Vertigo3d

Lately I wrote an article on Tesla (TSLA) highlighting the truth that despite the fact that the corporate is prone to develop considerably, there is not a lot upside from the already elevated a number of the corporate trades at at present. As we speak I need to begin protection on one other tech large – Meta (NASDAQ:META), previously often known as Fb, which at first look shares a whole lot of the identical traits with Tesla, but I feel it could be price shopping for.

The market general

Earlier than diving straight into Meta, I need to spotlight some related market-wide traits. You see, we at present discover ourselves in a state of affairs, the place regardless of excessive rates of interest and a deeply inverted yield curve, the S&P 500 is sort of at its all-time excessive. And it is solely as excessive as it’s, due to a latest tech rally, fuelled primarily by AI hypothesis, which led to sharp a number of enlargement.

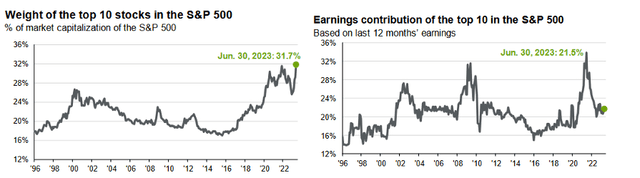

The market has basically been pushed by solely a handful of corporations. Particularly, the biggest ones, as the highest 10 corporations within the S&P 500 now account for a file 31.7% of the index, based mostly on market cap.

To make issues worse, the proportion of earnings that the highest 10 corporations contribute has dropped drastically from round 30% final yr to only about 20%. That is hardly shocking, since as soon as once more, the worth enhance might be completely attributed to a number of enlargement, versus earnings progress.

J. P. Morgan

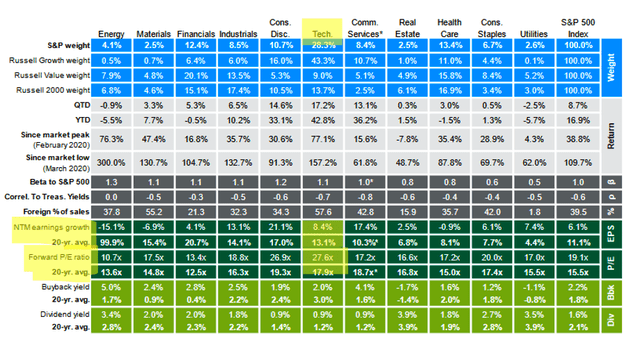

Trying on the desk beneath, it is evident, that the know-how sector, which has the very best weighting within the S&P 500, is at present costly (possible as a result of it has rallied a lot not based mostly on fundamentals, however hypothesis).

The tech sector at present trades at a ahead P/E of 27.6x, in comparison with a 20-year common of 17.9x. A pointy distinction, which is just magnified by the truth that ahead anticipated progress of 8.4% is considerably beneath historic common progress of 13.1%.

For those who take a look at the remainder of the sectors, issues should not practically as unhealthy there so one can conclude that the explanation the index as an entire is at present fairly costly, given the restricted progress prospects, is primarily attributable to tech being overvalued.

J. P. Morgan

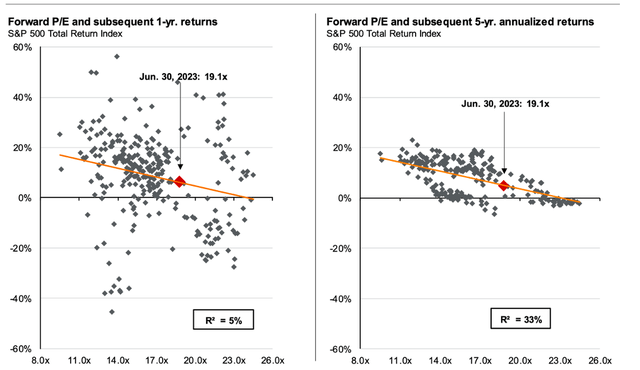

There’s a pretty robust relationship between the P/E a number of of the S&P 500 and future earnings. Particularly, based on J. P. Morgan, the present a number of of 19.1x earnings is prone to end in sub-par outcomes, with complete index returns of beneath 5% per yr. That is why I do not advocate investing within the index presently. The identical logic might be utilized to particular person corporations, which is why I not often advocate shopping for corporations at a excessive P/E, no matter how vibrant the long run may appear.

J. P. Morgan

That brings me to Meta.

Meta’s latest outcomes

At the start of 2022, Meta carried out a number of actions to extend effectivity and realign its enterprise and strategic goals. As of June 30, 2023, the enterprise had accomplished a big a part of anticipated employees layoffs whereas persevering with to judge facility consolidation and knowledge heart restructuring actions. Headcount was 71,469 within the second quarter, a lower of 14% year-over-year. This resulted from Zuckerberg’s deliberate “yr of effectivity, “which led to shedding greater than 21,000 staff, tightening spending in some divisions, and flattening the corporate’s hierarchy. Then again, complete prices and bills have been $22.61 billion, which is a rise of 10% YoY. This consists of authorized charges and restructuring costs (over $2.5 billion). The expansion in spending is predicted to proceed by high administration – you possibly can guess the trigger – the capital expenditures on AI programs (servers and “highly effective “computer systems) and better hiring prices and salaries for AI consultants.

Meta additionally disclosed a rise in energetic customers on their apps. The variety of day by day energetic people elevated by 7% yearly to three.07 billion, whereas the variety of month-to-month busy folks elevated by 6% YoY to three.88 billion. Moreover, whereas impressions delivered throughout Meta Platform climbed by 34% YoY, the typical worth per advert was diminished by 16%. Essentially the most intriguing assertion for some buyers was additionally not so terrible, with an 11% CAGR and income of $32.0 billion. Figures that should have happy buyers. Nonetheless, it should even be stated that Meta’s present web revenue margins lowered considerably from 28.2% final yr to 18.7% this yr. This means a low aggressive benefit because the firm can not increase its costs.

The corporate expects its working losses to rise YoY in constructing Actuality Labs, Zuckerberg’s most well-liked mission, which has failed to supply something promising and doesn’t seem promising sooner or later. In a quarterly report, Meta additionally said that essentially the most needed factor as of late is investing in synthetic intelligence, one of the vital compelling alternatives for the corporate. Zuckerberg additionally stated that the corporate is at present engaged on a number of thrilling tasks, corresponding to Llama 2, Threads, Reels, and the launch of Quest 3. Llama 2 is ready to compete with chatbots like OpenAI or Google’s Bard. Meta enhances Threads (competitors of “X” previously often known as Twitter) because it faces consumer exodus. Essentially the most vital adjustments are the nearer connection to Instagram and the desktop model, that are purported to regain customers.

Final however not least, Meta repurchased $793 million of its Class A standard inventory within the second quarter of 2023. As of June 30, 2023, the corporate had $40.91 billion obtainable and licensed for repurchases, which suggests it is able to purchase again a lot of its shares when the market goes down.

Valuation

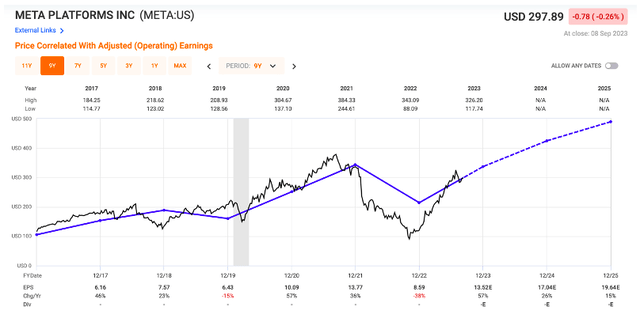

Let’s maintain issues easy. Meta is predicted to succeed in an EPS of $13.52 this yr, which might characterize annual progress of over 50%. Past this yr, the consensus is for a few 25% enhance in 2024 and a 17% enhance in 2025. So clearly, a whole lot of progress is predicted for the corporate.

Within the meantime, shares commerce at just below $300 per share, which corresponds to a ahead P/E of 22x. That is very cheap, on condition that earnings are anticipated to develop by about 20%. And in reality, it is in step with the corporate’s historic common P/E.

FastGraphs

What this implies is that the chance of a extreme worth drop, if for instance Meta underdelivers, is considerably decrease than that of Tesla. It additionally signifies that we will comfortably count on the corporate to generate complete returns in step with its EPS progress, without having to depend on an elevated P/E a number of to ship upside.

All issues thought of, I am fairly snug shopping for Meta (which is AA- rated, high quality firm) at 22x earnings, with anticipated 2024-2025 EPS progress of 20%, particularly when the tech sector as an entire trades at 27x earnings with solely 8% anticipated progress. I feel Meta will outperform the S&P 500, which as mentioned is prone to ship returns of round 5%, due to this fact producing strong alpha for buyers. I charge META as a BUY, right here at $297 per share.