tolgart/iStock through Getty Photographs

IVLU technique and portfolio

iShares Edge MSCI Intl Worth Issue ETF (IVLU) began investing operations on 6/16/2015 and tracks the MSCI World ex USA Enhanced Worth Index. It has $1.7B beneath administration, a portfolio of 347 shares, a 12-month distribution yield of three.63% and an expense ratio of 0.30%. Distributions are paid quarterly.

As described within the prospectus by iShares, the fund invests in giant and mid-cap corporations of developed international locations besides the U.S. The worth type is outlined by “three accounting variables primarily based on publicly reported monetary information: price-to-book worth, price-to-forward earnings and enterprise value-to-cash circulate from operations. The Index Supplier calculates a “worth rating” primarily based on these three variables. MSCI assigns weights by multiplying a part’s worth rating by its market capitalization. Weights within the Underlying Index are subsequent normalized in order that sectors within the Underlying Index signify the identical weight as within the Mother or father Index.” In the latest fiscal 12 months, the portfolio turnover fee was 17%, which is kind of low.

On this article, I examine IVLU with its hottest competitor by the identical issuer: iShares MSCI EAFE Worth ETF (EFV), which tracks the MSCI EAFE Worth Index. Each are value-style funds invested in developed markets excluding the U.S., principally in giant and mega-cap corporations (about 91% of asset worth for IVLU, 88% for EFV). EFV is an older, bigger and extra liquid fund, with an identical payment and a barely increased turnover, as famous within the subsequent desk.

|

IVLU |

EFV |

|

|

Inception |

6/16/2015 |

8/1/2005 |

|

Expense Ratio |

0.30% |

0.34% |

|

AUM |

$1.72B |

$17.24B |

|

Common Each day Quantity |

$5.90M |

$125.58M |

|

Variety of Holdings |

367 |

505 |

|

Turnover |

17% |

26% |

|

Weight in High 10 |

18.99% |

19.18% |

|

Yield |

3.63% |

3.75% |

IVLU is a bit cheaper than EFV relating to valuation ratios, as reported beneath.

|

IVLU |

EFV |

|

|

Worth/Earnings TTM |

8.77 |

9.88 |

|

Worth/Ebook |

0.95 |

1.12 |

|

Worth/Gross sales |

0.72 |

0.88 |

|

Worth/Money Movement |

5.71 |

6.06 |

Supply: Constancy

The subsequent desk reviews combination development charges within the trailing 12 months. They’re blended and there’s no clear winner on this level.

|

IVLU |

EFV |

|

|

Earnings development % |

18.12% |

15.87% |

|

Gross sales development % |

9.65% |

10.53% |

|

Money circulate development % |

9.23% |

11.29% |

Supply: Constancy

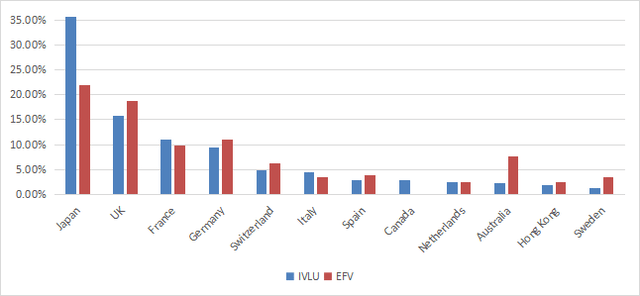

Europe is the heaviest area in each funds, with about 55% of asset worth for IVLU and 63% for EFV. The highest two international locations are Japan and the UK in each funds, however IVLU is actually obese in Japanese corporations (35.8% of property), whereas EFV is extra diversified geographically. The subsequent chart plots the highest 12 international locations, representing about 95% of property for IVLU and 91% for EFV. Hong Kong weighs 1.8%, so direct publicity to geopolitical and regulatory dangers associated to China may be very low. A minor distinction: EFV ignores Canada.

Nation allocation (chart: writer: information: iShares)

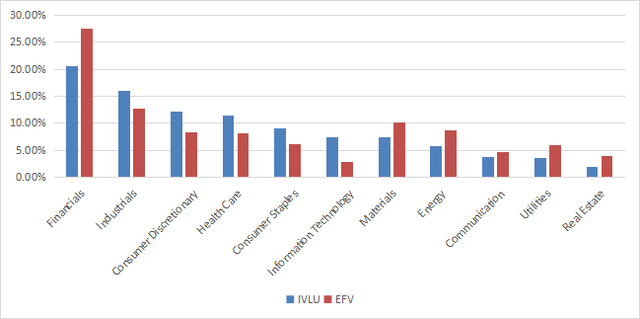

The 2 funds additionally share the identical high two sectors: financials and industrials. On this matter, IVLU is healthier balanced, whereas EFV is obese in financials (28.6%). IVLU considerably overweights know-how relative to its peer.

Sector breakdown (chart: writer: information: iShares)

The subsequent desk lists IVLU high 10 holdings, representing 19% of property. The heaviest one weighs 2.6%, so dangers associated to particular person corporations are low. EFV has nearly the identical weight in its high 10 elements, and the highest title is at 2.7%.

|

Identify |

Weight % |

Sector |

Ticker |

Location |

|

TOYOTA MOTOR CORP |

2.6 |

Client Discretionary |

7203 |

Japan |

|

BRITISH AMERICAN TOBACCO PLC |

2.41 |

Client Staples |

BATS |

UK |

|

NOVARTIS AG |

2.29 |

Well being Care |

NOVN |

Switzerland |

|

SANOFI SA |

2.02 |

Well being Care |

SAN |

France |

|

HSBC HOLDINGS PLC |

2.01 |

Financials |

HSBA |

UK |

|

SHELL PLC |

1.84 |

Power |

SHEL |

UK |

|

MITSUBISHI UFJ FINANCIAL GROUP INC |

1.51 |

Financials |

8306 |

Japan |

|

STELLANTIS NV |

1.47 |

Client Discretionary |

STLAM |

Italy |

|

MITSUBISHI CORP |

1.43 |

Industrials |

8058 |

Japan |

|

ROCHE HOLDING PAR AG |

1.43 |

Well being Care |

ROG |

Switzerland |

Efficiency

Since 9/1/2015, IVLU has outperformed EFV by about 7% in complete return: it’s lower than 1% annualized.

IVLU vs EFV since 9/1/2015 (Searching for Alpha)

In 2023 up to now, IVLU is forward by about 2.5%.

IVLU vs EFV year-to-date (Searching for Alpha)

Between 2016 and 2022, the annual sum of distributions has elevated by 48% for IVLU and solely 23% for EFV. Nevertheless, EFV distributions have stored tempo with inflation, which has additionally been about 23% in the identical time, primarily based on CPI.

|

Annual distributions/share |

IVLU |

EFV |

|

2016 |

$0.56 |

$1.55 |

|

2022 |

$0.83 |

$1.91 |

|

Whole dividend development |

48.2% |

23.2% |

Takeaway

iShares MSCI Intl Worth Issue ETF (IVLU) is an ex-US giant cap worth ETF, identical to its extra standard peer EFV. The subsequent desk presents a abstract of their comparability.

|

winner |

|

|

Liquidity and AUM |

EFV |

|

Expense ratio |

IVLU (shortly) |

|

Turnover |

IVLU |

|

Geographical diversification |

EFV |

|

Sector diversification |

IVLU |

|

Holding diversification |

On par |

|

Valuation |

IVLU (shortly) |

|

Progress |

On par |

|

Return |

IVLU (shortly) |

|

Yield |

On par |

|

Dividend development |

IVLU |

With one level per line, IVLU wins. Nevertheless, its focus in Japan could also be a problem for some traders, and these standards might not have the identical significance for everybody. Be at liberty to provide them weights and make your individual rating.