photoman/iStock by way of Getty Photographs

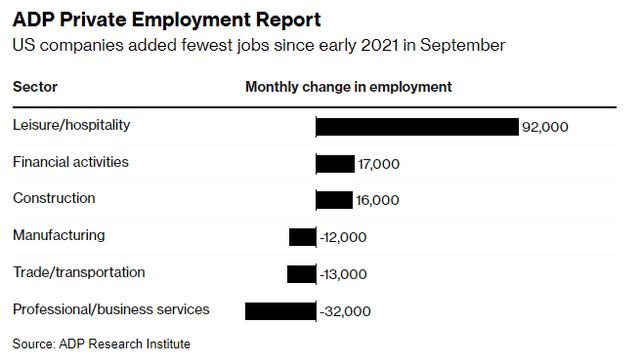

I raised suspicions concerning the accuracy of Tuesday’s JOLTS report for August, as a result of it indicated an enormous improve in new job openings to a complete of 9.61 million, led by greater than 500,000 new positions in skilled and enterprise companies. Yesterday’s ADP payroll report confirmed my suspicions, because it added a mere 89,000 jobs in September, which was nicely under expectations for 150,000. In actual fact, skilled and enterprise companies shed 32,000 jobs! What occurred to all these openings? Because of this, shares rose and yields fell, reversing a number of the earlier day’s harm.

Finviz

Fed officers and market pundits who proceed to espouse “increased for longer” rates of interest must give attention to main indicators, precise knowledge, and the truth that the speed of inflation retains falling. They need to even be cognizant of the truth that the Fed’s price will increase work with a 6 to 12-month lag, which implies that the newest ones have but to press on the brakes of the financial system. Because of this buyers ought to be cheering financial power right this moment within the face of financial coverage headwinds as a result of the battle with inflation is essentially over. Excluding hire, the August CPI and core CPI had been 1.9% and a pair of.2%, respectively. Lease will increase are coming down dramatically. The Fed is completed, and price cuts are more likely to come subsequent 12 months earlier than the consensus expects.

Bloomberg

The payroll report from ADP is way extra vital than the JOLTS report we obtained the day earlier than. Not solely is the labor market cooling, opposite to what JOLTS suggests, however wage development continues to abate, as ADP indicated that annualized development slowed to five.9%, which was the twelfth consecutive month-to-month decline. The JOLTS report is simply vital to the extent that it serves as a number one indicator of labor market power. Clearly, the elevated variety of job openings just isn’t translating into power, as one would possibly anticipate. Due to this fact, Fed officers and market pundits must cease utilizing it as a motive to maintain charges “increased for longer.”

Because the argument that charges have to be elevated or stay excessive is undermined, the bears will shift focus to softer charges of financial development, which they warn results in recession. It’s already beginning to occur. The issue is that it is not within the numbers right this moment any greater than it was after they had been forecasting a recession one 12 months in the past.

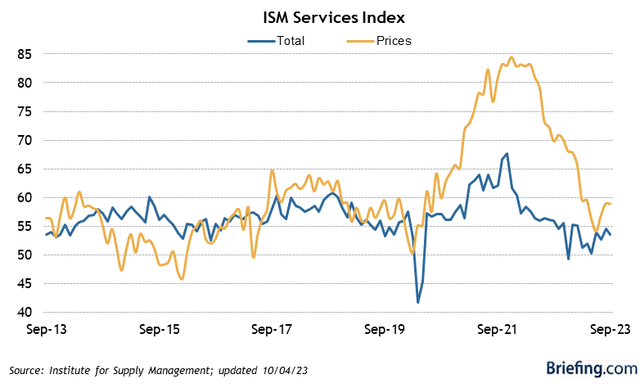

The Institute for Provide Administration reported that enterprise circumstances for the service sector weakened very modestly in September, with its index falling from 54.5% to 53.6%. It has ranged between 50-55% by means of all of 2023, and any quantity above 50% signifies development. Based on the survey, “the vast majority of respondents stay optimistic about enterprise circumstances.”

Briefing.com

This isn’t indicative of an impending recession. The labor market could also be weakening with fewer job additions and slower charges of wage development, however the unemployment price is close to a report low. Employees began realizing inflation-adjusted wage development over the previous three months for the primary time in practically two years. The financial system remains to be on observe for a delicate touchdown. Granted, long-term rates of interest have risen dramatically in a brief time period and that may additional sluggish development, however firms and the buyer are a lot much less delicate to modifications in rates of interest right this moment than they had been in prior enterprise cycles. I’ll clarify why in tomorrow’s transient.

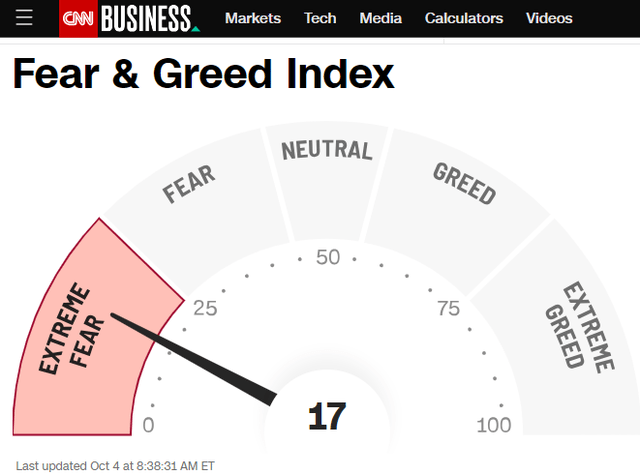

These details haven’t dissuaded the bear camp from fearmongering, which is way simpler throughout market corrections when volatility spikes and the costs of danger property fall. The proof could be seen in CNN’s extensively adopted Concern & Greed Index, which is at an excessive.

CNN

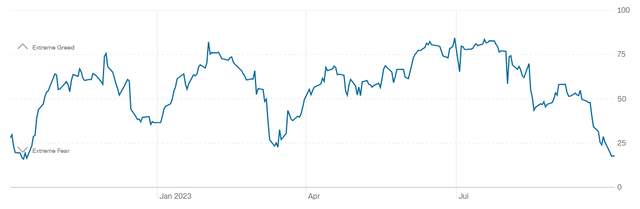

There have solely been two events over the previous 12 months when the Concern & Greed Index fell to a degree as little as it’s right this moment, which was in March of this 12 months and October of final 12 months. Each marked vital bottoms for the inventory market. I believe we’re forming one other vital backside right this moment.

CNN