One of many considerations concerning the resumption of pupil mortgage funds is that it may tank the U.S. financial system. Paying again pupil loans could trigger customers to cut back spending to the purpose of inflicting one other recession.

About 43.4 million Individuals have federal pupil loans, collectively amounting to $1.63 trillion of debt, in response to the Nationwide Scholar Mortgage Knowledge.

Based on the Federal Reserve Financial institution of New York knowledge, pupil mortgage debt accounted for roughly 11% of whole family debt, up from solely 3% in 2003.

These figures could seem to be quite a bit, however they don’t seem to be giant sufficient to trigger a big slowdown in GDP. Oxford Economics estimates the resumption of pupil mortgage funds will subtract 0.1% from GDP in 2023 and 0.3% in 2024. Different economists estimate related cuts as nicely.

Why Scholar Mortgage Repayments Will not Trigger A Recession

The final time I had pupil loans was between 2003-2007. I took out about $40,000 in pupil loans to attend enterprise college part-time at Berkeley (graduated in 2006). The typical rate of interest was about 4.5%.

Although my firm paid for 80+% of my college’s tuition, I nonetheless took out pupil loans as a option to enhance my liquidity and make investments. I do not advocate doing this until you’re a seasoned investor.

Fortunately, the inventory market did nicely till it imploded in 2008. However by then, I had already paid again all of my pupil loans.

Primarily based on my pupil mortgage debt historical past, I am sixteen years faraway from the method. Subsequently, I had a blind spot about pupil mortgage repayments which was revealed to me after a dialogue with one other dad or mum.

Listed below are 4 explanation why pupil mortgage repayments will not trigger one other recession. We may actually nonetheless go right into a recession. Nevertheless it will not be as a result of debtors instantly need to pay again their money owed.

1) Debtors have been paying again their pupil debt

I spoke to a dad or mum who went to medical college and is now a health care provider. We talked about doubtlessly shopping for west aspect actual property in San Francisco on condition that’s the place I believe the best alternative lies. He mentioned he is not be capable of purchase property simply but as a result of he is nonetheless working his means by pupil debt.

Once I informed him how nice it will need to have been to have their pupil debt fee paused, he talked about he and his spouse continued paying down their debt throughout the complete time!

Ah hah! Blind spot. I had assumed all pupil debt holders stopped repaying their debt starting in March 2020. Whereas the truth is, a great share of the 43.4 million Individuals with pupil mortgage debt continued with their repayments during the last 3.5+ years.

Given that is the case, the remaining funds and/or fee quantities will not be as giant as many worry. In spite of everything, there was a 3.5+-year interval the place pupil mortgage curiosity declined to 0%. A person’s pupil mortgage debt may solely have gone up in the event that they willingly took on extra debt.

With 3.5+ years of debt compensation, pupil mortgage debt holders have much less debt in the present day.

2) Scholar mortgage debtors saved and invested their additional money circulate

Financial idea states that we’re all rational actors long-term. Subsequently, all money circulate financial savings from not having to pay again pupil loans for 3.5 years have been both saved or invested.

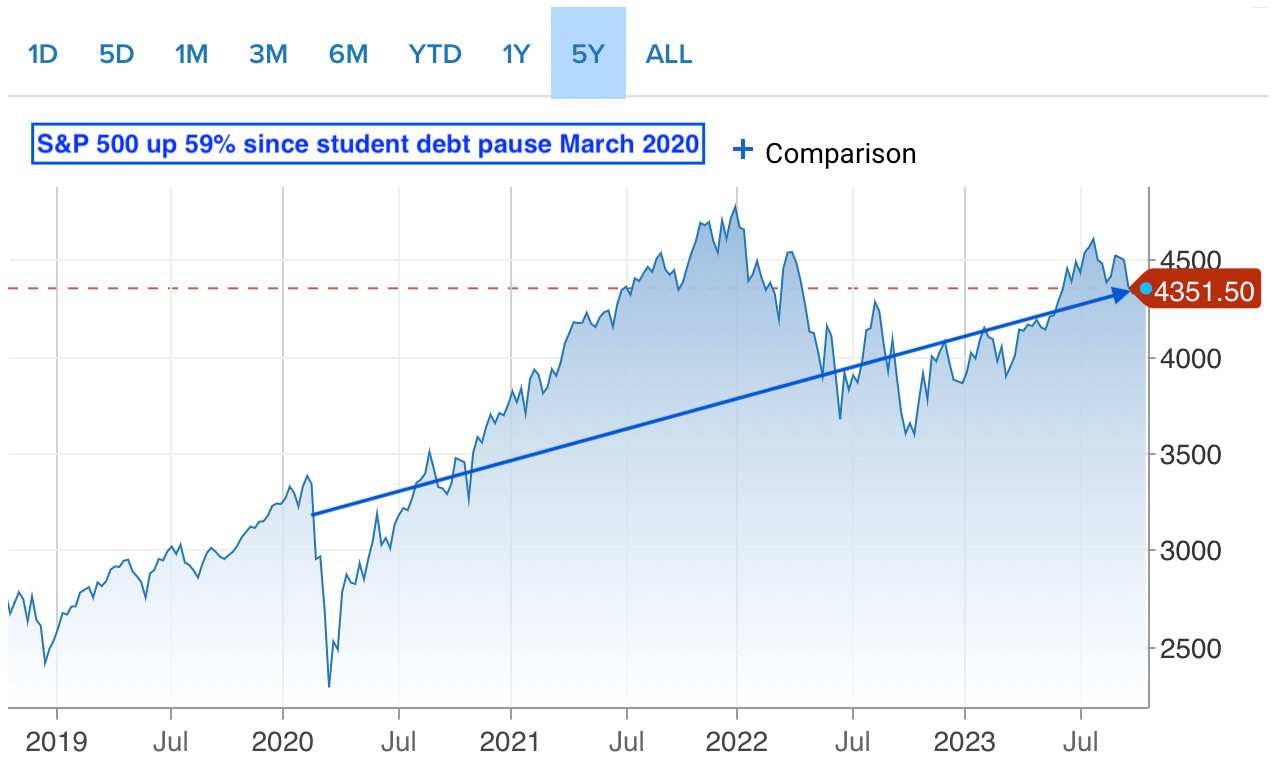

Since March 2020, the S&P 500 is up over 59% (2,700 to 4,300). In case you invested in actual property, your property can also be up between 10% – 60% un-leveraged. Subsequently, pupil mortgage debtors who saved and invested their pupil mortgage funds are wealthier in the present day.

Scholar mortgage debtors who saved and invested their additional money circulate can merely liquidate a few of their investments to pay their pupil loans if they want.

After all, not each pupil mortgage borrower saved and invested their additional money circulate. Loads of folks used the additional money circulate to pay for requirements or needs. However that is additionally an economically rational transfer. These folks deemed non-investment expenditure as extra necessary than funding expenditure.

3) The SAVE compensation plan

The Biden-Harris administration launched the SAVE Fee plan that has canceled thousands and thousands of loans value billions of {dollars}.

From the report, “The Biden-Harris Administration estimates that over 20 million debtors may gain advantage from the SAVE plan. Debtors can join in the present day by visiting StudentAid.gov/SAVE.”

Someway, the Biden-Harris administration has been in a position to efficiently cancel pupil mortgage debt regardless of the Supreme Court docket blocking Biden’s pupil mortgage forgiveness program in June 2023. Subsequently, as much as doubtlessly half of all pupil debtors could get additional reduction.

Extra authorities pupil debt reduction by an income-driven compensation plan will soften the blow of debt compensation. In consequence, client spending will not be negatively affected as a lot.

4) Individuals are making more cash and are wealthier 3.5 years later

Are you wealthier in the present day and incomes more cash than you have been in March 2020? Most individuals would say sure. Certain, inflation of products and companies has taken a big chunk out of the patron’s shopping for energy. Nonetheless, the vast majority of employees ought to not less than be incomes extra in the present day.

Take a look at all of the strikes in Hollywood, the auto trade, the media trade, the training trade, the transportation trade, and extra. Hanging employees are hammering out offers for 20%+ pay will increase.

UPS drivers are making $145,000 in the present day however will making $170,000 by the top of 2028. Not unhealthy!

Employees in all places are getting paid extra. With greater earnings and higher wealth, paying again current pupil mortgage debt needs to be simpler.

If You Are Struggling To Pay Again Scholar Debt

Sadly, all good issues should come to an finish. Getting a 3.5-year break with 0% curiosity and never having to pay was a pleasant reward. My hope is that most individuals took benefit by placing the additional money circulate to work.

For many who are struggling to renew paying again your pupil debt, this is what I would do.

First, undergo your funds and minimize out all non-necessities. Dinners out, pointless garments, live performance tickets, and holidays that require flying ought to all be eradicated. The pleasure you’ll expertise from being 100% pupil debt free will outweigh the enjoyment you obtain from spending on indulgences.

Second, put your self on a spend-less problem. Make it a recreation to see how a lot much less you possibly can spend every month. Begin with a ten% minimize general. Then carry on chopping by 10% each month till you possibly can’t take it anymore. Chances are you’ll be stunned by how simply you possibly can adapt. Use all financial savings towards paying down additional pupil debt.

Lastly, tackle a aspect hustle and use 100% of the earnings to pay down pupil debt. As quickly as you tether a transparent goal for work, work turns into rather more significant.

Do not Depend On The Authorities Without end

The one factor we are able to anticipate is extra authorities help sooner or later if issues get dire. Nonetheless, I would attempt to function your funds as if help by no means comes. This manner, you will be extra disciplined along with your funds. If help ever does come, the unanticipated assistance will really feel like an enormous bonus.

Personally, I am an enormous fan of paying much less for training since every little thing will be realized on-line at no cost. If you cannot get a big quantity from scholarships, keep away from attending an costly non-public college. Think about a public college or group school as an alternative.

The coed debt downside could also be too late for many people, however it’s not too late for our kids!

Reader Questions And Strategies

Do you suppose the resumption of pupil mortgage funds will tank the financial system? When you’ve got had pupil loans since March 2020, did you proceed to pay again your loans through the 3.5-year break? Are your earnings and wealth greater in the present day than it was since March 2020?

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and focus on a number of the most fascinating matters on this website. Please share, price, and assessment!

This is a associated podcast episode on pupil debt, entitlement mentality, and valuing a university diploma.

For extra nuanced private finance content material, be part of 60,000+ others and join the free Monetary Samurai e-newsletter and posts by way of e-mail. Monetary Samurai is without doubt one of the largest independently-owned private finance websites that began in 2009.