Attending to the highest 1% internet price by age is a really spectacular objective. However how a lot cash do you’ll want to get there? Total, to have a high 1% internet price in 2023 requires having not less than $13 million in line with the Federal Reserve.

$13 million is $3 million above the very best internet price quantity for retirement primarily based on a ballot I carried out a few years in the past that had hundreds of entries. For reference, the property tax threshold is $12.92 million per particular person. Therefore, we will use the property tax threshold as a information for a high 1% internet price.

Folks wish to throw round random internet price figures on a regular basis when requested how a lot is taken into account wealthy or how a lot they would wish to by no means work once more. Usually, the figures simply sound good, like saying “one meeeeleon {dollars}” with none mathematical justification.

This publish places some numbers behind ascertaining how a lot wealth one must be within the high 1%. To pay much less taxes, having a giant internet price is healthier than having a excessive revenue. The federal government goes after revenue greater than it goes after wealth.

However if you’re retired, then money circulation is extra necessary than internet price. As a retiree, you revenue is what’s going to preserve your life-style.

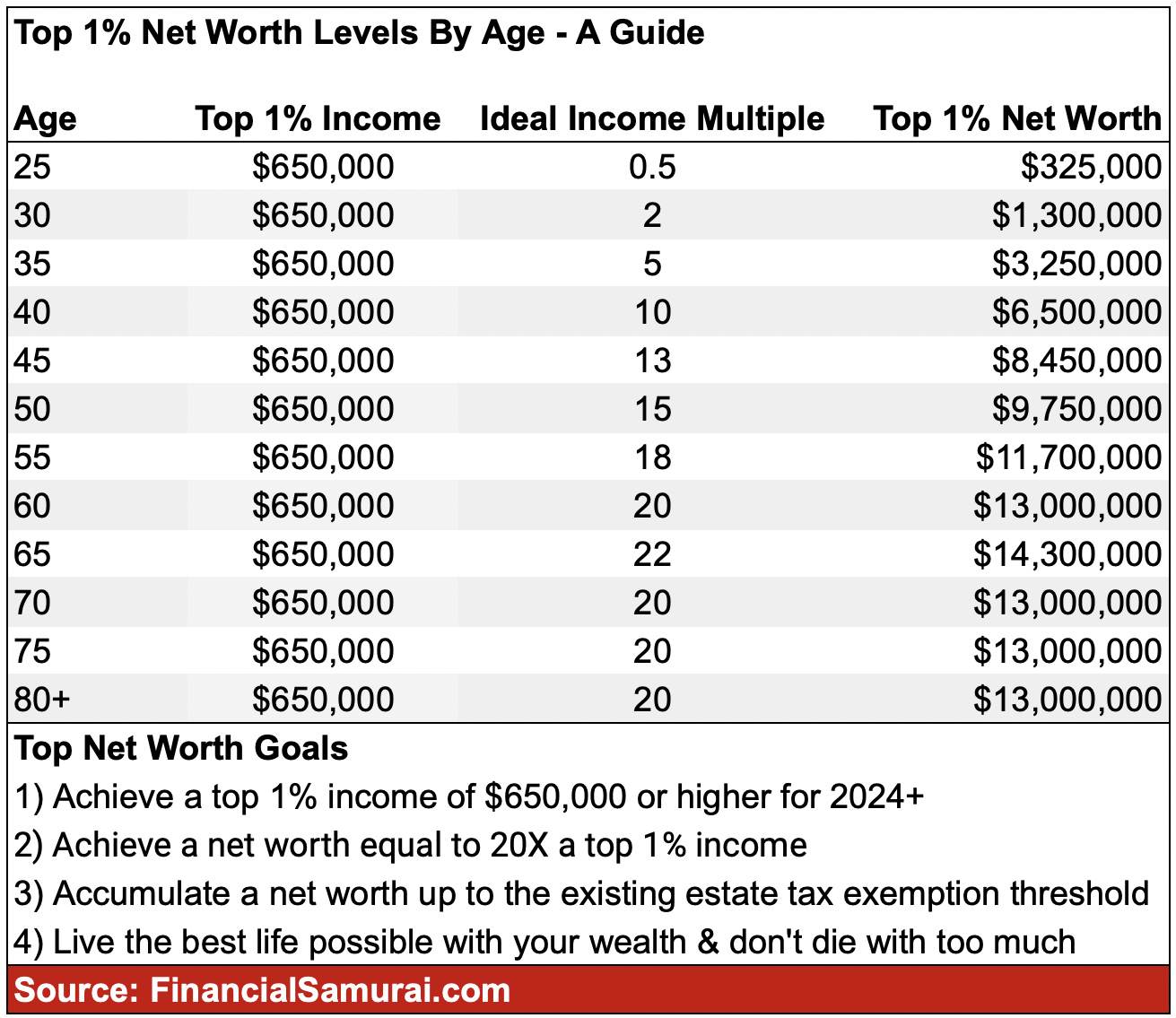

The Prime 1% Internet Value Quantities By Age

I might wish to assemble two easy fashions to show what I feel needs to be thought-about a high 1% internet price by age. All wealth and no revenue just isn’t very best. Equally, all revenue and no wealth just isn’t very best both. There must be a steadiness.

We all know the fixed variable X (high 1% revenue). All we’ve got to do is clear up for Y (high 1% internet price) primarily based on Z, an agreed upon revenue multiplier decided by yours actually.

A Prime 1% Earnings Has Elevated Tremendously Since 2016

Again in 2016, after I first wrote this publish, a high 1% revenue in America was $380,000. Due to financial development and inflation, a high 1% revenue in America is now $650,000. Additional, a high 1% revenue varies by state.

To have a high 1% revenue in Connecticut requires an revenue of over $955,000. In California, a high 1% revenue is not less than $805,000. In New York, a high revenue is not less than $818,000. Nevertheless, in West Virginia, you solely have to earn above $374,000 to earn a high 1% revenue.

However general, a high 1% revenue in America is $650,000, so we are going to use this determine in calculating my high 1% internet price by age information.

The Assumptions To My Prime 1% Internet Value By Age Information

- $650,000 is the fixed high 1% revenue variable

- The Best Earnings A number of will increase over time

- A internet price equal to 20X your common gross revenue equals true monetary independence

- A a number of of revenue is superior to a a number of of bills to find out a high 1% internet price as a result of revenue is more durable to control

Prime One P.c Internet Value By Age Chart

Take a look on the chart under. It is a good snapshot of high 1% internet price beginning at age 25. To have a high 1% at 25 requires a internet price of not less than $250,000. To have a high 1% internet price at age 30 requires a internet price of not less than $1 million and so forth.

As the newest Federal Reserve Client Finance Survey reveals, the common American family is now a millionaire with a internet price of $1.06 million. However the median American family internet price is about $193,000.

Given you are capturing for a high 1% internet price, you may take a look at the chart and see a high one % internet price goal of $5 million at age 40. Does $5 million seem to be an affordable high 1% internet price threshold if the common is about $1.06 million and the median is about $193,000? I feel it does.

My high 1% internet price by age may also be used for households, which might consist of people or {couples}.

Extra Notes About The Prime 1% Internet Value Chart

- Prime 1% internet price is relative to our ages. It is unfair to match a 60 12 months outdated’s internet price to a 25 12 months outdated’s internet price as a result of the 60 12 months outdated has had 35 extra years to build up wealth.

- Youthful folks on this chart will logically have a more durable time attending to the highest 1% revenue determine of $500,000 in comparison with older folks. On the similar time, the multiplier youthful folks should hit to get into the highest 1% internet price can also be decrease. I begin at age 25 as a result of so few folks will make $500,000 inside a pair years out of school.

- If in case you have round a $255,000 internet price at age 25, you are within the high 1% in all probability because of some savvy investments made proper out of school. Earnings alone is not going to chop it. You could have simply began making a high 1% revenue of as a extremely coveted software program engineer or finance whiz. Or you might have began a enterprise or made a fortunate funding.

- The minimal revenue multiplier peaks on the conventional retirement age of 65. It’s pointless to build up a lot extra money whenever you’ve obtained lower than 35 years to stay. Social Safety is obtainable at 65, including one other million to your internet price in case you capitalize its annual funds.

- In 2023, $12.92 million is the restrict per particular person one can move on earlier than the Dying Tax kicks in. Subsequently, you may as effectively spend each single final penny above the property tax threshold on your self, family members, or charities as an alternative of giving it to an inefficient authorities.

- The highest 1% internet price figures within the chart are for people. However, be at liberty to make use of the online price figures as targets to shoot for if you’re a married couple as effectively since you’re a unit. For {couples}, the property tax threshold is $25.84 million in 2023.

Replicating Prime 1% Internet Value By Life-style And Financial savings Charge

The definition of “wealthy” will be somebody who not has to work for a dwelling, whereas sustaining a high 1% revenue incomes life-style. That is the place issues get a bit difficult, as a result of many individuals spend $500,000+ in a different way.

Once I was making huge bucks, I might at all times save not less than 50% of every part I earned after maxing out my 401k. I knew the revenue would not final ceaselessly as a result of the job was not sustainable.

Given my 50% financial savings fee, a $500,000+ gross revenue life-style might be matched by somebody spending 100% of his $250,000 gross revenue. Therefore, my objective since retiring in 2012 was to attempt to replicate the gross revenue I lived off of in retirement via passive revenue.

Then again, lots of my colleagues simply spent 90% – 100% of their $500,000+ gross incomes. One shut colleague instructed me, if he did not make not less than $500,000 a 12 months, he could not save any cash! He required not less than $300,000 a 12 months after-taxes to help his household of 4. Speak about a excessive burn fee.

Associated: How To Make $200,000 A Yr And Not Really feel Wealthy

Extra Definitions Of Wealthy

A high one % internet price is by definition wealthy. However let us take a look at extra definitions of wealthy primarily based numerous financial components.

The chance-free fee (10-year bond yield) is at the moment round 5%. Subsequently, one wants a internet price of roughly $10 million ($500,000 / 5%) to have the ability to generate $500,000 a 12 months in high 1% revenue. In different phrases, due to a excessive risk-free fee, one wants about $3 million much less to copy a high 1% internet price life-style.

It is price adjusting your protected withdrawal fee in retirement, relying on the place the 10-year bond yield is. Have a dynamic protected withdrawal fee to vary with the instances.

In at present’s rate of interest surroundings, $10 million can subsequently be thought-about wealthy sufficient to be within the high 1%. Because the risk-free fee declines, the quantity of capital required to be wealthy will increase and vice versa. In a better rate of interest surroundings, it is really simpler to generate passive revenue.

The Best Earnings For Most Happiness Could Equal A Prime One P.c Internet Value

One other internet price calculation is utilizing the best revenue for optimum happiness. We are able to assume the objective of being within the high one % is to be glad.

I feel that very best revenue is $200,000 per particular person and $350,000 per couple dwelling in a coastal metropolis. When you earn these gross revenue figures, your happiness not will increase because of cash. You make sufficient to outlive and really feel glad.

Subsequently, utilizing the identical 5% divisor, we will get $4 million for a person ($200,000 / 5%) and $7 million ($350,000 / 5%) per couple as a high one % internet price for optimum happiness.

If the risk-free fee declines to 2.5%, the best revenue for optimum happiness can keep the identical. In a decrease rate of interest surroundings, the $200,000/single and $350,000/per couple incomes goes farther. Nevertheless, the online worths required to generate these very best incomes double to $8 million and $14 million, respectively.

In the event you do not stay in an costly coastal metropolis, you might in all probability cut back the $200,000/$350,000 revenue figures by 30% – 50%. Then divide the numbers by the risk-free fee to give you your personalised high 1% internet price for optimum happiness.

So allow us to embrace this high-interest fee surroundings. It allows us to work much less, chill out extra, and really feel safer. If and when rates of interest ultimately decline, we’ll have to work more durable to develop our internet worths.

Getting To The Prime 1% Internet Value Is Potential

The unhappy half a couple of high 1% internet price is that it looks like it is getting more durable to attain. A number of the causes are inflation, globalization, extra risky funding returns, and extra frequent boom-bust cycles. Inflation is an actual killer in case you’re not on its proper facet.

Just one % of individuals can obtain a high one % internet price. Therefore, it is probably not price attempting to avoid wasting, make investments, and work a lot to beat out ninety 9 % of your friends. You can find yourself extremely depressing for an extended portion of your life!

As a substitute, an important quick minimize is to really feel wealthy with out technically getting wealthy. Feeling wealthy consists of feeling grateful for the issues you might have at present that you just needed yesterday.

I bear in mind feeling extremely wealthy after I was a examine overseas scholar in Beijing in 1997. My dorm room was 88 levels at evening and my roommate and I have been sweating buckets every evening. However we felt grateful each eight seconds our fan rotated in the direction of. We have been poor college students, however we additionally felt extremely wealthy to be on such an important journey.

Fortunately, you do not want a high one % internet price to really feel wealthy. If in case you have sufficient to pay on your dwelling bills, household and mates who love you, and your well being, you’re wealthy it doesn’t matter what your internet price tracker says!

Make investments In Actual Property Like The Prime 1%

If you wish to get a high 1% internet price, spend money on actual property. Actual property is a core asset class that has confirmed to construct long-term wealth for People.

Actual property is a tangible asset that gives utility and a gentle stream of revenue in case you personal rental properties. Additional, the wealthiest People personal large actual property portfolios.

Personal your main residence to get impartial actual property. Then spend money on actual property by shopping for rental properties and actual property on-line.

My favourite personal actual property platform is Fundrise. The corporate started in 2012 and manages over $3.3 billion in belongings for over 400,000 buyers. Fundrise’s focus is on residential actual property within the Sunbelt area the place valuations are decrease and yields are larger. The demographic shift towards lower-cost areas of the nation is a multi-decade pattern.

I’ve personally invested $954,000 in personal actual property funds and particular person offers since 2016. My objective is to reap the benefits of decrease valuations within the heartland of America to diversify my costly San Francisco holdings. Actual property is at the moment in a downtrend because of larger mortgage charges, which is why I am shopping for now.

Make investments In Non-public Development Firms

Lastly, the richest People begin companies and spend money on personal companies. Subsequently, take into account diversifying into personal development firms via an open enterprise capital fund. Firms are staying personal for longer. Because of this, extra good points are accruing to non-public firm buyers.

Try the Innovation Fund, which invests within the following 5 sectors:

- Synthetic Intelligence & Machine Studying

- Fashionable Knowledge Infrastructure

- Growth Operations (DevOps)

- Monetary Know-how (FinTech)

- Actual Property & Property Know-how (PropTech)

Roughly 35% of the Innovation Fund is invested in synthetic intelligence, which I am extraordinarily bullish about. In 20 years, I do not need my children questioning why I did not spend money on AI or work in AI!

The funding minimal can also be solely $10. Most enterprise capital funds have a $250,000+ minimal. As well as, you may see what the Innovation Fund is holding earlier than deciding to take a position and the way a lot.

The Prime 1% Internet Value Quantities By Age is a Monetary Samurai unique publish. Be a part of 60,000+ others and join my free weekly publication the place I share extra tips about how you can obtain high one % wealth. I have been serving to folks obtain monetary independence since 2009.