Massimo Giachetti

AMC Leisure (NYSE:AMC) has a pathway to deleveraging as attendance continues to get well, however it must keep away from any bumps within the street.

Firm Profile

AMC owns and operates film theatres all through the US and Europe. The firm generates income by means of ticket gross sales, meals and beverage gross sales, and promoting. The corporate licenses movies from distributors owned by film manufacturing corporations, whereas exhibition prices are based mostly on a share of admissions income. The corporate additionally presents a month-to-month subscription service that permits visitors to see as much as three motion pictures per week.

On the finish of June, AMC operated 906 theatres with 10,120 screens. It had 184 IMAX screens within the U.S. and 33 in worldwide markets, whereas it had 158 Dolby Cinema screens within the U.S. and seven in worldwide markets. It additionally had 48 dine-in theatres within the U.S. with 667 screens, and it had 375 U.S. theatres that supplied alcohol. In worldwide markets, it had 3 dine-in theatres and supplied alcohol in 230 places.

AMC additionally owns 23.4 million items of Hycroft Mining Holding (HYMC), a gold and silver growth firm.

Alternatives and Dangers

The pandemic hit AMC’s enterprise as arduous as any firm, with the theatre operator seeing income fall -77% in 2020 to $1.24 billion. Whereas the corporate’s revenues have rebounded, they nonetheless nonetheless stay properly beneath the practically $5.5 billion the corporate was producing pre-pandemic, with revenues of simply $3.9 billion in 2022.

AMC may be very reliant on the film business and what Hollywood sends to the large display screen. The higher the film slate, the higher AMC sometimes does. Thus, an improved film slate is likely one of the largest alternatives for the corporate, as blockbuster motion pictures drive folks to the theatre. On that entrance, the corporate may really feel some stress down the street from the Hollywood writers’ strike, which might gradual some manufacturing and will push again some releases.

Within the close to time period, although, the corporate is trying to experience Taylor Swift mania, because the singer’s film about her Eras Live performance tour has already offered $100 million upfront international tickets earlier than it opens this Friday. For its half, AMC is displaying the film in 4,000 motion pictures theatres in North America, and the corporate has introduced that pre-sales for the film broke the corporate’s report for many single-day superior ticket gross sales with $26 million. Live performance-related motion pictures may show to be a driver, as subsequent month Beyonce may have her personal film hit theatres on the finish of November.

Now because the pandemic, the film business has modified considerably with the arrival of so many streaming companies vying for eyeballs, with the likes of Disney Plus, Max, Paramount, Peacock, and others trying to problem Netflix (NFLX). There’s a threat that film attendance doesn’t get again to pre-pandemic ranges due to this. Nevertheless, it does appear to be film corporations have realized that bringing massive finances motion pictures on to their streaming companies and skipping theatres economically isn’t one of the best transfer and that TV exhibits greater than motion pictures attract and preserve subscribers.

Outdoors of a greater Hollywood film slate and elevated attendance, driving premium ticket gross sales by means of the likes of IMAX and Dolby Cinema is one other alternative for the agency. These codecs have greater ticket costs and AMC is trying to proceed to broaden its IMAX and Dolby Cinema choices each within the U.S. and overseas. The corporate additionally has its personal personal label massive screens that it operates in some markets which are extra worth delicate.

Persevering with to improve its theatres with issues comparable to stadium seating, in addition to with dine-in theatres is one other alternative. Higher experiences have a tendency to herald transfer moviegoers, whereas dine-in theatres and theatres that serve alcohol have extra income alternatives. Meals and beverage gross sales are additionally very excessive margin.

Including further new, cutting-edge theatres is one other alternative. The corporate may also exit and purchase present theatres as properly. As well as, the corporate may profit from closing underperforming theatres as properly.

One the largest dangers AMC faces is its debt load. The corporate has all the time carried a good quantity of debt, however that solely elevated in the course of the pandemic because it struggled to remain in enterprise as admission fell off a cliff. With debt greater and income nonetheless not again to pre-pandemic ranges, leverage stays a problem. The corporate had $4.8 billion in debt towards $435.3 million in money and equivalents on its steadiness sheet. It additionally had one other $4.6 billion in working lease liabilities as properly. Adjusted EBITDA over the previous 12 months is $223.3 million, so leverage is almost 20x not together with its working lease liabilities.

AMC is also burning money, with working money circulation of -$203.3 million by means of the primary six months of the 12 months. Free money circulation was -$299.3 million.

Discussing the corporate’s outlook of its Q2 earnings name, CFO Sean Goodman mentioned:

“With the post-pandemic record-breaking second quarter behind us, our restoration to this point is obvious. Nevertheless, we’re not but able to declare victory. The field workplace stays round 16% beneath pre-pandemic ranges. And there is some draw back dangers with the continuing screenwriters’ and actors’ strikes. And with our fastened value construction and comparatively excessive debt-servicing prices, these are exacerbated by rate of interest will increase during the last 17 months, we proceed to burn money on the underside line. Primarily based on what we all know as we speak, we’re optimistic in regards to the the rest of the 12 months and we consider that the 2023 field workplace may exceed 2022 by greater than 20%. Nevertheless, if the strikes are extended or if our means to entry the capital markets is constrained, then our ongoing restoration glide path and our means to proceed to take the mandatory actions to strengthen our steadiness sheet and to make sure a full and sustained restoration could also be in jeopardy.”

That could be a fairly balanced assertion by the CFO, and demonstrates each its alternatives in addition to the dangers it faces.

Valuation

AMC at the moment trades round 27x the 2023 consensus EBITDA of $409 million and practically 21x the 2024 consensus of $528.3 million.

From an EBITDAR perceptive, it trades at about 9x 2023 EBITDAR and eight.2x 2024 EBITDAR.

The corporate isn’t projected to generate constructive new revenue any time quickly.

The corporate is projected to develop income practically 18% in 2023 to $4.65 billion, and three% in 2024 to $4.78 billion.

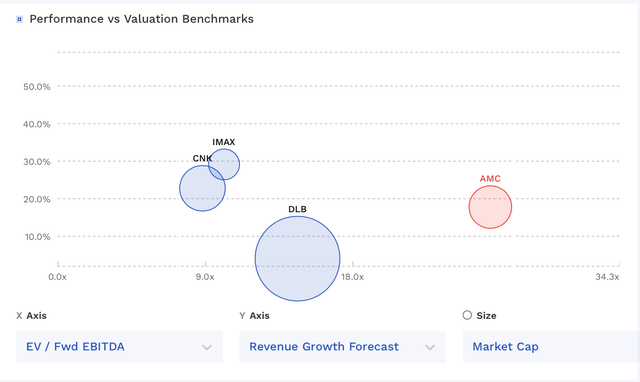

AMC at the moment trades at a premium to different film theatre associated corporations.

AMC Valuation Vs Friends (FinBox)

Conclusion

AMC has a fairly large debt drawback that it wants to beat. Leverage is astronomical and the corporate continues to burn money. If the enterprise was debt and lease free, it will be in fairly first rate form and be an fascinating field workplace restoration story. Nevertheless, curiosity and lease bills are simply consuming up all the corporate’s money producing skills in the mean time. AMC did increase $325.5 million with an fairness providing lately, however that also makes a fairly small dent into its debt load.

AMC is hoping to see attendance again to pre-pandemic ranges by 2025, with extra massive format screens boosting income above prior ranges. Even with greater curiosity expense, the corporate ought to nonetheless be capable of get to about $500 million in working money circulation if income will get again to these pre-Covid ranges. Then you can begin to see a deleveraging story begin to develop.

At this level, I’m a bit conflicted on the inventory. I can see the pathway to AMC turning into a deleveraging story, however there may very well be bumps alongside the best way as properly, particularly given future macro uncertainty. As such, I need to proceed to look at from the sidelines for now earlier than a clearer macro image develops given the debt dangers related to the title.