da-kuk

The case for China coming into a ‘steadiness sheet recession’ (a la Japan) is stronger than ever, following a slew of poor financial information in latest months and a faltering property market. Maybe the most effective rebuttal in opposition to a chronic downturn is China’s cash provide progress, which continues to run within the double digits (+10.3% YoY M2 progress in September), totally on the again of credit score growth from authorities bonds. From right here, although, Chinese language progress should be sustained with far much less state lending help, given the smaller remaining issuance quota. Financial easing and incremental fiscal measures may decide up some slack, nevertheless it appears doubtless, for my part, that total credit score progress will start decelerating within the coming months.

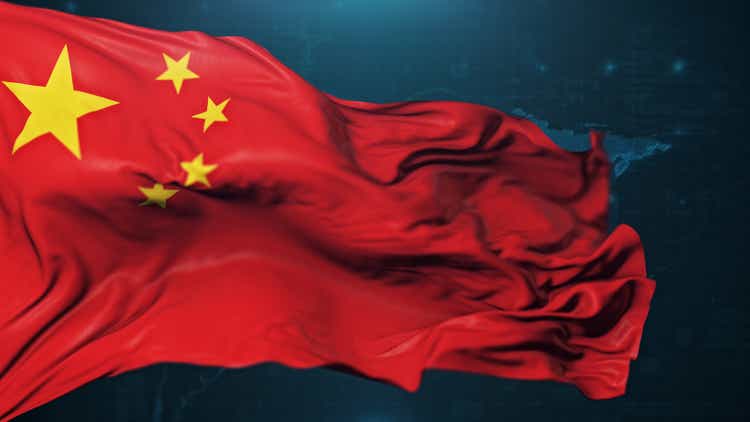

To be honest, among the pessimism has been priced in, and which may enchantment to discount hunters. However with out elementary enchancment, I’d hold a detailed eye on the ‘E’ in P/E, as earnings may nonetheless be revised meaningfully decrease from right here. Whereas I nonetheless like the patron/tech components of the SPDR S&P China ETF (NYSEARCA:GXC) as a beacon of resilience amidst the Chinese language storm (see prior protection right here), the remainder of the GXC portfolio might be extra ‘worth lure’ than ‘worth’ at this juncture. Internet, I’m turning impartial forward of the Nationwide Individuals’s Congress assembly later this month.

Fund Overview – A Broader Portfolio of Chinese language H-Shares

The State Avenue (STT) managed SPDR S&P China ETF tracks the market cap-weighted S&P China BMI Index, a basket of listed Chinese language shares accessible to overseas traders. GXC differentiates itself by primarily investing in Hong Kong-listed shares, which negates most of the dangers related to the variable curiosity entity possession constructions adopted by Chinese language depositary receipts listed within the US and globally.

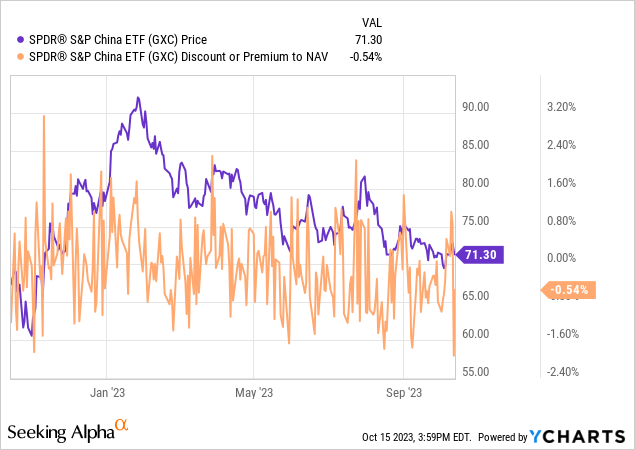

According to the more and more pessimistic view on China, GXC has seen one other quarterly decline in its web asset base to $845m (down from $1.1bn beforehand). The charge construction hasn’t modified, although, and the 0.6% expense ratio stays in keeping with comparable China large-cap ETFs just like the iShares MSCI China ETF (MCHI) however under the industry-leading 0.2% expense ratio supplied by the Franklin FTSE China ETF (FLCH) (see protection right here).

State Avenue

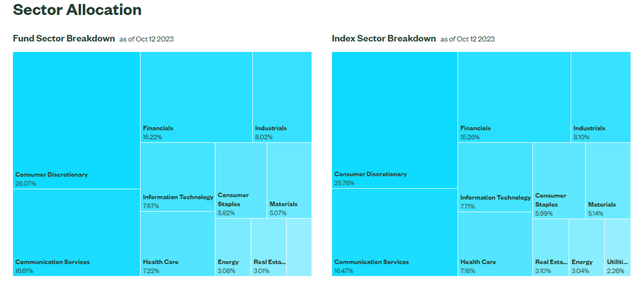

The GXC portfolio’s sector breakdown stays targeted on the Client Discretionary (26.1%) and Communication Providers (16.6%) sectors. The comparatively resilient Monetary sector additionally stays a staple holding at 15.2%, whereas Industrial has been the largest gainer over the past quarter at 8.0%, changing Info Expertise (7.7%) and Well being Care (7.2%).

State Avenue

The fund’s single-stock positioning is concentrated round China’s largest client/tech names like Tencent Holdings (OTCPK:TCEHY), Alibaba Group (BABA), PDD Holdings (PDD), and Meituan (OTCPK:MPNGF). Outdoors of client/tech, the relative resilience of main financial institution holdings like China Building Financial institution (OTCPK:CICHY) and Industrial and Business Financial institution of China (OTCPK:IDCBY) has additionally saved them within the prime ten checklist. Outdoors of Tencent and Alibaba (mixed ~17% publicity), the GXC portfolio is effectively unfold throughout an expanded 1.2k inventory portfolio (primarily H-shares), conserving the fund pretty well-diversified.

State Avenue

Fund Efficiency – Quarterly Decline Slows, Distribution Up

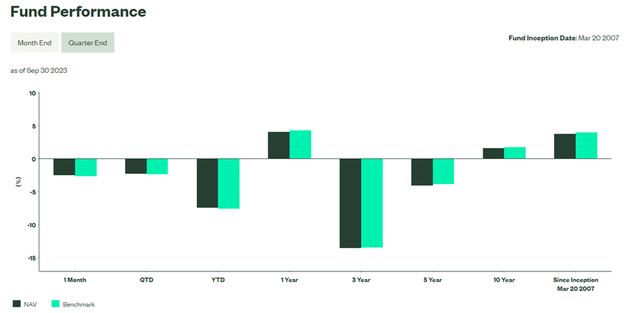

Q3 noticed a comparatively slower decline quarter-on-quarter, driving GXC’s whole NAV return to -7.4% for the 12 months (-7.5% YTD in marker value phrases). In tandem, the fund’s long-term annualized return profile has additionally decayed by 20bps, now standing at +3.8% every year since its inception in 2007. Nevertheless, the (semi-annual) distribution yield has elevated, reaching 2.9% on a trailing twelve-month foundation – effectively forward of comparable US-listed China funds. Having outpaced final 12 months’s run fee in H1, the ETF ought to exceed final 12 months’s $2.10/share distribution, a constructive restoration following a sequence of difficult COVID-impacted years.

State Avenue

Golden Week Ushers in Some Encouraging Information Factors

Chinese language information has lastly taken a flip for the higher, as vacation spending picked up throughout final week’s Nationwide ‘Golden Week’ vacation. Inflation (core CPI up 0.8% YoY; providers up 1.3% YoY) and commerce (narrowing decline in exports) had been additionally constructive, providing hope, notably on the consumption facet, for a better-than-expected progress final result this 12 months.

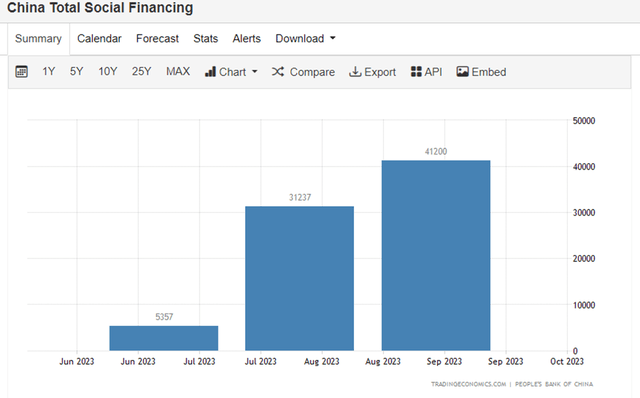

In my opinion, essentially the most encouraging information level was stronger-than-expected credit score information, helped by greater authorities bond issuances, together with bettering family and company mortgage progress. Together, this meant whole social financing progress (a proxy for Chinese language credit score and liquidity) accelerated from final month – a constructive shock given the declining property gross sales backdrop.

TradingEconomics

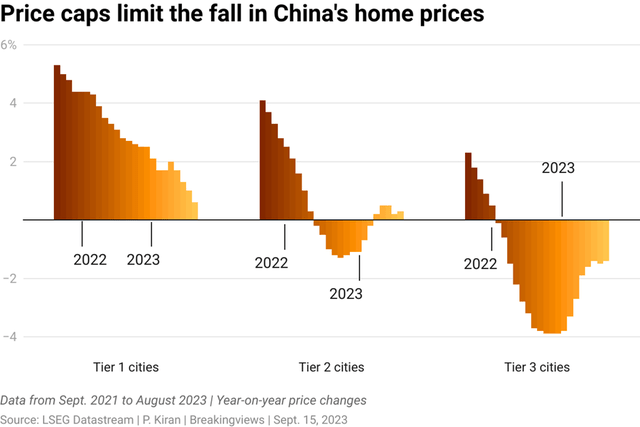

Going ahead, China is not at all out of the woods. The structural home property value weak spot (together with value caps) persists regardless of the incremental fiscal and financial easing measures in latest months. Given that ~70% of Chinese language family wealth is tied to property, the first concern is the potential knock-on results on combination demand and a possible ‘steadiness sheet recession’ situation.

Reuters

Exterior headwinds aren’t serving to both, because the one-two punch of ‘greater for longer’ charges globally and oil value spikes weigh on the demand outlook. With restricted headroom on native authorities steadiness sheets, this leaves the onus firmly on the central authorities’s willingness to develop its fiscal deficit to help the financial system. The upcoming coverage assembly later this month shall be key on this regard, although the offsetting threat of exacerbating structural imbalances means a large-scale stimulus catalyst for Chinese language equities is unlikely to materialize anytime quickly.

A Chinese language Stability Sheet Recession Looms Giant

It has been a surprisingly good Golden Week vacation for the Chinese language client, however I would not write off structural Japan-style financial considerations simply but. Credit score progress (presently at a double-digit YoY tempo) may face some headwinds via year-end as the federal government’s bond issuance runway narrows. With restricted offset from the financial facet, the place incremental fiscal/financial stimulus will doubtless be inadequate to offset a significant property reset, attaining the +5% progress goal shall be difficult.

To an extent, Chinese language equities are already priced for a bleak final result, having reversed most of the post-COVID positive factors. But, downward earnings revisions are gathering tempo, notably on the ex-tech/client facet, and the newest de-rate may show to be a ‘worth lure’ forward of an additional rebase in earnings expectations. Given the steadiness sheet constraints on the native authorities stage, the upcoming NPC standing committee assembly in all probability will not supply something game-changing however shall be value watching out for anyway.