Cindy Ord

Palantir Applied sciences (NYSE:PLTR) clearly has a robust future in enterprise AI software program. The most important query is why buyers are so desperate to overpay for the hype and never the precise enterprise mannequin. My funding thesis turns extra Bearish on the inventory preferring to solely purchase shares at a a lot cheaper price.

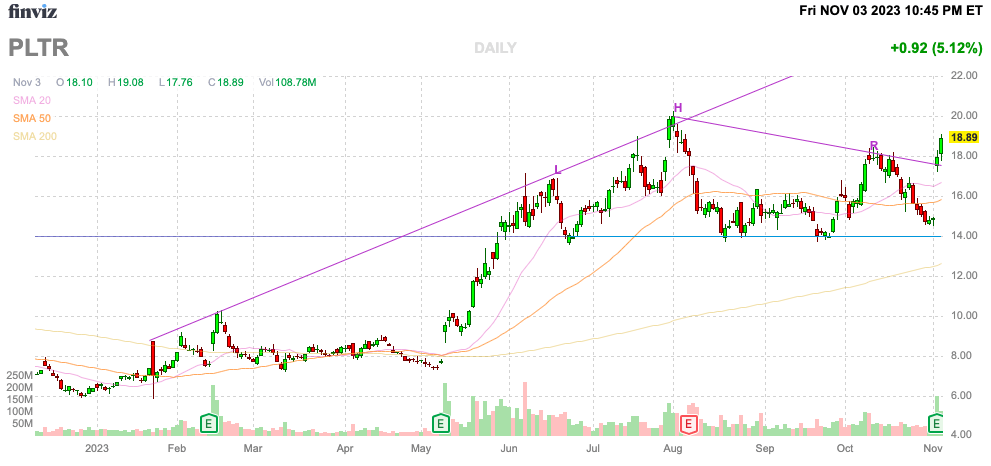

Supply: Finviz

Not Messi Spectacular

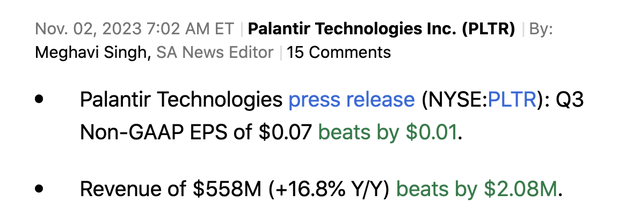

Again on November 2, Palantir reported a stable quarter the place the corporate beat consensus estimates:

Supply: In search of Alpha

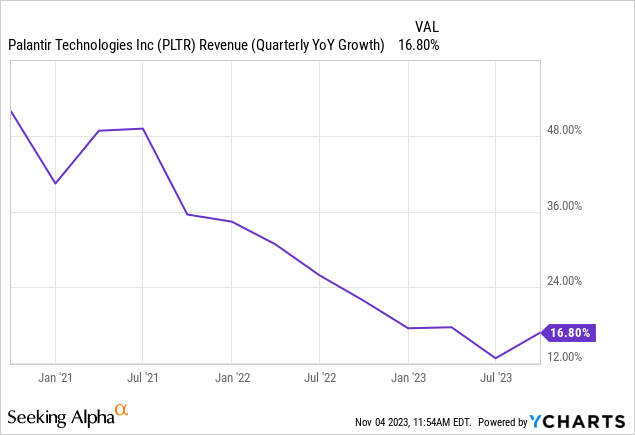

Most significantly, the enterprise software program firm reversed a downtrend within the progress price. Palantir had seen income progress decelerate to solely 12.8% in Q2 and the expansion price jumped again as much as 16.8% within the September quarter.

Whereas Palantir is a superb firm, buyers aren’t helped when the inventory is overvalued attributable to AI. Wedbush analyst known as the enterprise software program firm the Messi of AI, alluding to the enterprise that solely grew 12% within the prior quarter as equal to one of many biggest soccer gamers of all time.

Supply: Dan Ives Twitter/X account

For such an important firm, Dan Ives solely slapped a $25 goal on the inventory. Palantir rallied to just about $19 to shut the week implying ~32% upside within the inventory.

Not solely did Palantir simply report 16% progress, but additionally solely guided to This fall’23 for revenues of $599 to $603 million, implying simply 18% progress. These progress charges are hardly software program trade main.

If any AI firm is the Messi of AI that may be Nvidia (NVDA) with revenues hovering. The AI chip firm reported FQ2’24 revenues soared over 100% to $13.5 billion and guided to FQ3 revenues of $16.0 billion for enormous 170% progress.

The Palantir progress charges seem slightly pedestrian in comparison with the numbers of Nvidia.

Focus On A Cheap Value

Palantir jumped following the stable quarter, however the inventory is already forward of the particular numbers. Traders have to concentrate on paying an affordable value for the inventory to be able to generate robust returns over the long run.

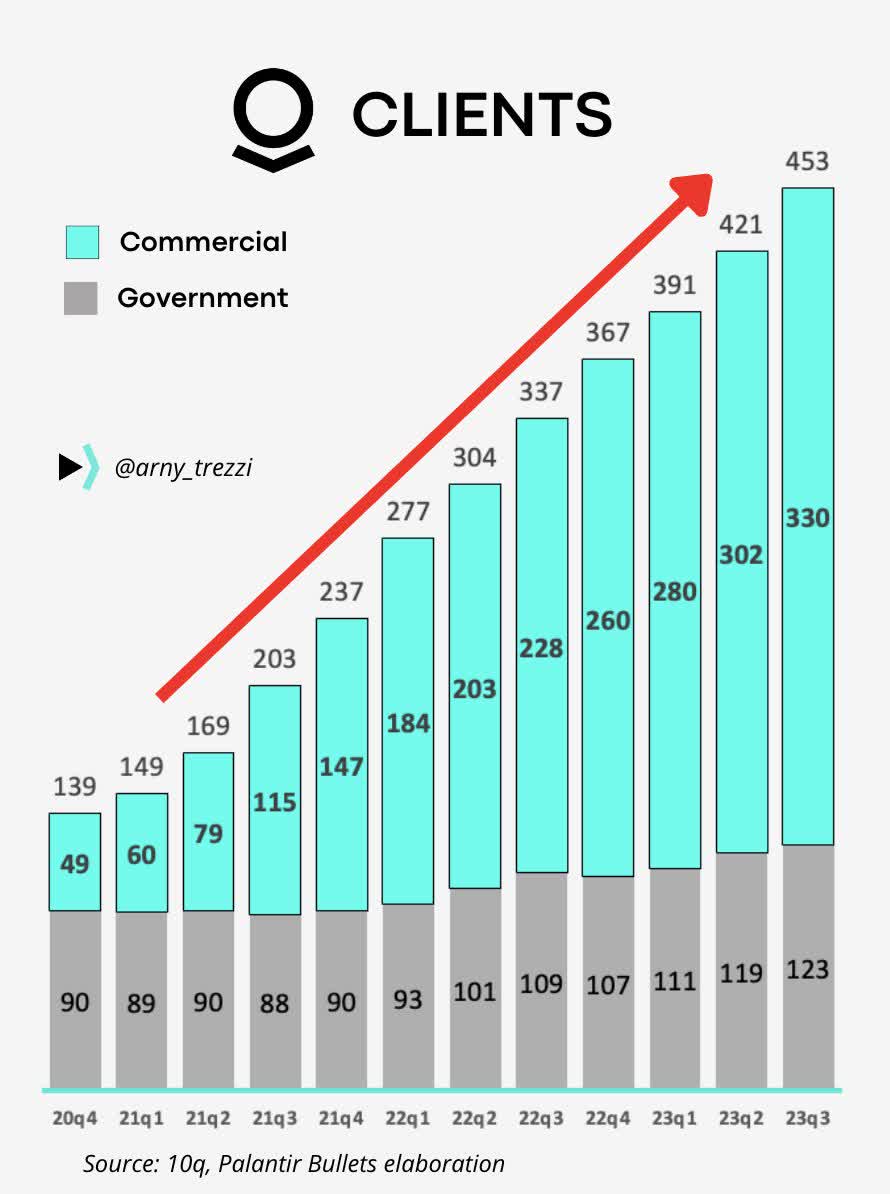

The enterprise AI software program firm is seeing large demand from business clients whereas the federal government facet of the enterprise is not shifting as quick. Palantir claims 330 business clients for 45% progress YoY whereas the federal government enterprise solely added 14 new clients within the 12 months.

Supply: @arny_trezzi on Twitter/X

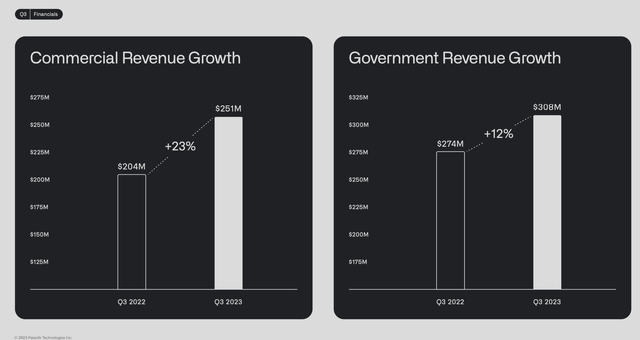

The corporate remains to be tilted in direction of the federal government section with Q32’3 revenues of $308 million for under 12% progress. The business section has way more spectacular progress at 23%, however the section remains to be $57 million per quarter smaller.

Supply: Palantir Q3’23 presentation

On the present progress charges, Palantir will not attain some extent the place business revenues prime authorities till 2025. The corporate even expects the US authorities enterprise to reaccelerate decreasing the power of the business section to prime the federal government enterprise and ditch the anchor on whole progress charges.

The inventory now has a market cap of almost $39 billion whereas Palantir is simply focusing on revenues of $2.2 billion this 12 months. The corporate has a $3.3 billion money stability and generates optimistic money movement, however the inventory nonetheless has an EV topping $35 billion.

The consensus analyst estimates solely predict Palantir reaches 2024 revenues of $2.6 billion or a slightly pedestrian progress price of beneath 19%. As nice because the quarter sounded with the AI boot camps, the AI software program firm solely barely topped analyst estimates and the steerage for This fall was principally in keeping with expectations suggesting the targets for 2024 are stable.

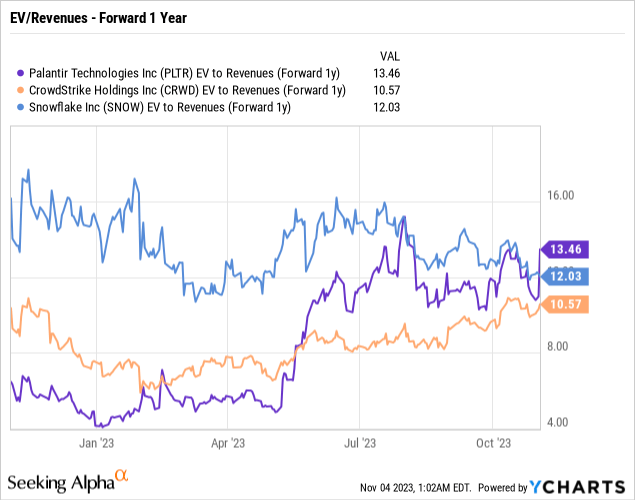

The inventory is flat out costly at over 13.5x EV/income targets for 2024. Each Snowflake (SNOW) and CrowdStrike Holdings (CRWD) within the enterprise software program sector have already got greater progress charges toping 30%, but each shares commerce at decrease ahead EV/S multiples than Palantir and neither of these shares are being in comparison with GOATs.

The issue is that the market is assigning a Messi sort valuation to the inventory whereas the corporate does not really generate the expansion to warrant such a lofty a number of. Palantir would want 30%+ progress to warrant the multiples of Snowflake and CrowdStrike, a lot much less a premium.

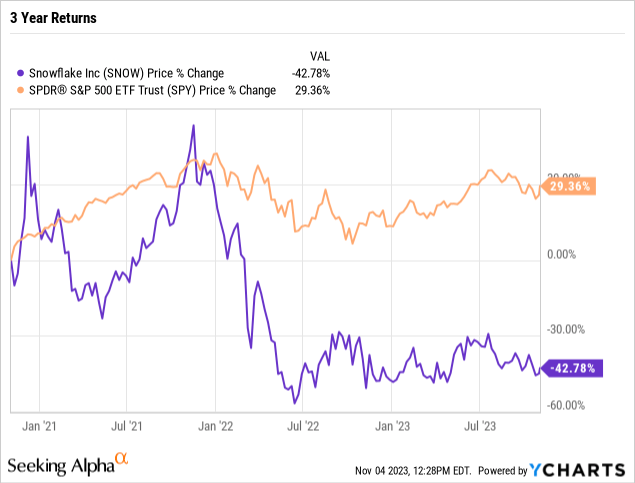

Snowflake is a major instance of what occurs when buyers overpay for the expansion charges of a inventory. The enterprise software program inventory has generated an almost 43% loss over the past 3 years whereas printing a 35.5% gross sales progress price within the July quarter. The S&P 500 is up almost 30% throughout this era.

Our view that Palantir will get fascinating round $10 hasn’t modified. The inventory would have a market cap of $23 billion, or 10x the 2023 gross sales goal.

The corporate is now GAAP worthwhile probably permitting an entry into the S&P 500. The inventory will probably get one other enhance and a rally to $20+ is the chance to promote Palantir for an unsustainable premium.

Takeaway

The important thing investor takeaway is that Palantir has a formidable enterprise alternative within the enterprise AI market. Sadly although, because of the unique concentrate on the federal government sector, the corporate does not have the huge progress charges warranting the next inventory value. Even worse, Palantir continues to be hyped with Messi claims which are not actually correct.

Traders ought to use the Messi hype and the probably inclusion into the S&P 500 as a possibility to unload Palantir at an extreme premium. Long run buyers will in the end be capable to purchase shares at a cheaper price or at comparable costs far into the long run to enhance annualized returns.