ImagineGolf/iStock by way of Getty Photos

Introduction

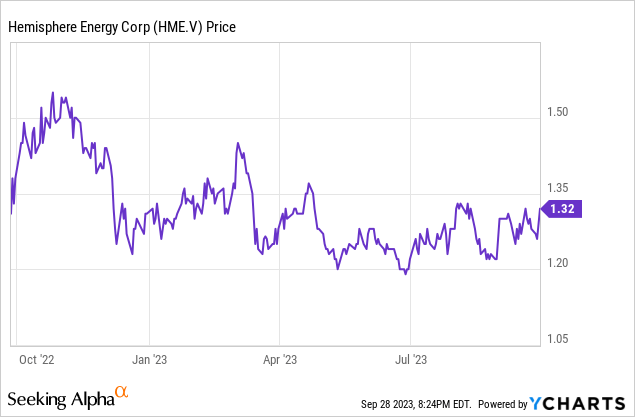

Again in July, I argued Hemisphere Vitality (TSXV:HME:CA) (OTCQX:HMENF) was an fascinating dividend candidate due to its sturdy dividend coverage. The corporate is paying a quarterly dividend of C$0.025 per share which represented an 8% dividend yield, however Hemisphere’s dividend coverage bases the dividends on the working money movement. Because the oil value was going up (and subsequently continued to extend all through the third quarter) I argued the dividend would doubtless be elevated. This has now occurred. And though the Q3 outcomes clearly nonetheless need to be reported, Hemisphere has simply introduced a C$0.03 particular dividend, bringing the anticipated dividend for the 12 months is C$0.13 for a yield of in extra of 10%. I wished to have one other have a look at the inventory to determine how sturdy the third quarter shall be.

The Q2 outcomes permit us to run the numbers on Q3

Earlier than diving into my expectations for the third quarter, it is essential to have a more in-depth have a look at the Q2 outcomes as that would be the place to begin for my Q3 projections.

As Hemisphere Vitality primarily produces heavy oil (representing in extra of 99% of the whole oil-equivalent manufacturing), the WCS value and the differential between mild oil and heavy oil is essential for the corporate (and its shareholders).

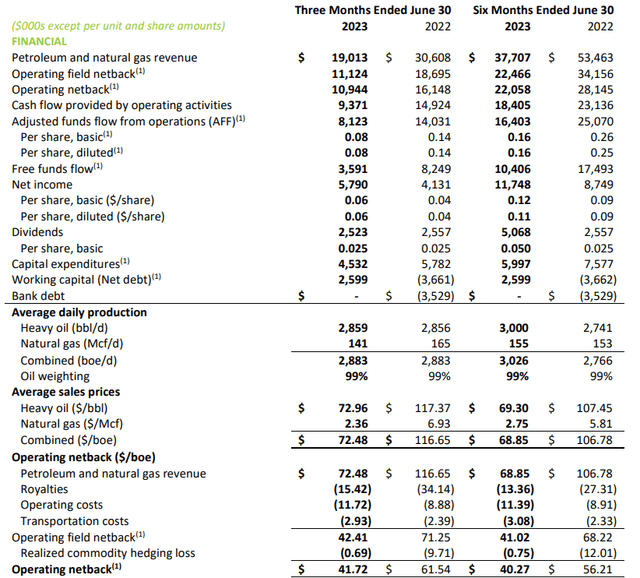

Through the second quarter of the present monetary 12 months, Hemisphere reported a mean realized value of C$73 for its heavy oil and about C$2.36 for the very small quantity of pure fuel that was produced throughout the quarter. This resulted in a mean obtained value of C$72.48 per barrel of oil-equivalent and this meant the whole netback was C$42.41 per barrel of oil-equivalent, excluding hedge losses. The very best working price wasn’t the pure manufacturing price or the transportation expense, however the royalties. As you may see beneath, the royalties made up about 50% of all manufacturing prices.

Hemisphere Investor Relations

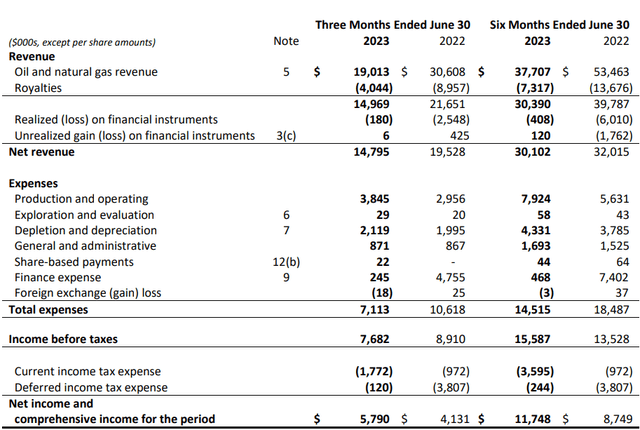

The overall income reported by Hemisphere within the second quarter was roughly C$19M and about C$15M after taking the royalty funds into consideration. The overall internet income of C$14.8M additionally included about C$0.2M in hedging losses.

Hemisphere Investor Relations

And the revenue assertion clearly additionally supplies proof of the low price nature of the manufacturing. The overall manufacturing prices have been lower than C$4M and depletion and depreciation bills made up about 30% of all working bills. That is nice as this meant the pre-tax revenue got here in at C$7.7M representing a internet revenue of C$5.8M after masking a C$1.9M tax invoice. This implies the EPS within the second quarter was roughly C$0.06 and this clearly additionally means the quarterly dividend of C$0.025 per share may be very effectively lined because the payout ratio is lower than 50%. And that was primarily based on a mean realized value of simply C$73 per barrel for the heavy oil.

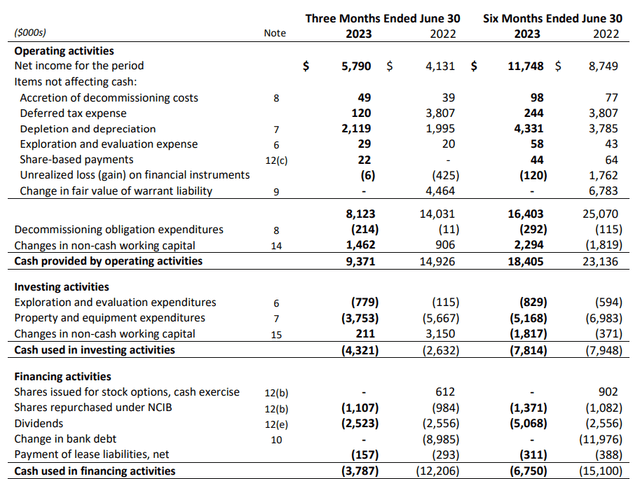

This wasn’t simply an accounting revenue as the corporate’s money movement assertion seems to again up the sturdy internet revenue.

The picture beneath reveals the corporate generated about C$9.4M in working money movement, however after deducting the C$1.5M contribution from working capital modifications and the C$0.2M in lease funds, the adjusted working money movement was C$7.7M. The overall capex and capitalized exploration money outflow was C$4.5M, leading to a internet free money movement of C$3.2M or C$0.032 per share.

Hemisphere Investor Relations

Whereas this nonetheless absolutely lined the quarterly dividend, the free money movement outcome was considerably decrease than the web revenue. This was predominantly brought on by the excessive capex and capitalized exploration which got here in at greater than twice the depreciation bills. This additionally was increased than the normalized capex as Hemisphere remains to be guiding for a full-year capex of C$14M, representing C$3.5M per quarter. And even in case you would use C$4M per quarter, the free money movement outcome would clearly nonetheless be sturdy.

Now we’ve got established how sturdy the outcomes have been within the second quarter, let’s take a look at what we might anticipate from the third quarter.

Oil costs continued to extend and it is essential to notice the heavy oil value is growing as effectively. The WCS value was C$83 in July, C$87 in August and can doubtless exceed C$95 for September. This implies we are able to anticipate the common realized value for the quarter to exceed C$85 per barrel and it might even are available nearer to C$90/barrel.

Assuming C$88/barrel as common realized value for the quarter, Hemisphere’s income per barrel will elevated by roughly C$14 in comparison with the second quarter. And after deducting the royalties and tax funds, the web working money movement ought to improve by roughly C$7/barrel. At a manufacturing fee of three,000 boe/day, this represents a further internet free money movement of C$21,000/day or C$1.8M for the quarter.

A particular dividend is underway

Which suggests the Q3 free money movement outcome might very effectively are available at C$5.5M within the third quarter (utilizing a normalized capex of C$4M) and that may characterize about C$0.055 per share.

The corporate’s dividend coverage requires a payout ratio of 30% of the adjusted funds movement. At a mean heavy oil value of C$88/barrel, the annualized adjusted funds movement could be roughly C$38M which suggests the annual dividend must be roughly C$0.12 per share. That is topic to high quality adjustment issue per barrel of oil.

That additionally was what I used to be anticipating within the earlier article. However earlier this week, Hemisphere Vitality introduced it is going to pay a particular dividend of C$0.03 per share in November. Mixed with the traditional quarterly dividends of C$0.025 per quarter, the full-year dividend will are available at C$0.13.

Funding thesis

And this reconfirms Hemisphere’s standing as a small-cap oil firm with dividend potential. As of the top of June, the corporate had no gross debt and a internet money place of roughly C$4M, so it is smart the corporate continues to concentrate on protecting its shareholders completely happy. I am wanting ahead to seeing the Q3 outcomes and I would not be shocked to see an adjusted working money movement of C$10M and a normalized free money movement results of C$6M. In the interim, I am barely extra conservative and I’ll use an anticipated free money movement of C$5.5M primarily based on a mean WCS value of round C$88/barrel. However consider the present WCS oil value is now greater than 10% increased at roughly C$100/barrel.

I’ve an extended place in Hemisphere, and though I am primarily specializing in capital positive aspects, I am very pleased with the beneficiant dividend funds.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.