G0d4ather

Thesis

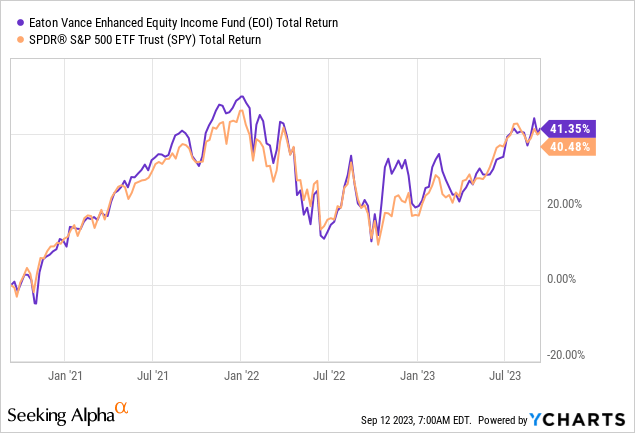

The Enhanced Fairness Revenue Fund (NYSE:EOI) is an fairness closed finish fund. The car falls within the ‘buy-write’ class. We have now lined this title earlier than and really personal it. As per our prior articles, this CEF carefully tracks the S&P 500 efficiency from a complete return perspective, and represents a sexy option to extract dividends from the asset class:

The fund achieves this feat by investing in a small pool of securities which might be discovered within the S&P 500, particularly 67 fairness names. Moreover, the CEF writes lined calls on roughly 50% of the collateral pool, thus with the ability to extract dividends by shorting volatility. With an 8% dividend yield the CEF represents a sturdy option to extract month-to-month revenue from the S&P 500, whereas sustaining a really comparable complete return profile.

On this article we’re going to discover the explanation why EOI represents a compelling different over the SPY at this juncture, and articulate the explanation why this CEF is smart for traders trying so as to add fairness publicity to their portfolios.

State of the Fairness Market

2023 has been nothing in need of breathtaking. We began the yr with most market analysts calling for a deep correction in Q1, solely to get a regional banking disaster as an alternative. Surprisingly for everyone, the market saved grinding larger because the yr went on, with market individuals serving to the transfer by closing massive brief positions.

As a retail investor one wants to grasp that timing the market is quasi-impossible. Even massive gamers akin to hedge-funds have an astonishingly arduous time to try this. What an investor can do is allocate a portfolio to an extent that it’s favorably set-up for prevailing circumstances. To that finish, if one simply held a better than regular money steadiness in 2023, they might have accomplished simply tremendous.

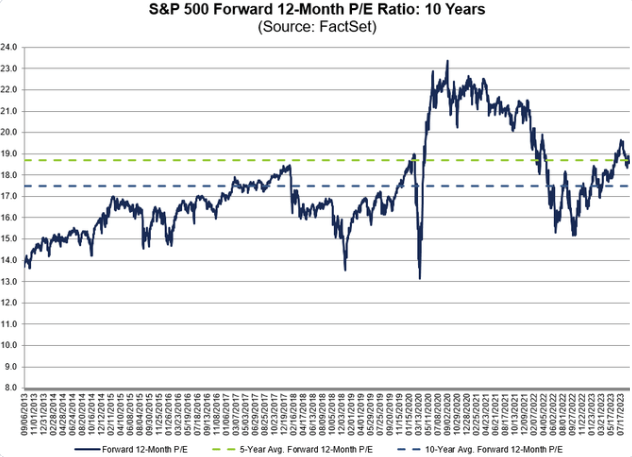

Which brings us to the present market ranges – by conventional valuation metrics the market is pretty costly:

S&P 500 Ahead P/E (FactSet)

The ahead 12-months P/E Ratio is at 19x, which is on the 5-year common, however above the 10-year one. We will see how valuations turned extraordinarily stretched throughout 2020 and 2021 because of the zero charges setting.

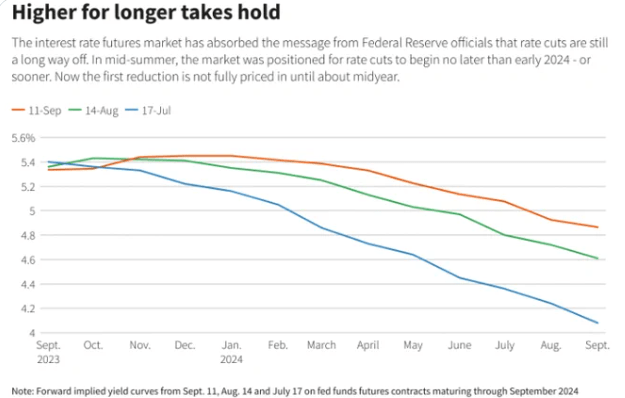

That was the intent engineered by the Federal Reserve, which wished traders to stimulate the economic system by giving them no different alternate options exterior fairness and debt investments. Therefore the TINA acronym throughout these days. The alternative is going on as we communicate, with Federal Funds above 5%, and anticipated to remain there nicely into 2024:

FedFunds Ahead (Reuters)

We will see how the ahead market is pricing Fed Funds at 5.4% by no less than March of subsequent yr now.

But the fairness market has been staunchly resistant, with the S&P 500 up over 17% this yr. Not all shares are equal although, with a lot of the returns this yr pushed by solely a handful of names.

How a lot larger can this market go? Is that this the beginning of a brand new bull run? All good questions the place market individuals differ. A great indicator of a real new bull run is breadth. And whereas breadth has been bettering over the previous couple of months, it’s astounding to see the equal weight S&P 500 fund Invesco S&P 500 Equal Weight ETF (RSP) up solely 4.8% this yr.

We really feel inflation will probably be stickier than thought, and that charges will keep larger for for much longer than beforehand anticipated. That can finally lead to one other risk-off occasion, however the primary query is ‘When’.

The market doesn’t wish to tread water, no less than not in 2023, so if it decides that the information reel just isn’t dangerous then it is going to in all probability transfer additional up till December. To that finish we’re presenting traders with a better different than simply shopping for the SPY at this stage.

Why EOI seems higher than SPY at this stage

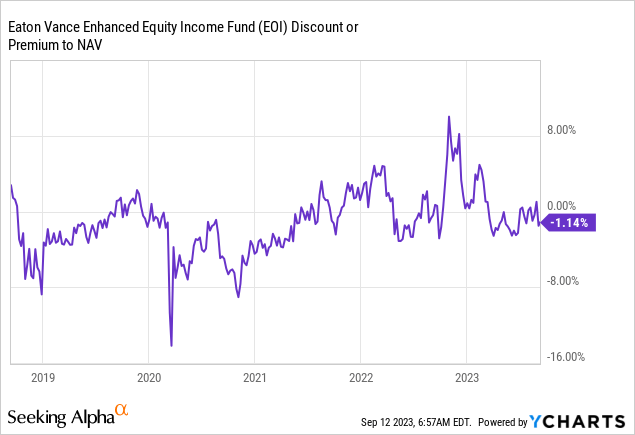

EOI is a closed finish fund, and structurally it’s lastly buying and selling once more at a reduction:

Through the previous few years the fund has been buying and selling at small or massive premiums to web asset worth. The CEF is now lastly in low cost territory, and it mainly represents a extra advantageous different to buying the SPY outright.

The rationale for the low cost is the brief volatility place the fund takes by way of its name writing:

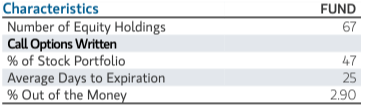

Traits (Fund Reality Sheet)

At the moment 47% of the portfolio is overwritten with calls which have a 25 day common maturity, and a 2.9% ‘out-of-the-moneyness’. This structural characteristic can add further revenue if the market doesn’t transfer up by greater than 2.9% throughout that time frame. Nonetheless, the market is at present punishing buy-write funds akin to EOI because of the very low VIX ranges available in the market:

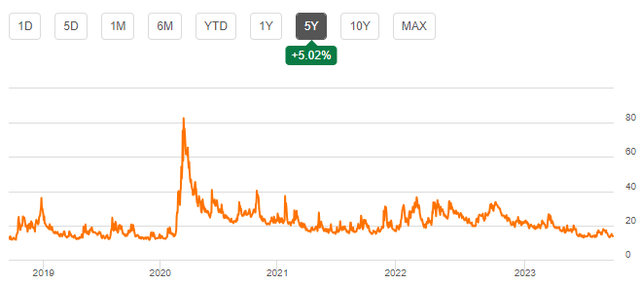

VIX (Searching for Alpha)

The VIX is again at pre-2020 ranges, which makes call-writing much less worthwhile. Writing choices ends in a premium paid to the fund. The upper the VIX, the upper the premium paid to the CEF. Conversely, when the VIX is low, the CEF makes much less of a premium. The market is now arguing the premium is just too low for the upside given up.

Nonetheless, as a retail investor we should always just like the small low cost that has opened up in EOI because it supplies with a less expensive entry level into the index. We have no idea the market’s subsequent transfer, however we do know that if a brand new cyclical bull is entered than the CEF will but once more transfer to a premium to NAV, whereas throughout a subsequent risk-off transfer, the fund could have some kind of premium to make up for the underlying fairness losses.

Conclusion

2023 has been a really arduous yr to anticipate. Regardless of market-wide expectations for a major leg down in Q1, we didn’t expertise that. Because the yr progressed, the market grinded larger, with many traders overlaying brief positions.

EOI is an fairness closed finish fund that falls within the buy-write class. The car has written calls on roughly 47% of its portfolio, and provides up any upside above 2.9% increments over 25 days. The market is punishing brief vol funds throughout the board, and this CEF is now lastly buying and selling at a reduction to NAV once more.

We have no idea what the longer term will maintain for the SPY, however given the shut return correlations between the CEF and the S&P 500, it’s a higher threat/reward proposal at this stage to purchase the index by way of EOI, given its low cost to NAV. If a bull cycle comes subsequent we anticipate EOI to maneuver again to a premium to NAV, whereas in a risk-off setting the fund ought to have an identical drawdown because the index with some premium compensation. We aren’t advocating shopping for the market right here. Nonetheless, we maintain this title and have been dripping into it, and consider it’s a smarter option to improve the fairness allocation of a portfolio moderately than shopping for the index outright at this juncture within the cycle.