PhonlamaiPhoto

In his 1865 ebook ‘The Coal Query’, economist William Stanley Jevons postulated that the invention of the steam engine, the good productiveness leap of the 19th century, wouldn’t merely result in a extra environment friendly and steady demand for the mining of coal. Reasonably, he advised (appropriately) that each time a step-up in productiveness development is achieved, it results in a spectacular enhance within the basic demand for vitality, as society seeks to leverage this nice new factor to lift its way of life.

In the present day, as we strategy a number of thrilling technological leaps, whether or not with synthetic intelligence or clear vitality, we anticipate to see a rise in demand for a key constructing block behind these leaps: metal. Nucor Company (NYSE:NUE), the most important and most diversified metal producer within the U.S., is that this week’s Lengthy Thought.

NUE presents high quality risk-reward given the corporate’s:

- place because the main home producer of metal amid rising demand,

- robust income development and enhancing profitability,

- constant money move technology,

- rising dividends and share repurchases and

- enticing valuation.

Metal Drives Clear Power Transition

Metal performs a vital position within the improvement of renewable vitality infrastructure and is the most recycled materials on the earth. The United Nations suggests that world renewable vitality capability must be doubled by 2030, which, in flip, will drive long-term demand for metal. The Worldwide Power Company (IEA) articulates this symbiotic relationship by stating, “metal wants vitality and the vitality system wants metal.”

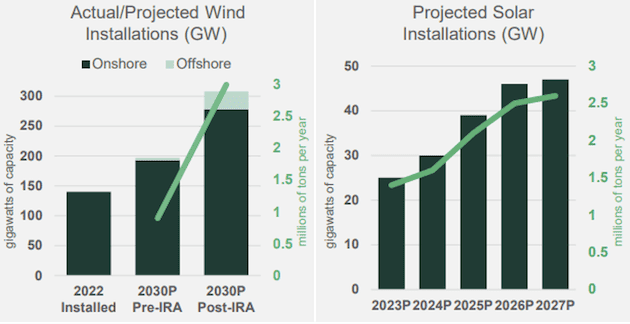

In response to Nucor’s analysis, the clear vitality transition within the U.S. alone is anticipated so as to add 2-3 Mtpa (million tons per 12 months) to metal demand. Determine 1 exhibits the anticipated development in wind and photo voltaic installations and the ensuing enhance in metal demand in thousands and thousands of tons per 12 months after accounting for the Inflation Discount Act (IRA).

Determine 1: Inexperienced Power Drives Elevated Metal Demand

Supply: Firm filings

Increasing to Meet Rising Demand

The IEA anticipates a major enhance in metal demand over the subsequent quarter century and past.

Nucor Company is actively investing in metal mill tasks to spice up manufacturing capability and meet the rising demand for metal. The corporate’s Nucor Metal Gallatin plant produced 365,000 tons in 1Q23 and is on observe to succeed in its full run-rate manufacturing of two.8 million tons per 12 months by the tip of 2Q23. This ramp-up, together with anticipated throughput and margins, positions Gallatin for profitability in 2Q23.

Moreover, Nucor Metal West Virginia is making progress in its development part, which is anticipated to final roughly two years after the receipt of all required permits. Though it’s nonetheless awaiting one federal allow, the undertaking’s up to date capital expenditure funds of $3.1 billion has already been introduced.

Within the metal plate division, Nucor Metal Brandenburg has continued to extend the manufacturing of its caster and rolling mill all through 1Q23. Boasting the most important caster within the western hemisphere, the plant is now focusing on a manufacturing of 500,000 tons in 2023. The Brandenburg plant is anticipated to show worthwhile by 4Q23.

In response to administration, these tasks are the results of a $14 billion capital marketing campaign that goals to double Nucor’s earnings energy from pre-pandemic ranges.

Fiscal Trifecta to Additional Drive Demand for Metal

Three key U.S. federal coverage initiatives may also enhance demand for metal: the Infrastructure Funding and Jobs Act (IIJA), the Inflation Discount Act (IRA), and the Creating Useful Incentives for the Manufacturing of Semiconductors (CHIPS) Act.

- The IIJA allocates $550 billion in new funding in direction of transportation and core infrastructure tasks. This laws is estimated to generate an incremental annual metal demand of 3-5 million tons every year (Mtpa). The preliminary wave of bridge tasks has already commenced, and the act stipulates transportation funding by means of 2026.

- The IRA has launched $370 billion in clear vitality tax incentives, one other potent driver of metal demand. The Biden administration’s goal of attaining 30 gigawatts of U.S. offshore wind capability by 2030 requires intensive infrastructure, which contributes to an anticipated 2-3 Mtpa of extra metal demand. This demand aligns with the greenhouse gasoline discount targets set by most giant utilities, which reinforces the trail to internet zero.

- The CHIPS Act, geared toward reshoring U.S. manufacturing, brings an extra supply of demand. With its allocation of $55 billion, the act is projected to fund over 30 superior manufacturing tasks over the subsequent decade and create an estimated 0.5 Mtpa in metal demand.

These federal initiatives, backed by almost $975 billion in funding, are projected to generate roughly 5-8 Mtpa in incremental annual metal demand over the approaching decade. In an attention-grabbing second-order impact, and in allusion to William Jevons’ concept in The Coal Query, administration says of the CHIPS Act and the ensuing semiconductor services:

“They’re going to supply the chips to our end-use Tier 1 automotive prospects, our HVAC prospects, and our heavy tools prospects which might be all ready for these, and we’re able to develop at that demand.”

Technological enhancements result in elevated demand, and the cycle feeds on itself.

Fiscal Trifecta Diminishes Buyer Focus Threat

Nucor is the most important metal producer within the U.S., and it additionally sells to prospects situated in Canada and Mexico. This gross sales combine might pose some buyer focus threat provided that Asia is projected to be the most important consumer of metal merchandise on the earth, adopted by Europe after which North America. Nevertheless, any threat of Nucor lacking out on demand in different elements of the world just isn’t solely mirrored in its inventory worth (after which some) but in addition diminished by the fiscal coverage initiatives famous above.

Cyclicality Extra Than Priced In

The cyclical nature of the metals business can’t be ignored when discussing an organization comparable to Nucor. Metal demand usually will increase throughout financial booms and falls throughout recessions. Nevertheless, Nucor, by means of its low-cost manufacturing and adaptability to regulate manufacturing to effectively match demand, has confirmed its potential to stay worthwhile all through financial cycles.

Since 1998, Nucor has generated optimistic NOPAT and return on invested capital (ROIC) in all however one 12 months, 2009.

Regardless of the constantly worthwhile enterprise operation, Nucor is priced as if its income will completely decline by 50% from present ranges, an expectation that doesn’t match the truth of administration’s projections or third-party evaluation of the metal business.

Engaging Dividend and Repurchase Yield

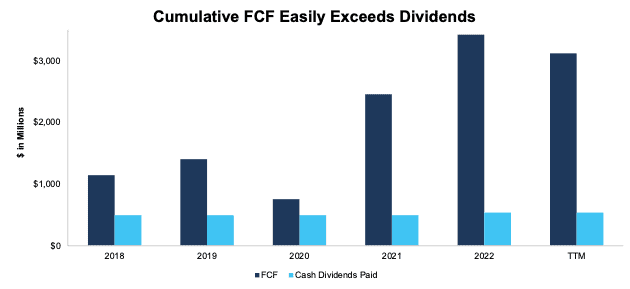

During the last three fiscal years, Nucor has returned roughly half of its internet earnings to shareholders through dividends and share repurchases. In truth, 1Q23’s dividend fee was Nucor’s 200th consecutive quarterly dividend. Since 2018, the corporate has paid $2.6 billion (7% of the present market cap) in cumulative dividends and has elevated its quarterly dividend from $0.38 per share in March 2018 to $0.51 per share in Could 2023. The corporate’s present dividend, when annualized, offers a 1.4% yield.

Nucor additionally returns capital to shareholders by means of share repurchases. From 2018 to 2022, the corporate repurchased $7.2 billion (19% of the market cap) value of inventory, of which $2.8 billion was repurchased in 2022.

In Could 2023, the corporate’s board of administrators authorised a $4.0 billion share repurchase plan, on the firm’s discretion and with no expiration date. Ought to the corporate repurchase shares at its 2022 price, the buybacks would offer an extra 7.4% annual yield at Nucor’s present market cap. Combining share repurchases with a present dividend yield of 1.4% might give buyers an 8.8% yield on their shares.

Additionally it is vital to notice that Nucor’s free money move simply exceeds its common dividend funds. From 2018 to 2022, Nucor generated $9.1 billion in FCF whereas paying $2.5 billion in dividends. See Determine 2.

Determine 2: Nucor’s Free Money Circulation Vs. Money Dividends Paid: 2018-TTM

Sources: firm filings

Enhancing Fundamentals

Nucor has generated optimistic NOPAT in 24 of the previous 25 years (2009 being the one exception).

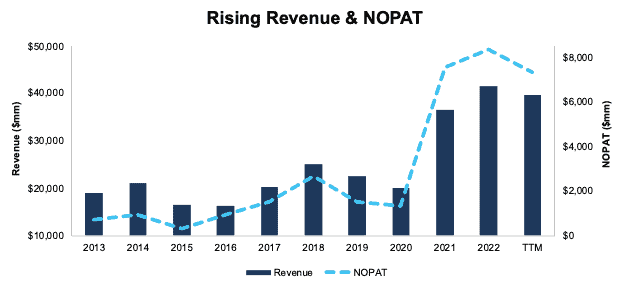

The corporate has grown income and NOPAT by 14% and 35% compounded yearly, respectively, since 2017. The corporate’s NOPAT margin improved from 8% in 2017 to 18% within the trailing twelve months (TTM), whereas invested capital turns remained unchanged at 1.5 over the identical time. Rising NOPAT margins drive the corporate’s return on invested capital from 11% in 2017 to 27% within the TTM. See Determine 3.

Determine 3: Nucor’s Income and NOPAT: 2013-TTM

Sources: firm filings

Robust and Rising Free Money Flows

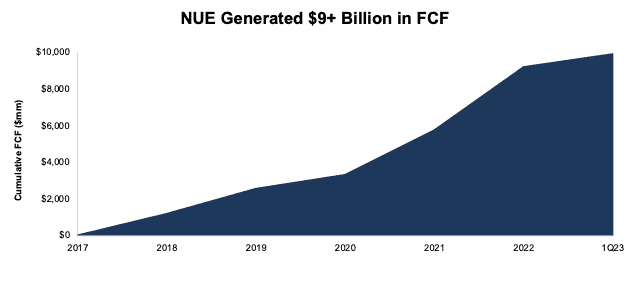

Per Determine 4, Nucor has generated a cumulative $9.9 billion in FCF since 2017, which represents 21% of its enterprise worth. Nucor’s giant and rising free money move (FCF) exhibits the corporate’s potential to broaden capability whereas working a really worthwhile enterprise.

Determine 4: Nucor’s Free Money Circulation, 2017–TTM

Sources: Firm filings

Superior Profitability

Not solely does Nucor function in an business going through rising demand, however the firm additionally manufactures metal at a decrease value than its rivals. Nucor makes use of scrap metal in its electrical arc furnaces (EAF), which lowers total prices and produces an finish product with a decrease carbon footprint. Be aware that EAF know-how is uneconomical for different giant rivals (comparable to Vale) as a result of a scarcity of availability of scrap metal and an abundance of iron ore, which favors conventional steelmaking strategies.

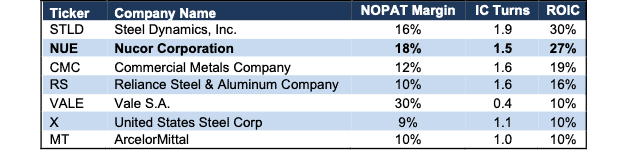

Accordingly, Nucor boasts superior profitability in comparison with its publicly traded friends. The corporate’s ROIC of 27% is second solely to Metal Dynamics, Inc. (STLD) in a peer group that features United States Metal Corp. (X), ArcelorMittal (MT), and different giant supplies firms. See Determine 5.

Determine 5: Nucor’s Profitability vs. Friends: TTM

Sources: Firm filings

Shares Have 30% Upside on the Present Worth

At its present worth of $150/share, Nucor has a price-to-economic ebook worth (PEBV) ratio of 0.5, which implies the market expects income to completely fall 50% from present ranges. Beneath, we use our reverse discounted money move (DCF) mannequin to additional quantify how low the expectations baked into Nucor’s inventory worth are. We additionally current the upside potential within the inventory if the corporate grows NOPAT beneath historic development charges.

DCF Situation 1: to Justify the Present Inventory Worth

We assume Nucor’s

- NOPAT margin falls to 10.7% (from 18% within the TTM and five-year common of 13%), and

- Income falls at consensus charges in 2023 and 2024 and by no means grows once more by means of 2032 (in comparison with 14% compound annual development since 2017).

On this state of affairs, Nucor’s NOPAT would fall 8% compounded yearly by means of 2032, and the inventory can be value $150/share right now, equal to the present worth. For reference, Nucor has grown NOPAT by 35% compounded yearly since 2017 and 18% compounded yearly since 2002.

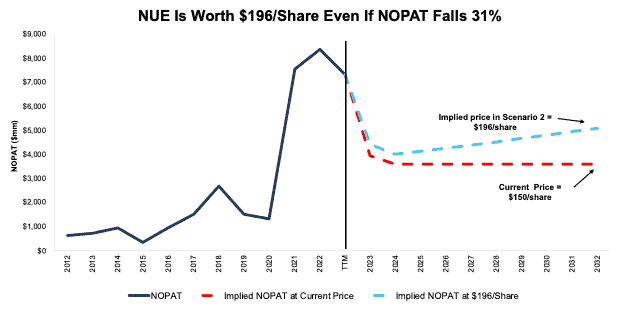

DCF Situation 2: Shares Have 31%+ Upside Even Assuming Massive Drop in Earnings

If we assume Nucor’s

- NOPAT margin falls to 12% (nonetheless beneath its 5-year common of 13%) from 2023 to 2032.

- Income grows at consensus estimates in 2023 (-14%) and 2024 (-6%), and

- Income grows 3% compounded yearly from 2025 to 2032 (versus 7% compounded yearly since 2012), then

NUE can be value at the very least $196/share right now – a 31% upside to the present worth. On this state of affairs, Nucor’s NOPAT nonetheless falls 5% compounded yearly over the subsequent decade and, in 2032, is simply over two-thirds its 2022 stage.

Ought to Nucor develop income extra in keeping with historic ranges, the inventory has much more upside. Determine 6 compares Nucor’s historic NOPAT to the NOPAT implied in every of the above DCF eventualities.

Determine 6: Nucor’s Historic and Implied NOPAT: DCF Valuation Eventualities

Sources: firm filings.

Sustainable Aggressive Benefits Will Drive Shareholder Worth Creation

Right here’s a abstract of why we expect the moat round Nucor’s enterprise will allow it to proceed to generate increased NOPAT than the present market valuation implies.

- distinctive place because the main producer of metal within the U.S.,

- extra environment friendly value construction based mostly on EAF know-how,

- robust income and margin development and

- increasing capability to satisfy rising demand.

What Noise Merchants Miss with Nucor

As of late, fewer buyers concentrate on discovering high quality capital allocators with shareholder-aligned company governance. As a result of proliferation of noise merchants, the main focus is on short-term technical buying and selling traits whereas extra dependable basic analysis is ignored. Right here’s a fast abstract of what noise merchants are lacking:

- the clear vitality transition drives a major enhance within the demand for metal,

- Nucor’s market management positions it to develop market share amid rising demand and

- robust public assist for infrastructure spending additionally drives long-term demand for metal.

Earnings Beats Might Ship Shares Greater

Nucor has overwhelmed earnings estimates in eight of the previous 10 quarters and doing so once more might ship shares increased. Past earnings beats, the market’s recognition of the importance of metal demand within the clear vitality transition, in addition to the avalanche of public funding that’s coming on-line to fund steel-intensive tasks, might ship shares increased as effectively.

Government Compensation Is Aligned With Shareholders’ Pursuits

Traders ought to favor firms with government compensation plans that instantly align executives’ pursuits with shareholders’ pursuits. High quality company governance holds executives accountable to shareholders by incentivizing them to allocate capital prudently.

Along with base wage, Nucor’s executives obtain annual incentives which might be awarded partly based mostly on return on common invested capital, the same metric to ROIC.

Tying government compensation to ROIC, or the same measure, ensures that executives’ pursuits are extra aligned with shareholders’ pursuits as there’s a robust correlation between enhancing ROIC and growing shareholder worth.

Given administration has an actual curiosity in creating shareholder worth, it ought to come as no shock that Nucor has grown financial earnings, the true money flows of the enterprise, from $611 million in 2017 to $5 billion within the TTM.

Insider Buying and selling and Brief Curiosity Tendencies

Over the previous 12 months, insiders have bought 407,849 shares and have offered 180,218 shares for a internet impact of 227,631 shares purchased. These gross sales signify lower than 1% of shares excellent.

There are at present 6.0 million shares offered quick, which equates to three% of shares excellent and 4 days to cowl. The shortage of great quick curiosity reveals not many are keen to take a stake in opposition to this extremely worthwhile firm.

Engaging Funds That Maintain NUE

The next funds obtain an Engaging-or-better ranking and allocate considerably to NUE:

- VanEck Metal ETF (SLX) – 6.9% allocation and Very Engaging ranking

- iShares U.S. Primary Supplies ETF (IYM) – 4.8% allocation and Engaging ranking

- First Belief Supplies AlphaDEX Fund (FXZ) – 4.8% allocation and Very Engaging ranking

- State Road SPDR S&P Metals & Mining ETF (XME) – 4.3% allocation and Engaging ranking

- State Road Supplies Choose Sector SPDR Fund (XLB) – 4.1% allocation and Engaging ranking

- Alpha Architect U.S. Quantitative Worth ETF – 2.0% allocation and a Very Engaging ranking.

This text was initially revealed on June 22, 2023.

Disclosure: David Coach, Kyle Guske II, and Italo Mendonca obtain no compensation to put in writing about any particular inventory, type, or theme.