Vanadium would not get fairly as a lot consideration as different important and battery metals, but it surely ought to.

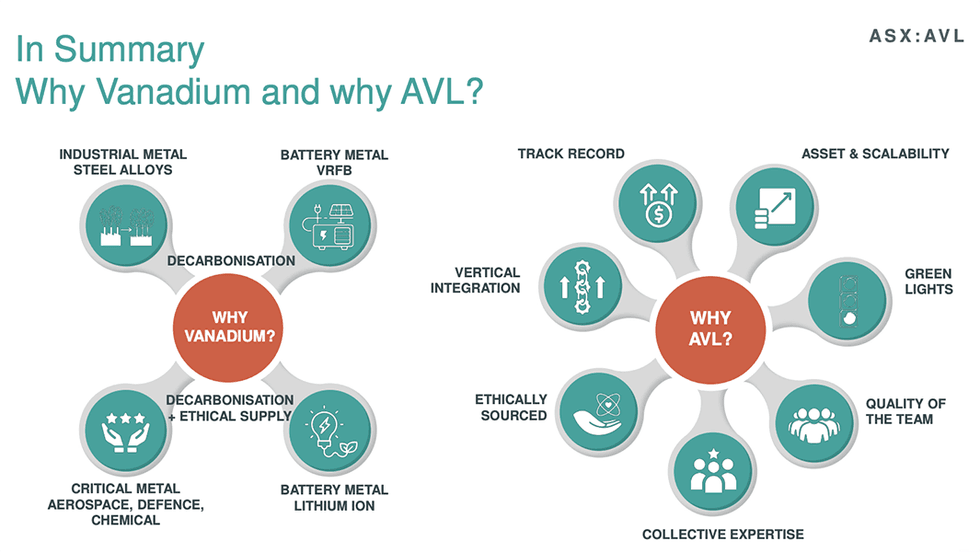

Immune to breakdown from each acid and salt, it provides appreciable energy, warmth resistance and toughness to metal when alloyed. Unsurprisingly, these traits have made vanadium a important mineral for protection purposes, notably as vanadium want solely be current in small quantities to impart its advantages. For the previous twenty years, demand for the metallic within the metal sector has steadily elevated. With the current push for clear vitality and net-zero emissions, that demand is about to rise exponentially.

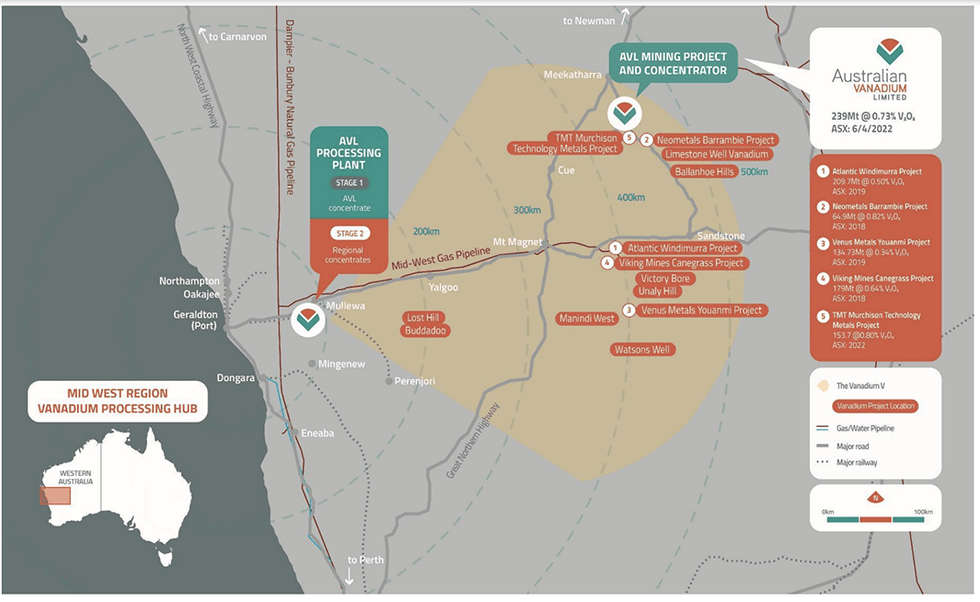

Australian Vanadium (ASX:AVL, FRA:JT71, OTC:ATVVF), which holds one of the superior high-grade vanadium deposits on the earth, has positioned vital concentrate on growing its Australian Vanadium Venture, a high-grade vanadium, titanium and iron useful resource located roughly 43 kilometers south of the mining city of Meekatharra in Western Australia.

Vanadium’s potential goes effectively past building metal. The metallic can be used extensively in a number of industries, together with aerospace, protection and as a chemical catalyst. What’s most notable, nevertheless, is vanadium’s standing as a battery metallic, particularly one suited to long-term, large-scale vitality storage.

Not at all a brand new expertise, the vanadium redox circulation battery (VRFB) was first invented in 1984 on the College of New South Wales in Australia. Early VRFBs needed to be the dimensions of roughly one to 2 basketball courts to adequately carry out, however the expertise has been refined over time since and at this time’s VRFBs are solely a 3rd of the dimensions of their colossal predecessors, with a considerably greater vitality capability.

As companies and governments search battery storage for large-scale use instances, demand is predicted to extend additional, with the VRFB market accounting for greater than ten % of all vanadium manufacturing by the top of 2023. Demand for vanadium is predicted to double by 2032, with 90 % of this demand pushed by VRFBs.

Australian Vanadium can be working to domesticate Australia’s burgeoning VRFB market, by means of its wholly owned subsidiary VSUN Power. VSUN Power’s present initiatives embrace the set up of a VRFB to energy an industrial chlorinator, as a standalone energy system for a bore pump at a significant nickel mission, and to energy the programs at an orchard in Victoria. VSUN Power can be consulting with a number of main mining shoppers.

The key part of a VRFB is vanadium electrolyte. This answer of vanadium combined with acid and water shall be manufactured by AVL at a facility being constructed within the Perth area.

Each VSUN Power and the AVL are a part of Australian Vanadium’s vertically built-in technique, by means of which it intends to assist each stage of VRFB manufacturing. This can, the corporate maintains, give it the flexibility to not solely produce the world’s highest-quality vanadium, but additionally tailor that vanadium to its prospects’ wants.

Situated in Western Australia’s Murchison Province, the Australian Vanadium Venture (AVL) consists of 15 tenements overlaying roughly 200 sq. kilometers. Upon completion, the mission will encompass an open lower mine and a processing plant close to the port metropolis of Geraldton. Australian Vanadium can be setting up an electrolyte manufacturing facility which is slated to start manufacturing within the latter a part of 2023.

Located in Perth, the 33MWh every year plant will leverage confirmed expertise sourced from US Vanadium LLC. Australian Vanadium has accomplished an in depth design schematic and ordered lengthy lead gear for the plant.

As one of many world’s most superior in-development vanadium initiatives, the AVL Venture has nationwide strategic significance to Australia’s important mineral provide chains. To that finish, the mission has been acknowledged by each the Australian federal authorities and the Western Australian authorities, receiving a number of grants for a mixed complete of roughly $49 million.

The AVL deposit consists of a basal large magnetite zone overlaid by 5 lower-grade mineralized magnetite-banded gabbro items, every of which is between 5 and 30 meters thick. Vanadium mineralization may be present in each the huge magnetite horizon and the lower-grade gabbro horizons. The deposit is additional divided into kilometer-scale blocks by a sequence of regional scale faults; the blocks present little signal of inside deformation and powerful consistency in layering.

In late April 2023, Australian Vanadium’s processing plant was authorized by the town of Larger Geraldton, pushing the crushing, milling and beneficiation plant one step nearer to commencing building. As soon as accomplished, the plant together with the mine will present high-purity vanadium oxide and an iron-titanium co-product.

Venture Highlights:

- Authorities-recognized: In recognition of its nationwide significance, the AVL Venture was awarded Federal Main Venture Standing by the Australian authorities in September 2019. It was additionally awarded State Lead Company Standing by the Western Australian Authorities in April 2020.

- Promising Feasibility Research Outcomes: In response to a bankable feasibility research launched on April 6, 2022, the mission comprises 239 million tons (Mt) at 0.73 % vanadium pentoxide (V2O5) consisting of:

- measured mineral useful resource of 11.3 Mt at 1.14 % V2O5

- indicated mineral useful resource of 82.4 Mt at 0.70 % V2O5

- inferred mineral useful resource of 145.3 Mt at 0.71 % V2O5

- Excessive-grade Magnetite: Australian Vanadium’s preliminary evaluation of the mission additionally signifies the presence of a definite large magnetite high-grade zone of 95.6 Mt at 1.07 % V2O5.

- Different Minerals: Along with vanadium, the AVL mission additionally comprises estimated cobalt, nickel and copper sources.

- Broad Focus: Moderately than solely focusing on the battery market, Australian Vanadium intends to serve all sectors that require the important metallic. This consists of the metal, titanium master-alloy, aerospace and specialty chemical substances markets.

- Sustainable Manufacturing: Australian Vanadium intends to function its mine ethically and with a low-carbon footprint by means of using photo voltaic and wind technology together with electrical or green-hydrogen-fueled autos.

- Longevity and Scalability: As soon as operational, the mine can have an estimated lifespan of greater than 25 years, whereas the configuration of the processing facility will permit the corporate to shortly scale manufacturing as obligatory.

Administration Staff

Cliff Lawrenson – Non-executive Chair

Cliff Lawrenson has greater than 10 years of expertise as a non-executive chair and non-executive director in each private and non-private corporations. He’s presently non-executive chair of Paladin Power Ltd (ASX:PDN) and Caspin Assets (ASX:CPN) and non-executive chair of privately owned Pacific Power Restricted and Onsite Rental Group.

Lawrenson was managing director of Atlas Iron Ltd from 2017 and led the corporate to its acquisition by Hancock Prospecting Pty Ltd. Previous to Atlas Iron, Lawrenson served as managing director of a variety of ASX-listed corporations within the mining and mining providers sectors. Lawrenson was additionally a senior government of CMS Power Company in the USA of America and Singapore, preceded by an funding banking profession.

Graham Arvidson – Chief Govt Officer

Graham Arvidson has 18 years of expertise within the minerals sector spanning feasibility, analysis, profitable improvement and operation of mineral belongings globally and throughout a broad vary of commodities together with deep expertise in vanadium, lithium, nickel and different future-focused battery metals.

Arvidson has confirmed mission improvement experience, a deep Western Australian mission improvement community particular to mining, business acumen borne of managing contracts from each the shopper and contractor facet and in depth mission administration expertise in tendering, negotiation, conforming and managing O&M, EPC, EPCM, EPC-O and BOO types of mission supply.

Todd Richardson – Chief Working Officer

Todd Richardson BSc ChE MBA is an professional in vanadium course of design, commissioning and operations with over 20 years’ expertise in vanadium. He has an intensive background in operations administration and technical providers each within the USA and Australia in all phases of plant operation – course of design by means of commissioning, ramp up and operation. Richardson leads the event of AVL’s world-class vanadium mission.

Tom Plant – Chief Monetary Officer

Tom Plant is a seasoned chartered accountant and finance government with virtually 30 years of expertise in varied company and business roles. He has a robust background in debt and fairness funding options, funding analysis and company transactions. Plant just lately served as interim CFO at Leo Lithium, which developed the Goulamina Lithium Venture in Mali. Previous to that, he was the CFO at Firefinch and spent 10 years at world mineral sands and uncommon earths producer Iluka Assets. He held varied positions in funding banking {and professional} providers with Macquarie Group, Dresdner Kleinwort Wasserstein and Arthur Andersen.

Daniel Harris – Technical Director

Daniel Harris is a vanadium trade veteran and has an understanding of the useful resource sector from each a technical and monetary perspective. He’s presently non-executive director of US Vanadium LLC, Queensland Power & Minerals (ASX:QEM) and Flinders Mines (ASX:FMS). He’s an advisory board member and vanadium guide for Blackrock Metals.

Earlier roles embrace interim CEO and managing director at Atlas Iron; chief government & working officer at Atlantic; vice-president and head of vanadium belongings at Evraz Group; managing director at Vametco Alloys; common supervisor of vanadium operations at Strategic Minerals Corp and appearing as an unbiased technical and government guide to GSA Environmental Restricted in the UK.

Miriam Stanborough – Non-executive Director

Miriam Stanborough is a chemical engineer with over 20 years of expertise within the mineral processing trade throughout a variety of commodities. She has held senior roles at Monadelphous, Iluka Assets, Alcoa and WMC Assets. Her ability base spans innovation and expertise, technical improvement, manufacturing administration, mission administration, enterprise enchancment and folks and tradition.

Stanborough is presently a non-executive director of Pilbara Minerals Restricted (ASX:PLS), BCI Minerals Restricted (ASX:BCI), chair of the Minerals Analysis Institute of Western Australia (MRIWA), deputy chair of the Northern Agricultural Catchments Council (NACC), and a director of Scouts WA.

Peter Watson – Non-executive Director

Peter Watson is a chemical engineer with 40 years of expertise in senior technical, mission and administration roles along with company expertise working ASX-listed corporations. He has vital board-level expertise, notably concerning security, governance, monetary reporting, danger administration and technique.

Watson is presently a non-executive director of Paladin Power Ltd (ASX:PDN), New Century Assets (ASX:NCZ) and Strandline Assets Restricted (ASX:STA).

Neville Bassett – Firm Secretary

Neville Bassett is a Chartered Accountant working his personal company consulting enterprise, specializing within the space of company, monetary and administration advisory providers. Bassett has been concerned with quite a few public firm listings and capital raisings.

His involvement within the company area has additionally taken in mergers and acquisitions and consists of vital data and publicity to the Australian monetary markets.

Bassett has a wealth of expertise in issues pertaining to the Firms Act, ASX itemizing necessities, company taxation and finance. He’s a director or firm secretary of a variety of private and non-private corporations.

Louis Mostert – Chief Authorized and Compliance Officer, Joint Firm Secretary

Louis Mostert has over 20 years of expertise in mission contracting and finance, company advisory, mergers and acquisitions, insurance coverage administration, dispute decision, work well being and security, employment and industrial relations, mental property, company governance and compliance.

Mostert graduated from the College of Western Australia with a Bachelor of Engineering (Hons) and a Bachelor of Legal guidelines (Hons) and has a Diploma of Utilized Company Governance from the Governance Institute of Australia. He’s admitted as a barrister and solicitor of the Supreme Courtroom of Western Australia, a fellow of the Chartered Institute of Secretaries, a fellow of the Governance Institute of Australia and a member of the Institute of Firm Administrators.

Samantha McGahan – VSUN Power Supervisor

Samantha McGahan BEd (Hons) GAICD has over 25 years expertise in a various vary of industries spanning schooling, legislation and expertise. She has led the event of VSUN Power since 2016 and fosters a robust community in each vanadium and vitality markets. Samantha is skilled in advertising and leads each AVL and VSUN Power’s social media and advertising methods.