Shares of Roku (ROKU) – Get Free Report tanked 8% Wednesday after Wells Fargo analyst Steve Cahall lower his value goal for the corporate. Cahall, citing issues a couple of softening pattern within the advert marketplace for the fourth quarter, introduced his value goal right down to $70 from $84, and warned that Roku may expertise some pullback.

“We heard at our Promoting Day final month that scatter stays weak quarter-over-quarter, whereas Roku can even face a discount in media and leisure spend because of the ongoing Hollywood strikes,” he wrote, including that he expects weaker fourth-quarter steering as properly.

The analyst moreover projected that income per streaming hour will fall 8% year-over-year within the fourth quarter, and that platform income would are available at $780 million, beneath Road consensus.

Although Roku’s inventory is down about 17% over the previous quarter, shares of the corporate are up greater than 50% for the yr.

Shares of Roku rose greater than 2% after market open.

Analysts, on common, have given Roku a “maintain” ranking, with a mean value goal of $84.43.

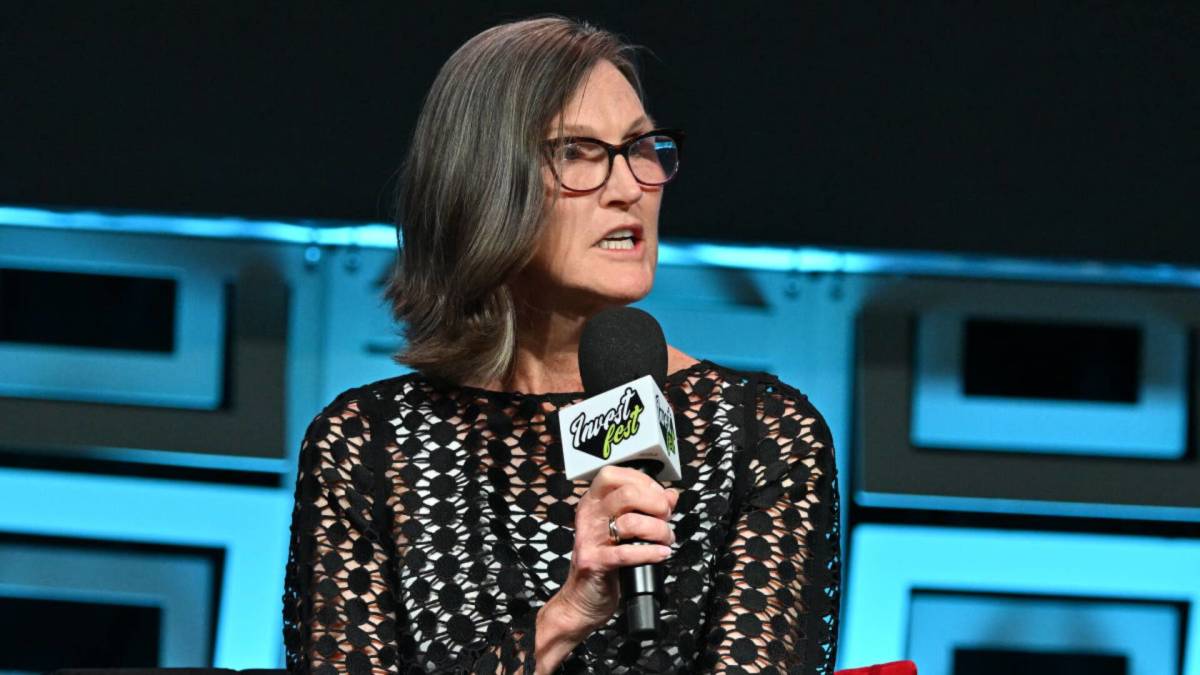

To Cathie Wooden of Ark Make investments, the dip offered a possibility to snap up extra shares in certainly one of her agency’s favourite shares. Ark’s flagship Innovation ETF picked up 104,393 shares of Roku Wednesday, a purchase order value round $6.5 million.

This brings the fund’s complete Roku holding as much as 7.62% of the fund, value simply shy of $500 million.

The corporate will announce its third-quarter outcomes Nov. 1.

Get funding steering from trusted portfolio managers with out the administration charges. Join Motion Alerts PLUS now.