It’s a brand new yr, and whereas which means celebrations, new plans, new objectives, and resolutions — it additionally means new work.

In spite of everything, as any small enterprise proprietor is aware of, there’s just one fixed in life: change.

Technically, really there are three constants in life — dying, taxes, and alter. However on this summation of modifications for 2017, we’ll give attention to the latter two constants.

Tax Deadline Modifications (Relying on Your Firm Kind)

The tax world rests on deadlines, and that’s no totally different now. What’s altering in 2017 are some fairly necessary deadlines — and also you’ll wish to mark your calendar sooner relatively than later.

Enterprise Information Every day notes that the deadlines for C firms have been moved to April fifteenth from March fifteenth. That leaves some extra wiggle room. However partnerships and S firms had been moved up a month, now touchdown on March fifteenth.

Even people submitting tax returns ought to be aware a change this yr, as April fifteenth is Emancipation Day. The submitting deadline for people is now April 18th, 2017, which supplies you just a few further days to organize.

To make sense of all of it, go to eFile for particular person returns and The Stability for partnership and firm returns. You’ll should do a little bit of scrolling to search out the related 2017 dates, nevertheless it’s value it to know that you simply’re making all the proper filings on time.

When you’re curious about discovering extra tax sources from probably the most direct supply there may be, just be sure you take a look at the IRS Small Enterprise and Self-Employed Tax Middle.

Reimbursing Workers for Well being Prices

This doesn’t impact your 2016 taxes, however is one thing to pay attention to for 2017: reimbursing staff for well being care prices.

As of January 1st of this yr, employers can supply QSEHRAs, or Certified Small Employer Well being Reimbursement Preparations — with out drawing Obamacare penalties. As Nola notes, “Below these new plans, an eligible small enterprise can reimburse an worker’s individually bought medical health insurance and different deductible medical prices of as much as $4,950 per yr for a person and as much as $10,000 for a household.”

There are just a few guidelines to make sure an worker qualifies for this sort of reimbursement, nevertheless, together with these necessities:

It’s value noting that these QSEHSA’s aren’t meant for use just for employers; actually, it can’t be utilized by sole proprietors, companions, LLC members, or anybody proudly owning greater than 2% in an S-Corp. As these folks don’t qualify as staff, Nola notes, they don’t qualify for an worker profit association of this sort.

When you’re self-employed, nevertheless, likelihood is you’re accustomed to those stipulations.

Adjustment in Revenue Tax for Inflation

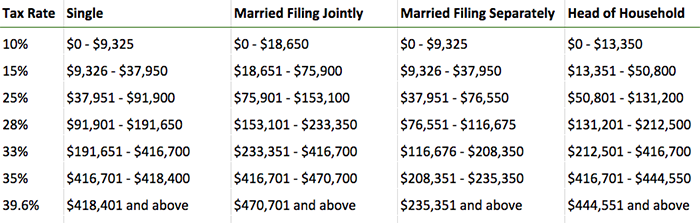

2017’s tax brackets will look a bit totally different than 2016’s — and that’s by design. The IRS adjusts these brackets for inflation.

When you take a look at the desk, you’ll discover that the brackets haven’t modified an entire lot — usually, modifications are inside just a few hundred {dollars} of earnings. However it’s one thing to pay attention to particularly for small enterprise house owners and even for entrepreneurs who should file their estimated taxes on a quarterly foundation.

Minimal Wage

Whereas the Federal minimal wage doesn’t seem like shifting any time quickly, there are nonetheless state-level will increase to think about.

Final yr, 17 states elevated minimal wage. That’s as much as 19 this yr, with the very best minimal wages seen in Massachusetts and Washington, tying at $11 per hour. Alaska, Florida, Missouri, Montana, New Jersey, Ohio, and South Dakota have automated will increase based mostly on their respective indexes.

Take note of your metropolis, as nicely: cities like San Diego, San Jose, and Seattle are slated to see larger minimal wages on an area stage.

Retirement Contributions and Limits

Any self-employed particular person has to take particular care to plan for retirement, and which means understanding what’s happening on this planet of retirement accounts.

SurePayroll has a listing of the modifications you’ll want to pay attention to in 2017—which is to say, little or no. The truth is, the massive change this yr is that there aren’t many massive modifications…which can have an effect on your retirement plans when you’ve been relying on them.

This hits on one other attention-grabbing level: though monetary modifications loom in politics, most small enterprise house owners will wish to proceed on as they’ve been, making filings as anticipated. It’s solely when the modifications are made official and enacted into legislation that you simply’ll wish to make any onerous selections concerning your small enterprise.

A Shifting Political Panorama

Since 2009, the U.S. has been led by Barack Obama. There’s yet one more change we will’t ignore right here, as Donald Trump comes into workplace, flanked by political help in Congress.

If the one fixed in life is change, then small companies will wish to watch political tales with eager curiosity in 2017. Modifications to the Inexpensive Care Act—maybe even dismantling it—loom in Congress. Small companies like yours can be affected.

With the soundness of a two-term president, small companies have come accustomed to the sorts of shifts they could see year-to-year. With a brand new administration, new insurance policies are to be anticipated, although it’s extremely doable that any modifications will formally place in 2018 and additional down the road. Most notably, the brand new administration has promised modifications to maternity depart, the Inexpensive Care Act, and enterprise rules.

No matter your political leanings, one factor is evident: small enterprise house owners on both aspect of the aisle might want to keep watch over headlines to know what’s in retailer for them for 2017 and past.