver in as soon as your lease is over.

However if you happen to personal your present residence and purchase a brand new residence with all money, then you have to determine what to do along with your present residence. Will you rent an actual property agent to promote it? Or will you attempt to discover renters and construct your passive revenue portfolio for monetary freedom?

Personally, I like shopping for a property each 3-10 years after which renting it out when it is time to purchase one other major residence. Do that over thirty years and you can fund your retirement with rental properties no downside.

Feeling Nervous About Shopping for A House With All Money

I am contemplating shopping for one other residence with all money. However now that I am in contract with contingencies, I am second-guessing my determination, as I all the time do.

Possibly I did not have to promote as many property and pay all money within the first place. Given how lengthy the escrow interval has been, taking out a mortgage would have been simply effective. However that is sort of like saying perhaps I did not have to have good grades and take a look at scores after I bought accepted to an awesome school!

There is a consolation in seeing different individuals purchase houses throughout a bull market. It implies that different individuals need what you need and are serving to justify your determination, even when it could be the flawed one. However throughout a bear market, you’re feeling like a lonely fish out of water, questioning whether or not the tide will ever return.

Can individuals merely not afford to pay all money or take out a mortgage at these charges? Or are individuals ready as a result of they count on actual property costs to crash? It is a disconcerting feeling not figuring out what’s maintaining individuals from profiting from offers.

Why I Provided All Money

I needed to make my provide engaging sufficient for the vendor to simply accept. I used to be providing to pay 14% beneath final 12 months’s asking worth and seven.5% beneath this 12 months’s new asking worth. By providing to pay all money, I hoped to make my provide engaging sufficient for him to contemplate. Insulting a vendor with a low-ball provide just isn’t the way in which to win offers.

Initially, the vendor declined my provide by way of his itemizing agent. However then a month glided by and the itemizing agent contacted me once more to say the vendor could be shifting in. This was my final likelihood to make a aggressive provide!

I did not really feel a lot actual property FOMO given I used to be pleased with our present residence, so I simply stood agency on my provide worth. However I additionally determined to spend 35 minutes writing an actual property love letter, explaining why my household could be an awesome selection.

The vendor wrote again a letter of his personal saying how a lot he appreciated my letter. I had touched upon the whole lot from how a lot I valued his reworking, to the significance of household, to our mutual love of tennis, and our comparable tradition. Possibly writing 2,200+ articles on Monetary Samurai since 2009 has some advantages in any case!

The Remaining Technique

As soon as I used to be in a position to make a reference to the vendor, then I used to be in a position to persuade the itemizing agent to scale back her total commissions by 2.5% in lieu of her additionally representing me by means of twin company. She initially refused as a result of she did not need to earn much less. However I defined to her she would not be incomes much less as a result of she would have needed to have paid the two.5% fee to a purchaser’s dealer anyway.

I used to be thus in a position to persuade her to offer me at the least a 2.5% worth low cost and simply signify me. It was that, or no transaction in any respect. Lastly, she was in a position to persuade the vendor to go ahead.

Elevating The Stakes By Shopping for One thing I Do not Want

As I discussed to my spouse in a earlier podcast episode (Apple), “No one wants nothing.” We do not want something greater than a studio residence, water, and cereal to outlive. Consequently, I typically query the purpose of shopping for something we do not really want. We’re frugal people.

Paying all money for a brand new residence raises the monetary stakes as a result of it reduces our passive retirement revenue. Consequently, I’ll really feel extra strain to earn more money and develop our internet value additional.

The primary two years of possession will hold me in a heightened state of hysteria as a result of our funds shall be most in danger. The nervousness will not be debilitating to the purpose the place I will not be capable of sleep or perform. It will simply be larger than I am used to since leaving work in 2012. I hope I am going to be capable of adapt.

Possibly I’ll use this nervousness as motivation to write extra books and/or discover a well-paying job. When my son was born in 2017, my motivation to earn shot by means of the roof! Additional, I plan on giving up on early retirement anyway as soon as each children go to highschool full-time in 2024. So the celebrities appear to align.

In conclusion, concentrate on the downsides of paying all money for a house. Use your all-cash provide to get a cheaper price after which shortly replenish your money reserves after you shut. In case you do, you will really feel significantly better about your buy.

Reader Questions And Recommendations

Have you ever paid all money for a house earlier than? If that’s the case, how did you’re feeling? What are another downsides to purchasing a house with money?

Do not have all money to purchase a home? No worries. You may put money into non-public actual property with Fundrise with as little as $10. Fundrise funds primarily invests in residential and industrial properties within the Sunbelt, the place valuations are decrease and yields are larger.

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and talk about a few of the most fascinating matters on this website. Please share, charge, and evaluation!

For extra nuanced private finance content material, be a part of 60,000+ others and join the free Monetary Samurai publication and posts by way of e-mail. Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009.