Context for October:

Important Avenue exercise steadies to pre-pandemic ranges, as employees really feel more and more safe at work and issues over the financial system decline.

This enchancment alerts Important Avenue is heading in the direction of a powerful vacation season, which can set them up for the New 12 months.

Whereas the Fed deliberate price hikes, Important Avenue is stabilizing in keeping with prior years, marking a turning level in financial stability. In the meantime, small enterprise groups are extra assured in regards to the well being of their companies. Homebase seeks to know how the broader financial setting is affecting small companies and their workers throughout October by analyzing behavioral information from greater than two million workers working at multiple hundred thousand SMBs.

Important Avenue at a look:

Whereas inflation stays high of thoughts, financial anxieties amongst hourly employees dipped in October. Knowledge confirmed diminished concern round inflation, a attainable recession and unemployment. Staff really feel extra assured and safe of their jobs.

The previous three years have examined Important Avenue, however we’re seeing enhancements and a return to normalcy. Core indicators, like workers working and hours labored, are lastly returning to pre-pandemic ranges.

- Continued wage inflation has the vast majority of employees glad with their compensation. Non-wage elements, like schedule flexibility and workforce relationships, are high motivators for deciding the place to work for many hourly workers.

- Core indicators present an anticipated October slowdown in employment exercise throughout industries. Leisure, particularly, has gained stability, steadying to pre-pandemic ranges.

- Staff are much less apprehensive in regards to the financial system, signaling confidence in Important Avenue exercise and job safety. Most employees notice the rising price of products, but issues over inflation dipped.

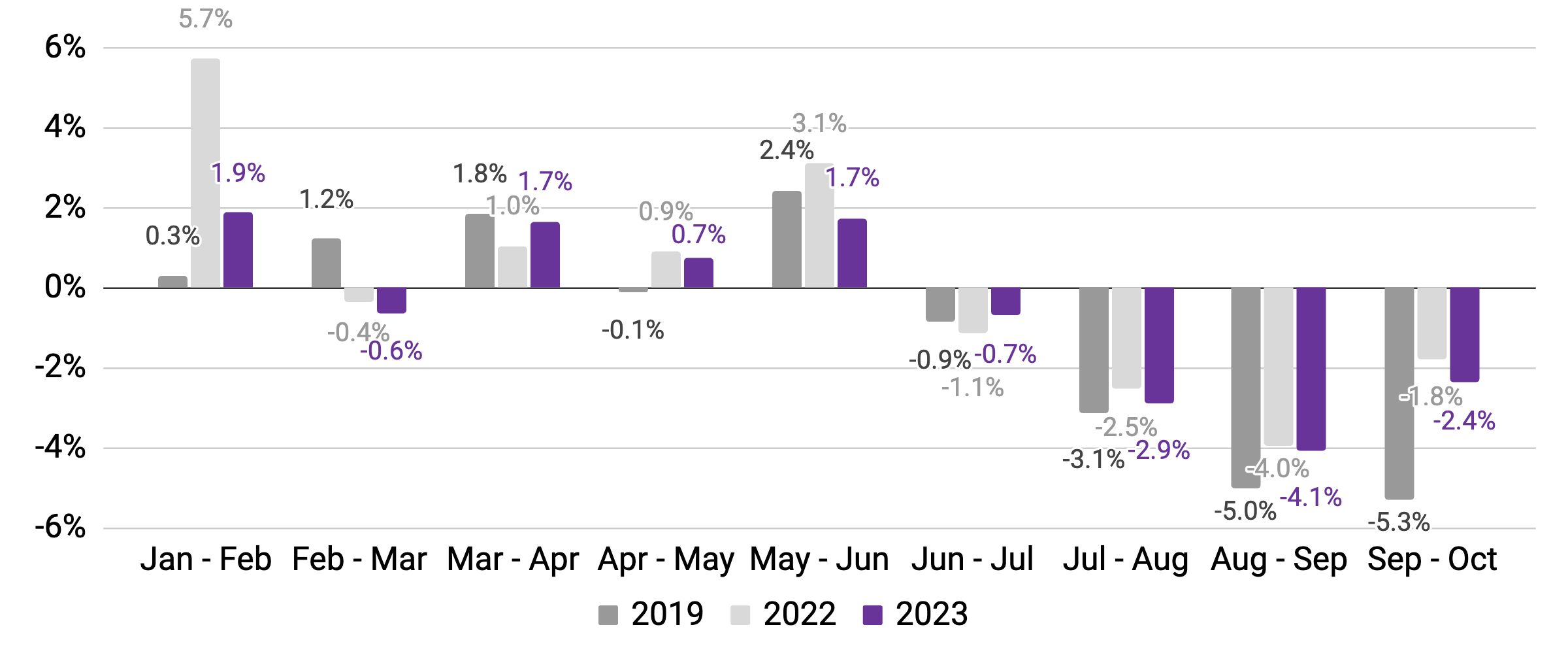

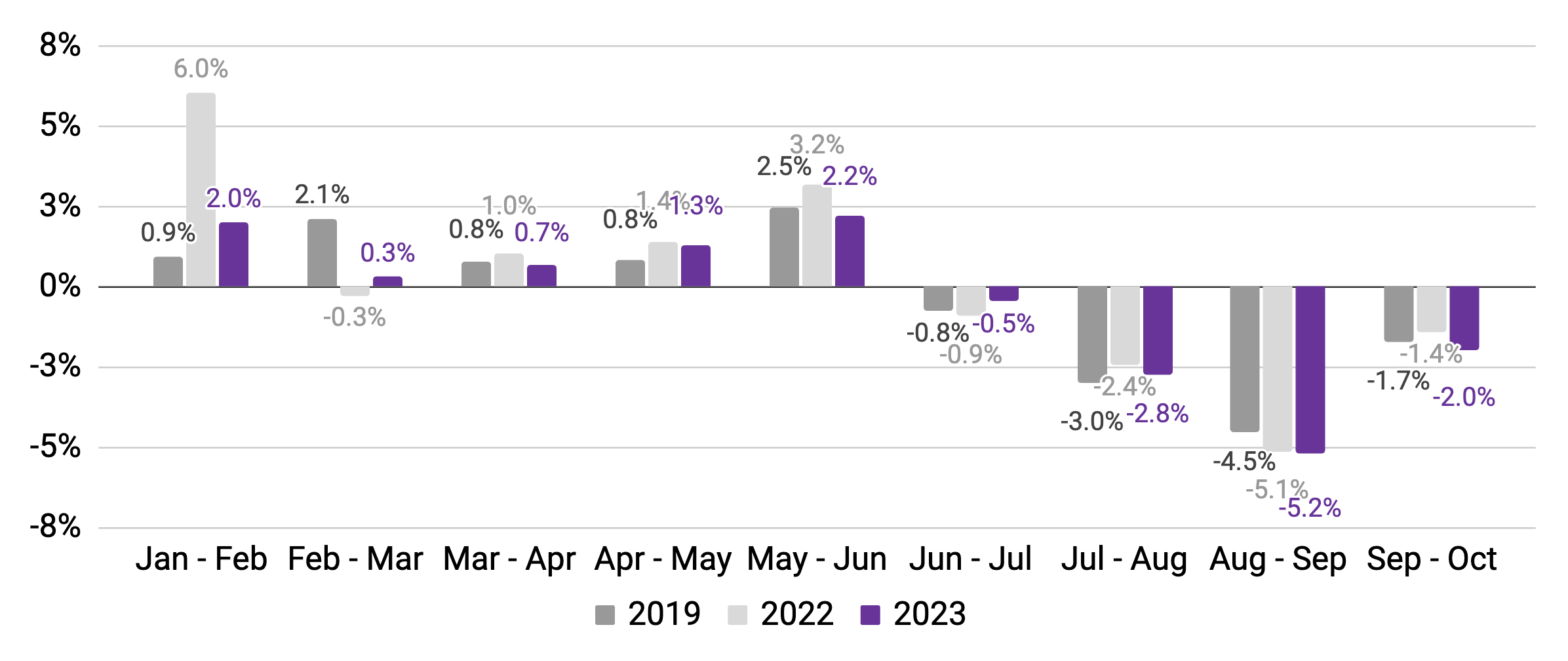

Core indicators revealed Important Avenue labor market steadied in October

In October, workers working and hours labored noticed anticipated seasonal dips in keeping with pre-pandemic ranges.

Staff working

(Month-to-month change in 7-day common, relative to January of reported yr)

Hours labored

(Month-to-month change in 7-day common, relative to January of reported yr)

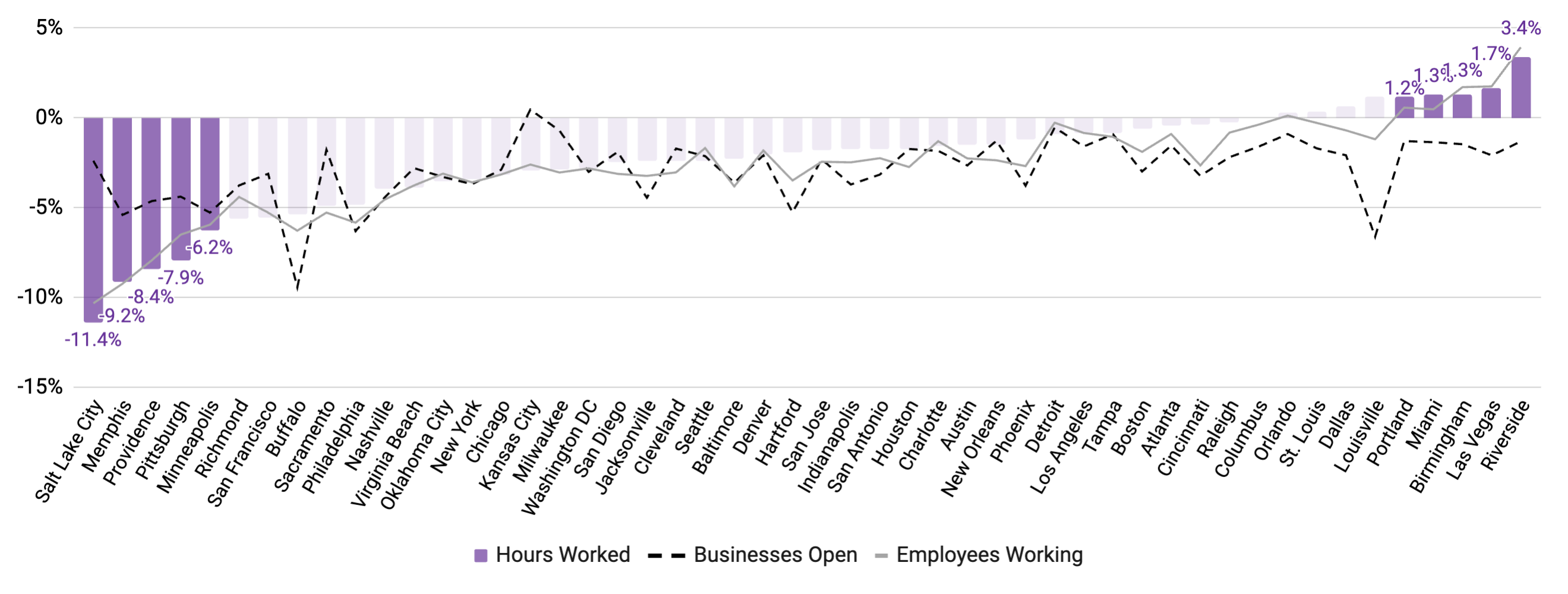

SMBs in key areas defied seasonal dip, driving development in October

Riverside, Las Vegas, Birmingham, Miami and Portland noticed a rise in hours labored and workers working, whereas the remainder of the nation declined.

Output by MSA – Month-over-month change in core financial indicators, by metropolitan statistical space

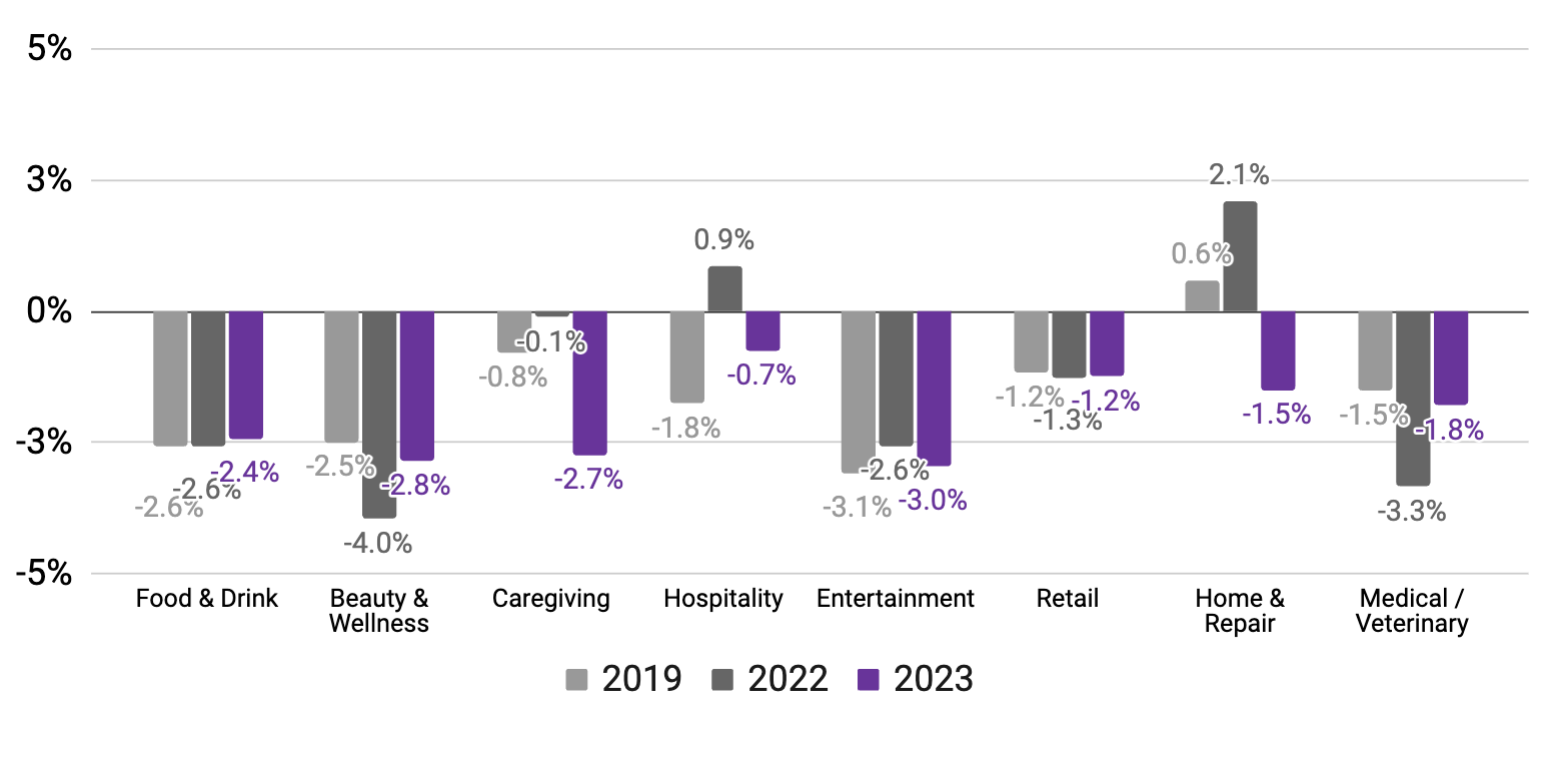

Most industries confirmed a return to pre-pandemic charges of workers working traits

After a powerful September, Leisure posted a snug decline for October relative to 2019, signalling the return to a gradual rhythm.

P.c change in workers working

(Mid-October vs. mid-September, utilizing Jan. ‘19, Jan. ‘22, and Jan. ‘23 baselines) 3

Leisure continues to indicate indicators of a return to pre-pandemic ranges within the price of workers working. September, noticed a extra muted finish of summer season decline than prior years, and now October information exhibits stability has returned to 2019 ranges.

Actually, most industries throughout the board are displaying a seasonal dip in workers working in keeping with pre-pandemic years. This might sign a turning level in financial stability on Important Avenue.

- Hospitality consists of tourism and lodge/lodging companies.

- Leisure consists of occasions/festivals, sports activities/recreation, parks, film theaters, and different classes.

- October 6-12 vs. September 8-14 (2019); October 9-15 vs. September 11-17 (2022); October 8-14 vs. September 10-16 (2023). Supply: Homebase information

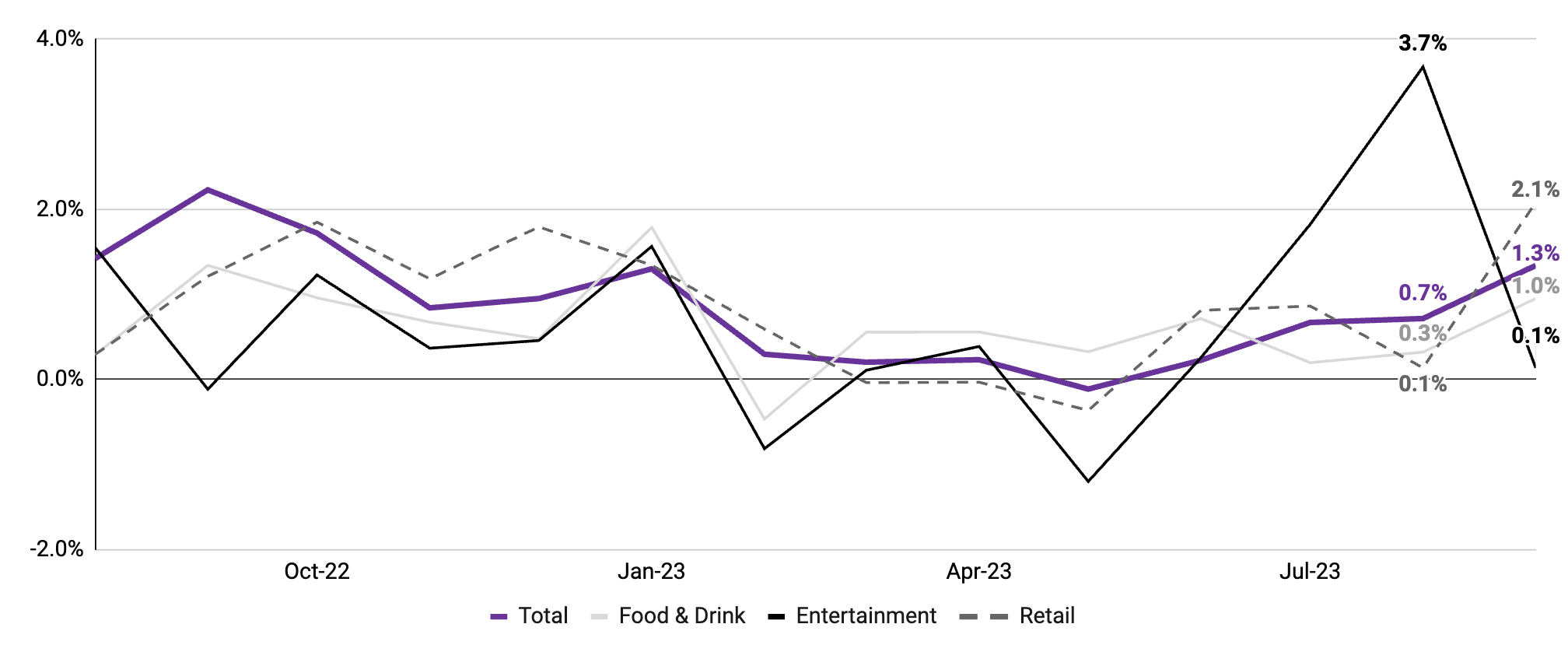

Wages at small companies continued to develop in October

Leisure noticed a spike coming into October however then stabilized, whereas whole wage adjustments continued on an upward pattern.

Avg. wage adjustments, m/m

Month-to-month change in common hourly wages throughout all jobs

Word: Knowledge measures common hourly wages for places that utilized Homebase to pay workers in each October 2022 and October 2023. Complete consists of industries not depicted right here. Supply: Homebase Payroll information.

Hourly Employee Pulse Test

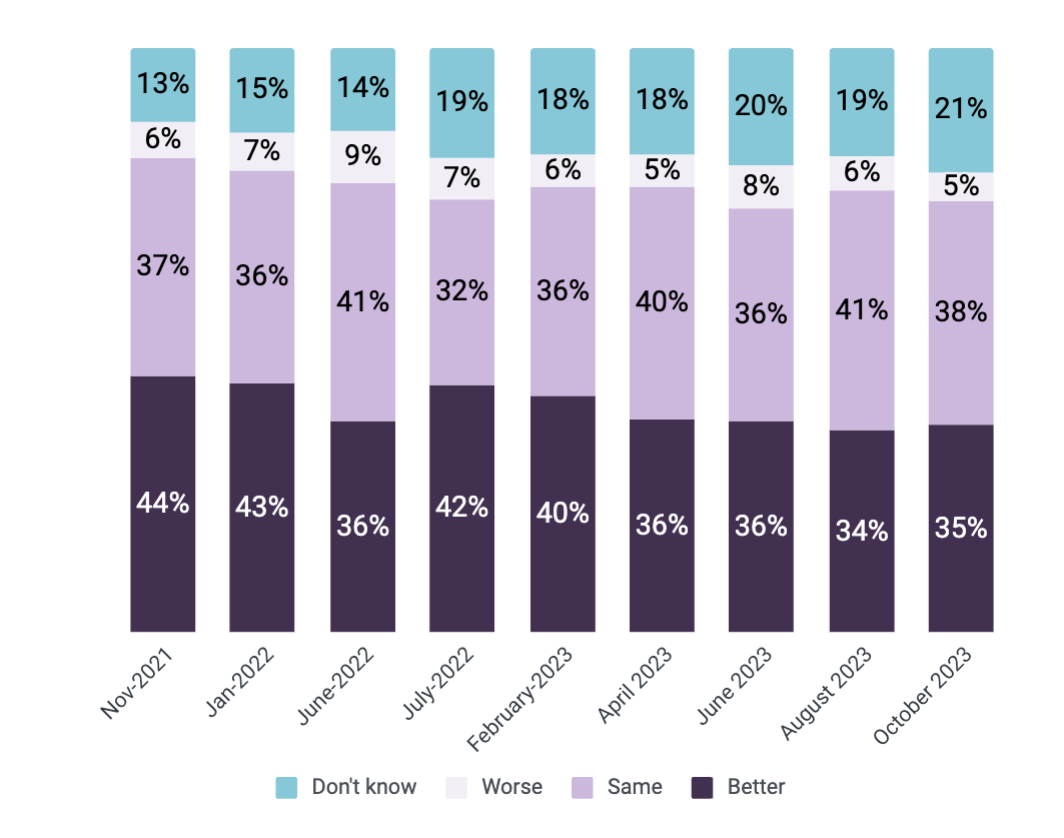

Staff are hopeful however unsure in regards to the future

Over a 3rd of employees assume job alternatives will enhance one yr down the road. As many as 21%, up from 19% in August, are unsure about future prospects.

Whereas uncertainty stays, a modest rebound in positivity exhibits employees are cautiously optimistic about exercise and potential for work on Important Avenue.

Survey query: Do you assume your job choices will probably be higher, about the identical, or worse in 12 months in comparison with at present?

Supply: Homebase Worker Pulse Survey

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23)

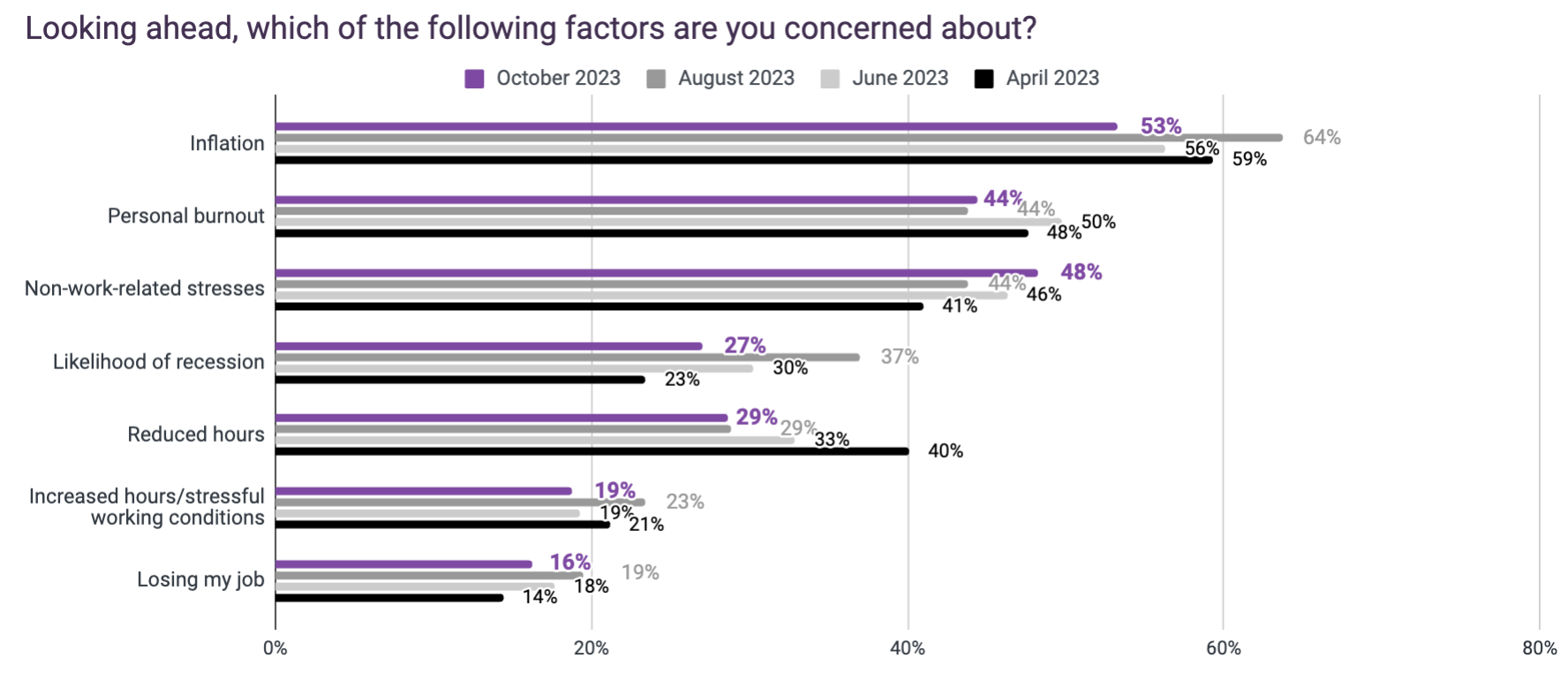

Financial issues declined for employees

Whereas employees are nonetheless apprehensive in regards to the probability of a recession and inflation, their fears are lessening. In October, 53% of hourly employees reported caring about inflation, a lower of 11% from August. Fears round a recession additionally dropped 10% in October in comparison with August.

Financial fears are being changed by extra private fears. In October, 48% of hourly employees reported issues over non-work-related stresses, up from 44% in August.

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23)

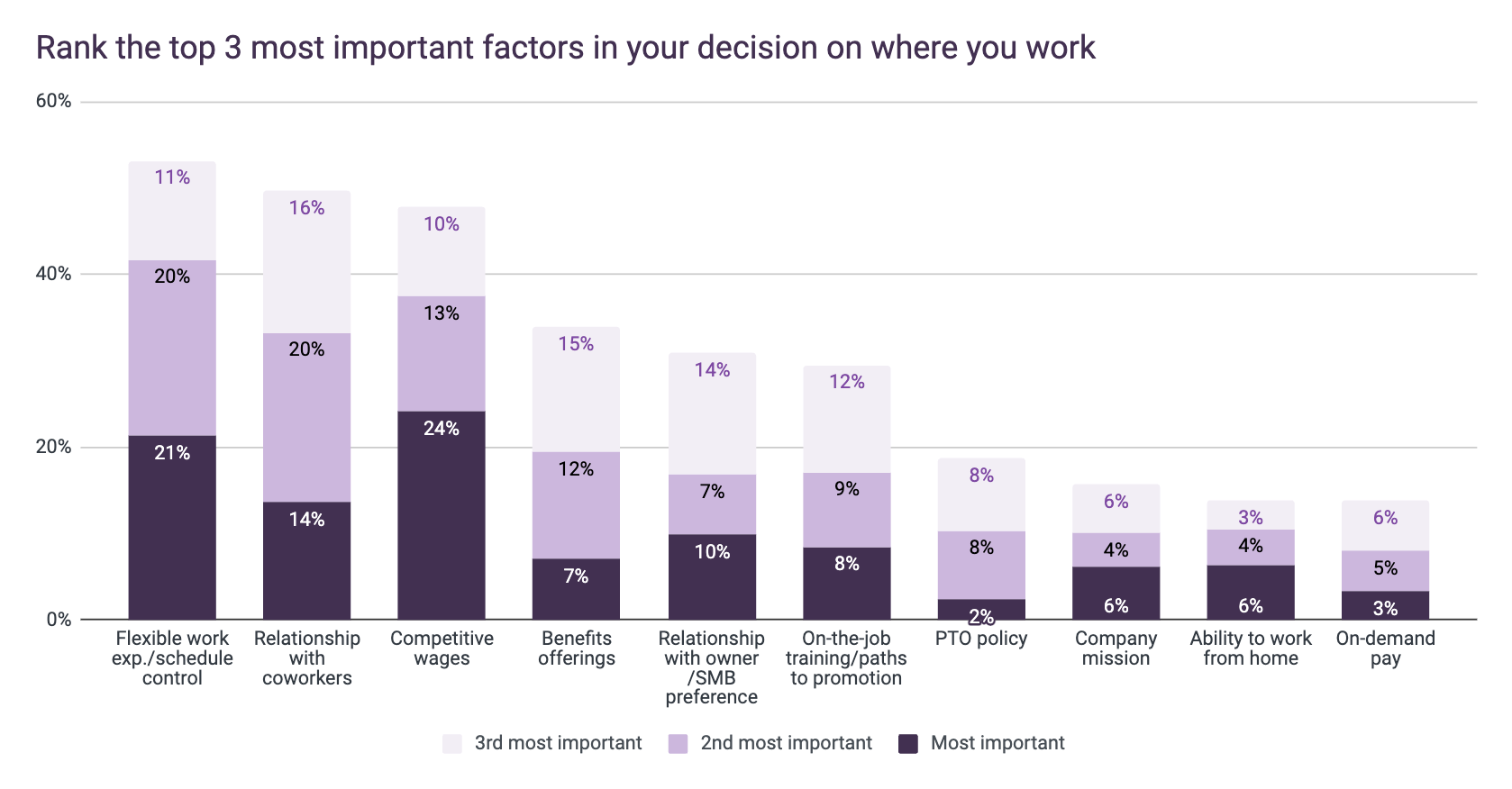

Non-wage elements like schedule flexibility and workforce relationships are high motivators for employees

Wages stay vital however take third place, all whereas financial issues soften for employees.

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23)

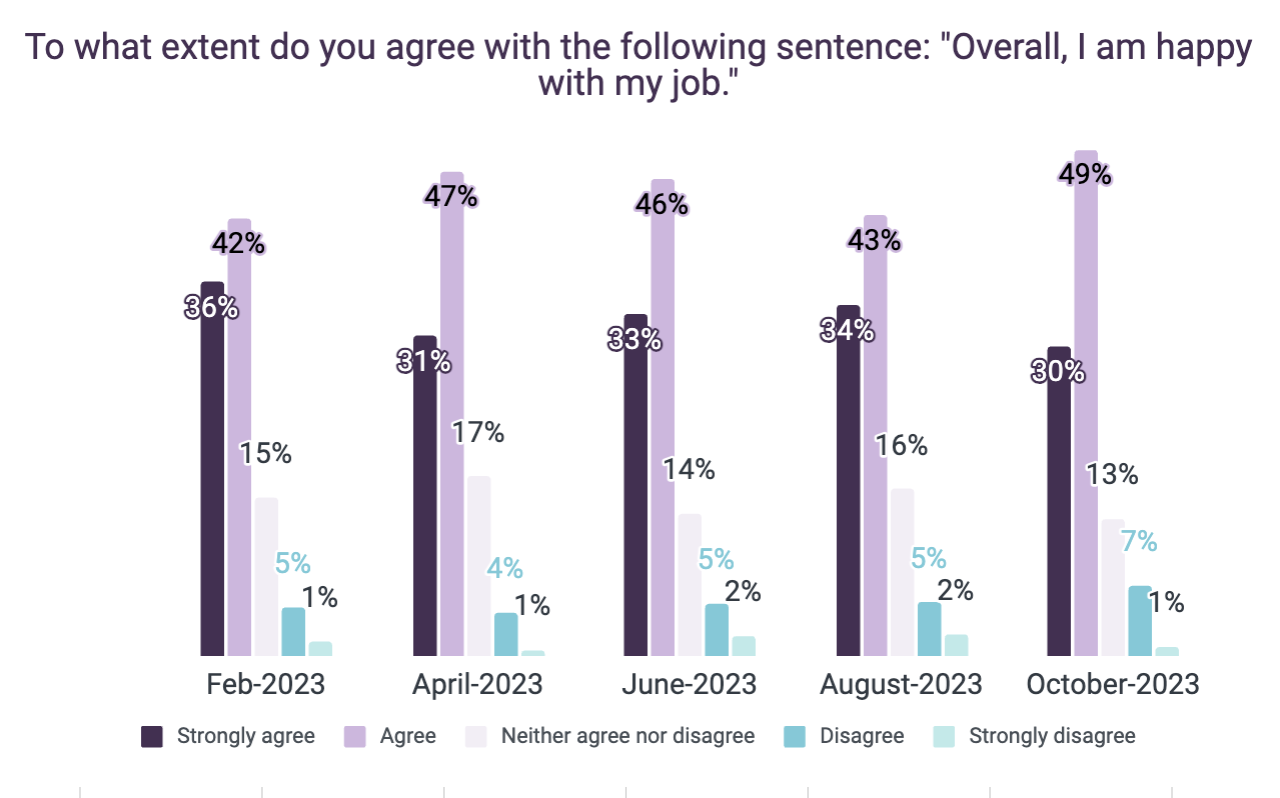

Job satisfaction on Important Avenue has elevated since August

As many as 4 out of 5 hourly employees agree they’re proud of their jobs general.

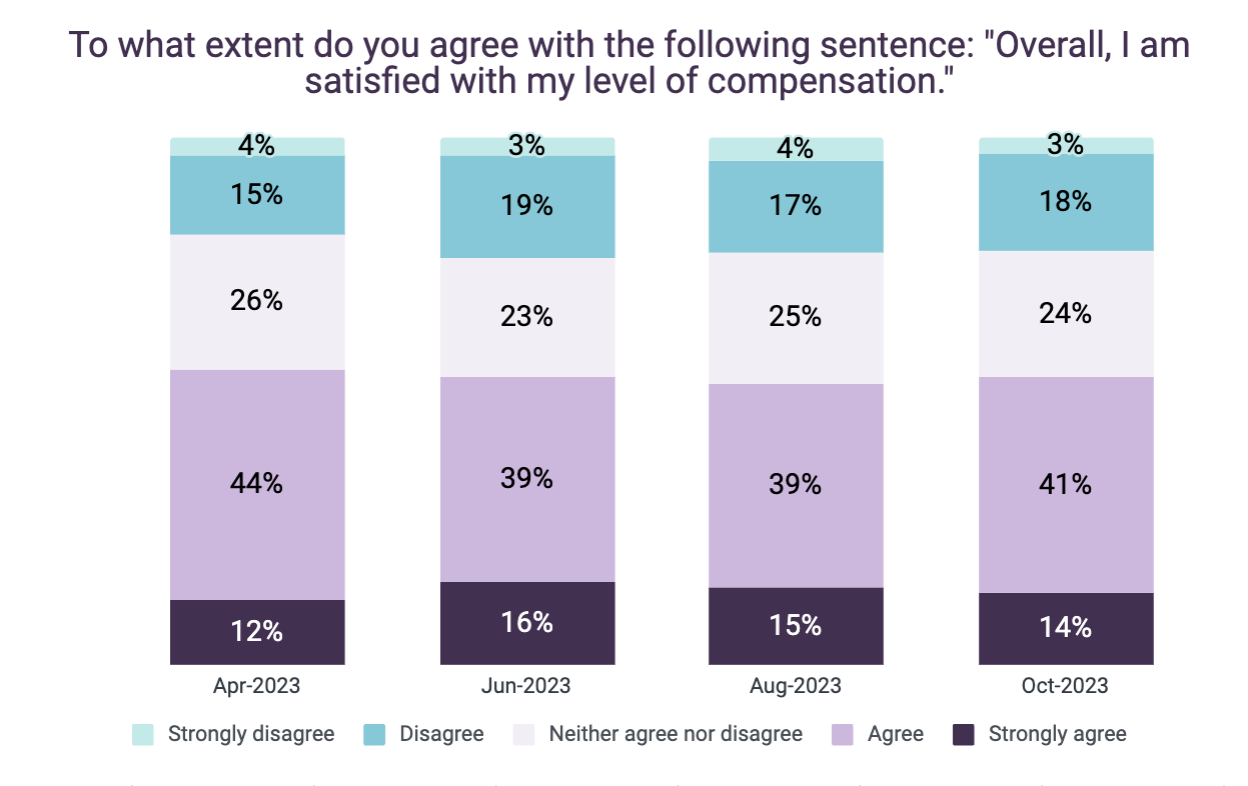

81% of employees surveyed noticed a rise in the price of family items and companies. Regardless of that, their outlook on wages has remained usually constant. In October 2023, 55% of hourly employees at small companies stated they had been glad with their compensation.

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23)

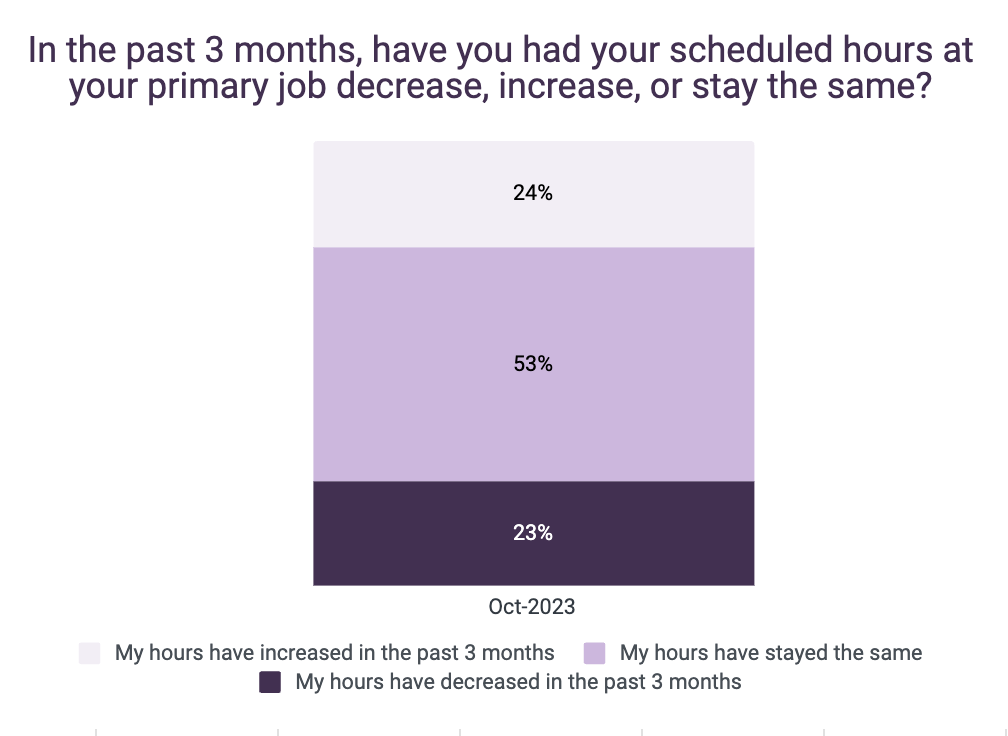

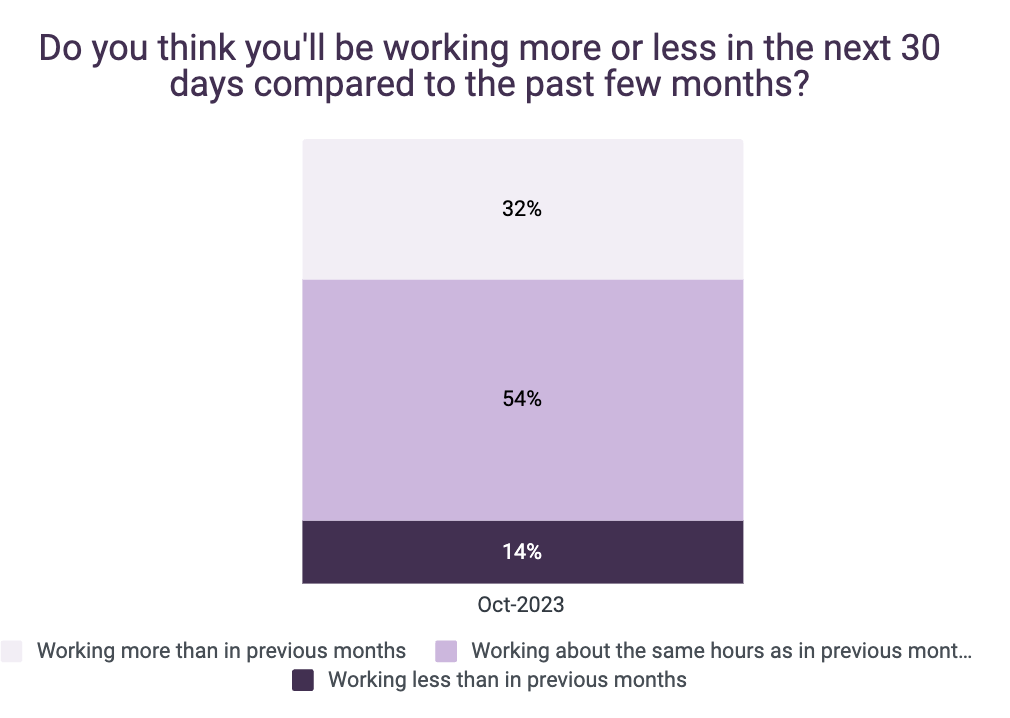

Regardless of constant work over the previous 3 months, workers count on work to choose up for the vacations

Staff are assured that the vacations will convey enterprise, and with it, larger paychecks.

Supply: Homebase Worker Pulse Survey. N = 437 (Oct. ‘23)

Hyperlink to PDF of: October 2023 Important Avenue Well being Report. If you happen to select to make use of this information for analysis or reporting functions, please cite Homebase.