ferrantraite

Word that the title says it would shock you. It didn’t shock us.

The Solactive World SuperDividend Index includes the highest 100 dividend payers from around the globe. The elements are equal weighted and the rebalancing is finished on a quarterly foundation. The businesses have to satisfy liquidity and capitalization standards to qualify for inclusion. To qualify, the businesses should yield higher than 6% and fewer than 20%, with no whispers about an imminent dividend reduce. Closed finish funds, partnerships, trusts and enterprise improvement companies or BDCs are excluded from the pool.

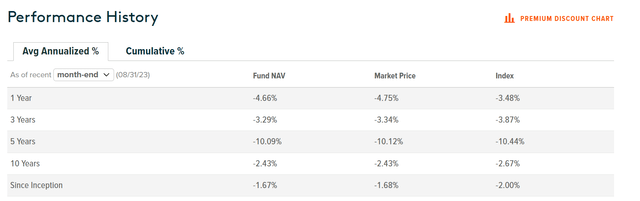

Our protagonist, World X SuperDividend ETF (NYSEARCA:SDIV) is a passive entity, that goals to attain the efficiency of the Solactive index that we launched above. Since an ETF, not like an index, has bills, SDIV measures its returns versus the index, earlier than bills, that are 0.58% on an annual foundation. Aside from the one 12 months interval, the ETF has really outperformed the index in all remaining time frames. That’s an accomplishment of types.

Fund Web site

However since SDIV is a passive ETF, its solely objective is to trace the index, making it on the mercy of the checks and balances employed by the index. The fund doesn’t make any try and strategize to sidestep unfavorable macro situations. It doesn’t have a fantastic technique to even decide dividend winners as we will see. Setting apart that it misplaced rather less cash than the index, the standalone whole return numbers from inception to this point don’t paint a reasonably image for SDIV.

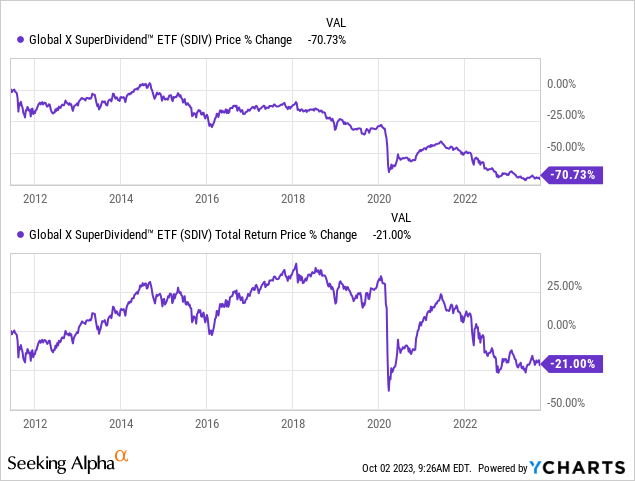

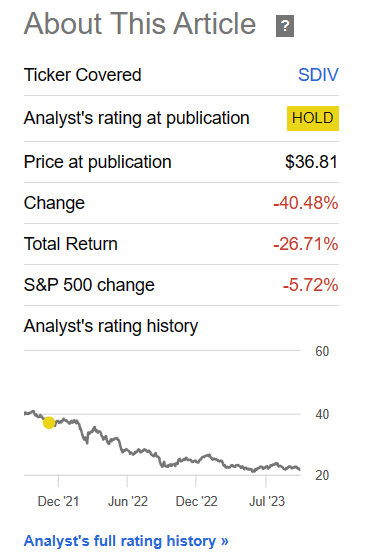

It misplaced over 70% of its worth, however its hefty yield offset a serious chunk of that. Some readers could argue that only a few have purchased and held since inception and therefore the above end result doesn’t maintain true for a typical SDIV investor. Honest sufficient. We take to you December 2021, which is once we final coated this ETF. At the moment, we had confirmed how SDIV lagged even the 7-10 12 months treasury bonds by over 35%. We argued that the long run for this ETF would proceed to be as unfavorable because the previous, and that earnings traders ought to look elsewhere for his or her yield repair. People who exited at that time prevented the damaging 26.71% whole returns.

In search of Alpha

SDIV had one of many poorest fundamentals amongst ETFs that we might discover. The message in our article was an unequivocal “get out of dodge”.

We get that traders are prepared to surrender some stage of appreciation for a daily month-to-month earnings stream, however this stage of underperformance doesn’t remotely justify it. Excessive yield world does have some bargains right this moment, however it additionally has a whole lot of ticking bombs. The proof is within the pudding so far as SDIV is worried. It has lagged 7-10 12 months Treasury Bond ETF (IEF) since inception.

So, whereas the current dividend bumps could also be interesting, we might focus elsewhere on earnings wants.

Supply: A Look At World X SuperDividend’s 9% Yield

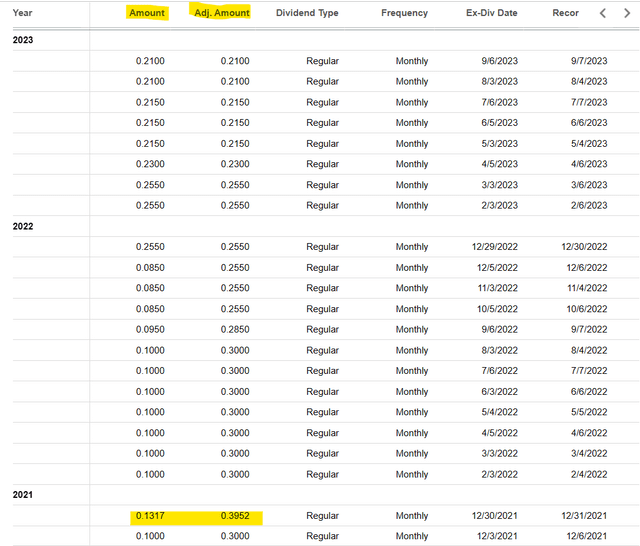

The rates of interest have undergone a sea of change since December 2021, with the underlying excessive dividend payers little question feeling the warmth. SDIV made one last roar when it elevated its dividends from 30 cents to 39.52 cents (break up adjusted quantity) because the world ushered in 2022.

In search of Alpha

It has been all downhill since then, with the month-to-month payout now near half of that. By way of yield nevertheless, this ETF stays a juicy decide for the earnings investor.

Fund Web site

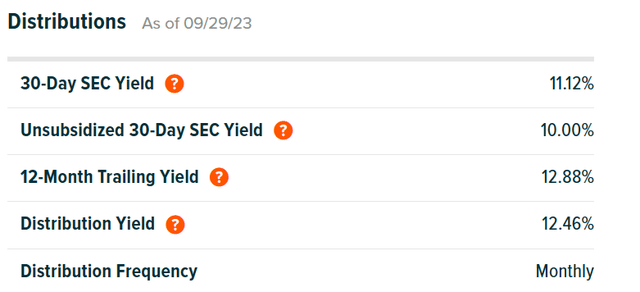

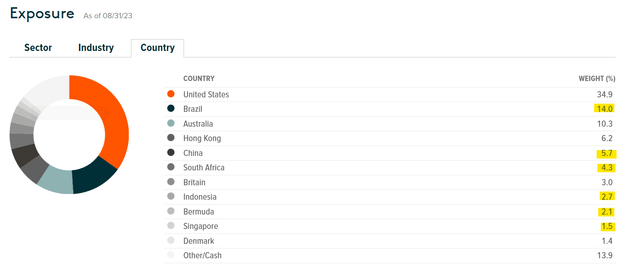

“Aided” by the value decline, the fund really yields increased right this moment than what it did again in December 2021 (round 9%). This yield is even supported by the online earnings of the fund, mirrored by the 30-Day SEC Yield quantity famous above. By way of the supply of this earnings, SDIV continues to have a piece of its belongings invested in rising markets primarily based on probably the most not too long ago revealed information.

Fund Web site

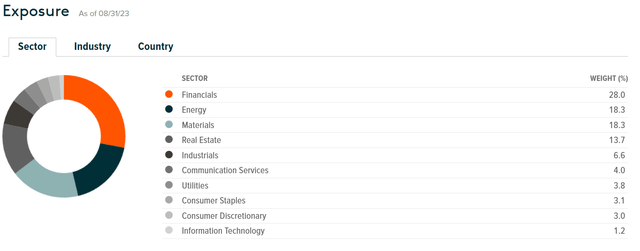

On a comparatively brighter notice, Brazil changed Russia as the highest rising market holding. Financials proceed to carry the highest spot, with the actual property publicity declining from over 25% to underneath 14%.

Fund Web site

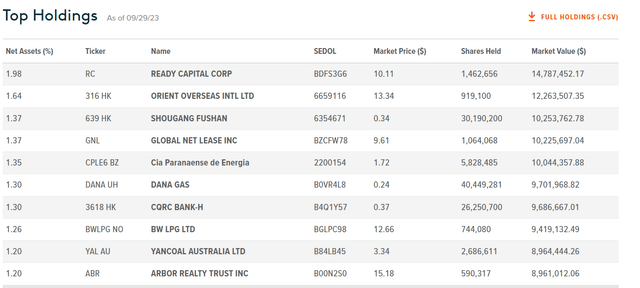

SDIV held 103 securities on the finish of final month, with the highest 10 making up near 14% of the online belongings.

Fund Web site

Whereas this listing is generally made up of names from exterior of North America, it consists of a few names that now we have coated on this platform, specifically, Prepared Capital Company (RC) and World Internet Lease Inc. (GNL).

We notice that SDIV has little to do with the geographic/sector/safety choice, as it’s simply making an attempt to duplicate the index efficiency. As acknowledged within the prospectus, “the Fund doesn’t attempt to outperform the Underlying Index and doesn’t search momentary defensive positions when markets decline or seem overvalued”. With the intention to make a name on the fund’s future prospects, it’s nevertheless, crucial to assessment its composition.

Verdict

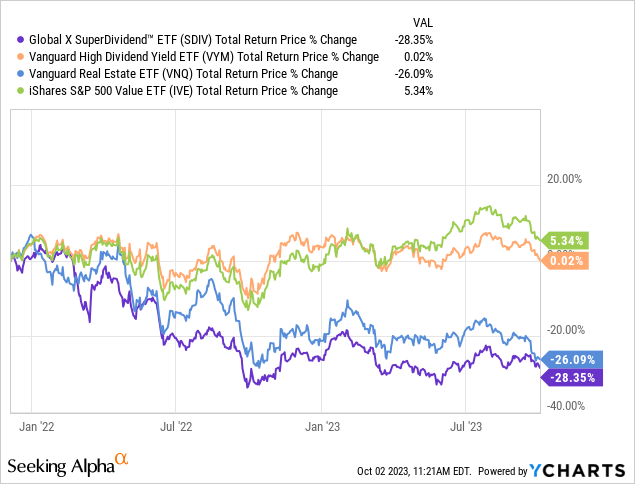

In our earlier piece, we had in contrast SDIV’s whole return with Vanguard Excessive Dividend Yield ETF (VYM), Vanguard Actual Property ETF (VNQ) and iShares S&P 500 Worth ETF (IVE) over 5 years. This ETF continues to carry the final spot when it comes to whole returns for the shut to 2 years since then.

VNQ, has joined the celebration on the bottom flooring, however nonetheless managed to beat SDIV by a small margin. SDIV buys the highest-yielders and makes no try to grasp how the yield received so excessive within the first place. It runs head-first into many dividend cuts. These won’t occur instantly after they’re added to the portfolio, however are par for the course within the minefield during which they play. It is without doubt one of the strangest methods now we have seen and now we have seen fairly a number of unusual issues. We can not wrap our head across the notion traders fully disregard the erosion of their capital, chasing these excessive yield funds. Blind yield chasing is dangerous in any local weather, however extra so when backside strains are underneath stress because of the increased rates of interest. Even the as soon as steady corporations like W. P. Carey Inc. (WPC) are pulling stunts like this. Why would anybody go scouting the globe for the very best yielders is past us. We proceed to remain out. It’s best to take into account it too.

Please notice that this isn’t monetary recommendation. It might look like it, sound prefer it, however surprisingly, it’s not. Buyers are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their targets and constraints.