Buyers and significantly homebuyers are questioning when will the Fed lastly begin chopping charges? After 11 fee hikes to date since 2022, buyers and homebuyers are beginning to really feel the pressure of upper borrowing prices.

The longer the Fed Funds fee stays excessive, the extra adverse influence it’s going to have on the economic system. Ideally, the Fed needs to keep away from one other U.S. financial recession. Nevertheless, if the Fed retains charges excessive and doesn’t minimize by the top of 2024, there’ll possible be a lot more durable occasions forward.

For homebuyers, pent-up demand will proceed to develop. Sooner or later, life should go on, as individuals are pressured to purchase properties as a result of start of a kid, a change in jobs, dad and mom shifting in and extra.

Nevertheless, the typical fee for a 30-year fixed-rate mortgage is over 7%, up from roughly 3% firstly of 2022. This has deterred potential homebuyers from shopping for and made current owners reluctant to promote their properties and purchase one other. In consequence, stock stays low and residential costs stay excessive.

Though housing exercise has fallen sharply, a lot of the remainder of the economic system appears to be chugging alongside. Households’ extra financial savings and actual wage progress have quickly blunted the influence of upper rates of interest. Nevertheless, the shields are forming holes.

Excessive-Curiosity Charges Profit The Rich Most

Satirically, high-interest charges have helped wealthy buyers get richer on the expense of the center class and the poor. This is sensible as a result of many of the Fed Governors are wealthy and folks generally tend to handle their very own wants first.

The wealthy are much less possible in want of a mortgage to purchase a house. Due to this fact, the wealthy can get higher offers with no financing contingencies.

The wealthy even have extra extra financial savings, which profit extra from larger Treasury bond yields, cash market fund yields, and CD charges.

Lastly, the wealthy have seen their inventory portfolios rebound essentially the most in 2023. With their internet worths again to close all-time highs, buyers are feeling much more safe on this high-interest fee surroundings.

Managing Inflation Again Down From Its 2022 Excessive

Inflation peaked in mid-2022 and has trended downward since. Due to this fact, the Fed’s fee hikes are working to decelerate the economic system.

The primary query now could be when will the Fed start to chop charges? As soon as the Fed begins chopping charges, bond costs ought to enhance and mortgage charges ought to begin to head again down, if not beforehand, as a result of anticipation of additional fee hikes.

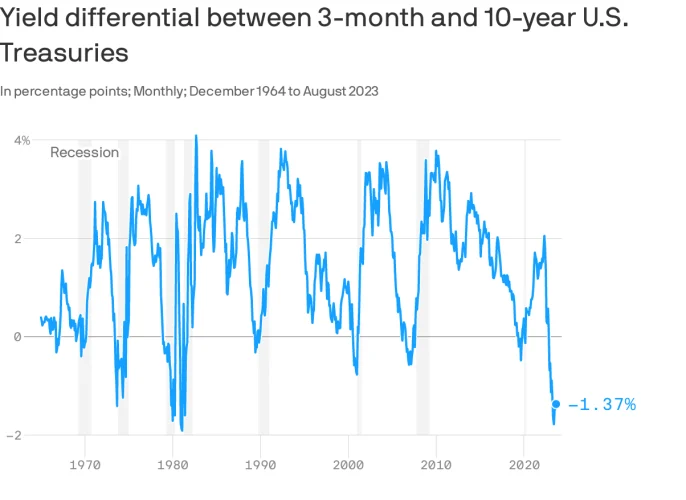

As well as, the yield curve will possible steepen as at the least the brief finish of the curve lastly declines. The Fed Funds fee is the shortest of the brief finish.

Reducing charges will assist forestall a hard-landing financial state of affairs that drives the unemployment fee up and pummels danger belongings. Reducing rates of interest will assist the center class essentially the most as a result of high-interest charges harm the center class essentially the most.

Let’s assessment some predictions from numerous economists, cash managers, an bankers concerning when the primary Fed fee minimize will likely be. I will then share my prediction and why. Please fill out the survey on the finish and share your reasonings why as properly.

Fed Fee Reduce By Finish Of 2023 In accordance To JPAM Chief Funding Supervisor

Bob Michele, J.P. Morgan Asset Administration’s chief funding supervisor, stated the Fed might pivot and minimize charges by the top of 2023.

“They are going to inform us that they will preserve charges larger for longer till inflation is at their goal,” he stated. “However the magnitude of the slowdown we’re seeing throughout the board tells us that we’ll in all probability nonetheless be hitting recession round year-end, in order that they’ll be chopping charges by then.”

Presently, the consensus is for no fee cuts in 2023. There’s truly a rising probability of 1 final Fed hike by the top of 2023.

Fed Fee Reduce In February 2024 In accordance To Morningstar Economist

On August 31, 2023, Preston Caldwell, a Morningstar senior US economist, wrote in a submit he expects the Fed to start out chopping rates of interest in February 2024, the primary Fed assembly of 2024.

Caldwell argues,

The Fed will pivot to financial easing as inflation falls again to its 2% goal and the necessity to shore up financial progress turns into a high concern.

1) Curiosity-rate forecast. We undertaking a year-end 2023 federal-funds fee of 5.25%, falling to about 2.00% by the top of 2025. That may assist drive the 10-year Treasury yield right down to 2.50% in 2025 from a mean of three.75% in 2023. We anticipate the 30-year mortgage fee to fall to 4.50% in 2025 from a mean of 6.75% in 2023.

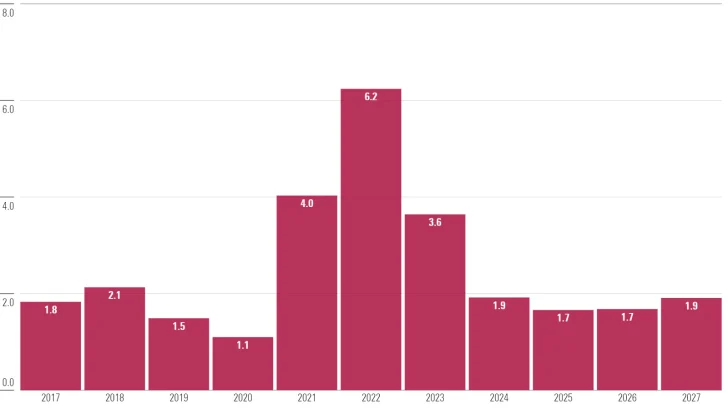

2) Inflation forecast. We undertaking value pressures to swing from inflationary to deflationary in 2023 and the next years, owing significantly to the unwinding of value spikes brought on by provide constraints in durables, power, and different areas. This can make the Fed’s job of curbing inflation a lot simpler. In reality, we expect the Fed will overshoot its purpose, with inflation averaging 1.8% over 2024-27.

We anticipate that GDP progress will begin accelerating within the second half of 2024 because the Fed pivots to easing, with full-year progress numbers peaking in 2025 and 2026. The decision of provide constraints ought to facilitate an acceleration in progress with out inflation turning into a priority once more.

Supply: Morningstar

The Fed Will not Reduce Charges Earlier than April 2023 In accordance To A Hedge Fund Supervisor

David Einhorn, the founder and president of the hedge fund Greenlight Capital, wrote that he did not anticipate the Fed to chop rates of interest till March 2024.

“We proceed to consider that the market is over-anticipating fee cuts and we’ve prolonged that view by way of March of 2024,” he stated.

David Einhorn is legendary for shorting Tesla and shedding a bunch of cash throughout its 1,000% run-up. Regardless, David remains to be a really rich man given hedge funds make tons of cash.

Reducing in February or March 2024 is about the identical. I would buck them collectively.

Fed Fee Reduce In Might 2024 In accordance To KPMG Economist

Following the discharge of August’s inflation report, KPMG US’s chief economist, Diane Swonk, wrote in her piece, Inflation Reheats, the Federal Reserve won’t be performed elevating rates of interest. She writes,

The Fed must see quarters, not months, of essentially cooler inflation to chop charges. We aren’t even shut. Our forecast for the primary fee minimize in Might 2024 holds.

“The trail down on inflation is suffering from potholes. We hit one in August, which is one among many causes that the Fed will pause however go away the choice to boost charges once more in November on the desk at its assembly subsequent week.

The message from the Fed will likely be clear. It intends to carry charges excessive for longer and won’t hesitate to boost once more if inflation will get caught at year-end. The Fed must see quarters, not months, of essentially cooler inflation to chop charges. We aren’t even shut. Our forecast for the primary fee minimize in Might 2024 holds.

Fed Fee Reduce Between April and June, 2024 In accordance To A Reuters Ballot

In a Reuters ballot of 97 economists, the consensus prediction is that the Fed would not minimize rates of interest till at the least April 2024. Listed below are extra particulars from the Reuters article.

Almost 20% of the economists, 17 of 97, predicted at the least yet another fee rise earlier than the top of the yr, together with three who anticipated one in September.

Although we proceed to anticipate the Fed to stay on maintain on the Sept. 20 FOMC assembly, we might not be stunned to see most officers proceed to undertaking yet another fee hike by year-end of their up to date ‘dot plot,’” stated Brett Ryan, senior U.S. economist at Deutsche Financial institution, referring to the rate of interest projections launched by Fed policymakers on a quarterly foundation.

Of the 87 respondents who had forecasts till the center of 2024, 28 put the timing of the primary fee minimize within the first quarter and 33 had it within the quarter after that. Just one stated the Fed would minimize charges this yr.

Round 70% of these respondents, 62 of 87, had at the least one fee minimize by the top of subsequent June. Nonetheless, all however 5 of 28 respondents to an additional query stated the larger danger was that the primary Fed minimize would come later than they at present forecast.

A critical financial downturn might justify an earlier fee minimize, however that’s trying much less possible. The economic system was anticipated to increase by 2.0% this yr and 0.9% in 2024, in accordance with the ballot.

The median view from a dwindling pattern of economists who supplied responses on the chance of a recession inside one yr fell additional to 30%, after tumbling beneath 50% for the primary time in practically a yr final month. It peaked at 65% in October 2022.

Goldman Sachs Believes Fee Cuts Will Occur In 2Q 2024

Goldman Sachs chief US economist, David Mericle, stated he expects the Fed to chop charges in 2Q 2024. On the Goldman Sachs Exchanges podcast episode (Apple), he additionally believes the Fed is completed mountaineering charges in 2023.

“We have now the primary fee minimize penciled in for 2Q of 2024. The edge that we bear in mind that is met at that horizon in our forecast is core PCE falls beneath 3% YoY and beneath 2.5% on a month-to-month annualized foundation.

I do not really feel terribly strongly concerning the fee cuts as a result of I do not suppose it is proper to say the Fed wants to chop. I see it type of non-obligatory. I can definitely envision a state of affairs the place we get there and inflation would not come down fairly sufficient, or even when it does, Fed officers say to themselves, ‘This can be a sturdy economic system with a traditionally tight labor market, simply coming off a scary inflation surge, what precisely is the purpose of chopping, what downside are we attempting to unravel?’ and resolve it is simply not value it.

Why do I feel the proper baseline is for the Fed to chop? As a result of a 5.5% nominal funds fee, a 3%+ actual funds fee will really feel excessive relative to latest historical past for many Fed officers. We have now penciled in in our forecasts 25 foundation level (cuts) per quarter. We have now it ending within the low 3s, not on the 2.5% quantity the FOMC has written down.”

American Bankers Affiliation’s Financial Advisory Committee Expects Fee Cuts After Might 2024

The newest forecast from the American Bankers Affiliation’s Financial Advisory Committee stated it expects the Fed to carry off on chopping charges till someday between Might and the top of subsequent yr. They anticipate the Fed to chop the Fed Funds fee by 1% in 2024. The ABA compromises of economists from the biggest banks corresponding to JP Morgan, Morgan Stanley, and Wells Fargo.

“Given each demonstrated and anticipated progress on inflation, the vast majority of the committee members consider the Fed’s tightening cycle has run its course,” stated Simona Mocuta, chair of the 14-member panel and chief economist at State Avenue International Advisors.

Supply: Morningstar, U.S. inflation fee (PCE Index, %)

Vanguard Believes Fed Fee Cuts Will Start In 2H 2024

Everyone’s favourite cash administration firm, Vanguard, printed an article believing the Fed might have to boost charges additional. From the article,

Josh Hirt, a Vanguard senior economist explains, “Financial coverage remains to be working its manner by way of the economic system, attempting to constrain exercise even because the impacts of supportive fiscal coverage have kicked in. This is without doubt one of the causes we consider the economic system faces a interval of upper sustained rates of interest than we’ve grown accustomed to seeing.” Vanguard believes that the Federal Reserve might have to boost charges additional and preserve them at their highest ranges for an prolonged interval within the face of continued financial resilience.

Latest Vanguard analysis concludes that the “impartial fee of curiosity”—a theoretical fee that neither promotes nor restricts financial exercise—is larger than many might have thought. That discovering and our associated coverage evaluation help our view that the Fed might have to boost its federal funds goal fee by an extra 25–75 foundation factors earlier than ending a rate-hiking cycle that started in March 2022 and has totaled 525 foundation factors. (A foundation level is one-hundredth of a share level.)

The Fed’s fee goal at present stands at 5.25%–5.5%. We don’t foresee the central financial institution chopping its goal till the second half of 2024.

“We consider the catalyst for alleviating could be both a recession or inflation falling whereas financial exercise stays sturdy (a ‘mushy touchdown’),” the crew stated.

2024 Fed Conferences Schedule

Now that you’ve a good suggestion of when the Fed will minimize charges, let’s undergo a forecasting train of our personal. Let’s faux to be an economist and make our personal Fed fee minimize timing prediction.

One of many methods to find out when the Fed will minimize charges is to take a look at the upcoming FOMC assembly schedule.

There are eight scheduled Federal Reserve conferences for 2024. Allow us to assume with 99% certainty the Fed will minimize charges in 2024. Due to this fact, we’ve a one-in-eight or 12.5% probability of guessing appropriately when the Fed will start chopping charges.

We should additionally assume there will likely be no shock fee cuts off schedule.

Bettering The Odds Of Our Fed Fee Reduce Forecast

We are able to throw out the January 2024 assembly as a possible for a Fed fee minimize as a result of:

1) It’s too quickly after the Fed doubtlessly makes its final fee hike in 2023. Reducing charges so quickly after would make the Federal Governors look silly.

2) January can also be too quickly given we’re simply beginning the yr. Fed workers are simply getting again to work and there could also be an excessive amount of financial distortion through the vacation interval,

By eliminating January, we now have a one-in-seven, or 14.28% probability of appropriately forecasting when the Fed will minimize charges.

We are able to in all probability throw out December 2024 too. The lag impact of the Fed fee hikes needs to be in full impact properly earlier than December 2024 as unemployment rises, company earnings sluggish, and GDP progress slows.

With six Fed conferences left to chop charges, we now have a 16.7% probability of appropriately forecasting when the subsequent fee minimize will likely be. All we have to do is select a gathering date after which write about why we expect the date is the right one.

Hooray for some good old style deductive reasoning!

After I Suppose The Fed Will Reduce Charges

As we enter 4Q 2023, all of the financial information and client sentiment surveys level towards a slowdown. Delinquency charges are ticking up, housing demand is manner down, and inflation has rolled over.

Sure, there’s a danger inflation will reaccelerate given rising oil and gasoline costs. Nevertheless, I consider the larger driver for the value enhance is a synthetic discount in provide, not accelerating demand.

Given how essential the U.S. housing market is to the economic system, it is onerous to examine the Fed mountaineering as soon as extra in 2023 (~50% probability). Roughly 66% of Individuals personal properties. If transaction quantity continues to remain at multi-decade lows, associated companies corresponding to building, furnishings, mortgage origination, structure and design, and lots of extra will endure.

The brand new yr at all times brings about new demand for items and providers. As a private finance author since 2009, I at all times see a pickup in visitors through the first quarter of the yr. I anticipate 2024 to be no totally different. Individuals are most motivated to take motion within the first quarter of every yr.

June 2024 Or Later Is The Goal Date For Cuts

We might see a rebound in financial exercise in 1Q2024, partly as a consequence of pent-up demand from the vacations. In that case, strong-than-expected client spending will delay inflation getting right down to the Fed’s long-term goal of two%. In flip, this can even cut back the Fed’s want to chop charges as a result of it’s going to delay a recession.

In consequence, the soonest the Fed will minimize charges is Might 1, 2024. However I’ll go along with June 12, 2024 because the assembly/month when the Fed will lastly minimize. By June 12, 2024, the Fed could have had two months to digest the 1Q 2024 information. It’s going to even have had two months of 2Q 2024 information.

If the Fed does hike once more in 2023, then it strengthens my perception additional the Fed will minimize in June 2024. The logic is that one other fee hike in 2023 will slowdown the economic system additional.

My Fed fee minimize views parallel these of Goldman Sachs’ economist, David Mericle, and the American Banker’s Affiliation.

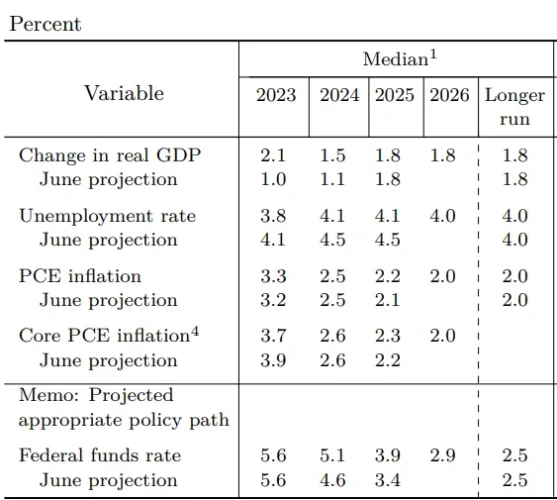

Please observe that after the September 20, 2023 FOMC assembly, Fed officers see the Fed Funds fee at a median of 5.1% on the finish of 2024, up from 4.6% in June. The median Fed funds fee expectations for 2025 is now 3.9%, up from 3.4% in June.

Fed Fee Reduce Possibilities By FOMC Assembly / Month

Listed below are some chances for a Fed fee minimize I assign by FOMC meet. As we all know from investing, there are not any absolutes. Due to this fact, we should assign chances and put together accordingly.

January 2024: 20%

February 2024: 5% (no conferences scheduled, so this could be an intra-meeting minimize, as believed by Morningstar)

March 2024: 25%

April/Might 2024: 40%

June 2024: 60%

July 2024: 55%

September 2024: 50%

November 2024: 40%

December 2024: 20%

2025: 10%

In accordance with CME Group’s FedWatch device, the probabilities of a fee minimize in March 2024 is nineteen%, however jumps to 82.3% in Might 2023.

Beneath is a snapshot of the goal fee and chances in June 2024 after the September 20, 2024 FOMC assembly notes have been launched. It says with a 34% chance the Fed funds fee will keep the identical at 5.25 – 5.5%, and a 42.8% chance there will likely be a 0.25% minimize by June 2024. Fascinating stuff!

Thrilling Occasions For Cashed-Up Buyers

Let’s take pleasure in these larger risk-free charges whereas they final. As we patiently wait to seek out nice offers in danger belongings like actual property, we’ll strengthen our steadiness sheets with every passing month.

The important thing to creating extra money will likely be to reap the benefits of offers BEFORE all people can discover cheaper financing. Therefore, some individuals are discovering offers and placing some capital to work now. Whereas some will likely be looking for offers in 1H 2024.

As soon as the Fed does minimize charges, there could also be a rush of laggard patrons IF the economic system would not crash with a surge within the unemployment fee. Discover on this chart how recessions (gray bars) virtually at all times observe after the Fed begins chopping charges. In different phrases, the Fed typically raises an excessive amount of and cuts too late to forestall a recession from occurring.

However danger belongings can carry out throughout recessions. It simply is determined by how dangerous and lengthy the recession will likely be.

It isn’t a lot the preliminary fee minimize that will likely be driving patrons because the low cost will likely be miniscule. Somewhat, it will likely be the aid felt that the Fed will now not be mountaineering charges and that future rates of interest are possible.

The one individuals who lose are massive spenders with little money and weak money circulate. They’re going to both get beat up by a worse-than-expected recession or miss out on the shopping for alternatives. Be ready!

Reader Questions and Recommendations

When do you suppose the Fed will lastly minimize rates of interest and why?

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and talk about a few of the most attention-grabbing matters on this website. Please share, fee, and assessment!

For extra nuanced private finance content material, be a part of 60,000+ others and join the free Monetary Samurai e-newsletter and posts by way of e-mail. Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009.